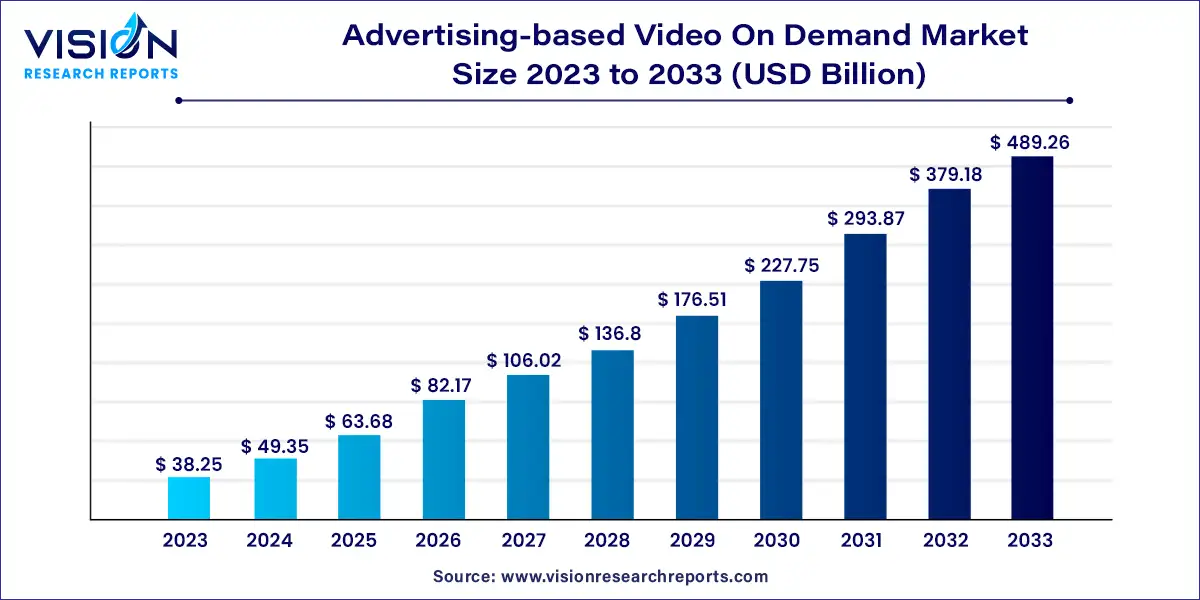

The global advertising-based video on demand market size was estimated at USD 38.25 billion in 2023 and it is expected to surpass around USD 489.26 billion by 2033, poised to grow at a CAGR of 29.03% from 2024 to 2033.

The landscape of entertainment consumption has witnessed a significant shift in recent years, with the rise of advertising-based video on demand (AVOD) platforms. These platforms offer viewers access to a wide array of content, ranging from movies and TV shows to user-generated videos, all supported by advertisements.

The growth of the advertising-based video on demand (AVOD) market is propelled by an increasing accessibility of high-speed internet and the widespread adoption of connected devices have expanded the reach of AVOD platforms, enabling users to stream content conveniently across multiple devices. Moreover, the rising demand for free, ad-supported content among consumers, coupled with the preference for personalized viewing experiences, has fueled the rapid adoption of AVOD services. Additionally, advancements in advertising technologies, such as programmatic advertising and dynamic ad insertion, have empowered advertisers to deliver more targeted and engaging advertisements, enhancing viewer engagement and driving revenue growth for AVOD platforms. Furthermore, the proliferation of original content on AVOD platforms, along with strategic partnerships and acquisitions, has contributed to the diversification and enrichment of content libraries, attracting a broader audience base. Collectively, these factors are driving the robust growth of the AVOD market, positioning it as a prominent player in the evolving landscape of digital entertainment.

