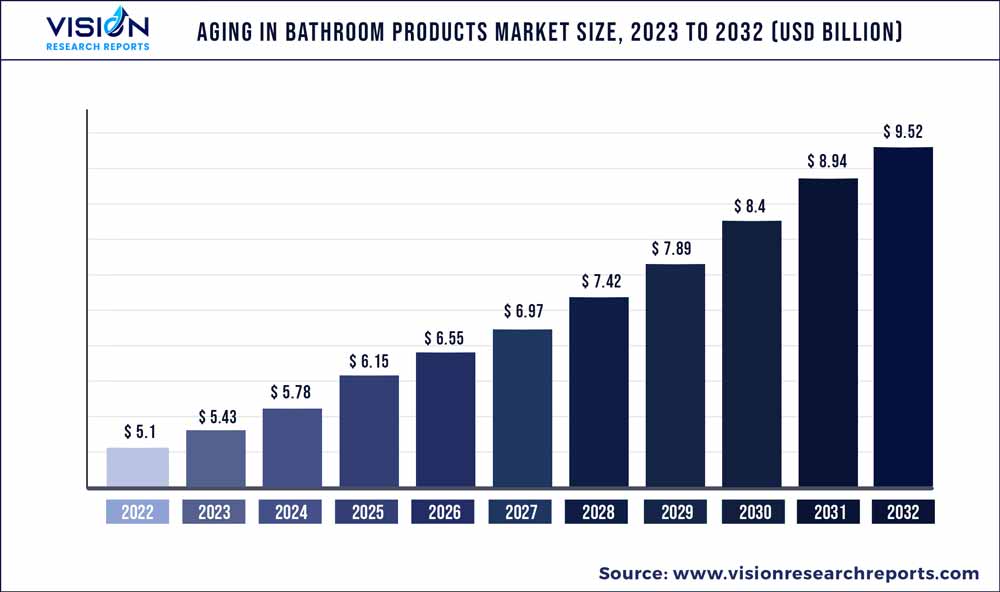

The global aging in bathroom products market was valued at USD 5.1 billion in 2022 and it is predicted to surpass around USD 9.52 billion by 2032 with a CAGR of 6.44% from 2023 to 2032.

Key Pointers

Report Scope of the Aging In Bathroom Products Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.1 billion |

| Revenue Forecast by 2032 | USD 9.52 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.44% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Vermeiren India Rehab Pvt. Ltd.; Genteel Homecare Products Co., Ltd.; SENIORITY.IN; Jianlian Homecare Products Co., Ltd.; Jinan Hengsheng New Building Materials Co., Ltd.; YUYAO BEILV SANITARY WARE CO., LTD; Saamipya; Old is Gold Store; IgnoxLabs Pvt Ltd. (Emoha Elder Care); Wenzhou Baogeli Sanitary Wares Co.,ltd. |

The ideal aging in bathroom products is essential for ensuring older users’ ease of use, convenience, and maximum safety. Although these products may take some time and money to install; they are often worth the expense. However, several of the most recent bathroom design trends, such as more natural lighting, spacious bathroom seat raisers, commode, and bath handles, are recommendations for making bathrooms safer, more economically sound, and simpler to use.

The Americans with Disabilities Act (ADA) established requirements that must be adhered to in public areas such as malls, shops, public restrooms, theatres, and others. Even new homeowners can make their homes more secure and useful by following the disabilities act ensures safety and convenience for a person with a disability. Houses with bathroom aids offer a more competitive edge and sell quickly as compared to other regular homes.

The bath lifts segment held the largest market share in 2022. This segment is observed to be the spearhead segment, which indicates the product has the largest market share as it generates significant cash flows and has excellent future growth prospects. These are commonly used as bathroom aid that helps a person move freely around a bathtub and the bathroom area. It is a cost-effective alternative to walk-in baths with external help from a caregiver as it provides a non-slip transfer seat and a retractable belt. These aids lower the elderly or disabled individual in the bathtub safely without making the person feel dependent on someone else to take a bath with utmost privacy.

Remodeling residential properties to make living safer for the senior population is a trend that is on the rise and is predicted to continue in the years to come. In January 2020, more than half (53%) of the 1.13 million households residing in public housing were headed by an individual who was 62 years of age or older and/or disabled, according to an article published by the Urban Institute. The market for toilet goods for the older population is predicted to benefit from these demographic trends.

Furthermore, the growing interest of retailers to provide products for older people according to their needs and requirements of safety and convenience is expected to bode well for the market. For instance, Kohler Co. showcases a variety of bathroom products for the elderly such as walk-in-tubs, grab bars & handrails, toilets, and faucets, in its stores so that the consumer can verify the products before buying them.

