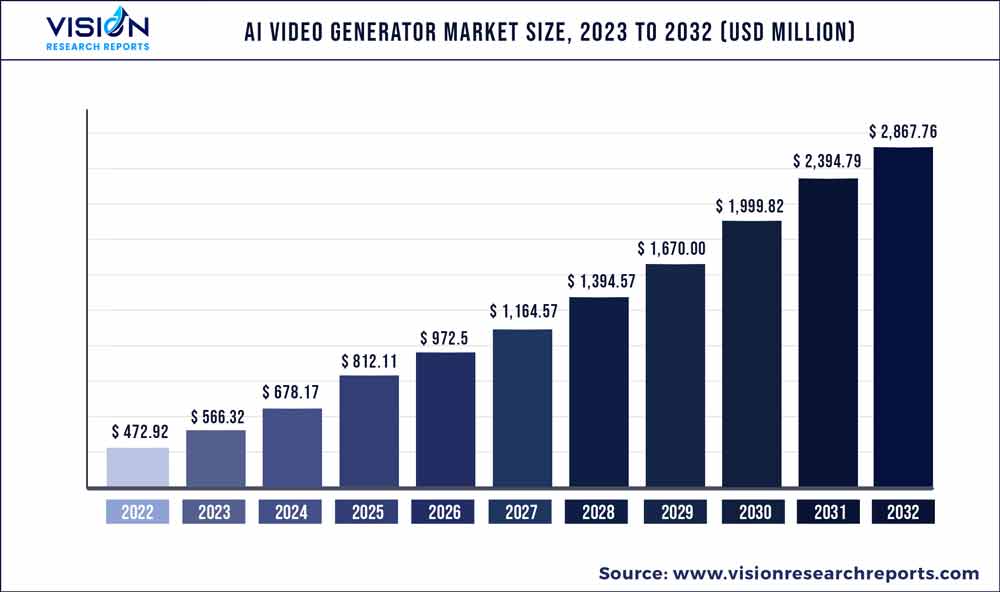

The global AI video generator market size was estimated at around USD 472.92 million in 2022 and it is projected to hit around USD 2,867.76 million by 2032, growing at a CAGR of 19.75% from 2023 to 2032.

Key Pointers

Report Scope of the AI Video Generator Market

| Report Coverage | Details |

| Market Size in 2022 | USD 472.92 million |

| Revenue Forecast by 2032 | USD 2,867.76 million |

| Growth rate from 2023 to 2032 | CAGR of 19.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Synthesia; Lumen5; Muse.ai; Rephrase.ai; Synths Video; Raw Shorts; Pictory; FlexClip; Designs.Ai; InVideo |

The rising need for technological advancements and smartphones is the primary factor driving the industry. The market growth is increasing through video content and the demand for audio-video materials in various industries. For instance, according to the data collected by Statista, 3.5 billion internet users watch online video content and download data worldwide. The increasing need for video content across many industries, including media, entertainment, advertising, and e-commerce, has resulted in substantial growth in the global industry in recent years.

AI video generators are utilized to automate video production with less human involvement. Moreover, advanced technologies make video generators more innovative and capable of creating high-quality videos. The media and entertainment sectors, where video content is produced quickly, are particularly affected by this trend. Another key factor influencing the growth of this market is the focus on offering consumers quick and precise solutions and technical skills that use AI video-generating tools to address more problems. Solutions for AI video generators provide businesses with exceptional market opportunities and aid in their quest for competitive advantage.

The services sector will experience the most significant growth over the projection period due to a greater focus on enhancing the services offered to consumers. The market for services serves as a conduit between customers and businesses. It boosts business for the corporation and offers better consumer services.The prominent advancement in employee training through AI video generators is augmenting segment growth. The generators alter the text data into video, and businesses are also developing AI video generator tools to address the rising consumer demand for high-quality, cost-effective services. Educational institutions utilize these tools to create engaging lessons.

These developments are accelerating the market growth for AI video generators. Developed nations like the U.S. and Canada have advanced infrastructures and copyright laws to safeguard the author’s original content. The next creative work utilizing generative AI, ML, and big data is not subject to any changes. These technological tools involve hazards, and the government may act in the form of rules to safeguard the content produced. Major players like Meta and Google release products connected to the Al video generation market. For instance, in October 2022, Google released its text-to-video generator. It can make 1280x768 films from a typed prompt at 24 frames per second.

Component Insights

The solutions segment dominated the industry and accounted for the largest share of 63.55% of the global revenue in 2022. The solution segment comprises software or platforms provided by the key vendors for AI video generation. For instance, Synthesia is an AI video generation platform that is used by multiple organizations, including Reuters, Accenture, BBC, and others, in their marketing & business strategies. The pricing and deployment of the software is the major cost associated with the component category, hence the high market share. The benefits associated with AI video generation tools that make it a better alternative for conventional video creation are:

Services associated with AI video generation include installation, maintenance, management, and upgrade services. The segment is projected to grow at a considerable rate during the forecast period. In addition, educational institutes as well as EduTech platforms are adopting AI generators to enhance content quality and student engagement. During the COVID-19 pandemic, video-based education experienced high demand. There are several AI video generator platforms used by educational institutes to automate video creation and editing with high quality. For instance, VEED enables the user to record the screen and webcam at the same time, allowing to create instructional or lecture videos.

