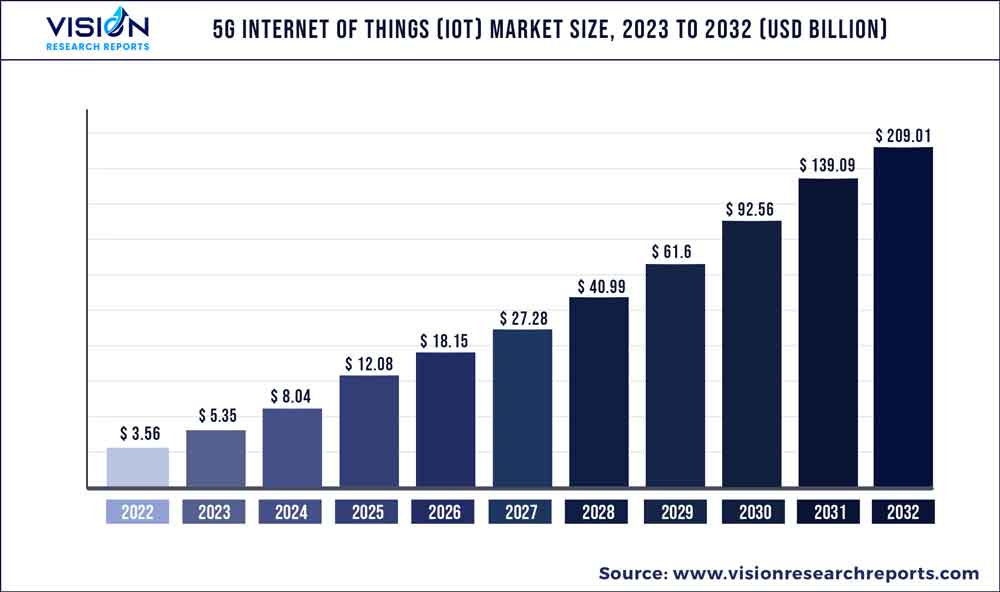

The global 5G internet of things (IoT) market was valued at USD 3.56 billion in 2022 and it is predicted to surpass around USD 209.01 billion by 2032 with a CAGR of 50.27% from 2023 to 2032. The 5G internet of things (IoT) market in the United States was accounted for USD 689.1 million in 2022.

Key Pointers

Report Scope of the 5G Internet of Things (IoT) Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 38.06% |

| Revenue Forecast by 2032 | USD 209.01 billion |

| Growth Rate from 2023 to 2032 | CAGR of 50.27% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation |

The growth can be ascribed to improved dependability, decreased latency, expanded capacity, and network speeds of 5G internet of things (IoT). It may also automate corporate operations and enable end-to-end communication. Manufacturers are aggressively adopting novel technologies such as IoT, AI & machine learning, and cloud computing & analytics into their manufacturing facilities and operations as part of this revolution. This has increased the demand for 5G technology with low latency and greater speeds for the successful use of wearables, autonomous robotics, and virtual reality (VR) headsets.

Private 5G networks are expected to play a significant role in the growth of the 5G IoT industry. These networks provide dedicated high-speed connectivity, offering greater reliability, security, and control compared to public networks. In particular, private 5G networks will be critical for industries such as manufacturing, logistics, and healthcare, where high-bandwidth, low-latency connectivity is essential for real-time applications and services. Moreover, private 5G networks can enable automation and robotics, allowing for more efficient and cost-effective operations.

The increasing proliferation of 5G networks which are being deployed by telecommunication companies across the globe is a significant factor driving the market growth. As 5G networks become more widely available, businesses and consumers will increasingly adopt 5G-enabled IoT devices, leading to further investment in this market. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) with 5G IoT devices is expected to fuel investment, as these technologies can enable predictive analytics and automated decision-making, further enhancing the capabilities of IoT systems.

The outbreak of the COVID-19 pandemic positively impacted the market. The pandemic has highlighted the importance of connectivity and the need for robust and reliable networks. As more countries begin to emerge from the pandemic and the rollout of 5G infrastructure resumes, demand for IoT devices is expected to increase. Additionally, the development of new 5G-enabled applications, such as remote healthcare and autonomous vehicles, could further drive the market’s growth.

Component Insights

The hardware segment dominated the market in 2022 and accounted for more than 45.05% share of the global revenue. The segment growth can be attributed to significant innovation and investment in the coming years as companies seek to capitalize on the potential of this new technology. As 5G networks become more widely available, the cost of 5G IoT hardware will likely fall. This would make it cheaper for manufacturers to incorporate 5G IoT hardware into their business processes and utilize smart cities, industrial automation, and autonomous cars, among others. The combination of 5G technology with IoT has the potential to alter businesses and generate demand for 5G IoT hardware over the forecast period.

The services segment is projected to witness remarkable growth over the forecast period. The segment is expected to grow over the forecast period in line with the continued adoption of IoT devices in manufacturing, transportation, and automotive, among other industries and industry verticals. The support & maintenance segment is anticipated to witness the fastest growth over the forecast period. Businesses are increasingly depending on 5G IoT services to suit their demands as the number of IoT devices linked to the internet rises and the demand for a high-speed connection and real-time data processing rises.

IoT Connectivity Insights

The massive IoT segment dominated the market in 2022 and accounted for more than 43.07% share of the global revenue. The growing number of massive IoT connections is expected to drive the growth of the segment. Massive IoT connects massive amounts of devices that require minimal connectivity and computing resources and are low-power, low-cost devices. Smart agriculture, asset tracking, supply chain management, smart energy, industrial monitoring, smart homes, and wearables are just a few industries where the combination of 5G with large IoT has applications. The advantages of Massive IoT propel its acceptance in the 5G IoT industry.

