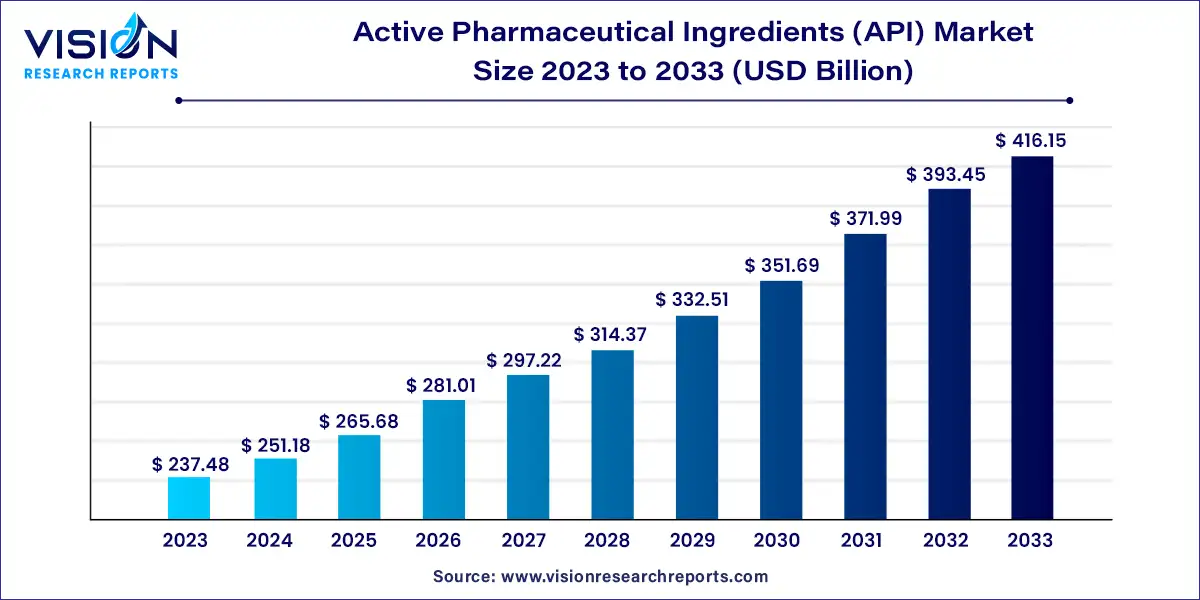

The global active pharmaceutical ingredients market was estimated at USD 237.48 billion in 2023 and it is expected to surpass around USD 416.15 billion by 2033, poised to grow at a CAGR of 5.77% from 2024 to 2033.

The global active pharmaceutical ingredients (API) market is witnessing robust growth driven by several key factors, including increasing prevalence of chronic diseases, rising demand for generic drugs, and advancements in pharmaceutical manufacturing technologies. API, the biologically active component of a drug, forms the core of pharmaceutical formulations and plays a critical role in therapeutic efficacy.

The growth of the active pharmaceutical ingredients (API) market is underpinned by several key factors driving its expansion. Firstly, the increasing prevalence of chronic diseases worldwide, such as cardiovascular disorders, cancer, and diabetes, has propelled the demand for pharmaceutical products containing high-quality active ingredients. Additionally, the rising adoption of generic drugs, fueled by patent expirations of branded medications, contributes significantly to market growth by offering cost savings and improved accessibility to essential medications, particularly in emerging economies. Furthermore, advancements in pharmaceutical manufacturing processes, including continuous manufacturing, nanotechnology, and biocatalysis, are enhancing efficiency, scalability, and sustainability, thereby reducing manufacturing costs and meeting stringent regulatory requirements. These factors collectively stimulate the growth trajectory of the API market, positioning it for sustained expansion in the foreseeable future.

