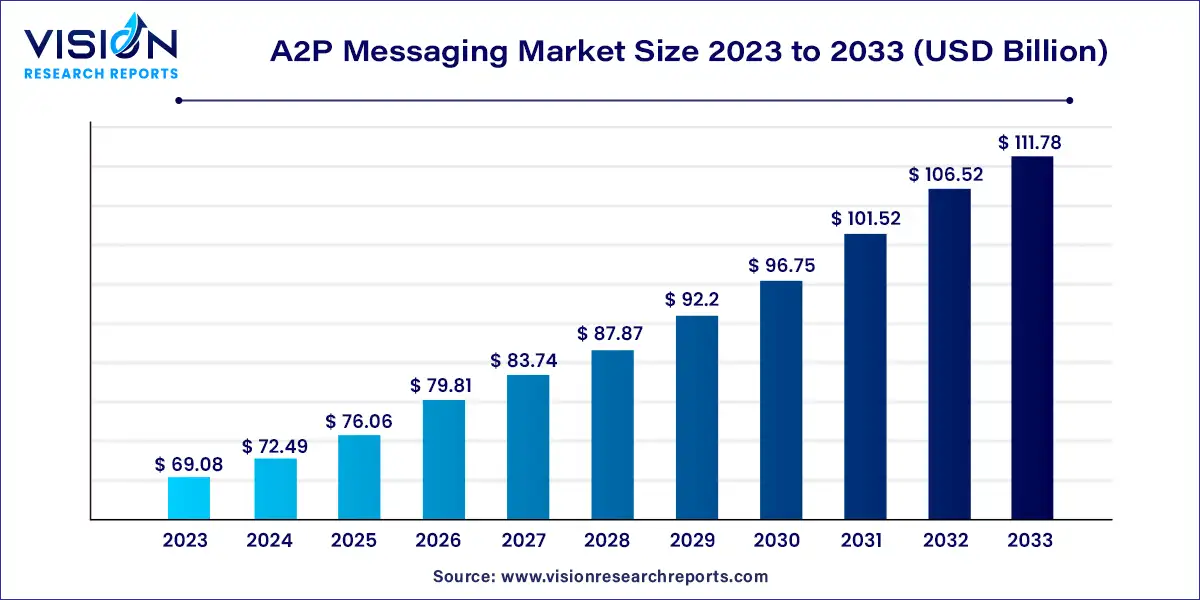

The global A2P messaging market size was estimated at around USD 69.08 billion in 2023 and it is projected to hit around USD 111.78 billion by 2033, growing at a CAGR of 4.93% from 2024 to 2033.

Application-to-Person (A2P) messaging market has witnessed significant growth, driven by the increasing adoption of mobile devices and the rising demand for efficient communication solutions. A2P messaging refers to the process of sending text messages from an application to a mobile user, typically for notifications, alerts, marketing campaigns, and transactional purposes.

The growth of the A2P messaging market is driven by the widespread adoption of mobile devices globally has created a fertile ground for A2P messaging, as businesses capitalize on the ubiquitous nature of smartphones to reach their target audience efficiently. Secondly, the rising demand for real-time communication solutions, coupled with the increasing emphasis on customer engagement, has propelled the use of A2P messaging for delivering personalized notifications, alerts, and promotional offers. Additionally, technological advancements in messaging platforms, security protocols, and analytics tools have enhanced the effectiveness and user experience of A2P messaging campaigns, driving further market expansion. Moreover, regulatory initiatives aimed at combating spam and protecting user privacy have instilled confidence among businesses and consumers, fostering a conducive environment for A2P messaging growth.

