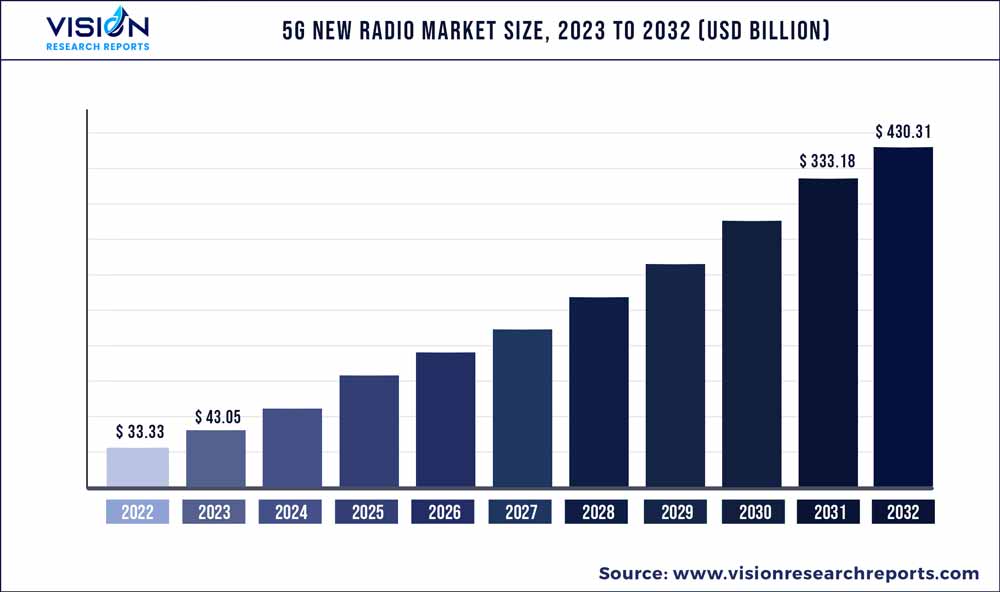

The global 5G new radio market was valued at USD 33.33 billion in 2022 and it is predicted to surpass around USD 430.31 billion by 2032 with a CAGR of 29.15% from 2023 to 2032. The 5G new radio market in the United States was accounted for USD 6 billion in 2022.

Key Pointers

Report Scope of the 5G New Radio Market

| Report Coverage | Details |

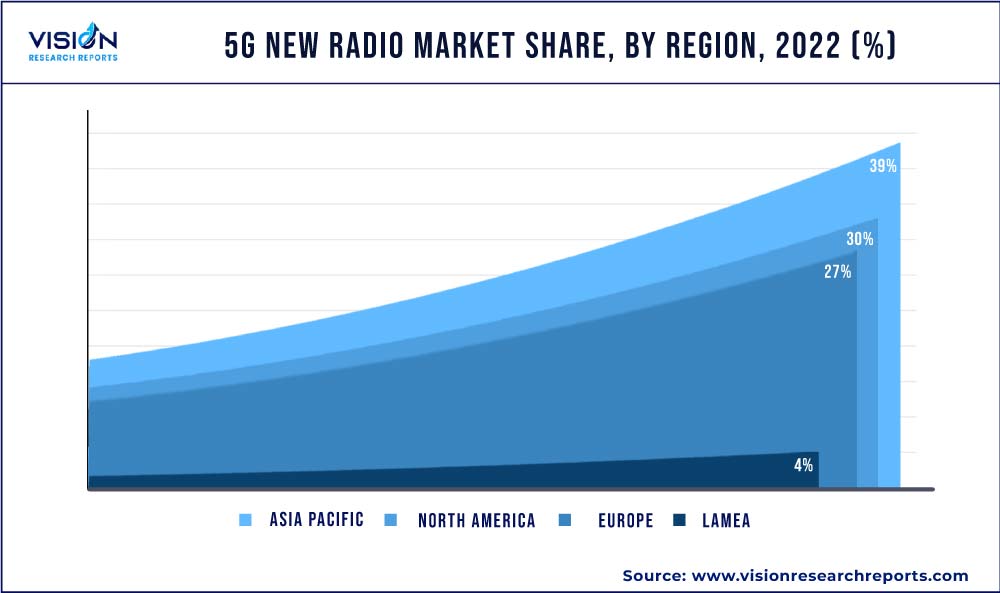

| Revenue Share of Asia Pacific in 2022 | 39% |

| Revenue Forecast by 2032 | USD 430.31 billion |

| Growth Rate from 2023 to 2032 | CAGR of 29.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Huawei Technologies Co., Ltd.; Qualcomm Technologies, Inc; Telefonaktiebolaget LM Ericsson; Samsung; Intel Corporation; Cisco Systems Inc.; Fujitsu; NEC Corporation; Verizon Communications Inc.; Keysight Technologies |

