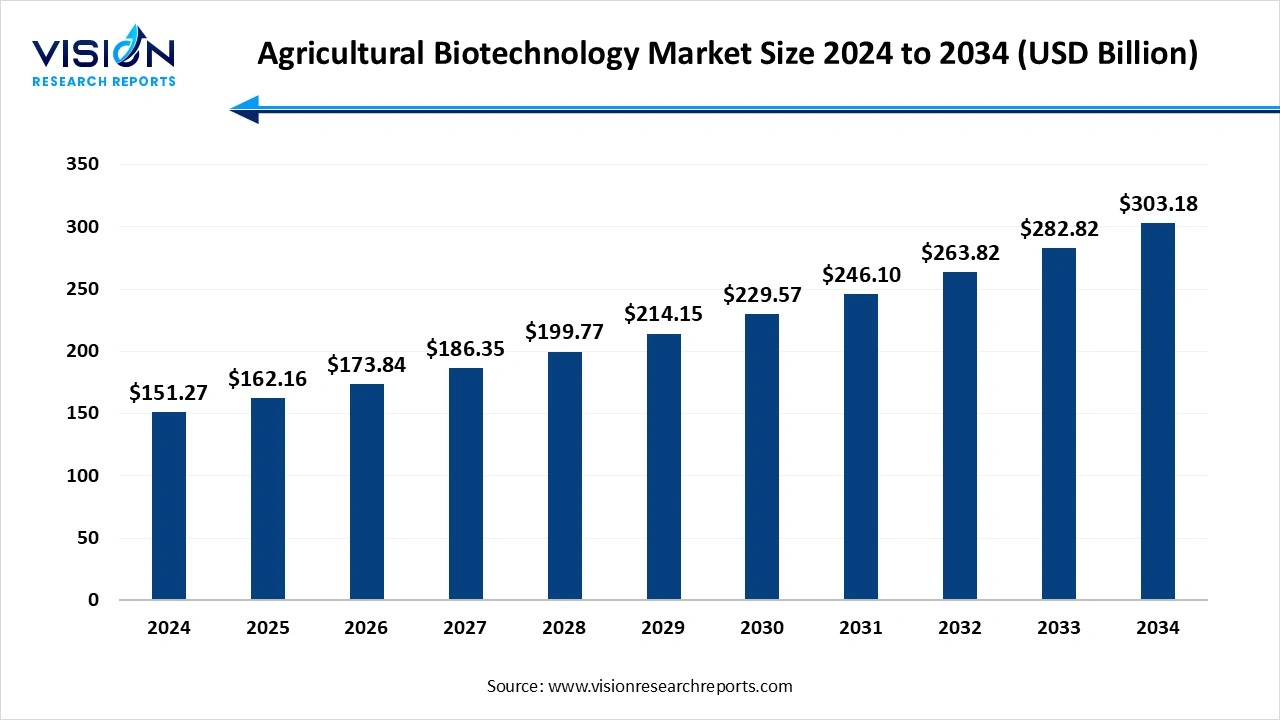

The global agricultural biotechnology market size was valued at USD 151.27 billion in 2024 and it is predicted to surpass around USD 303.18 billion by 2034 with a CAGR of 7.20% from 2025 to 2034.

The agricultural biotechnology market is rapidly evolving, driven by the increasing demand for sustainable farming practices and enhanced crop productivity. This sector focuses on the application of genetic engineering, molecular markers, and bioinformatics to develop crops that are resistant to pests, diseases, and environmental stresses. Innovations such as genetically modified organisms (GMOs), biofertilizers, and biopesticides are playing a crucial role in improving yield and reducing reliance on chemical inputs. Additionally, the growing global population and the need for food security are propelling investments in biotechnology research, making it a pivotal element in modern agriculture.

The growth of the agricultural biotechnology market is primarily driven by the increasing global demand for food due to rapid population growth and changing dietary preferences. Biotechnology innovations such as genetically modified crops enable higher yields and improved resistance to pests, diseases, and environmental stresses like drought and salinity. These advancements help farmers optimize crop production while reducing dependency on chemical fertilizers and pesticides, supporting more sustainable agricultural practices. Additionally, rising awareness about the benefits of biotech crops among farmers and consumers is encouraging wider adoption, further fueling market expansion.

