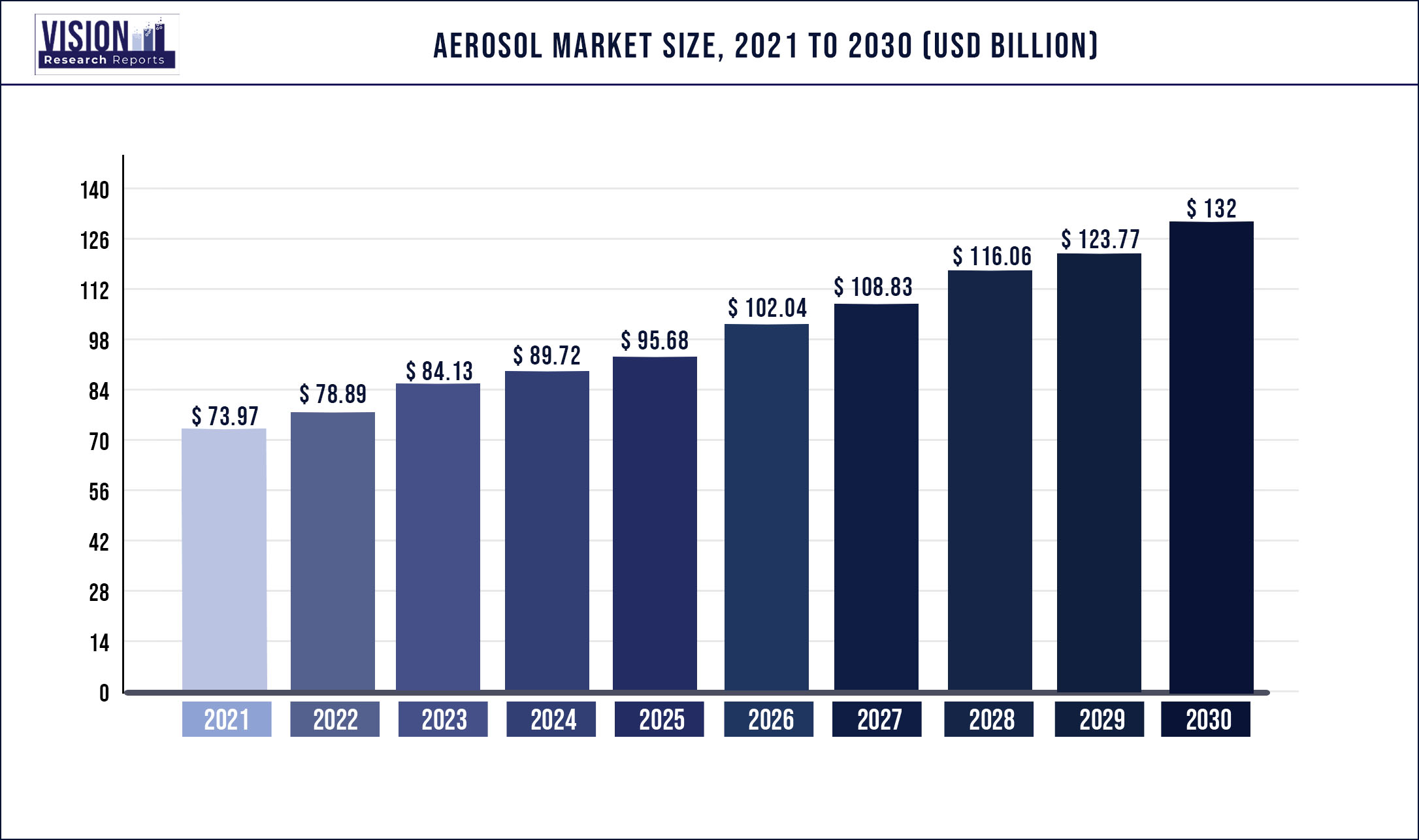

The global aerosol market was surpassed at USD 73.97 billion in 2021 and is expected to hit around USD 132 billion by 2030, growing at a CAGR of 6.65% from 2022 to 2030.

Report Highlights

The rising demand for aerosol products from various end-use industries, such as personal care, household, automotive and industrial, and medical, is anticipated to drive the growth. Aerosol paints are being increasingly used for automotive as well as architectural paint applications. Uniform propulsion, ease of application, and aesthetic appeal of aerosols are key factors driving their demand in architectural and automotive paint end-use industries.

Furthermore, the rapidly expanding construction sector, especially in developing countries such as India, China, Vietnam, and Indonesia, is expected to further fuel the product demand in paint application. Globally, the cases of respiratory diseases, such as asthma and Chronic Obstructive Pulmonary Disease (COPD), have considerably increased over the past several years, majorly due to the changing lifestyle and rising geriatric population. The growing cases of such respiratory diseases are principally driving the demand for aerosol-based inhalers. In addition, high demand for various pain relief sprays owing to their convenience of application is further anticipated to expand the market growth in the coming years. Asia Pacific is among the significant regional markets.

