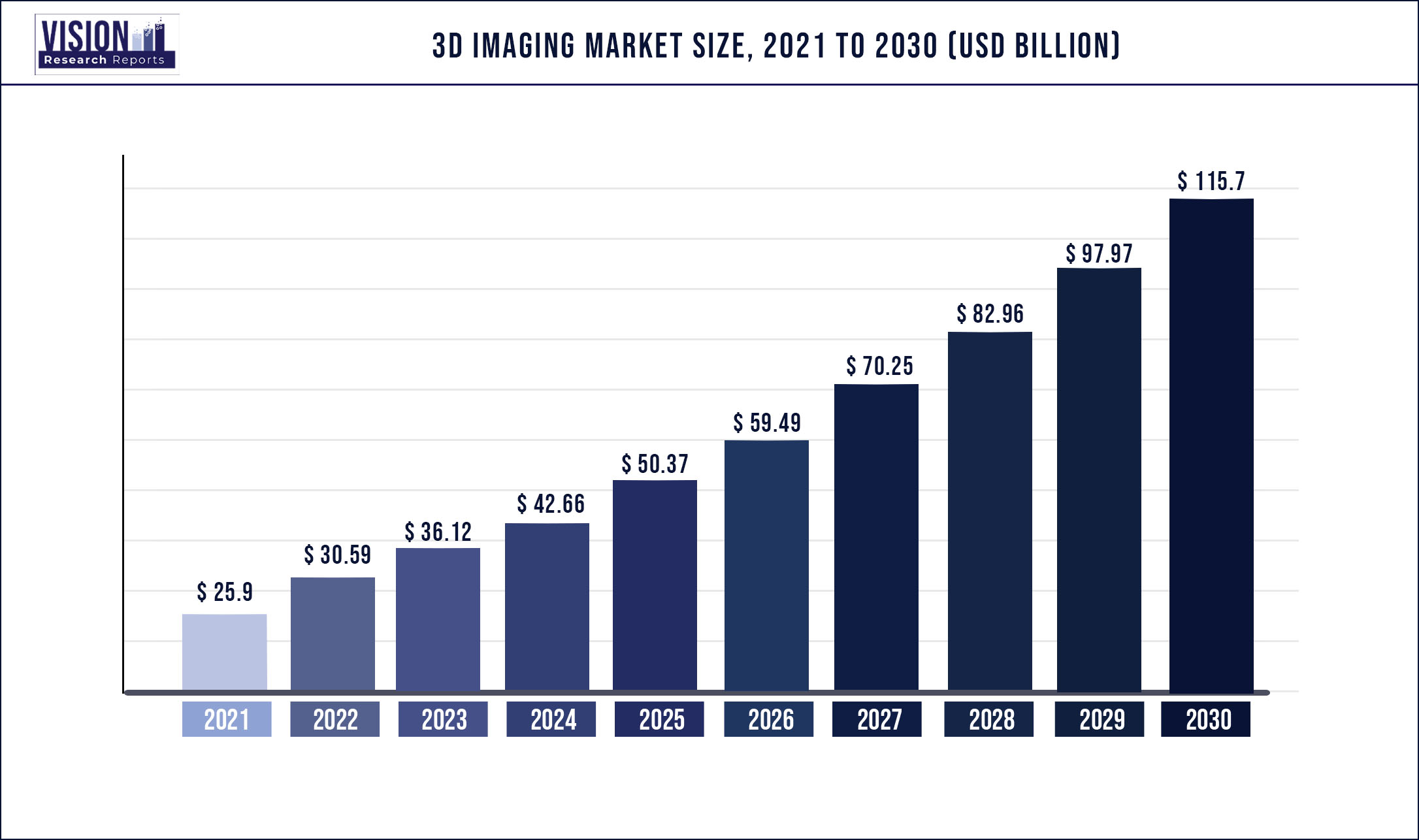

The global 3D imaging market was valued at USD 25.9 billion in 2021 and it is predicted to surpass around USD 115.7 billion by 2030 with a CAGR of 18.09% from 2022 to 2030.

Report Highlights

The 3D imaging technology in the media and entertainment sector has been gaining momentum as the demand for 3D video games and theatrical films have risen tremendously over the years, acting as one of the key drivers in the market.

The COVID-19 pandemic significantly impacted the 3D imaging market. Lockdowns were implemented due to the pandemic that led to a temporary prohibition on import and export and manufacturing across multiple industries. The closure of manufacturing plants resulted in a significant loss of business and revenue for the regions under lockdown. The disruption in global supply chains negatively impacted the sales of products, delivery schedules, and manufacturing in the global market, which led to a notable drop in the sales of 3D imaging.

Mergers & acquisitions, agreements, and expansions are the key strategies adopted by the companies over the past years. For instance, in August 2021, FARO Technologies announced the acquisition of ATS AB, a Swedish-based company in 3D digital twin solution technology. The agreement will include the integration of ATS patented Traceable 3D system and software, which allows highly precise and reproducible 3D scans into the FARO Webshare Cloud system.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 25.9 billion |

| Revenue Forecast by 2030 | USD 115.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 18.09% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | End-use, component, organization, deployment, region |

| Companies Covered |

General Electric; TomTec Imaging Systems GMBH; PLANMECA OY; Ajile Light Industry; OLYMPUS CORPORATION; EOS Imaging; Siemens Healthcare GmbH; INTRASENSE; eCential Robotics; FARO; Koninklijke Philips N.V. |

Component Insights

The hardware segment accounted for the largest revenue share of over 45.05% in 2021 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing demand for 3D imaging devices such as X-ray devices, ultrasound systems, CT, and MRI in the healthcare sector. In addition, the growing gaming and entertainment industry has fueled the demand for 3D imaging technology as the viewers can witness the 3D experience with their own eyes because of these technologies. In terms of components, the market has been segmented into software, hardware, and services.

