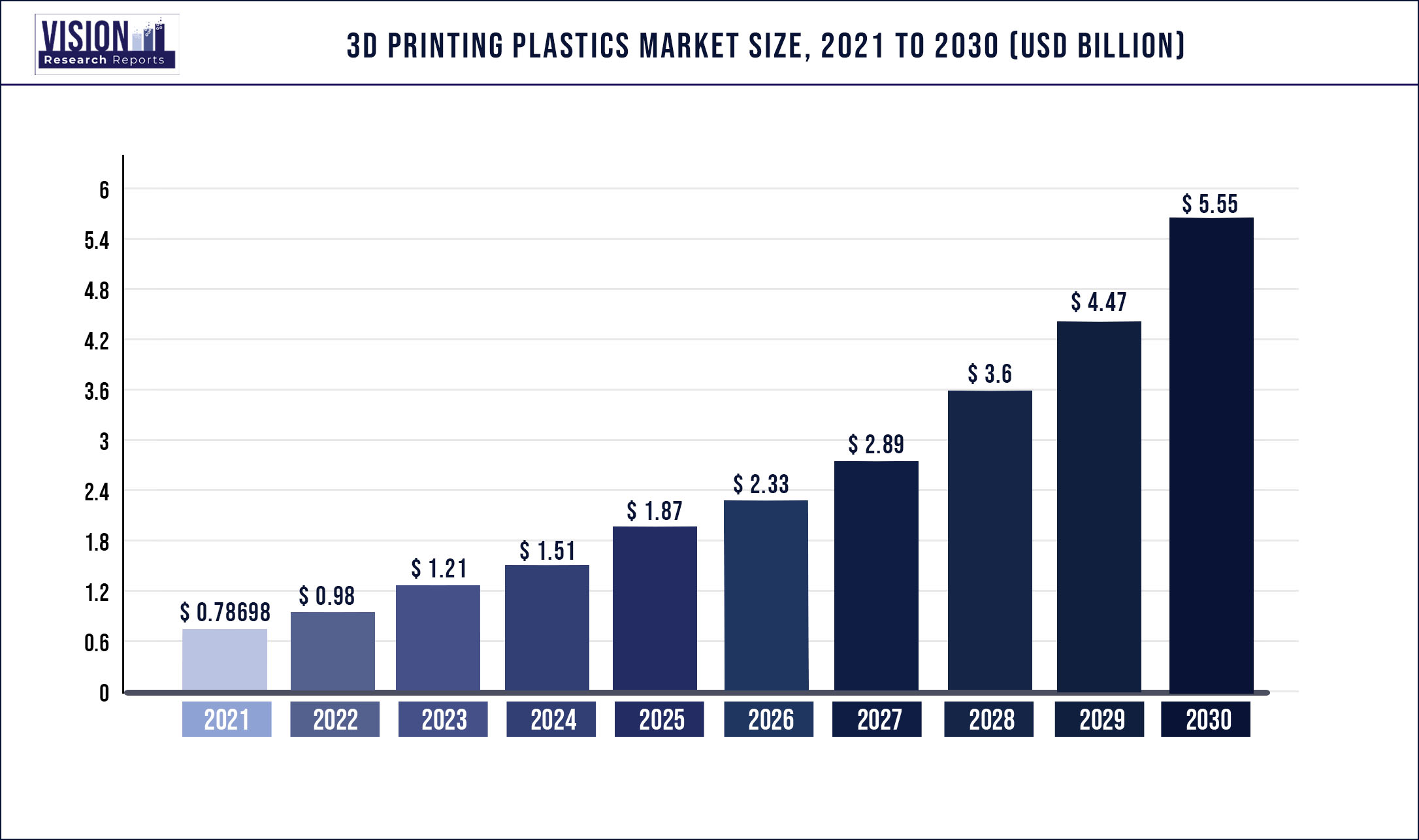

The global 3D printing plastics market was estimated at USD 786.98 million in 2021 and it is expected to surpass around USD 5.55 billion by 2030, poised to grow at a CAGR of 24.24% from 2022 to 2030.

Report Highlights

By type, the U.S. 3D printing plastics market was valued at USD 247.1 million in 2021 and expected to witness growth at a CAGR of 21.71% from 2022 to 2030.

The market is projected to witness substantial growth due to rising demand from various end-use industries such as medical, automotive, aerospace and defense, and consumer goods. Properties such as clarity in the image, high durability, high impact resistance, excellent UV and temperature resistant, sliding friction, high chemical resistance, rigidity, and dimensional stability are significantly fueling the demand for 3D printing plastics in the above-mentioned end-use industries across the globe.

3D printed products assist significantly in attaining economies of scale through the consumption of lesser lead time, reduced costs, and mitigated risks. 3D plastics also allow easier customization as per the consumers’ needs. Thus, attracting favorable government regulations across various end-use industries such as automotive, medical, and consumer goods. Asia Pacific is anticipated to expand at a lucrative CAGR over the forecast period. The medical end-use segment in the region is expected to witness substantial growth over the forecast period on account of the increasing applications of 3D plastics in prototyping, custom orthodontic implants, prosthetics, medical instruments, and others.

Moreover, the rising demand for high-quality medical instruments and components from hospitals in major economies, such as China, India, and Singapore, is anticipated to create lucrative opportunities in the medical industry. Furthermore, the recent outbreak of COVID-19 in countries such as India, China, Australia, Japan, and Malaysia is creating a high demand for 3D printing plastics, especially in face shields, 3D printed masks, and filter cover applications. Thus, the rising positive cases in the region are projected to significantly boost the market growth.