| Report Coverage | Details |

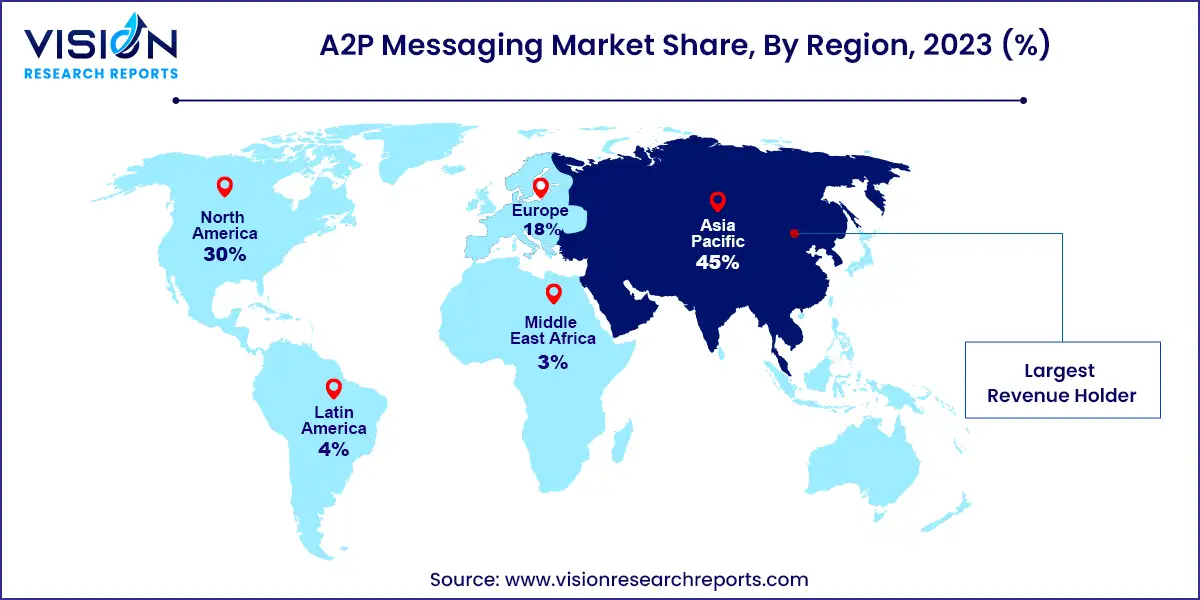

| Revenue Share of Asia Pacific in 2023 | 45% |

| CAGR of North America from 2024 to 2033 | 2.87% |

| Revenue Forecast by 2033 | USD 111.78 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The platform segment dominated the overall market in 2023 and accounted for a share of over 63% in 2023 and is expected to witness a CAGR of 4.44% during the forecast period. The demand for cloud-based A2P messaging platforms is on the rise, driving the growth of this segment. Businesses are increasingly embracing cloud solutions due to their scalability, flexibility, and cost-effectiveness. By adopting cloud platforms, businesses can seamlessly integrate A2P messaging capabilities into their existing infrastructure while ensuring reliable global reach and the ability to scale according to messaging volumes. Moreover, a growing trend is observed in omnichannel A2P messaging platforms. As customers engage with businesses across multiple channels like SMS, chat apps, and social media, integrated platforms are needed to effectively manage A2P messaging across these communication channels.

Omnichannel platforms empower businesses to deliver consistent and personalized messaging experiences, resulting in a unified customer journey and improved customer engagement. The A2P SMS services segment is anticipated to witness the fastest CAGR of over 5.03% throughout the forecast period. The segment’s growth is fueled by the increasing demand for value-added services in A2P messaging. Businesses are now seeking comprehensive service packages that go beyond simple message delivery. These additional services, such as message personalization, interactive messaging campaigns, chatbot integration, analytics, reporting, and customer journey optimization, facilitate enhanced customer e¬ngagement, improved conversion rates, and actionable insights from A2P messaging campaigns.

