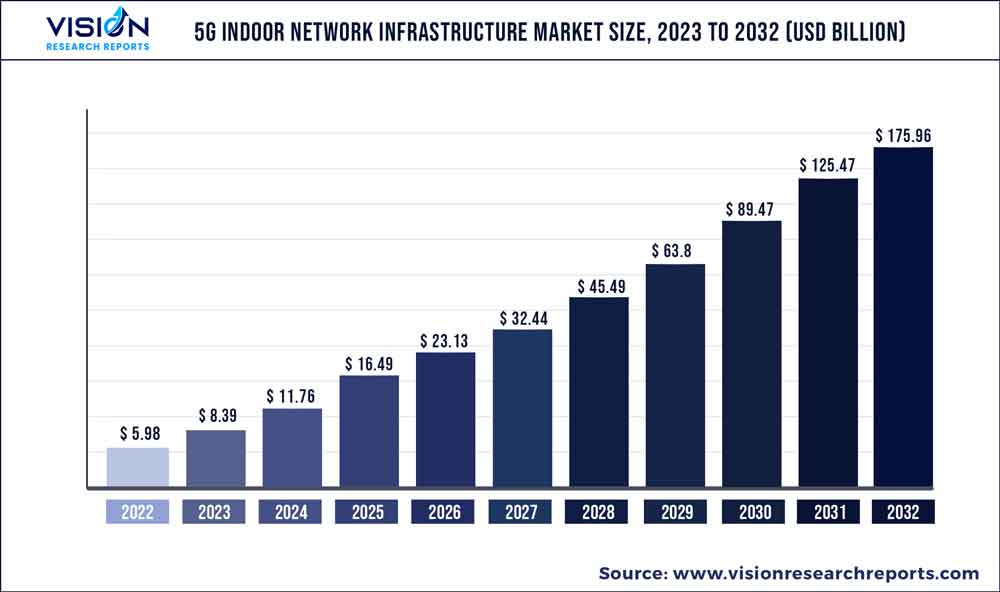

The global 5G indoor network infrastructure market size was estimated at around USD 5.98 billion in 2022 and it is projected to hit around USD 175.96 billion by 2032, growing at a CAGR of 40.24% from 2023 to 2032. The 5G indoor network infrastructure market in the United States was accounted for USD 1031.6 million in 2022.

Key Pointers

Report Scope of the 5G Indoor Network Infrastructure Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 39.06% |

| Revenue Forecast by 2032 | USD 175.96 billion |

| Growth Rate from 2023 to 2032 | CAGR of 40.24% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Airspan Networks; Samsung Electronics Co., Ltd.; CommScope Holding Company, Inc.; Telefonaktiebolaget LM Ericsson; Nokia; Huawei Technologies Co., Ltd.; Corning Inc.; Comba Telecom Systems Holdings Ltd. |

The growth of the market can be attributed to the factors, such as enhanced connectivity indoors and the growing adoption of 5G in applications, such as data centers, manufacturing, healthcare, and real estate, among others. The high speed and low latency provided by 5G indoor network infrastructure indoors are expected to drive the market’s growth over the forecast period.Countries across the world are rapidly adopting 5G technologies for enhanced connectivity. Countries, such as China, the U.S., Japan, South Korea, the UK, Italy, and Spain, are deploying 5G to keep pace with the growing digitization.

However, in these countries, especially China and the U.S., with a majority of the population living in urban areas, the existing 5G network infrastructure lacks indoor coverage. Countries with high networking traffic are adopting 5G indoor network infrastructure for enhanced coverage and better connectivity. Consumers, businesses, and commercial buildings are realizing the potential of deploying 5G services on their premises. Even though 5G service is still a niche market, where countries are still piloting 5G projects, the benefits of the 5th generation of networks are undeniable. A wide range of applications, including store navigation, video recognition-based shopping, smart hotels, robotic services, robotic control in manufacturing, defect identification services, cloud-based digital working spaces, and facial recognition, is driving the market.

