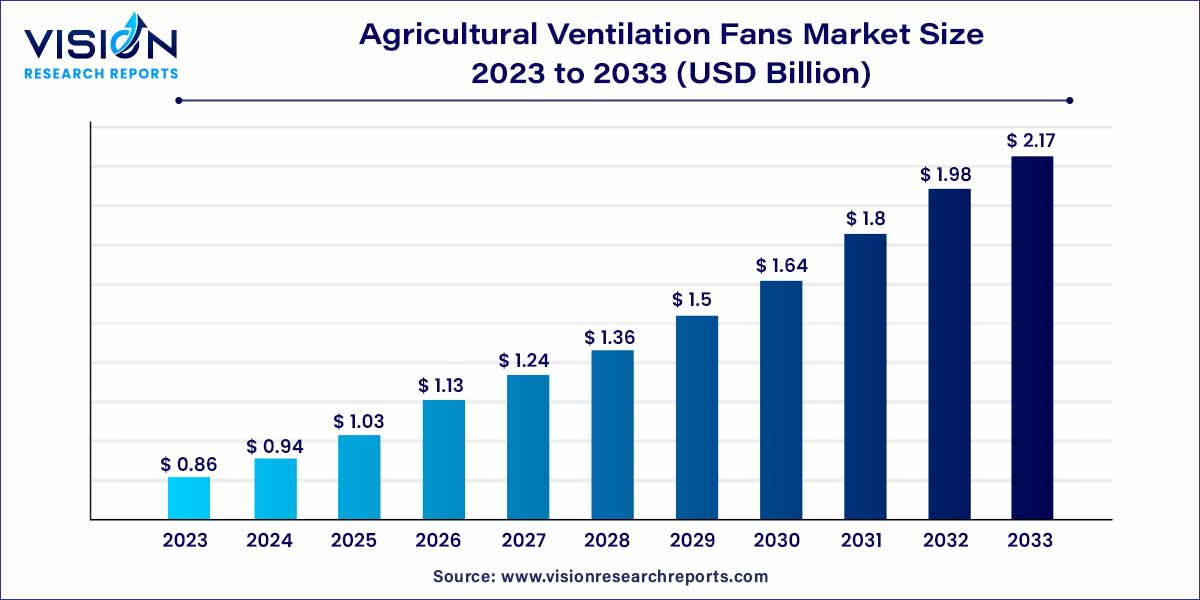

The global agricultural ventilation fans market size was estimated at around USD 0.86 billion in 2023 and it is projected to hit around USD 2.17 billion by 2033, growing at a CAGR of 9.75% from 2024 to 2033.

The global agricultural ventilation fans market has witnessed significant growth in recent years, driven by the increasing emphasis on sustainable agricultural practices and the rising awareness about the impact of proper ventilation on crop yields. This overview delves into the key factors shaping the market, the current landscape, and future trends that are likely to influence the trajectory of the Agricultural Ventilation Fans Market.

The agricultural ventilation fans market is experiencing robust growth driven by several key factors. Firstly, the increasing adoption of sustainable farming practices has elevated the importance of efficient ventilation in optimizing environmental conditions for crops. Smart ventilation systems, incorporating sensors and automated controls, are gaining traction, enhancing operational efficiency and reducing energy costs. Manufacturers' focus on developing energy-efficient fan designs addresses concerns about operational expenses and environmental impact. The expanding application of ventilation fans in livestock farming, coupled with the rising demand for variable speed fans, reflects a growing awareness of the critical role ventilation plays in ensuring animal well-being and farm productivity. Additionally, the market is expanding into new regions, supported by government initiatives and subsidies aimed at promoting advanced agricultural technologies. The emphasis on durability, noise reduction, and the integration of renewable energy sources further contribute to the market's positive trajectory, offering stakeholders promising opportunities in the agricultural ventilation sector.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2.17 billion |