| Report Coverage | Details |

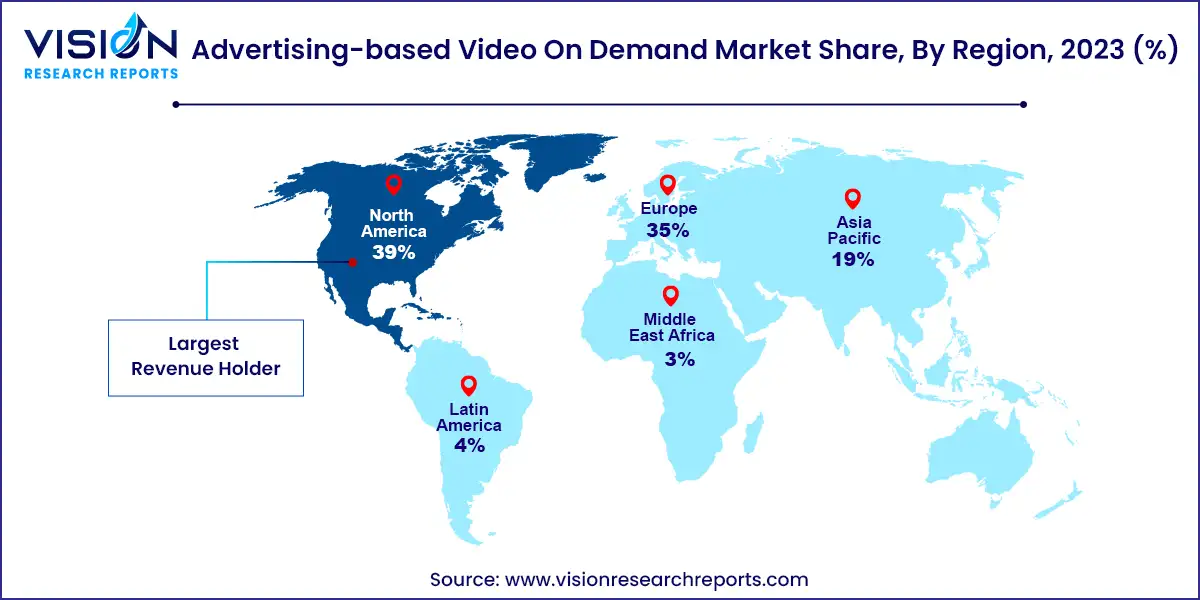

| Revenue Share of North America in 2023 | 39% |

| CAGR of Asia Pacific from 2024 to 2033 | 30.26% |

| Revenue Forecast by 2033 | USD 489.26 billion |

| Growth Rate from 2024 to 2033 | CAGR of 29.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of advertisement position, the market is classified into pre-roll, mid-roll, and post-roll. The mid-roll advertisement position segment dominated the overall market, gaining a revenue share of 51% in 2023 and registering a CAGR of 28.25% during the forecast period. Mid-roll advertising is placed in the middle of a video or audio clip, frequently interrupting the viewer's or listener's experience. Additionally, a mid-roll advertisement's position might vary based on the platform and content format. Moreover, mid-roll adverts on online video platforms such as YouTube are often put at regular intervals, such as every five minutes or at specified timestamps defined by the content provider. This maintains a balance between keeping viewer interest and allowing advertising to reach their intended group.

The pre-roll advertisement position segment is anticipated to grow at the fastest CAGR of 30.44% throughout the forecast period. Pre-roll advertising appears before the main video or audio content begins. Additionally, this advertising is widespread in online video platforms, streaming services, and podcasts. Pre-roll advertising appears at the start of the content and is usually played automatically before the viewer or listener can access the desired content. Furthermore, pre-roll commercials can run for various lengths, but they are often kept brief to minimize disturbance to the user experience. Pre-roll ad lengths can range from a few seconds to a minute, with 15 to 30 seconds being the most popular. The main aim of this sort of advertisement position is to create a favorable balance between generating ad revenue and maintaining a positive user experience.

Based on device, the market is classified into laptops and tablet PCs, mobile, console, and TV. The mobile segment dominated the overall market, gaining a revenue share of 48% in 2023, and is expected to grow at a CAGR of 27.94% during the forecast period. The segment's growth is attributed to the increasing mobile device adoption due to its unparalleled convenience and accessibility. These devices are also portable and lightweight, allowing users to stay connected and access information on the go. The widespread availability of affordable smartphones has made them accessible to many people, especially, in countries such as India, China, and Japan.

The laptops and tablet PCs segment is anticipated to grow at the fastest CAGR of 30.36% throughout the forecast period. Laptops and tablets are popular video consumption devices owing to their bigger screens and a more immersive viewing experience than smartphones or mobile phones. Many people choose these devices for long-term viewing, such as watching films, TV series, or web videos. Moreover, laptop and tablet devices capitalize on technological advancements and enhanced connectivity. With improved screen resolutions, more robust processing capabilities, and faster internet speeds, users can enjoy a smooth and immersive experience on these devices. These technological enhancements contribute to a seamless and pleasurable viewing experience for AVOD content on laptops and tablets.

In terms of enterprise size, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated with a revenue share of 65% in 2023. It is expected to grow at a CAGR of 28.45% during the forecast period. Large enterprises usually have significant resources to develop high-quality video material. They create professional videos such as advertisements, product demonstrations, brand promotions, and corporate documentaries for distribution on advertisement channels. Furthermore, large enterprises use sophisticated advertising strategies in the industry. Additionally, they employ AVOD platforms' user data and analytics to target certain demographics, interests and watching behaviors. This allows companies to display personalized adverts to their target demographic, increasing the efficacy of their marketing initiatives.