The growth of the market can be ascribed to the increased demand for high-speed data services and an increase in the number of customers using internet globally. At the same time, the increased use of industrial automation and organizations shifting preferences towards cloud services are important factors driving the growth of the 5G new radio (NR) market. Additionally, the worldwide aggressive rollout of a 5G Radio Access Network (RAN) with numerous small cells and macrocell base stations is further fueling the market's expansion during the anticipated period. Several 5G RAN providers across the globe are focusing on developing solutions to support performance verification along with the evaluation of new solutions. For instance, in February 2023, Fujitsu, a communication technology company, launched a new 5G vRAN solution that combines Fujitsu's virtualized DU (vDU) and virtualized CU (vCU) technologies with NVIDIA's GPU technology. Fujitsu will begin delivering the new solution to customers worldwide, including telecommunications operators, from March 2023. The new solution was created as part of the NTT DOCOMO-sponsored "5G Open RAN Ecosystem" (OREC) project, which also funded performance verification and assessment testing of the new solution. Through this launch, Fujitsu hopes to contribute to the worldwide growth of the open 5G network in collaboration with telecom carriers like as NTT DOCOMO.

The development of Open RAN solutions, which offer a more flexible and cost-effective alternative to traditional proprietary RAN systems is also a significant factor driving the growth of the market. Open RAN allows for the integration of software and hardware components from multiple vendors, which can help reduce the cost of deploying and operating a 5G network. The use of virtualization and cloud-native architectures, which enable network operators to deliver services more efficiently and at a lower cost. These technologies enable network operators to deliver services more efficiently and at a lower cost by leveraging the benefits of cloud computing. Virtualization involves the separation of hardware and software, allowing multiple virtual instances to run on the same physical infrastructure.

Nowadays, there is a growing focus on automation and Artificial Intelligence (AI) in the 5G New Radio (NR) market, as operators seek to improve network performance, optimize resource allocation, and reduce operating costs. Automation and AI can help network operators to improve network performance, optimize resource allocation, and reduce operating costs. For instance, automation can be used to simplify and accelerate network configuration, management, and maintenance tasks. AI can be used to analyze network data in real-time and provide insights into network performance, traffic patterns, and user behavior. This can enable operators to identify and resolve network issues more quickly, as well as allocate network resources more efficiently based on real-time demand.

The increasing use of advanced radio units such as massive MIMO and beamforming, which offer better coverage and capacity, and help in optimizing resource allocation are also driving the market growth.These technologies enable better coverage and capacity in the network, which is crucial for supporting the increasing demand for data-intensive applications. Massive MIMO, which stands for Multiple Input Multiple Output, uses multiple antennas on both the transmitter and receiver sides to improve signal quality and reduce interference. This technology allows multiple devices to transmit and receive data simultaneously, thereby increasing network capacity. Beamforming, on the other hand, uses algorithms to direct radio signals in a specific direction, which improves network coverage and enables more efficient use of radio resources.

Offering Insights

The hardware segment dominated the market in 2022 and accounted for more than 58% share of the global revenue. The increasing demand for advanced radio units such as massive MIMO and beamforming, which offers better coverage and capacity and help in optimizing resource allocation, is a significant factor contributing to the segment growth. At the same time, the rising adoption of cloud-native architectures and virtualization enables network operators to deliver services more efficiently and at a lower cost. Furthermore, the growing popularity of Internet-of-Things (IoT) and edge computing is driving the demand for specialized hardware such as IoT gateways, edge servers, and routers, thereby contributing to the growth of the segment.

The services segment is projected to witness remarkable growth over the forecast period owing to the increasing adoption of managed services, as operators seek to outsource non-core activities such as network management and maintenance. This allows them to focus on their core business and achieve cost savings. Additionally, the rise of network slicing allows operators to create multiple virtual networks within a single physical network. This enables them to offer customized services for specific use cases and industries and to optimize network resources. Moreover, with the deployment of 5G networks, there is a growing demand for value-added services such as edge computing, which enables faster processing and lower latency for data-intensive applications. Additionally, the emergence of 5G-enabled applications such as augmented reality, virtual reality, and autonomous vehicles is expected to drive demand for specialized services such as network testing and optimization, as well as security and privacy services.

