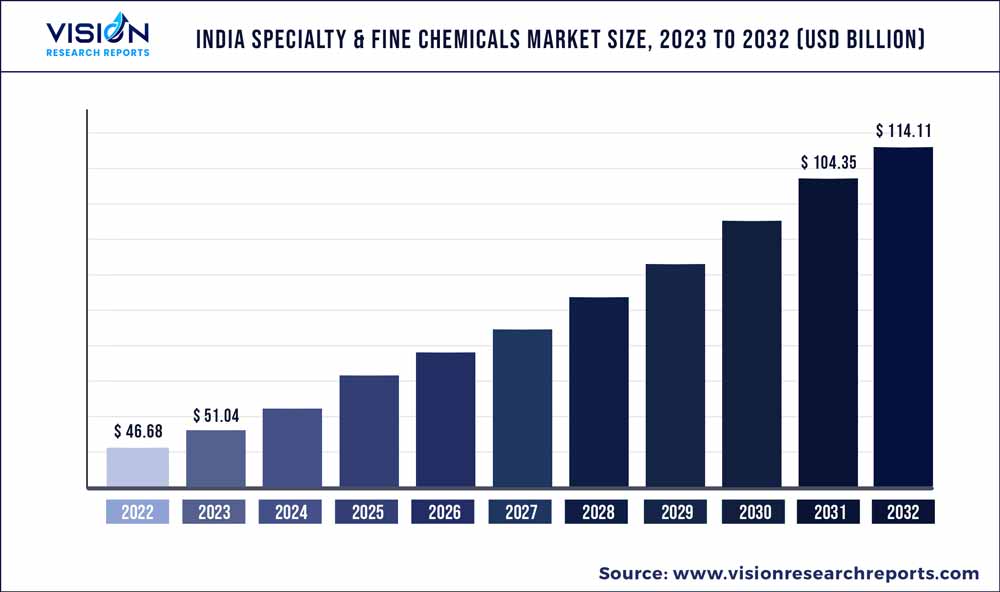

The India specialty & fine chemicals market was valued at USD 46.68 billion in 2022 and it is predicted to surpass around USD 114.11 billion by 2032 with a CAGR of 9.35% from 2023 to 2032.

Key Pointers

The institutional & industrial cleaners segment led the market with a revenue share of 10% in 2022.

Report Scope of the India Specialty & Fine Chemicals Market

| Report Coverage | Details |

| Market Size in 2022 | USD 46.68 billion |

| Revenue Forecast by 2032 | USD 114.11 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Akzo Nobel N.V.; Albemarle Corporation; Baker Hughes, a GE company LLC.; BASF SE; Buckman; Chr. Hansen Holding A/S; Clariant AG; Cortec Corporation; Croda International; Ecolab; Evonik Industries AG; DuPont; LANXESS; Nouryon; SNF Group; Solenis; Solvay S.A.; SUEZ; Dow; The Lubrizol Corporation; Veolia; Paragon Fine and Specialty Chemical Pvt. Ltd.; Organo Fine Chemicals; Lifechem Pharma; Atul Ltd.; Infinity Specialty Chemicals; Jeevan Chemicals Private Limited; Sami-Sabinsa Group; Satol Chemicals |

The easy availability of raw materials required to produce various specialty & fine chemicals, along with the low cost of production and huge availability of workforce, is driving the market growth in the country.

The market witnesses fierce competition due to the presence of numerous international manufacturers such as Evonik Industries AG, Clariant AG, LANXESS, Solvay, The Lubrizol Corporation, BASF SE, and DuPont, along with a few domestic manufacturers such as Aarti Industries Ltd., Jeevan Chemicals Private Limited, Organo Fine Chemicals, Paragon Fine and Specialty Chemicals Pvt. Ltd., and Atul Ltd.

Specialty chemicals consist of products that are of high value but are produced in small volumes. Such products are sold globally based on their functionalities. Fine chemicals are generally used as starting materials for specialty chemicals, especially biopharmaceutical and pharmaceutical products. They are produced and used according to required special applications. Moreover, these products are pressure and temperature sensitive. As such, the production process and the storage conditions of fine chemicals are to be adhered to accordingly.

Specialty chemicals play an important role as raw materials in the production of final products such as paints & coatings, personal care & cosmetics, flavors & fragrances, paper & pulp, and home & industrial surfactants, among others. In other words, these are majorly intermediate products. Some of the most used products in the market are adhesives, food & feed additives, rubber processing additives, and fuel additives, to name a few.

These products are also known as effect chemicals as they are majorly employed based on their functionalities. Moreover, these products come in diverse formulations that make it easy to distinguish their different functions. The interaction between the chemical and physical characteristics of constituents that are used in production has an impact on the effectiveness of these products in different working conditions.

Fine chemicals, on the other hand, are pure, single but complex chemical substances. They are produced in limited volumes in various multifunctional manufacturing facilities. These production facilities use multi-step batch processing methods to get the desired products. These products are used in a variety of end-use applications such as biotechnology and drug development. They are used in the development of products that increase the healthy life expectancy of the masses.

The market is expected to grow significantly in the coming years, owing to the rising population in the country, rapid ongoing industrialization, increasing chemical demand, and flourishing end-use industries in regions such as Europe, Asia Pacific, and North America. The leading manufacturers in India are BASF SE, Dow, Evonik Industries AG, Solvay, Tosoh Corporation, and Atul, among others.

The Asia Pacific region accounts for the largest market share globally for these products. The growth is attributed to the extensive presence of companies manufacturing them on a large scale, especially in countries such as India and China. AJ Chemicals, Atul, Finornic Chemicals, Karnataka Aromas, Para Fine Chem Industries, and Sami-Sabinsa Group are some of the leading manufacturers in the country.

Moreover, the penetration of these products in India is high, owing to the presence of several mature end-use industries in the country. For instance, India is among the major automotive manufacturing countries in the Asia Pacific. The growing utilization of fibers, sealants, paints, and adhesives in the automotive industry of the country is expected to fuel market growth in India in the coming years.

Product Insights

The institutional & industrial cleaners segment led the market with a revenue share of 10% in 2022. This is attributable to the rising public concerns over cleanliness and hygiene in India, which are anticipated to further increase in the coming years. As a result, institutions in India are expected to increasingly adopt regular and intensive cleaning practices.

The consumption of surfactants is the highest in India for the development of industrial & institutional cleaners. They are used in general-purpose, commercial floor, and surface cleaning applications. Industrial & institutional cleaners offer ease of use, high cleaning efficiency, increased hygiene, and enhanced technical performance, while also ensuring food safety. The rising requirement for eco-friendly, effective, and less labor-intensive cleaning products is fueling the demand for industrial & institutional cleaners in India.

Plastics are highly favored for manufacturing fast-moving products and goods. This increases the demand for specialty polymers, as they have properties like plastics. Most plastic manufacturers prefer the development of multi-functional products that have widespread industrial applications. For instance, Anshika Polysurf Limited has developed ingredients that are used in paints & coatings, textiles, packaging, paper & pulp, and flocking industries. Thus, the demand for these polymers in India is poised to grow with their rising penetration in major applications in several end-use industries.

India Specialty & Fine Chemicals Market Segmentations:

By Product

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others