In 2023, the synthetic segment dominated the market with a substantial revenue share of 71%. The primary driver for this segment is the soaring demand for generic drugs. APIs utilized in the production of generic drugs contribute significantly to the revenue of companies engaged in synthetic and chemical API manufacturing. This trend presents a vast opportunity for Contract Development and Manufacturing Organizations (CDMOs) operating within this sector. Furthermore, the synthetic API market is becoming increasingly attractive for CDMOs due to the growing outsourcing trend, as companies aim to bolster profitability by trimming production costs.

On the other hand, the biotech API segment is poised for the fastest growth during the forecast period. This growth is fueled by escalating investments in the biopharmaceutical and biotechnology sectors, facilitating the innovation of new molecules tailored to combat diseases such as cancer. Major industry players are directing significant attention towards biotech APIs due to their substantial revenue potential and profitability.

In 2023, the Innovative APIs segment emerged as the dominant force in the overall API market, commanding a significant revenue share. The market's robust growth is primarily fueled by an increase in funding and favorable regulations governing research and development (R&D) facilities. Extensive research efforts in this domain have resulted in the development of numerous novel innovative products, which are poised for launch in the near future. Additionally, the growing support from regulatory agencies for the approval of new drugs is expected to further facilitate market expansion. This trend can be attributed to heightened government focus on healthcare and pharmaceuticals in response to the COVID-19 pandemic.

Conversely, the Generic APIs segment is forecasted to exhibit the fastest growth over the forecast period. The expiration of patents for various branded molecules represents a significant opportunity for the growth of generic API drugs. Post-pandemic, the pharmaceutical industry is approaching a patent cliff by 2030, with nearly 200 molecules losing exclusivity and over 100 biosimilars in development as of 2023. This scenario presents a favorable landscape for generic API manufacturers, as the demand for APIs of these products is poised to surge by the end of the decade. Notably, this includes over 60 molecules within the oncology segment, featuring complex, high-revenue-generating APIs.

In 2023, the cardiology segment emerged as the dominant force in the API market, boasting a substantial revenue share. This dominance can be attributed to the escalating prevalence of cardiovascular diseases (CVDs) on a global scale. According to the World Heart Report 2023, over half a billion people worldwide are afflicted by CVDs, resulting in approximately 20.5 million deaths in 2021. This staggering statistic represents nearly a third of all global deaths and marks an increase from previous estimates. Cardiovascular disease stands as one of the most pressing public health challenges worldwide, driving extensive research efforts into APIs within this field. Notably, Simvastatin, a cholesterol-lowering drug belonging to the statin class, is widely utilized in the treatment of dyslipidemia.

Conversely, the Oncology segment is poised to experience the fastest growth rate over the forecast period. The burgeoning global prevalence of cancer serves as a primary catalyst propelling this market forward. Collaboration among pharmaceutical companies, research institutions, and regulatory entities remains instrumental in accelerating drug development, ensuring patient safety, and fostering innovation. A noteworthy example of such collaboration is evident in the March 2023 merger agreement between Pfizer Inc. and Seagen Inc. Through this strategic alliance, Pfizer will acquire Seagen, a renowned biotech firm renowned for its groundbreaking cancer treatments. The agreement, structured as a cash transaction of USD 229 per Seagen share, will result in an enterprise value of USD 43 billion.

In 2023, the Prescription segment emerged as the dominant force in the overall API market, capturing a significant revenue share. The utilization of prescription drugs hinges largely on physicians' prescriptions. While the use of prescription drugs like Proton Pump Inhibitors (PPIs) for managing general conditions such as heartburn has plateaued due to various adverse effects, there has been an impact on the prescription rates of Histamine-2 Receptor Antagonists (H2RAs). In the oncology segment, prescription drugs reign supreme as cancer treatment primarily involves chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. Additionally, the utilization of biologics is on the rise.

Conversely, the Over-the-Counter (OTC) segment is anticipated to exhibit the fastest growth over the forecast period. OTC products enjoy widespread accessibility among the population and are often influenced by shifts in consumer behavior. There is a notable shift in consumer preference from using antacids for heartburn to focusing on gut health through the consumption of probiotics. This paradigm shift has created significant opportunities for preventive products such as health supplements, nutraceuticals, and probiotics, while simultaneously slowing the growth of existing products.