Operating Frequency Insights

The Sub-6 GHz segment dominated the market in 2022 and accounted for more than 65% share of the global revenue. The ability of Sub-6 GHz spectrum bands to offer a good balance between coverage and capacity, making them suitable for providing high-speed connectivity to large numbers of users, is a major factor contributing to the segment growth. With the growth in data traffic, there is a need for higher data rates, lower latency, and improved network efficiency. Additionally, the growing adoption of Massive MIMO technology, which uses many antennas to improve spectral efficiency and increase capacity, is also driving segment growth. This technology can be deployed in the sub-6 GHz spectrum bands to improve network performance and coverage.

The mmWave segment is projected to witness significant growth over the forecast period. With the expansion of 5G networks, the mmWave segment is expected to become more important in the coming years, particularly in urban areas where there is a high demand for high-speed data services. To meet the growing demand for mmWave technology, companies are investing in research and development to improve the performance and reliability of mmWave equipment. The integration of mmWave technology with other technologies such as sub-6 GHz, which allows for a more comprehensive 5G coverage is also driving the segment growth. Additionally, there is a growing focus on improving the energy efficiency of mmWave equipment, which can help reduce the overall operating costs of 5G networks.

Architecture Insights

The Non-Standalone (NSA) segment dominated the market in 2022 and accounted for more than 66% share of the global revenue. The ability of 5G NR NSA solutions to allow operators to deploy 5G radio access technology using the existing 4G LTE core network, enabling faster time-to-market and cost savings, is a major factor contributing to the growth of the segment. With NSA solutions, operators can offer Enhanced Mobile Broadband (eMBB) services and improved network performance while paving the way for future standalone (SA) 5G deployments. Moreover, NSA solutions can support advanced features such as massive MIMO, beamforming, and carrier aggregation. Such factors are further expected to drive the adoption of 5G NR technology and accelerate the deployment of next-generation networks.

The Standalone (SA) segment is projected to expand at the highest CAGR over the forecast period. The deployment of 5G New Radio in standalone mode is gaining popularity in the industry, and it is projected to fuel the growth over the coming years. Standalone mode has various advantages over non-standalone mode, including greater network speed and lower latency. The standalone mode enables network operators to deliver end-to-end 5G services that are not available in the non-standalone mode. The standalone mode also allows for the implementation of sophisticated services like as network slicing and edge computing, which may be utilized for applications such as autonomous driving and smart cities. Furthermore, the growing demand for high-speed internet and the growing number of connected devices are driving the adoption of standalone mode.

Application Insights

The Enhanced Mobile Broadband (eMBB) segment dominated the market in 2022 and accounted for more than 39% share of the global revenue. The segment growth can be attributed to the increasing demand for high-speed internet connectivity and data-intensive applications such as Virtual Reality (VR), Augmented Reality (AR), and high-definition video streaming. To cater to this growing demand, network operators are deploying advanced 5G New Radio infrastructure that can support higher data rates, lower latency, and better spectral efficiency. Additionally, there is a growing focus on improving the user experience by optimizing network coverage, capacity, and reliability through the use of advanced technologies such as massive MIMO and beamforming.

The Ultra-reliable Low-Latency Communications (URLLC) segment is expected to grow significantly over the forecast period. The increasing demand for mission-critical applications that require high reliability and low latency is driving the growth of the URLLC segment in the 5G New Radio (NR) market. For instance, remote surgery and telemedicine, requires minimal latency and excellent dependability to assure patient safety. Similarly, the employment of robots and autonomous systems in manufacturing necessitates dependable and low-latency connection to enable seamless operations. Such factors bode well for the growth of the segment over the coming years.