The consumer goods segment is emerging as a significant end-use of 3D plastic products on account of the reduced lead time offered by additive manufacturing techniques. Innovative additive manufacturing solutions enable the production of designer parts with complex geometries. Thus, facilitating the manufacturers to cater to rising consumer needs for personalized parts.

The photopolymers segment is anticipated to progress at a substantial rate over the forecast period. Massive demand for photopolymers is attributed to high consumption in the production of industrial prototypes through the utilization of SLA technology. Polyamide/nylon is anticipated to witness the fastest growth during the forecast period on account of the rising demand from both domestic as well as commercial applications. The demand for polyamide/nylon is majorly contributed by laser sintering technology.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 786.98 million |

| Revenue Forecast by 2030 | USD 5.55 billion |

| Growth rate from 2022 to 2030 | CAGR of 24.24% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, form, end use, region |

| Companies Covered | 3D Systems Corporation; Arkema Inc.; Envisiontec Inc.; Stratasys Ltd.; SABIC; Materialise NV; HP INC.; Eos GmbH Electro Optical Systems; PolyOne Corporation; Royal DSM N.V. |

Type Insights

The photopolymers segment led the market and accounted for more than 55.09% share of the global revenue in 2021. Photopolymers are soluble liquid mixtures of monomer, polymer base, and oligomers along with a photoinitiator. They are lightly sensitive polymeric materials that when exposed to light, change their physical as well as chemical properties. Ultraviolet rays initiate the reaction and change the properties of photopolymers. They are extensively utilized in various printing technologies, including inkjet, polyjet, and 3D jetted printing.

Polyamide/Nylon is anticipated to grow at the fastest rate during the forecast period. Nylon is also called Polyamide (PA). Nylon 6 and Nylon 6, 6 are two different grades of nylon, consisting of almost similar ratios of hydrogen, oxygen, nitrogen, and carbon. Nylon consists of a comparatively higher melting point, which allows it to become an ideal material to be used in several applications. In addition, it contains strong oxygen barrier properties, thus making it suitable for combination with other materials such as paper, which do not possess good gas resistance.

Form Insights

The filament segment led the market and accounted for more than 65.1% share of the global revenue in 2021. They are manufactured and marketed in two diameters only, which include 1.75mm and 3mm. Their versatile properties, coupled with a surge in demand from several application industries such as food packaging, tableware, upholstery, and disposable garments, are expected to drive the demand over the forecast period.

3D printing inks are anticipated to witness promising growth during the forecast period on account of the ongoing research & development activities as well as investments to develop smart inks. These inks enable the 3D printed structures to change their shape as well as color, thereby enhancing their functionality. Moreover, researchers are focusing on developing low-cost options to manufacture critical parts in application areas such as biomechanics and energy.

End-use Insights

The medical end-use segment led the market and accounted for more than 45.15% share of the global revenue in 2021. Key factors propelling the demand for 3D printing plastics in the medical industry include its cost-effectiveness, ease in customization, and growing incidences of vascular and osteoarthritis diseases. Moreover, improved technology, favorable government support, and rapid product development are expected to propel product demand in medical applications. In addition, growing demand for medical components such as face shields, mask clips, and 3D printed masks & filter covers on account of the outbreak of the COVID-19 pandemic is projected to propel the market growth.

Growth in aircraft manufacturing for defense and commercial purposes is likely to drive the demand for plastics in additive manufacturing. Increasing military and defense expenditure is anticipated to fuel the growth of the aerospace industry, thereby propelling the product demand. Airbus Group’s A350 and Boeing’s Dreamliner are among the most popular aircraft fleets witnessing demand in the aviation industry.

Regional Insights

North America dominated the market and accounted for more than 40.11% share of the global revenue in 2021. The region comprises matured markets and is characterized by a technologically advanced 3D printing industry, thereby contributing significantly to the market growth. Polylactic acid (PLA) is projected to grow at a promising rate in the North American market. Filament produced from PLA is widely used across several application areas as it is available in various colors and blends. It is also easier to use and gives a premium finish to the final printed product.

The U.S. dominated the North American market in 2021 and is expected to maintain its lead over the forecast period. The demand for 3D printing plastics in the country is majorly generated from the growing medical end-use segment owing to the rising elderly population in the country. Increasing demand for 3D printing plastics in medical equipment can be attributed to the mechanical and chemical properties offered by 3D printed plastics. Biocompatibility, optical clarity, and cost-effective method of production are expected to drive the product demand in the healthcare industry. In addition, the constantly rising patient population on account of the outbreak of COVID-19 at the community level is projected to propel the demand for medical components, thereby boosting the demand for 3D printing plastics in the U.S.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 3D Printing Plastics Market

5.1. COVID-19 Landscape: 3D Printing Plastics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 3D Printing Plastics Market, By Type

8.1. 3D Printing Plastics Market, by Type, 2022-2030

8.1.1 Photopolymers

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. ABS & ASA

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polyamide/Nylon

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polylactic acid

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global 3D Printing Plastics Market, By Form

9.1. 3D Printing Plastics Market, by Form, 2022-2030

9.1.1. Filament

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Ink

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Powder

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global 3D Printing Plastics Market, By End-use

10.1. 3D Printing Plastics Market, by End-use, 2022-2030

10.1.1. Automotive

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Medical

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Aerospace & Defense

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Consumer Goods

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global 3D Printing Plastics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Form (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Form (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Form (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Form (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Form (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Form (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Form (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Form (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Form (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Form (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Form (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. 3D Systems Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Arkema Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Envisiontec Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Stratasys Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SABIC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Materialise NV

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HP INC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Eos GmbH Electro Optical Systems

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PolyOne Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Royal DSM N.V.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others