Another significant growth factor is the continuous advancement in research and development activities supported by government initiatives and private sector investments. Governments across various countries are providing incentives and regulatory frameworks that promote biotechnology adoption in agriculture, especially in emerging economies. Moreover, technological breakthroughs such as CRISPR gene-editing and bioinformatics are enhancing the precision and efficiency of developing improved crop varieties.

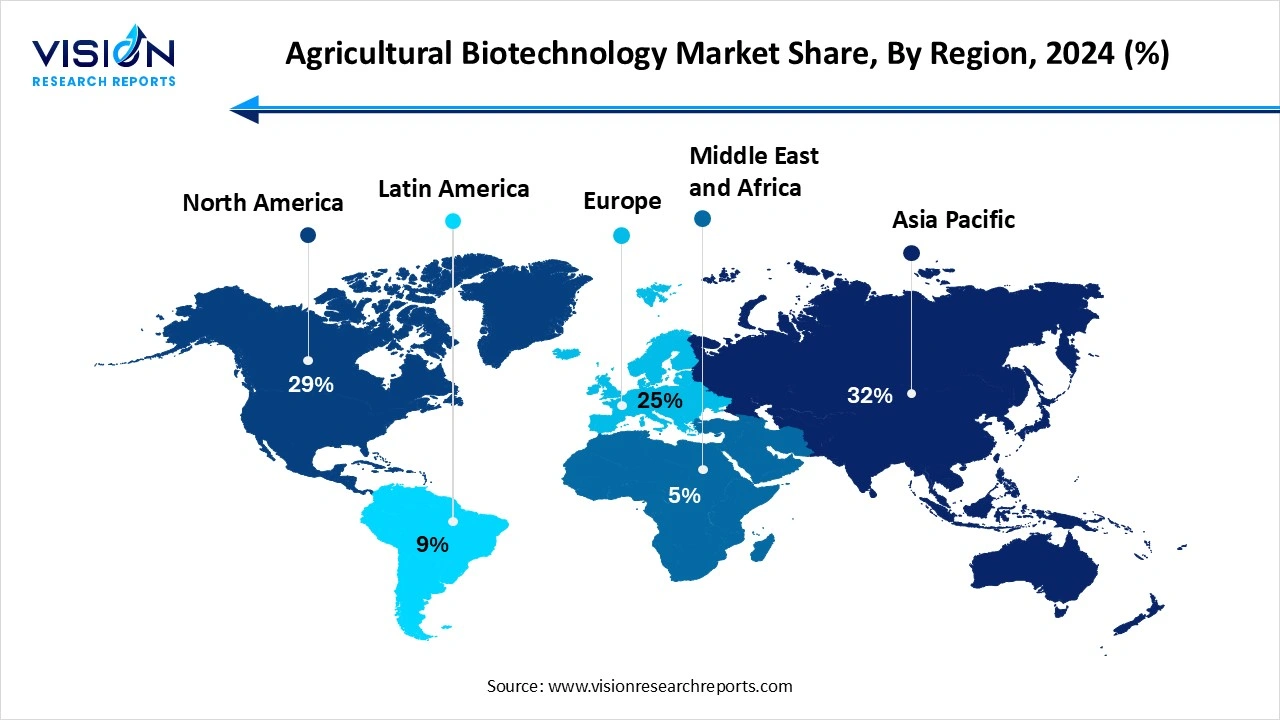

The Asia Pacific agricultural biotechnology market led the global sector in 2024, capturing the largest revenue share of 32%. This growth is driven by the rising demand for food security and sustainable farming practices. With the population steadily increasing, there is an urgent need for innovative approaches that boost crop productivity and resilience. Additionally, the region is grappling with significant climate change challenges, encouraging farmers to adopt biotechnology for developing climate-resilient crops. Strong government backing for research and development initiatives also creates a supportive environment for biotechnological progress, fostering collaboration among key stakeholders.

