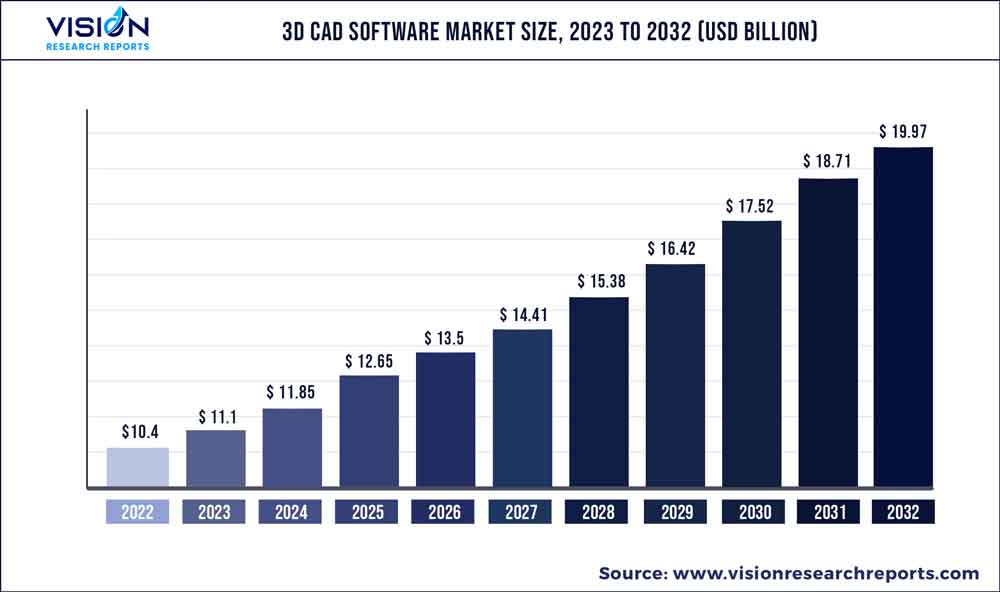

The global 3D CAD software market was estimated at USD 10.4 billion in 2022 and it is expected to surpass around USD 19.97 billion by 2032, poised to grow at a CAGR of 6.74% from 2023 to 2032. The 3D CAD software market in the United States was estimated for USD 3.3 billion in 2022.

Key Pointers

Report Scope of the 3D CAD Software Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 30.02% |

| CAGR of Asia Pacific | 8.06% |

| Revenue Forecast by 2032 | USD 19.97 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Autodesk Inc; Bentley Systems Inc.; Bricsys NV.; Beijing generous Digital Technology Co. Ltd. (CAXA); Graphisoft; Hexagon AB; Oracle; PTC; Schott Systeme GmbH; Siemens; Dassault Systemes Solidworks Corporation; ZWSOFT Co. Ltd. |

The demand for 3D CAD (Computer-Aided Design) software is expected to remain strong in the forecasted period due to the increasing use of 3D modeling and simulation across various industries, including automotive, aerospace, healthcare, and consumer goods. The trend of shifting toward remote work and digital collaboration continues as companies realize the benefits of using 3D modeling and simulation tools to reduce product development costs and time-to-market.

The advancement in computer hardware, graphics processing, and software development have made it possible to create powerful 3D CAD software that can handle complex designs and simulations, which led to the development of more sophisticated and efficient 3D modeling, analysis, and simulation tools. CAD software has made it easier for teams to collaborate on design projects and share information across different departments and locations, leading to increased efficiencies and productivity and reduced errors and rework. With the growth of manufacturing and product development industries, there is a higher demand for advanced design and prototyping tools. The CAD software provides an efficient and cost-effective way to create accurate and detailed product designs that can help companies save time and money.

The use of this software has expanded beyond traditional manufacturing industries to include architecture, construction, and even healthcare, leading to the growth of specialized software tools for the industries, further fueling the 3D CAD software market’s growth. With the rise in 3D printing technology, there is an outburst in demand for 3D modeling software that generates accurate and optimized designs for 3D printing. This has led to the development of specialized software tools tailored to the needs of 3D printing users.

The growth of software in the European 3D CAD software market is increasing due to the adoption of cloud-based 3D CAD solutions. Cloud-based solutions offer several benefits, such as easy accessibility, scalability, and cost-effectiveness, which drive their adoption among small and medium-sized enterprises in Europe. Moreover, the increasing focus on digitization and industry 4.0 initiatives in Europe is expected to drive further the adoption of this software solution in the region. The European Union’s Horizon 2020 program, which promotes innovation and research in various industries, is also expected to boost the region’s demand for advanced design and prototyping tools.