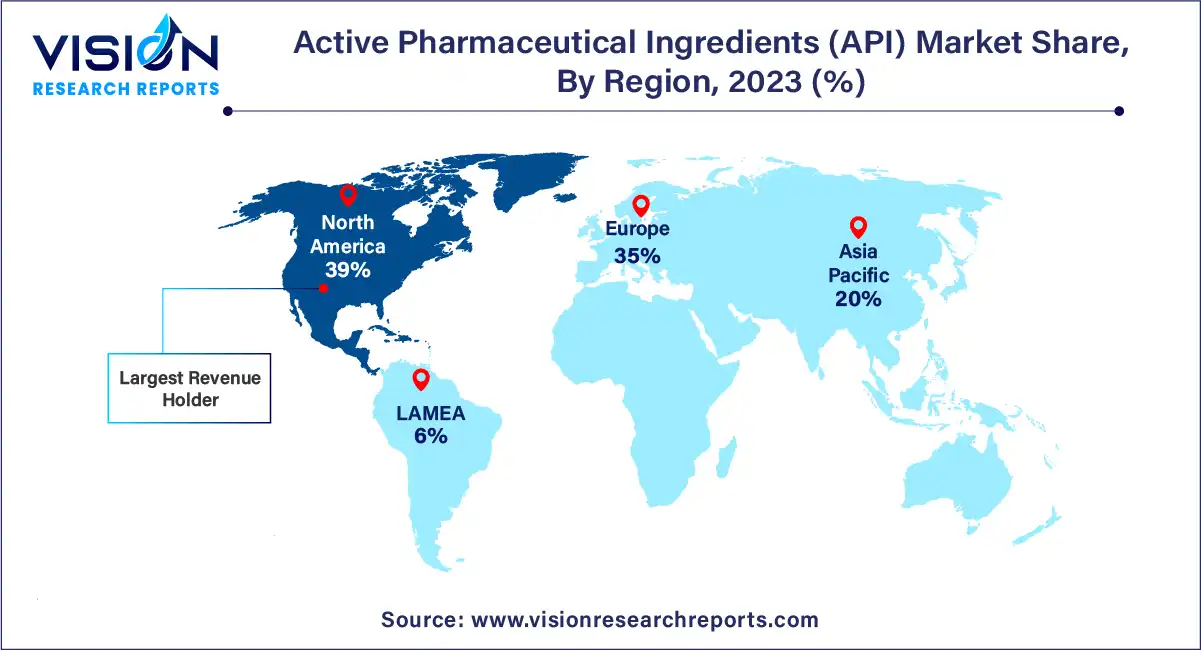

In 2023, the North America API market led the industry with a commanding share of 39%. This dominance is attributed to the increasing prevalence of cardiovascular, genetic, and other chronic diseases, coupled with burgeoning research in drug development within the region. The presence of key players such as AbbVie Inc., Curia, Pfizer Inc. (Pfizer Center One), Viatris Inc., and Fresenius Kabi AG further augments growth prospects. For instance, in February 2022, Viatris obtained FDA approval for Generic Restasis, a cyclosporine ophthalmic emulsion used in treating dry eye disease. The region boasts high-value manufacturing areas, encompassing complex and high-potency APIs, gene therapies, and biologicals, which are anticipated to drive relative growth.

Meanwhile, the API market in the Asia Pacific region is witnessing the fastest growth over the forecasted years. This surge is fueled by the majority of API production occurring in countries within the region, coupled with a high API export rate. China emerges as the largest producer of APIs, manufacturing over 1,600 varieties of chemical APIs. Furthermore, several key global players are establishing their operations in the region. Rising investments and initiatives to bolster and expand manufacturing facilities further propel the overall API market growth.

By Type of Synthesis

By Type of Manufacturer

By Type

By Application

By Type of Drug

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others