Product Insights

The bath lifts segment dominated the market with a share of around 22.02% in 2022. Due to an increase in the number of disabled people, their decreased mobility, and their increased ability to pay for healthcare, this market has grown quickly over the past several years and is predicted to continue its growth at a constant rate. For instance, AmeriGlide Distribution, Inc. sells a luxury bath lift that allows the user to be raised up completely in the bathtub without having to move or lift their legs. Such advantages are anticipated to boost product visibility among consumers with limited mobility who are disabled.

The chairs & stools segment is projected to register a CAGR of 7.52% from 2023 to 2032. It is projected that a driving factor would be the rising use of bath chairs and stools among those with long-term disabilities and injuries. These gadgets offer assistance to those who have trouble standing in the shower, such as the elderly or those with injuries. According to a KAISER FAMILY FOUNDATION article from February 2019, almost 25 million Americans who are aging require assistance from others and equipment like shower seats and chairs to complete necessary daily tasks.

Application Insights

The residential segment dominated the market with a share of around 61.05% in 2022. Toilet products are finding new growth opportunities as more consumers in emerging nations like China and India depend on nursing facilities, as they get older. Nursing homes have become more popular recently because there are fewer young people available to care for the elderly. Over 16% of China's elderly population is over 60 years old, and among these individuals, more than 42 million people are incapacitated seniors, according to a May 2021 report by China Global Television Network (CGTN). Such information points to a favorable market picture for the anticipated period.

The commercial segment is estimated to grow at the fastest CAGR of 7.16% over the forecast period. The increasing development and expansion of commercial infrastructure across developing economies are supporting the demand for aging bathroom products. Apart from this, the significant growth of the healthcare industry, coupled with the rising number of hospitals across the globe, is projected to propel product demand over the forecast period. According to a survey conducted by the American Hospital Association in 2022, there are more than 6,000 hospitals in the U.S.

Distribution Channel Insights

In terms of revenue, the offline segment dominated the market with a share of 68.06% in 2022. The market's overall sales are expected to increase as a result of the growing trend among businesses selling bathroom products through physical stores to increase customer value by offering customers the physical interaction they need to buy "deep" products, which require extensive inspection before being purchased. In June 2021, 78% of American consumers made more in-store purchases since they could see the products in person before making a decision.

The online segment is estimated to grow at the fastest CAGR of 7.07% over the forecast period. With convenience being a primary facilitator of e-commerce, consumers are looking for hassle-free experiences that save time and provide convenient payment & delivery options. To address consumer concerns regarding the authenticity of aging in bathroom products through online channels, companies have increasingly started adopting a direct-to-consumer approach, which skips the distributors/retailers completely and guarantees product authenticity. For instance, Pottery Barn introduced an accessible home collection in July 2022 that included bath aids for seniors living in their homes as well as people with impairments and accidents.

Regional Insights

North America dominated the aging in bathroom products industry with a share of around 30.06% in 2022. The region's market for aging bathroom products is anticipated to expand in the years to come, largely as a result of an increase in the proportion of Americans who are sixty-five or older. The number of Americans sixty-five and older will nearly double in the upcoming 40 years, expected to reach 80 million in 2040, according to the U.S. Census Bureau. Between 2000 and 2040, the proportion of seniors 85 and older, who frequently require assistance with basic personal care, including bathroom supplies and accessories, will almost quadruple. These numbers point to a favorable outcome for the market during the projected period.

Asia Pacific is expected to witness a CAGR of 22.34% from 2023 to 2032. The increasing geriatric population, caused by substantial declines in fertility and significant improvements in life expectancy, will drive the aging in bathroom products application across the region. Given the rapid growth in the older population, governments have been increasingly concerned with maintaining the quality of life in old age and prioritizing aging-related issues. They have also taken into account the costs entailing an aging population, which will significantly boost the market growth.

Aging In Bathroom Products Market Segmentations:

By Product

By Application

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aging In Bathroom Products Market

5.1. COVID-19 Landscape: Aging In Bathroom Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aging In Bathroom Products Market, By Bath Aids

8.1. Aging In Bathroom Products Market, by Product, 2023-2032

8.1.1 Bath Aids

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Bath Lifts

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Grab Handles & Bars

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Chairs & Stools

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Toilet Seat Raisers

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Commodes

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Aging In Bathroom Products Market, By Application

9.1. Aging In Bathroom Products Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Aging In Bathroom Products Market, By Distribution Channel

10.1. Aging In Bathroom Products Market, by Distribution Channel, 2023-2032

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Aging In Bathroom Products Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Vermeiren India Rehab Pvt. Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Genteel Homecare Products Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. SENIORITY.IN

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Jianlian Homecare Products Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Jinan Hengsheng New Building Materials Co., Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. YUYAO BEILV SANITARY WARE CO., LTD

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Saamipya

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Old is Gold Store

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. IgnoxLabs Pvt Ltd. (Emoha Elder Care)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Wenzhou Baogeli Sanitary Wares Co.,ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others