Deployment Insights

The on-premises deployment segment is gaining market traction with an outstanding revenue share of around 70.03% in 2022. The companies can have complete control over their software & data and can customize the software to their specific needs and requirements. On-premises deployment can be limited in terms of scalability. Companies may need to invest in more hardware and servers to support their increasing user base. It also has limited mobility as users are tied to their physical workstations or devices. It requires significant maintenance, updates, and troubleshooting efforts which can be complex and time-consuming.

The cloud-based deployment segment is attributed to growing at the fastest growth rate with a CAGR of around 8.02% during 2023-2032. The cloud-based deployment eliminates the need for expensive hardware and IT infrastructure, reducing upfront and ongoing maintenance costs. It also enables collaboration between designers, engineers, and other stakeholders, regardless of their location. They improve communication and collaboration, leading to better designs. It also offers advanced security measures, such as encryption and multi-factor authentication, to protect designs and intellectual property from unauthorized access.

Application Insights

The manufacturing application segment accounts for a revenue share of nearly 26.06% in 2022, owing to the increasing adoption of additive manufacturing technologies such as 3D printing. CAD software is an essential tool for designing 3D printable parts, and as the use of 3D printing continues to grow in various industries, so does the demand for the software. The increasing demand for customization in manufacturing 3D modeling software enables manufacturers to easily create custom designs and variations of products, allowing them to better meet their customers' needs. Furthermore, advancements in cloud computing and virtual reality technology have also contributed to the market's growth. Cloud-based software enables easy collaboration and access to design data from anywhere. At the same time, virtual reality allows designers and engineers to visualize and test their designs in a realistic and immersive environment.

The healthcare application segment is the highest-growing market, with a CAGR of around 7.54% from 2023-2032. The ability to create detailed 3D models of patient anatomy using medical imaging data has revolutionized the medical device industry allowing for the creation of customized implants and devices that is individual patients' needs. The software enables the device and implant placement simulation, allowing surgeons to plan and prepare for procedures more accurately and efficiently.

In addition, 3D printing technology has also found application in healthcare, particularly in the production of prosthetics, implants, and surgical tools. This software is essential for designing 3D printable medical devices and implants. This software helped create realistic anatomical models and simulations to train medical professionals in procedures and surgical techniques.

Regional Insights

North America is gaining market traction by acquiring market revenue of more than 30.02% in 2022, attributed to the increasing adoption of cloud-based solutions, rising demand for automation and efficiency in the manufacturing industry, and the growth of the aerospace and defense industries. In addition, the increasing investment in research and development activities for developing advanced CAD software is likely to offer significant growth opportunities in the region. The support offered by the U.S. government for deploying digitization solutions to enhance the development of the manufacturing industry in the region is expected to encourage the implementation of 3D CAD software solutions across the end-use industries. The major players operating in the region include Autodesk Inc, Dassault Systemes SE, PTC Inc., and Siemens.

Asia Pacific is the fastest-growing market, with a CAGR of around 8.06% during 2023-2032, owing to the increasing adoption of digital design tools, the rise of industry 4.0, and the expanding use of 3D printing across various industries. Software such as Solidworks, Autodesk Inventor, CATIA, PTC Creo, and Siemens NX are majorly used in automotive, aerospace, and industrial design industries for product design, simulation, and analysis. The extensive growth in the region’s engineering, design, and development sectors is anticipated to boost the adoption of designing and modeling tools over the forecast period.

3D CAD Software Market Segmentations:

By Deployment

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 3D CAD Market

5.1. COVID-19 Landscape: 3D CAD Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 3D CAD Market, By Deployment

8.1. 3D CAD Market, by Deployment, 2023-2032

8.1.1. Cloud

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. On-premises

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global 3D CAD Market, By Application

9.1. 3D CAD Market, by Application, 2023-2032

9.1.1. AEC (Architecture, Engineering, & Construction)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Manufacturing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Automotive

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Healthcare

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Media & Entertainment

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global 3D CAD Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Autodesk Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Bentley Systems Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bricsys NV.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Beijing generous Digital Technology Co. Ltd. (CAXA)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hexagon AB

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Oracle

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PTC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Schott Systeme GmbH

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Siemens

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Dassault Systemes Solidworks Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others