The small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR of 29.93% throughout the projected period. AVOD platforms provide SMEs with a low-cost advertising channel to market their products and services. Additionally, SMEs can access a broad audience while avoiding the substantial costs linked with conventional advertising methods by using the advertising-based video on demand platform. They may boost brand recognition by creating tailored commercials that resonate with their unique target market. Furthermore, SMEs cater to specific regional or specialty markets. They may target local or niche audiences via AVOD platforms. SMEs may maximize the relevance and efficacy of their advertising campaigns by placing their commercials on AVOD channels that are relevant to their target audience.

Based on industry vertical, the market is classified into BFSI, education, media & entertainment, IT & telecom, retail & consumer goods, healthcare, and others. The retail & consumer goods segment dominated the overall market, gaining a share of 30% in 2023. It is expected to grow at a CAGR of 28.17% over the forecast period. Retailers and consumer goods corporations use AVOD platforms to market their brands and products through tailored adverts. Additionally, the retail segment often focuses on advertisements that showcase their products, highlight promotional offers, or tell brand stories to capture viewers' attention and drive consumer engagement. Furthermore, AVOD platforms often offer opportunities for retailers to integrate e-commerce capabilities directly into their video content. This allows viewers to buy or learn more about the items featured in the videos without leaving the AVOD site, streamlining the purchasing process.

The media & entertainment segment is expected to grow at the fastest CAGR of 30.97% throughout the forecast period. AVOD platforms offer media and entertainment enterprises a large distribution network via which they may reach a large audience. They may use advertising-based video on demand channels to disseminate their movies, TV shows, web series, documentaries, and other video material to audiences worldwide. Furthermore, AVOD systems allow media and entertainment firms to monetize their content by generating advertising income. They can display adverts to viewers during their content consumption by collaborating with advertisers or through programmatic advertising, collecting money depending on ad impressions or interactions.

North America led the overall market in 2023, with a revenue share of 39%. The regional growth can be attributed to several major AVOD platforms that have a strong presence in the North American region. Platforms like YouTube, Hulu, Tubi, Facebook, and Roku Channel have established themselves as leading players, offering viewers a wide range of free, ad-supported content. For instance, in February 2023, according to a report by Digital TV Research, the U.S. is expected to contribute USD 30 billion. Such trends are anticipated to propel regional growth over the forecast period.

Asia Pacific is expected to witness the fastest CAGR of 30.26% over the projected period. The advertising-based video on demand industry in Asia Pacific is one of the second-largest and fastest-growing markets in the world. It has experienced significant growth in recent years, driven by increased internet penetration, rising demand for online video content, and the shift toward digital advertising. Additionally, the affordability of smartphones has significantly increased their accessibility, particularly in countries like India, China, and Japan. Notably, iQiyi, MXPlayer, JioCinema, Viu, and Line TV have established themselves as key players in the Asia Pacific region. Their diverse range of AVOD content offerings has played a significant role in driving the growth of the AVOD industry in the region.

By Advertisement Position

By Device

By Enterprise Size

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Advertising-based Video On Demand Market

5.1. COVID-19 Landscape: Advertising-based Video On Demand Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Advertising-based Video On Demand Market, By Advertisement Position

8.1. Advertising-based Video On Demand Market, by Advertisement Position, 2024-2033

8.1.1. Pre-roll

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mid-roll

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Post-roll

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Advertising-based Video On Demand Market, By Device

9.1. Advertising-based Video On Demand Market, by Device, 2024-2033

9.1.1. Laptops & Tablet PCs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Mobile

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Console

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. TV

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Advertising-based Video On Demand Market, By Enterprise Size

10.1. Advertising-based Video On Demand Market, by Enterprise Size, 2024-2033

10.1.1. Small & Medium Enterprise (SME)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Large Enterprise

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Advertising-based Video On Demand Market, By Industry Vertical

11.1. Advertising-based Video On Demand Market, by Industry Vertical, 2024-2033

11.1.1. Media & Entertainment

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. BFSI

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Education

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Retail & Consumer Goods

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. IT & Telecom

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Advertising-based Video On Demand Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.1.2. Market Revenue and Forecast, by Device (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Device (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.2.2. Market Revenue and Forecast, by Device (2021-2033)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Device (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Device (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Device (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.3.2. Market Revenue and Forecast, by Device (2021-2033)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Device (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Device (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Device (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.4.2. Market Revenue and Forecast, by Device (2021-2033)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Device (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Device (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Device (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Device (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Advertisement Position (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Device (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. Brightcove

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Dacast

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Dailymotion

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Facebook

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. IBM

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kaltura

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Muvi

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SymphonyAI Media

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Vdocipher

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Vidyard

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others