The software segment is expected to expand at a CAGR of 19.94% over the forecast period. This can be attributed to the use of 3D imaging software in the healthcare, automotive, and manufacturing industry. In addition, its growing popularity in other industries such as media and entertainment, architecture and construction, and archaeological studies is fueling the segment growth.

Deployment Insights

The on-premise segment accounted for the largest revenue share of over 75.19% in 2021 and is expected to retain its position in the market over the forecast period. This can be attributed to a one-time upfront license purchase, an internal network that can be accessed anytime, and high security as data is stored locally.

The cloud segment is expected to expand at a CAGR of 19.84% over the forecast period. The use of cloud-based 3D imaging systems is growing owing to their advantages such as easy and effective management, image data maintenance, flexibility, cost-effectiveness, agility, and scalability.

Organization Insights

The large enterprise segment accounted for the largest revenue share of over 55.46% in 2021 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing usage of 3D imaging hardware and solutions in large enterprises to manufacture improved products and give a better customer experience. Moreover, the dominance of this segment in the market is primarily accredited to the growing investments by large organizations.

The small and medium segment is expected to expand at a CAGR of 19.22% over the forecast period. This can be attributed to the increasing adoption of 3D imaging technologies by small and medium organizations to compete with other market players.

End-use Insights

The healthcare and life sciences segment accounted for the largest revenue share of over 55.31% in 2021 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing adoption and growing need for 3D medical imaging technology in the healthcare sector to determine and diagnose the disease in the body. In terms of end-use, the market has been segmented into automotive and transportation, healthcare and life science, architecture and construction, manufacturing, media and entertainment, and security and surveillance.

Due to sedentary lifestyles, the increasing frequency of chronic diseases worldwide, and a considerable growth in the aging population, there's been an increase in the occurrence of lifestyle diseases and age-related illnesses. As a result, the 3D imaging devices demand has increased.

The automotive and transportation segment is anticipated to register a CAGR of 17.43% over the forecast period. The growth of this segment can be attributed to the advanced features offered by 3D imaging, an increase in the number of cars, increased usage of advanced driver assistance systems (ADAS), and the growing trend of driverless vehicles are all driving the market for automotive 3D imaging. This technology enables protection, parking surveillance, anti-theft measures, healthcare, social media, forensics, and mobile commerce.

Regional Insights

North America accounted for the largest revenue share of over 35.68% in 2021 and is anticipated to retain its position over the forecast period. Factors such as the presence of major market vendors and the high adoption of advanced technologies are fueling the market growth in the region.

Asia Pacific is anticipated to expand at the highest CAGR of 20.97% over the forecast period. The growth of the regional market is mainly attributed to the growth in the healthcare, automation, media and entertainment, and the manufacturing sector. With the potential growth in the sectors, there have been increasing investments from Asia Pacific nations such as Japan, India, and China. The growing technological awareness and adoption in the region are also expected to fuel the market growth across the region over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 3D Imaging Market

5.1. COVID-19 Landscape: 3D Imaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 3D Imaging Market, By End-use

8.1. 3D Imaging Market, by End-use, 2022-2030

8.1.1. Automotive and Transportation

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Manufacturing

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Healthcare and Life Sciences

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Architecture and Construction

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Media and Entertainment

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Security & Surveillance

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global 3D Imaging Market, By Component

9.1. 3D Imaging Market, by Component, 2022-2030

9.1.1. Software

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Hardware

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global 3D Imaging Market, By Organization

10.1. 3D Imaging Market, by Organization, 2022-2030

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Small and Medium-sized Enterprises

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global 3D Imaging Market, By Deployment

11.1. 3D Imaging Market, by Deployment, 2022-2030

11.1.1. On-premise

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Cloud

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global 3D Imaging Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by End-use (2017-2030)

12.1.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.3. Market Revenue and Forecast, by Organization (2017-2030)

12.1.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Organization (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by End-use (2017-2030)

12.2.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.3. Market Revenue and Forecast, by Organization (2017-2030)

12.2.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Organization (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Organization (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Organization (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by End-use (2017-2030)

12.3.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.3. Market Revenue and Forecast, by Organization (2017-2030)

12.3.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Organization (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Organization (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Organization (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by End-use (2017-2030)

12.4.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.3. Market Revenue and Forecast, by Organization (2017-2030)

12.4.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Organization (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Organization (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Organization (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Organization (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Organization (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

Chapter 13. Company Profiles

13.1. General Electric

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. TomTec Imaging Systems GMBH

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. PLANMECA OY

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Ajile Light Industry

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. OLYMPUS CORPORATION

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. EOS Imaging

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Siemens Healthcare GmbH

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. INTRASENSE

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. eCential Robotics

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. FARO

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others