The cloud segment dominated the overall market in 2023 with a revenue share of over 59% in 2023 and is expected to witness a CAGR of 5.65% during the forecast period. The demand for cloud-based A2P messaging platforms and services is increasing rapidly due to their inherent scalability, resulting in significant segment growth. Businesses are progressively adopting cloud solutions to leverage the advantages of scalability, flexibility, and cost-effectiveness. By integrating A2P messaging capabilities into their existing infrastructure through cloud-based platforms, businesses enjoy high reliability, global reach, and seamless scalability to accommodate diverse messaging volumes. Furthermore, cloud deployments allow companies to harness the benefits of Infrastructure¬as-a-Service (IaaS) and Platform-as-a-Service¬ (PaaS) models, reducing hardware investments and minimizing maintenance complexities.

The on-premises segment is projected to witness significant growth over the forecast period.The demand for on-premise A2P messaging solutions remains strong in industries where data security and compliance are of paramount importance. This is a crucial factor fueling the growth of this segment. Various organizations, including government institutions, financial services providers, and healthcare facilities, have a preference for maintaining their messaging infrastructure within their own premises. They do so to uphold strict control over data privacy and meet industry-specific regulations effectively. In addition, hybrid deployments that combine on-premise and cloud-based A2P messaging solutions have gained popularity in this segment. Such hybrid deployments enable businesses to strike a balance between maintaining data control while also ensuring scalability.

The large enterprises segment dominated the overall market in 2023 and accounted for a share of over 63% of the overall revenue. Large enterprises are leveraging A2P messaging to deliver tailored and contextually relevant messages to their customers. By analyzing customer data and behavior, these enterprises can create personalized messaging experiences that enhance customer engagement, drive conversions, and build brand loyalty. Large enterprises understand the importance of meeting customers on their preferred communication channels, be it SMS, chat apps, social media, or voice. By adopting omnichannel messaging, enterprises can engage customers across multiple touchpoints and provide consistent messaging, thereby contributing to the growth of the segment.

The small & medium enterprises (SMEs) segment is expected to grow at the highest CAGR during the forecast period. SMEs commonly rely on A2P messaging to promote their products, provide updates, and engage in promotional activities. A2P messaging platforms play a crucial role in product development, allowing enterprises to advertise new product launches and enhance brand recognition effectively. As a result of its cost-effectiveness and efficient communication capabilities, A2P messaging is expected to see increased adoption among SMEs in the near future. This technology provides SMEs with a low-cost and efficient means of reaching many potential customers, making it an attractive option for expanding their customer base.

The national segment dominated the market in 2023 and accounted for more than 57% share of the global revenue. Growing emphasis on real-time communication and operational efficiency in the aviation industry is a significant factor contributing to the growth of the segment. National air traffic authorities and service providers are increasingly adopting A2P messaging to streamline communication with airlines, pilots, ground staff, and other stakeholders. SMS serves as a reliable and immediate channel for transmitting critical information, such as flight updates, weather conditions, safety alerts, and operational changes. This trend is driven by the need to enhance the efficiency of air traffic management, improve flight safety, and ensure seamless coordination among various entities within the national airspace.

The cross-border segment is projected to grow at the highest CAGR over the forecast period. The segment growth can be attributed to the significant increase in international business and global connectivity, leading to a growing need for cross-border communication. Businesses are expanding their operations across borders, and cross-border SMS messaging provides a reliable and efficient means of communication with customers, partners, and suppliers in different countries. This trend is driven by the need to establish global reach, enhance customer engagement, and facilitate seamless international transactions.

The CRM segment dominated the overall market with a revenue share of over 32% in 2023. The increase in segment growth can be credited to the rising trend of combining A2P messaging with CRM systems to improve customer service and support. A2P messaging is being utilized by businesses to offer immediate aid, self-service choices, and efficient resolutions to customer inquiries. Businesses are strategically using A2P messaging in their CRM strategies to send personalized messages, including transactional notifications, order updates, and appointment reminders. Through the integration of A2P messaging with CRM systems, businesses can automate and streamline customer interactions, ultimately building stronger relationships and increasing customer satisfaction.