The COVID-19 pandemic has highlighted the vulnerabilities and weaknesses of economies and businesses, leading governments and citizens to take more measures and initiatives toward creating a more connected and digitized working environment. The rollout of 5G services declined due to the adversities of the pandemic. However, as the world recovers from the pandemic, growing consumer expectations and increasing government and private spending in the 5G infrastructure sector are expected to boost the growth of the market over the forecast period. Asia Pacific dominated theindustry in 2022. The growth can be attributed to a broader customer base and a substantial number of 5G indoor network infrastructure providers in the region. Encouraging government initiatives to promote 5G services also bodes well for the region’s growth.

Technology Insights

The distributed antenna systems (DAS) segment dominated the market in 2022 and accounted for a revenue share of more than 48.08%. The growing demand for DAS can be attributed to their ability to help distribute 5G signals indoors. Traditional 5G cell towers provide 5G coverage outdoors, while 80% of data usage occurs indoors by consumers and businesses. Building materials, such as concrete, metal, and glass can block the signals from the cell towers, which hampers the 5G connectivity indoors. Moreover, many indoor venues already consist of DAS that can be upgraded for 5G coverage, making it quicker in deployment and less costly, which contributed to the segment gaining a large market share in 2022. The small cell systems segment is anticipated to register the fastest growth rate over the forecast period.

Small cell systems are standalone technology in the market. They are small and modular and enhance 5G connectivity indoors. Small cells benefit operators and IT managers who may be responsible for multiple locations, businesses, and campuses where buildings vary in size and user traffic. Moreover, they are cost-effective and modular high-performance solutions that can cover a wide range of indoor environments with a common solution for better coverage. When the number of 5G users will increase rapidly, the existing infrastructure will become insufficient, and businesses & consumers will shift to new network infrastructure, such as small cell systems, which is expected to drive the segment’s growth over the forecast period.

Network Architecture Insights

The non-standalone segment dominated the market in 2022 and accounted for a revenue share of more than 84.02%. The initial rollout of 5G included providing customers with 5G coverage using the existing (non-standalone, compatible with 4G & LTE, and upgraded for 5G) infrastructure. Network providers offered their customers 5G services with higher data transfer speeds by pairing a 5G RAN with LTE evolved packet core. The non-standalone network infrastructure of 5G indoor network infrastructure was easy to deploy and cost-effective at the initial stage of 5G rollouts, contributing to the dominating share of the non-standalone segment.

The standalone segment is anticipated to register the fastest growth rate over the forecast period. Even though the initial rollouts of 5G constituted non-standalone networks, as the network evolves and more & more businesses & consumers move to 5G connectivity, the non-standalone networks will be insufficient. At that juncture, standalone 5G will bring faster, more reliable, and largely capable telecommunications. The standalone indoor network infrastructure presents logistical, financial, and operational roadblocks. However, 5G service providers are investing heavily to tackle these issues and move forward with the standalone networks, which are expected to fuel the market’s growth over the forecast period.

Spectrum Insights

The sub-6 GHz segment dominated the market in 2022 and accounted for a revenue share of more than 74.01%. The sub-6 GHz spectrum uses frequencies below 6GHz, where the 4G, 3G, and 2G networks have historically operated. This has made the deployment of 5G easier using the existing systems. 5G carriers have successfully deployed nationwide networks quickly by using their existing towers and spectrums, as sub-6 5G does not require more than tower upgrades. With the sub-6 GHz spectrum, telecom operators can provide relatively high output with 5G without compromising their 4G offerings, which has contributed to the significant share of the segment in 2022.

The mmWave (millimeter wave) segment is anticipated to register the fastest growth rate over the forecast period. mmWave spectrum uses significantly higher frequencies ranging between 30 and 300 GHz. Carriers currently operate between 30 and 40 GHz. Hence, mmWave 5G coverage can use previously untouched spectrum and provide tremendous data speeds and ultralow latency. Moreover, the mmWave can allow future communications between devices, cars, and medical equipment. The vital and vast benefits of the mmWave spectrum are expected to drive the segment’s growth over the forecast period.