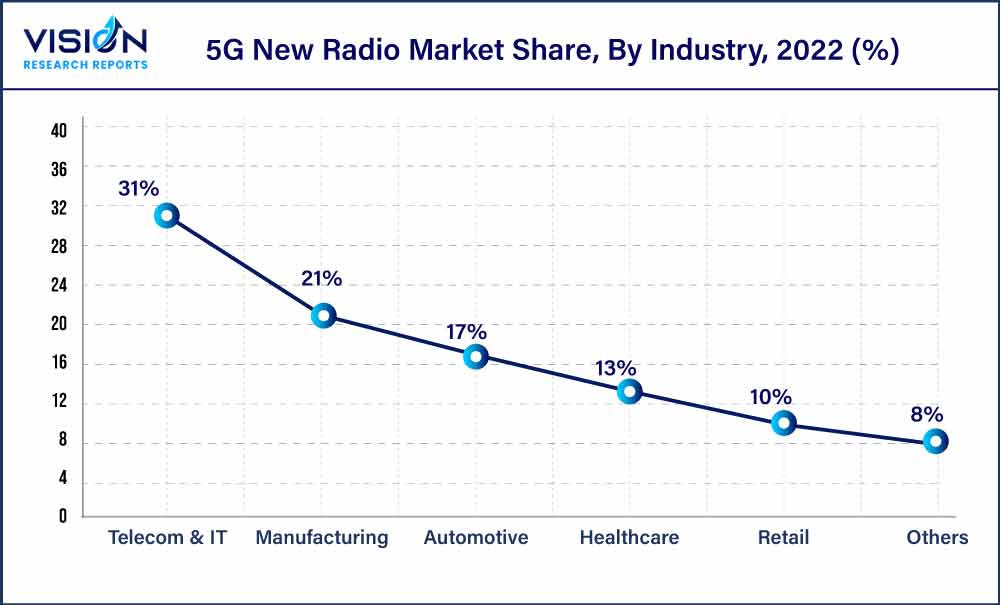

Industry Insights

The telecom and IT segment dominated the market in 2022 and accounted for more than 31% share of the global revenue. The growing adoption of cloud-native technologies, which allow operators to virtualize network functions and deploy them on cloud infrastructure, is a significant factor contributing to segment growth. With the increased speed, bandwidth, and capacity of 5G, telecommunication companies can offer faster and more reliable mobile connectivity to their customers, enabling new applications and services that were not possible with previous generations of wireless technology. This includes things like virtual and augmented reality, high-definition video streaming, and real-time gaming. Additionally, 5G networks are highly customizable, allowing telecommunication and IT companies to tailor their services to meet the specific needs of different industries and use cases.

The manufacturing segment is projected to expand at the highest CAGR over the forecast period. The ability of 5G NR technology to enable real-time monitoring and control of manufacturing processes, leading to greater efficiency and productivity is a significant factor contributing to the segment growth. For instance, 5G NR can facilitate the use of Industrial Internet of Things (IIoT) sensors and devices, which can provide real-time data on machine performance, production line throughput, and other critical metrics. This data can be used to optimize processes, reduce downtime, and improve quality control. Additionally, 5G NR can enable remote access and control of manufacturing equipment, allowing for greater flexibility and responsiveness in managing production processes. These benefits can lead to increased profitability and competitiveness for manufacturers, driving the adoption of 5G NR solutions in the manufacturing industry.

Regional Insights

The Asia Pacific region dominated the market in 2022 and accounted for more than 39% share of the global revenue. The increasing adoption of 5G technology in countries such as China, Japan, South Korea, and India is a major factor contributing to the regional growth. The region has a large population and a growing number of mobile subscribers, which is driving the demand for high-speed internet services and advanced applications. The governments in these countries are also investing heavily in the development of 5G infrastructure, which is expected to provide significant opportunities for telecom companies and network equipment providers in the region. Additionally, the region is witnessing a significant increase in the use of smartphones and other mobile devices, which is driving the demand for 5G-enabled devices and services.

The North America region is projected to expand at the highest CAGR over the forecast period. Significant investment is being made in the development and implementation of 5G infrastructure in the area, owing to the growing demand for high-speed internet access, IoT applications, and cloud services. Furthermore, the use of technologies such as artificial intelligence, edge computing, and big data analytics is increasing, which is pushing the demand for high-performance 5G networks. Collaborations between telecom firms and technological behemoths to build and implement 5G networks and services are also developing in the area. In addition, the area has been an early user of 5G-enabled smartphones and other gadgets, which is projected to boost market development in the future years. Furthermore, the region has been an early adopter of 5G-enabled smartphones and other devices, which is expected to further drive the growth of the market in the coming years.

5G New Radio Market Segmentations:

By Offering

By Operating Frequency

By Architecture

By Application

By Industry

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others