| Growth Rate from 2024 to 2033 | CAGR of 9.75% |

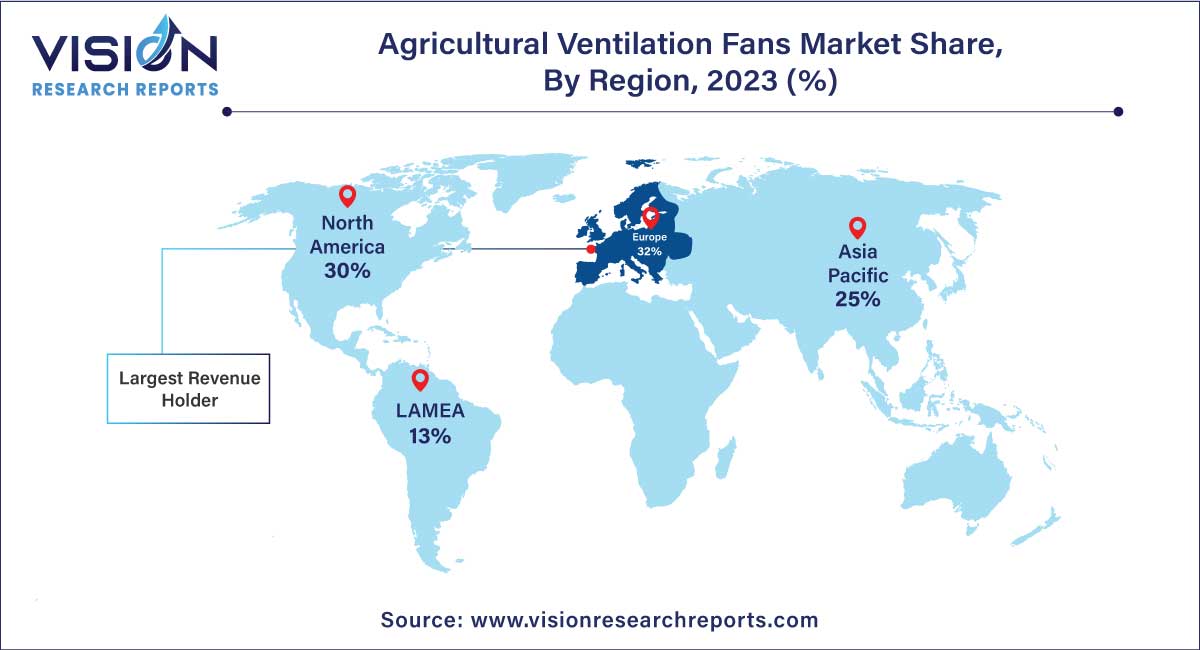

| Revenue Share of Europe in 2023 | 32% |

| CAGR of Asia Pacific from 2024 to 2033 | 11.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The circulation fan segment held the largest revenue share of 32% in 2023. This significant share is attributed to the widespread adoption of the dual-functionality feature, providing both cooling and ventilation in open livestock barns. These fans are adept at moving a high volume of air at low pressure, effectively balancing greenhouse temperatures. Additionally, during colder seasons, circulation fans play a crucial role in distributing warm air from overhead heating systems.

In contrast, the exhaust fan segment is expected to expand at the highest CAGR of 11.53% throughout the forecast period. Recognized as a vital component in mechanical ventilation systems, exhaust fans play a pivotal role in eliminating odors and exhalations in livestock environments. Beyond enhancing animal life quality, they contribute significantly to disease prevention and the mitigation of epidemic risks in livestock. In poultry and livestock housing facilities, these fans act as a driving force for essential air exchange. Moreover, the integration of agricultural ventilation fans, such as circulation and exhaust fans, with other equipment like humidifiers, is on the rise, facilitating the creation of micro-climates ideal for diverse cultivation practices.