The rising demand for personal care products from developing countries is anticipated to propel the demand for aerosol. In addition, increasing awareness regarding cleanliness and hygiene is boosting the growth of household products like cleaners, sanitizing agents, and air fresheners. The growing demand from Asia Pacific is encouraging aerosol manufacturers to increase their production. For example, in February 2019, Vanesa Care announced plans to set up its fourth manufacturing facility in India. The global market is highly competitive with numerous players involved in acquisitions and expansions. In addition, they also conduct R&D for the emerging sectors, such as household and personal care.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 73.97 billion |

| Revenue Forecast by 2030 | USD 132 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.65% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Material, type, application, region |

| Companies Covered | Henkel; Proctor & Gamble; Reckitt Benckiser; Unilever; Honeywell International Inc.; SC Johnson & Son Inc.; Crabtree & Evelyn; Beiersdorf AG; Akzo Nobel N.V.; Oriflame Cosmetics S.A.; Estee Lauder |

Material Insights

On the basis of materials, the global market has been segmented into steel, aluminum, and others. The aluminum material segment held the largest revenue share of 60.45% in 2021 and is also projected to expand at a considerable growth rate over the forecast period. Aluminum is an environmentally friendly material and can be recycled multiple times. In addition, it also offers robust packaging and significantly enhances the aesthetic appeal of the product. These factors are majorly contributing to the growth of the segment. Globally, aluminum prices are significantly increasing over the past several years.

Increasing aluminum prices are further leading to a rise in the final costs of aerosols. On account of this factor, aerosol manufacturers are expected to opt for a low-priced alternative, which may hamper the growth of the aluminum material segment in the coming years. The plastic material segment has also been experiencing significant demand for the past few years due to the low weight, low cost, and high recyclability of PET plastic. However, a strict ban on plastic packaging, especially in Europe, is expected to hamper the growth of this segment over the coming years.

Type Insights

The standard segment accounted for the maximum revenue share of 82.4% in 2021 and is projected to continue with its dominance throughout the forecast period. This segment includes continuous and metering type valves; continuous valves are used in applications where continuous spray is required. The increasing utilization of these valves in food products, technical products, and home care products, such as insecticides, rodenticides, and decoration products, is expected to drive the segment growth. Metered valves are specifically preferred for efficient dispensing of metered doses, thus used in pharmaceutical applications and air fresheners. Bag-in-valve is a packaging technology wherein the bag containing the product is welded to the valve.

The propellant is placed in between the bag and the can. Therefore, the propellant and the product are completely separated from each other, which improves the integrity of the packaged product. In a bag-in-valve aerosol, the product is dispensed mainly by the propellant by squeezing the bag after the pressing of the spray button. Cosmetic, medical, and food products are usually packaged in the aerosol with a bag-in-valve to maintain the purity of the product. The bag in the valve offers nearly 99.5% of product dispersion; the bag is usually made of four-layer laminates, which minimizes the possibility of oxidation, and the product is hermetically sealed with the bag. These advantages are attracting various product manufacturers towards the bag in the valve aerosol type segment. This, in turn, is expected to propel the segment growth in the coming years.

Application Insights

The personal care segment held the largest market share of more than 41.88%, in terms of volume, in 2021. The segment is driven by the growing demand for hair care products and deodorants. The demand for personal care products is increasing in emerging economies owing to the changing lifestyle, rising consumer spending, and emphasis on gender-specific products. The rapid growth of the household segment is attributed to the improvement in standards of living and emphasis on hygiene, especially in developing regions. This has led to a rise in the consumption of household products like air fresheners, cleaners, sanitizing agents, and disinfectants. Dispersion of these products in less quantity reduces wastage and increases their longevity.

This property further propels their usage. The automotive and industrial segment is also among the significant applications. Increasing consumer awareness regarding the appearance and maintenance of vehicles is propelling the demand for products like spray paints and automotive cleaning agents. In addition, increasing sales of vehicles are positively impacting the consumption of other products, such as adhesives and sealants, anti-fog agents, and lubricants. The growth of the medical segment can be credited to the increasing demand for dry powder respiratory inhalers and metered dose inhalers, especially in North America. The growing pollution has led to a rise in the number of asthma patients, which is anticipated to propel the demand for these inhalers over the forecast period.

Regional Insights

Europe held the largest market share of 33.16% in terms of volume in 2021. The region is also the leading producer of aerosols. Its large share is mainly attributable to the personal care industry. Factors including high cosmetics consumption, rapid growth in the fragrance industry, and increasing consumer spending are boosting the regional market growth. Despite the increasing demand from the personal care industry, the growth of the Europe market is hindered by the regulations regarding Volatile Organic Compounds (VOC) emissions, laid down by the European Commission and Environmental Protection Agency (EPA). However, the region is anticipated to overcome this challenge in the near future with innovations. For example, in 2017, a new line of aerosol cleaners was introduced by Breathe, certified by the EPA’s Safer Choice Program.

In terms of revenue, Asia Pacific is amongst the fastest-growing regions and is expected to register a CAGR of 8.09% over the forecast period. The governments of China and India have been focusing on promoting favorable investments, which is expected to create lucrative growth opportunities for the market over the forecast period. Increasing consumer spending in emerging Asian economies is boosting the demand for aerosol in the personal care, automotive, and paints sectors. The Middle East and Africa are also estimated to witness significant growth over the forecast period due to high spending on hair care products in countries such as Saudi Arabia and UAE. In addition, the presence of hypermarkets, such as Carrefour, and Lulu Hypermarket, in the UAE, Saudi Arabia, and Kuwait have ensured the retail distribution of consumer products.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aerosol Market

5.1. COVID-19 Landscape: Aerosol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aerosol Market, By Material

8.1. Aerosol Market, by Material, 2022-2030

8.1.1. Steel

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Aluminum

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Aerosol Market, By Type

9.1. Aerosol Market, by Type, 2022-2030

9.1.1. Bag-In-Valve

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Standard

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Aerosol Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.2. Market Revenue and Forecast, by Type (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Type (2017-2030)

Chapter 11. Company Profiles

11.1. Proctor & Gamble

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Reckitt Benckiser

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Unilever

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Honeywell International Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. SC Johnson & Son Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Henkel

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others