Industrial automation IoT is anticipated to emerge as the fastest-growing segment over the forecast period. Industrial automation IoT adds cellular connection into the wired industrial infrastructure needed for real-time sophisticated automation. This technology enables greater communication between industrial equipment and systems by merging 5G technologies with Ethernet-based industrial protocols and Time-Sensitive Networking. Industrial automation IoT is projected to alter the way organizations function by enabling seamless integration of cellular connection into the industrial infrastructure, resulting in increased cost savings, improved performance, and enhanced capabilities, consequently boosting the segment's growth.

Network Architecture Insights

The 5G non-standalone segment dominated the market in 2022 and accounted for more than 67.02% share of the global revenue. The growth can be attributed to the early deployment of 5G non-standalone networks throughout the world to provide 5G services to businesses and consumers. The 5G non-standalone network uses the existing 4G infrastructure to provide 5G connectivity.

During the first implementation of 5G networks, the non-standalone 5G network design will be critical in allowing users to experience faster data transfer speeds while still utilizing the current 4G/LTE infrastructure. Since they are built on existing infrastructure, they offer the most affordable and time-efficient way of upgrading to 5G, which is contributing to their dominant share in the market.

The 5G standalone segment is projected to grow at the highest CAGR over the forecast period. The ability of 5G standalone to maintain continuous machine-to-machine communication, which requires ultra-reliable, high-frequency, and low-latency connectivity is a major factor driving the segment growth.

5G standalone is a sort of 5G network architecture that is solely based on 5G infrastructure and is designed to deliver a more efficient and effective network for IoT devices. Globally, growing industrial digitization is creating new opportunities for service providers. The combination of these trends is expected to drive the growth of the segment in the 5G IoT market over the coming years.

Vertical Insights

The manufacturing segment dominated the market in 2022 and accounted for more than 22.04% share of the global revenue. 5G IoT has the potential to revolutionize the manufacturing industry and fuel the growth of Industry 4.0 transformation. Its various applications in the manufacturing industry, including automation, autonomous vehicles, machine-to-machine connectivity, machine health monitoring, asset tracking, supply chain management, and predictive maintenance, are contributing to the segment’s growth.

Adoption of 5G IoT would be critical in assisting manufacturing entities in accelerating this transformation by providing enhanced visibility across the entire ecosystem and laying the groundwork for the implementation of cutting-edge technologies such as AI and ML, resulting in the creation of novel use cases and improved commercial outcomes.

The smart cities segment is expected to grow significantly over the forecast period. The rising deployment of connected sensors and devices, such as smart streetlights, traffic sensors, and waste management systems in smart cities are the major factors driving the growth opportunities for the segment. These devices collect and transmit data in real-time, allowing city managers to optimize operations and improve citizen services.

Additionally, with the rise of urbanization and population growth, cities worldwide are facing numerous challenges related to traffic management, energy consumption, and environmental sustainability. To address these challenges, smart cities are increasingly turning to 5G IoT technologies to enable real-time monitoring, analysis, and optimization of city services and infrastructure.

Regional Insights

The Asia Pacific region dominated the market in 2022 and accounted for more than 38.06% share of the global revenue. The growth can be attributed to the increasing 5G IoT initiatives, such as smart cities, in nations like China and India. At the same time, favorable government measures for automation and technologically advanced start-ups in the country are propelling the regional market's growth.

Additionally, APAC is characterized by countries with large populations, emerging economies, and evolving businesses and startups, which offers a significant growth opportunity for 5G IoT network providers owing to the presence of a sizeable untapped consumer base in the region.

North America is expected to witness significant growth over the forecast period. Increasing 5G infrastructure investments are a key component fueling the region's expansion. Significant investments are made in 5G infrastructure, including the installation of fiber-optic cables, and other network elements. Moreover, the regional governments are encouraging the use of 5G technology through various programs and laws designed to enhance the network infrastructure. These elements are encouraging for the region's progress throughout the study period.

5G Internet of Things (IoT) Market Segmentations:

By Component

By IoT Connectivity

By Network Architecture

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 5G Internet of Things (IoT) Market

5.1. COVID-19 Landscape: 5G Internet of Things (IoT) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 5G Internet of Things (IoT) Market, By Component

8.1. 5G Internet of Things (IoT) Market, by Component, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global 5G Internet of Things (IoT) Market, By IoT Connectivity

9.1. 5G Internet of Things (IoT) Market, by IoT Connectivity, 2023-2032

9.1.1. Sub-Massive IoT

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Broadband IoT

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Critical IoT

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Industrial Automation IoT

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global 5G Internet of Things (IoT) Market, By Network Architecture

10.1. 5G Internet of Things (IoT) Market, by Network Architecture, 2023-2032

10.1.1. 5G Non-standalone

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. 5G Standalone

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global 5G Internet of Things (IoT) Market, By Vertical

11.1. 5G Internet of Things (IoT) Market, by Vertical, 2023-2032

11.1.1. Manufacturing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Smart Cities

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Energy & Utilities

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Transportation & Logistics

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Enterprises/Corporates

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Oil & Gas

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Others

11.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global 5G Internet of Things (IoT) Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.1.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.2.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.3.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.4.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by IoT Connectivity (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Network Architecture (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. Nokia Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. TELEFONAKTIEBOLAGET LM ERICSSON

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. ZTE Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. AT&T INC.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Huawei Technologies Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Verizon Communications Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Thales Group

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Vodafone Group Plc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. China Mobile Limited

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microsoft Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others