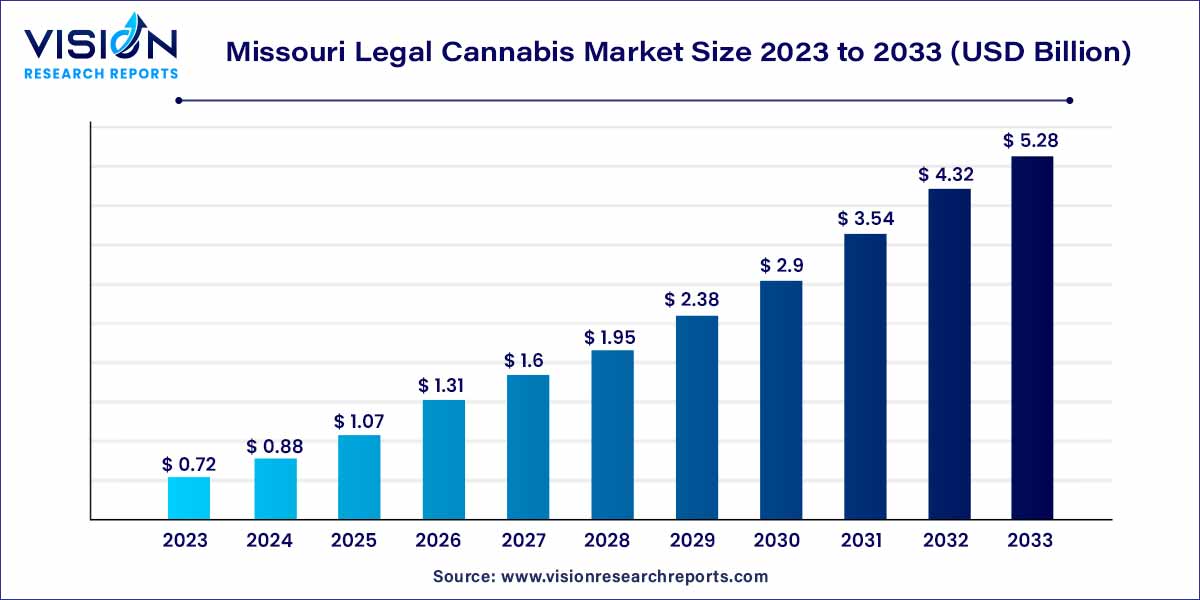

The Missouri legal cannabis market was estimated at USD 0.72 billion in 2023 and it is expected to surpass around USD 5.28 billion by 2033, poised to grow at a CAGR of 22.04% from 2024 to 2033.

The growth of Missouri's legal cannabis market can be attributed to a confluence of factors propelling its expansion. Foremost among these is the progressive legislative landscape that has facilitated the legalization of cannabis for both medicinal and recreational use. This regulatory openness has not only attracted established players but has also fostered a nurturing environment for entrepreneurial ventures. Additionally, the increasing societal acceptance and changing attitudes towards cannabis contribute significantly to the market's growth. The rising demand for alternative therapeutic solutions, coupled with a growing awareness of the potential health benefits of cannabis, further propels the market forward. Furthermore, the economic impact, including job creation and increased tax revenues, adds to the allure for both investors and policymakers. As Missouri's legal cannabis market continues to evolve, these growth factors collectively shape an industry poised for sustained expansion and innovation.

| Report Coverage | Details |

| Market Size in 2023 | USD 0.72 billion |

| Revenue Forecast by 2033 | USD 5.28 billion |

| Growth rate from 2024 to 2033 | CAGR of 22.04% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The flower segment accounted for the largest revenue share of 36% in 2023 and is anticipated to register a significant CAGR from 2023 to 2032. This growth can be attributed to the benefits, ease of utilization, and lower cost of cannabis flowers compared to other products.

Pre-rolls are expected to grow at the fastest CAGR from 2024 to 2033, owing to rising adoption of pre-rolls by Missourians and legalization of marijuana for recreational purposes. Pre-rolls are considered one of the most common methods of smoking cannabis. Pre-rolls are gaining popularity owing to their ease of use and easy availability of these in multiple dispensaries across the state.

The medical use segment dominated the market with the largest market share of 90% in 2023. The effectiveness and potency of cannabis in treating several kinds of illnesses have become the subjects of several research studies, leading to a rise in the medical usage of cannabis. Legalization has further acted as a significant enabler of market growth. Medical use has received widespread acceptance, which bodes well for segment expansion. Medical professionals are now finding it simpler to prescribe cannabis to patients who request it because of the ease of laws and regulations around its usage. The stigma associated with marijuana usage has considerably decreased as a result of increased public understanding of its advantages.

Recreational usage of cannabis is predicted to grow at the remarkable CAGR during forecast period. Cannabis is rapidly becoming popular among young people across Missouri. In addition, concerning Missouri, legalization is anticipated to generate considerable tax money for the government, while also aiding their efforts to suppress the illegal marijuana trade.

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Missouri Legal Cannabis Market

5.1. COVID-19 Landscape: Missouri Legal Cannabis Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Missouri Legal Cannabis Market, By Product

8.1. Missouri Legal Cannabis Market, by Product, 2024-2033

8.1.1. Flowers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Oils and Tinctures

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pre-rolls

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Concentrates

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Edibles

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Missouri Legal Cannabis Market, By End-use

9.1. Missouri Legal Cannabis Market, by End-use, 2024-2033

9.1.1. Recreational Use

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Medical Use

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Missouri Legal Cannabis Market, Regional Estimates and Trend Forecast

10.1. Missouri

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. BeLeaf Medical

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Blue Sage Cannabis Co.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Show Me Alternatives

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Heya Wellness

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Missouri Wild Alchemy

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Organic Remedies

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Holistic Industries

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kansas City Cannabis

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. LOCAL CANNABIS COMPANY

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. MOcann Extracts

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others