Organization Size Insights

The large enterprises segment accounted for the maximum share of 62.72% of the overall revenue in 2022. Based on organization sizes, the industry is further segmented into large enterprises and Small & Medium Enterprises (SMEs). The SMEs segment is expected to register the fastest growth rate during the forecast period. Video presentations hold great importance in organizations as they are one of the proven methods of communicating information, especially for learning & education purposes. Participants can get the needed flexibility to access the video in their own time and re-watch the presentation to refresh their memory.

Therefore, the demand for efficient video creation tools has been on the rise over the past few years. With AI video generator software, the task of creating a video has become easier and cheaper compared to conventional methods. Several organizations are using AI video generators to create training modules as well as to digitize communication mediums. For instance, Synthesia’s AI video generator software has been adopted by over 40,000 training support & marketing teams by 2023.

Source Insights

The text-to-video segment accounted for a dominant revenue share of 39.24% in 2022. The source segment is further divided into text-to-video, PowerPoint-to-video, and spreadsheet-to-video. The PowerPoint-to-video segment is expected to grow rapidly over the forecast period. The text-to-video (including articles, scripts, blogs, and other forms) AI video generator software is an easy-to-use tool that is used to turn a writer’s content into videos.

For instance, Make-a-Video made progress in text-to-image generation technology that enables text-to-video generation. The system uses images with descriptions to understand and analyze how the video should be presented. Lumen5 is another platform that offers text-to-video software. Lumen5’s software has a user base of more than 800,000. Media & entertainment, especially the films & advertising industry, is one of the prime users of these tools followed by education and public sectors.

Application Insights

Based on applications, the industry is segmented into marketing, education, e-commerce, social media, and others. Followed by the education segment, the marketing segment dominated the industry in 2022 and accounted for the largest share of more than 27.71%of the overall revenue. The AI Video Generator can optimize the content quality used by marketing teams for organizations efficiently and cost-effectively. With conventional video-making, organizations faced multiple issues including the cost associated with actors, film equipment, studio, etc. along with a big budget, flexibility, time, and control over the process. With AI video generators, the process became smooth and in lower budgets without hampering the intended quality of the content.

It also allowed users to take control over the process, which provided needed confidence in sharing the video over their marketing channels. Education-relevant applications are also major adopters of AI video generators. The major challenges users faced in this segment include limited accessibility for rendering videos for the lessons and the parameters around producing customized content 24/7. This also led to many iterations of video production in a conventional way, resulting in a longer lead time for delivery. However, due to AI video generators, video production became easier and more cost-effective with many vendors offering access to a media library, which contains a wide range of stock images as well as relevant videos.

Regional Insights

Asia Pacific has a large customer base, which resulted in it accounting for the largest revenue share of around 31.67% in 2022. The Middle East & Africa region is estimated to grow at the highest CAGR during the forecast period as the region is at a very nascent stage of adopting this software and offers considerable growth opportunities for the key vendors to expand. Asia Pacific is the largest region in terms of population and has high internet penetration.

With a growing number of SMEs and a rising user base for social media in the region, the demand for quality video content is also growing. In addition, the number of AI startups, as well as the adoption of AI tools, is growing in the region considerably over the past few years. For instance, Singapore alone has more than 350 AI start-ups, while China’s AI penetration is projected to account for the equivalent of 25% of the country’s GDP by 2023.

AI Video Generator Market Segmentations:

By Component

By Organization Size

By Source

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI Video Generator Market

5.1. COVID-19 Landscape: AI Video Generator Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI Video Generator Market, By Component

8.1. AI Video Generator Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global AI Video Generator Market, By Organization Size

9.1. AI Video Generator Market, by Organization Size, 2023-2032

9.1.1. Large Enterprises

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. SMEs

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global AI Video Generator Market, By Source

10.1. AI Video Generator Market, by Source, 2023-2032

10.1.1. Text to Video

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. PowerPoint to Video

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Spreadsheet to Video

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global AI Video Generator Market, By Application

11.1. AI Video Generator Market, by Application, 2023-2032

11.1.1. Marketing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Education

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. E-commerce

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Social Media

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global AI Video Generator Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.3. Market Revenue and Forecast, by Source (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Source (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.3. Market Revenue and Forecast, by Source (2020-2032)

12.2.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Source (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Source (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Source (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.3. Market Revenue and Forecast, by Source (2020-2032)

12.3.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Source (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Source (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Source (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.3. Market Revenue and Forecast, by Source (2020-2032)

12.4.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Source (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Source (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Source (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Source (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Source (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Synthesia

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Lumen5

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Muse.ai

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Rephrase.ai

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Synths Video

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Raw Shorts

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Pictory

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. FlexClip

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Designs.Ai

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. InVideo

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others