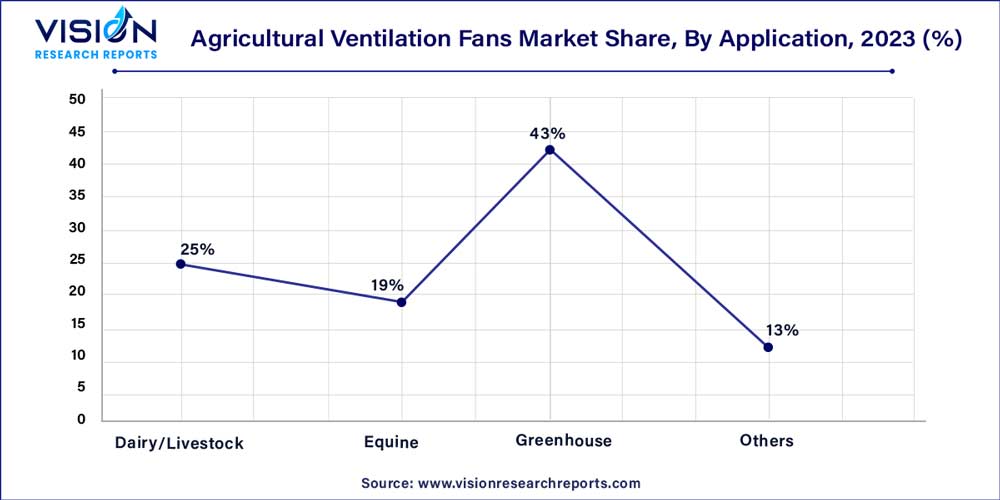

The greenhouse segment had the largest market share of 43% in 2023. This substantial share is driven by the growing demand for vertical and indoor farming practices, particularly for cultivating fruits and vegetables. Agricultural ventilation fans play a crucial role in greenhouses by controlling climatic conditions, enhancing both the quality and quantity of agricultural products. Additionally, during the summer, the need to replace hot air inside the greenhouse with cooler outside air for temperature regulation is fulfilled by ventilation fans. This application results in increased crop production compared to relying solely on natural ventilation techniques.

In 2023, the dairy/livestock segment held the largest revenue share of 31% and it is expected to grow at the notable CAGR of 10.65% during the forecast period. The accelerated growth is attributed to the rising livestock population in advanced economies like the U.S., the U.K., China, and Germany. Ventilation fans utilized in dairy/livestock housing contribute to maintaining a comfortable and uniform climate for the animals. These fans effectively remove odors, heat, and moisture generated by the livestock, while replenishing the oxygen supply by introducing cooler outside air.

In 2023, Europe region dominated the market with the largest market share of 32%. This substantial share is credited to the region's escalating adoption of technologies like Controlled Environment Agriculture (CEA). The United Kingdom played a pivotal role, holding a significant share in the European market due to the prevailing trend of embracing U.S.-style greenhouse cultivation. Furthermore, governmental and agency initiatives across multiple countries aimed at establishing indoor farms address challenges such as population growth, food production limitations, and the impacts of climate change.

Meanwhile, the Asia Pacific region is anticipated to register the highest CAGR of 11.25% throughout the forecast period. This growth is characterized by a confluence of factors, including a burgeoning population, heightened farmer awareness regarding the necessity of alternative farming practices, evolving consumer consumption patterns, and a growing aversion to excessive pesticide use in fruit and vegetable cultivation. The imperative to adopt alternative farming practices amidst unpredictable climatic conditions and surging food demand has led to an increased construction of greenhouses and vertical farms, thereby boosting the installation of agricultural ventilation fans in the region.

China and India stand out as countries with sizable livestock populations and prevalent conventional farming practices. Consequently, these markets present substantial opportunities for the adoption of agricultural technology, particularly in the field of ventilation. Additionally, various countries across the Asia Pacific region have experienced positive outcomes due to supportive government policies and subsidies that encourage the embrace of indoor farming. An illustrative example is Japan, where over half of growers have received either subsidies or loans to establish indoor agriculture operations. This proactive support is anticipated to stimulate the demand for agricultural ventilation fans in the region.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Agricultural Ventilation Fans Market

5.1. COVID-19 Landscape: Agricultural Ventilation Fans Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Agricultural Ventilation Fans Market, By Product

8.1. Agricultural Ventilation Fans Market, by Product, 2024-2033

8.1.1. Circulation fans

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Duct fans

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Exhaust fans

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Portable fans

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Agricultural Ventilation Fans Market, By Application

9.1. Agricultural Ventilation Fans Market, by Application, 2024-2033

9.1.1. Dairy/Livestock

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Equine

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Greenhouse

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Agricultural Ventilation Fans Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. AirMax Fans

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. American Coolair Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bigass Fans (Delta T, LLC)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Multi-Wing America, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. OSBORNE INDUSTRIES INC.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. QC Supply, a PS Operating Company LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Schaefer

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Vostermans Ventilation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. New York Blower Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ebm-papst

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others