Organizations are leveraging A2P messaging to reach their target audience with tailored promotional content, fostering customer engagement and brand loyalty. For instance, leading e-commerce platforms are utilizing A2P messaging to send exclusive discount codes to their subscribers, resulting in increased sales and customer retention. This trend reflects a shift toward personalized marketing strategies, as businesses recognize the efficiency of A2P messaging in delivering time-sensitive offers and discounts. Moreover, the integration of advanced analytics tools enables better campaign tracking and optimization, ensuring higher conversion rates. As this trend continues, further innovation is anticipated in message formats and delivery mechanisms, enhancing the overall effectiveness of promotional campaigns within the market.

The BFSI segment dominated the market in 2023 and accounted for a revenue share of over 30% in 2023. The growth of the BFSI segment can be attributed to the increasing volume of payment transactions and the rising adoption of online A2P messaging within the BFSI industry. Financial institutions and banks are leveraging A2P messaging to facilitate various communication needs, including balance statements, payment reminders, notifications, one-time passwords, and anti-fraud alerts. By utilizing an A2P messaging system to communicate transaction information, consumer actions, and retail banking operations, these institutions can effectively connect with their clients and establish strong customer relationships.

The proliferation of smartphones and the expanding user base of the internet have led to the growing demand for swift services from tech-savvy customers. As a result, an increasing number of banks and financial institutions are adopting A2P messaging to cater to these customer expectations. The media & entertainment segment is anticipated to witness the fastest growth rate during the forecast period. The increasing focus on monetization opportunities through A2P messaging is a significant factor contributing to the growth of the segment. Media and entertainment companies are exploring innovative ways to generate revenue through A2P messaging channels.

This includes offering premium content subscriptions, exclusive access to events or releases, and interactive contests or quizzes that require paid participation. Media and entertainment companies are leveraging A2P messaging to deliver personalized content updates, promotional offers, event notifications, and interactive experiences to their audiences. By incorporating features, such as rich media messaging, video links, and voting options, businesses can create immersive and participatory experiences that enhance audience engagement and drive loyalty.

The Asia Pacific region dominated the overall market in 2023 with a share of over 45% of the overall revenue. With a large population and increasing internet connectivity, the Asia Pacific region presents immense opportunities for A2P messaging services. Businesses are capitalizing on this trend by leveraging A2P messaging to reach a vast consumer base, deliver time-sensitive information, and engage with customers directly and personally. In addition, there is a growing emphasis on mobile commerce and digital payments in the Asia Pacific region. A2P messaging is playing a vital role in facilitating secure and convenient payment transactions, providing one-time passwords (OTPs) for authentication, and delivering payment notifications to customers.

North America is expected to witness a significant CAGR of 2.87% over the forecast period. Retailers and e-commerce platforms in North America are leveraging A2P messaging to send customers order confirmations, delivery updates, and promotional offers, thereby enhancing their shopping experiences. In addition, healthcare providers are utilizing A2P messaging for appointment reminders, prescription notifications, and patient communications, streamlining processes and improving patient engagement. Furthermore, there is increasing integration of A2P messaging with other communication channels and technologies. By incorporating A2P messaging into their omnichannel marketing strategies, businesses can create a cohesive and consistent brand experience across multiple touchpoints.

By Component

By Deployment Mode

By Enterprise Size

By SMS Traffic

By Application

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Vertical Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on A2P Messaging Market

5.1. COVID-19 Landscape: A2P Messaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global A2P Messaging Market, By Component

8.1. A2P Messaging Market, by Component, 2024-2033

8.1.1. Platform

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global A2P Messaging Market, By Deployment Mode

9.1. A2P Messaging Market, by Deployment Mode, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global A2P Messaging Market, By Enterprise Size

10.1. A2P Messaging Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global A2P Messaging Market, By SMS Traffic

11.1. A2P Messaging Market, by SMS Traffic, 2024-2033

11.1.1. National

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cross-border

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global A2P Messaging Market, By Application

12.1. A2P Messaging Market, by Application, 2024-2033

12.1.1. Pushed Content Services

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Interactive Services

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Promotional Campaigns

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Customer Relationship Management (CRM) Services

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Others

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global A2P Messaging Market, By Vertical