Application Insights

The commercial buildings segment dominated the market in 2022 and accounted for a revenue share of over 30.04%. The 5G indoor network infrastructure provides various benefits in commercial buildings, which contributed to the segment's dominant market share in 2022. Some of these benefits include enhanced IoT capabilities, increasing data collection capabilities, and adding enhanced value to buildings. The 5G indoor network infrastructure is used in commercial buildings to enhance 5G connectivity, support user experience, and connect teams at multiple locations all at once, driving the segment's growth. The manufacturing segment is anticipated to register significant growth over the forecast period.

5G technologies provide fundamental network characteristics, such as low latency and high reliability, which are needed to support critical applications. Moreover, it allows manufacturers to build smart factories and take advantage of advanced technologies, such as Artificial Intelligence (AI), automation, AR for troubleshooting, and the Internet of Things (IoT). One of the roadblocks faced by the manufacturing industry is connectivity issues in warehouses and factories, which are generally located on the outskirts of the cities. 5G indoor network infrastructure helps manufacturers tackle this problem, which is expected to drive its adoption in manufacturing applications over the forecast period.

Regional Insights

Asia Pacific dominated the global market in 2022 and accounted for a revenue share of more than 39.06%. The 5G network rollout across the Asia Pacific region has been uneven, with developed markets, such as China, Singapore, South Korea, and Australia, leading the way. The growth of the regional market can be attributed to enterprise use cases, such as robotics, that take advantage of the low-latency capabilities of technology. The growing government initiatives in countries, such as China and India, are expected to fuel the regional market’s growth. Moreover, the APAC region houses several countries with high populations, which leads to dense infrastructure. 5G indoor network infrastructure is highly suitable for providing 5G connectivity in densely populated areas, thus driving the regional market.

Europe is expected to emerge as the fastest-growing regional market over the forecast period. The European governments are looking at 5G infrastructure as the key to accelerating the use of 5G in automation, the Internet of Things (IoT), smart manufacturing, and smart buildings. The Europe region houses many countries with large manufacturing plants. Manufacturers in this region are looking for 5G connectivity to automate their processes to earn larger profits, greater precision, and enhanced accuracy. The growing use of 5G technologies in indoor applications, such as manufacturing, commercial buildings, transportation & hospitality, data centers, health care, and retail, is driving the market growth in the European region.

5G Indoor Network Infrastructure Market Segmentations:

By Technology

By Network Architecture

By Spectrum

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 5G Indoor Network Infrastructure Market

5.1. COVID-19 Landscape: 5G Indoor Network Infrastructure Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 5G Indoor Network Infrastructure Market, By Technology

8.1. 5G Indoor Network Infrastructure Market, by Technology, 2023-2032

8.1.1. Distributed Antenna Systems (DAS)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Small Cell Systems

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Open RAN

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global 5G Indoor Network Infrastructure Market, By Network Architecture

9.1. 5G Indoor Network Infrastructure Market, by Network Architecture, 2023-2032

9.1.1. Standalone

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-standalone

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global 5G Indoor Network Infrastructure Market, By Spectrum

10.1. 5G Indoor Network Infrastructure Market, by Spectrum, 2023-2032

10.1.1. Sub-6 GHz

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. mmWave

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global 5G Indoor Network Infrastructure Market, By Application

11.1. 5G Indoor Network Infrastructure Market, by Application, 2023-2032

11.1.1. Retail

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Transportation & Hospitality

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Manufacturing

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Commercial Buildings

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Data Centers

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global 5G Indoor Network Infrastructure Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.2.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.3.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.4.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Airspan Networks

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Samsung Electronics Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. CommScope Holding Company, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Telefonaktiebolaget LM Ericsson

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nokia

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Huawei Technologies Co., Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Corning Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Comba Telecom Systems Holdings Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others