The North America agricultural biotechnology market is projected to grow at a CAGR of 7.2% during the forecast period, driven by the growing acceptance of genetic engineering techniques among farmers. The region’s focus on sustainability and food security also supports the adoption of biotechnological solutions that improve crop yields while minimizing the use of chemical inputs. Additionally, ongoing advancements in research and development are leading to the creation of innovative biotech products designed to address specific agricultural challenges, further fueling market growth.

The North America agricultural biotechnology market is projected to grow at a CAGR of 7.2% during the forecast period, driven by the growing acceptance of genetic engineering techniques among farmers. The region’s focus on sustainability and food security also supports the adoption of biotechnological solutions that improve crop yields while minimizing the use of chemical inputs. Additionally, ongoing advancements in research and development are leading to the creation of innovative biotech products designed to address specific agricultural challenges, further fueling market growth.

The plants segment dominated the market, capturing the largest revenue share of 43% in 2024. In the context of plants, biotechnology has revolutionized crop production by enabling the development of genetically modified (GM) crops that exhibit improved traits such as pest resistance, herbicide tolerance, enhanced nutritional content, and increased yield. These modifications help farmers reduce reliance on chemical inputs, mitigate crop losses due to pests and diseases, and adapt crops to varying climatic conditions. Innovations in plant biotechnology also include the development of biofertilizers and biopesticides, which contribute to sustainable agricultural practices by reducing environmental impact and promoting soil health.

The animals segment is projected to expand at a compound annual growth rate (CAGR) of 7.8% during the forecast period. These biotechnological applications aim to enhance desirable traits in animals such as faster growth rates, disease resistance, better feed efficiency, and improved reproductive performance. Biotechnology also plays a role in animal health management by enabling the development of vaccines and diagnostic tools to prevent and control infectious diseases.

The transgenic crops and animals segment led the global agricultural biotechnology industry in 2024, accounting for the largest revenue share at 25%.These animals are engineered to improve growth rates, disease resistance, and feed efficiency, which ultimately contribute to increased production and reduced environmental impact. Examples include transgenic fish and livestock that produce leaner meat or have enhanced immunity against common diseases. The integration of biotechnology in animal husbandry not only improves productivity but also helps address food security challenges by optimizing resource utilization and minimizing losses due to illnesses.

The vaccine development segment is projected to expand at a compound annual growth rate (CAGR) of 8.2% between 2025 and 2034. Advances in biotechnology have enabled the creation of novel vaccines that are more effective, targeted, and safer than traditional ones. These vaccines often utilize recombinant DNA technology, subunit vaccines, or DNA vaccines to induce immunity in animals, thereby reducing dependency on antibiotics and other chemical treatments. In crops, biotechnology-driven vaccines and bio-pesticides can help combat viral and bacterial infections, further protecting agricultural productivity.

By Organism

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Agricultural Biotechnology Market

5.1. COVID-19 Landscape: Agricultural Biotechnology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Agricultural Biotechnology Market, By Organism

8.1. Agricultural Biotechnology Market, by Organism

8.1.1. Plants

8.1.1.1. Market Revenue and Forecast

8.1.2. Animals

8.1.2.1. Market Revenue and Forecast

8.1.3. Microbes

8.1.3.1. Market Revenue and Forecast

Chapter 9. Agricultural Biotechnology Market, By Application

9.1. Agricultural Biotechnology Market, by Application

9.1.1. Vaccine Development

9.1.1.1. Market Revenue and Forecast

9.1.2. Transgenic Crops & Animals

9.1.2.1. Market Revenue and Forecast

9.1.3. Antibiotic Development

9.1.3.1. Market Revenue and Forecast

9.1.4. Nutritional Supplements

9.1.4.1. Market Revenue and Forecast

9.1.5. Flower Culturing

9.1.5.1. Market Revenue and Forecast

9.1.6. Bio-Fuels

9.1.6.1. Market Revenue and Forecast

Chapter 10. Agricultural Biotechnology Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Organism

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Bayer Crop Science (including Monsanto)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Syngenta AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Corteva Agriscience

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. KWS SAAT SE

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dow AgroSciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. FMC Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. DuPont Pioneer

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Evogene Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Zoetis Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others