13.1. A2P Messaging Market, by Vertical, 2024-2033

13.1.1. BFSI

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Healthcare

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Media & Entertainment

13.1.3.1. Market Revenue and Forecast (2021-2033)

13.1.4. Retail & E-commerce

13.1.4.1. Market Revenue and Forecast (2021-2033)

13.1.5. Travel & Tourism

13.1.5.1. Market Revenue and Forecast (2021-2033)

13.1.6. Others

13.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Global A2P Messaging Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Component (2021-2033)

14.1.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.1.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.1.5. Market Revenue and Forecast, by Application (2021-2033)

14.1.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Component (2021-2033)

14.1.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.1.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.1.7.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.1.8. Market Revenue and Forecast, by Application (2021-2033)

14.1.8.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Component (2021-2033)

14.1.9.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.1.9.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.1.9.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.1.10. Market Revenue and Forecast, by Application (2021-2033)

14.1.11. Market Revenue and Forecast, by Vertical (2021-2033)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Component (2021-2033)

14.2.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.2.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.2.5. Market Revenue and Forecast, by Application (2021-2033)

14.2.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

14.2.8.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.2.9. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.2.10. Market Revenue and Forecast, by Application (2021-2033)

14.2.10.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Component (2021-2033)

14.2.11.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.2.11.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.2.12. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.2.13. Market Revenue and Forecast, by Application (2021-2033)

14.2.14. Market Revenue and Forecast, by Vertical (2021-2033)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Component (2021-2033)

14.2.15.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.2.15.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.2.15.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.2.16. Market Revenue and Forecast, by Application (2021-2033)

14.2.16.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Component (2021-2033)

14.2.17.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.2.17.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.2.17.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.2.18. Market Revenue and Forecast, by Application (2021-2033)

14.2.18.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Component (2021-2033)

14.3.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.3.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.3.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

14.3.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.3.7.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.3.8. Market Revenue and Forecast, by Application (2021-2033)

14.3.9. Market Revenue and Forecast, by Vertical (2021-2033)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

14.3.10.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.3.10.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.3.10.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.3.11. Market Revenue and Forecast, by Application (2021-2033)

14.3.11.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Component (2021-2033)

14.3.12.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.3.12.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.3.12.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.3.12.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.12.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Component (2021-2033)

14.3.13.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.3.13.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.3.13.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.3.13.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.13.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Component (2021-2033)

14.4.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.4.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.4.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

14.4.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.4.7.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.4.8. Market Revenue and Forecast, by Application (2021-2033)

14.4.9. Market Revenue and Forecast, by Vertical (2021-2033)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

14.4.10.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.4.10.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.4.10.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.4.11. Market Revenue and Forecast, by Application (2021-2033)

14.4.12. Market Revenue and Forecast, by Vertical (2021-2033)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Component (2021-2033)

14.4.13.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.4.13.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.4.13.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.4.13.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.13.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Component (2021-2033)

14.4.14.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.4.14.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.4.14.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.4.14.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.14.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Component (2021-2033)

14.5.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.5.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.5.5. Market Revenue and Forecast, by Application (2021-2033)

14.5.6. Market Revenue and Forecast, by Vertical (2021-2033)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Component (2021-2033)

14.5.7.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.5.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.5.7.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.5.8. Market Revenue and Forecast, by Application (2021-2033)

14.5.8.1. Market Revenue and Forecast, by Vertical (2021-2033)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Component (2021-2033)

14.5.9.2. Market Revenue and Forecast, by Deployment Mode (2021-2033)

14.5.9.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

14.5.9.4. Market Revenue and Forecast, by SMS Traffic (2021-2033)

14.5.9.5. Market Revenue and Forecast, by Application (2021-2033)

14.5.9.6. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 15. Company Profiles

15.1. Twilio Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Dialogue Communications

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Infobip Ltd.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Sinch

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Proximus

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Tata Communications

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. AT&T, Inc.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. China Mobile Ltd.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Orange S.A.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Genesys

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others