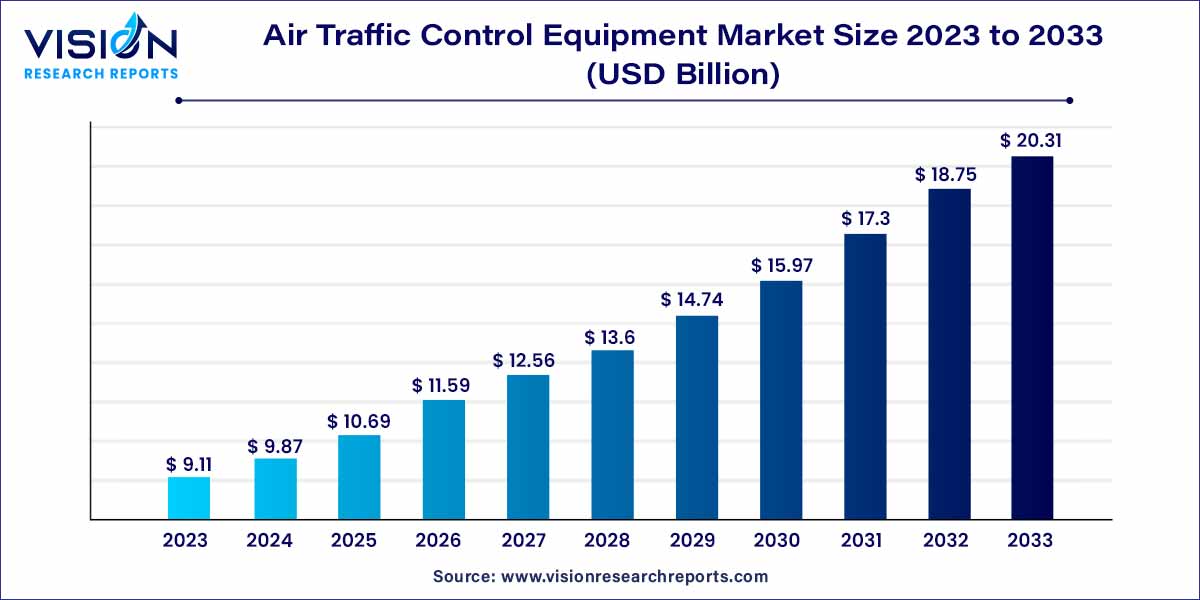

The global air traffic control equipment market size was estimated at around USD 9.11 billion in 2023 and it is projected to hit around USD 20.31 billion by 2033, growing at a CAGR of 8.35% from 2024 to 2033. The construction of new airports and renovations to existing ones to modernize and expand their capacity are the results of increased aircraft movement and passenger and freight traffic.

The air traffic control equipment market stands at the forefront of modern aviation infrastructure, playing a vital role in shaping the safety and efficiency of global air travel. This comprehensive overview aims to provide a detailed insight into the key facets of the market, ranging from its foundational principles to the latest technological advancements that drive its evolution.

The growth of the air traffic control equipment market is propelled by several key factors. Firstly, the increasing demand for air travel on a global scale has driven the need for advanced and efficient air traffic control systems to manage the growing volume of flights. Additionally, technological advancements, such as the integration of artificial intelligence and digital communication protocols, contribute to the market's expansion by enhancing the precision and responsiveness of air traffic management. Moreover, the imperative for heightened airspace security and the continuous efforts of industry stakeholders to comply with evolving regulatory standards further stimulate market growth. Strategic collaborations and investments in research and development by major players play a crucial role in fostering innovation and driving the adoption of state-of-the-art air traffic control equipment. The convergence of these factors creates a conducive environment for sustained growth within the air traffic control equipment market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 20.31 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.35% |

| Revenue Share of Asia Pacific in 2023 | 35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The communication equipment segment held the largest market share of 39% in 2023. The replacement rate of obsolete communications equipment has increased due to the improvement of digital data communication due to the ubiquitous use of air traffic control systems.

The surveillance equipment segment is estimated to register a significant CAGR of 8.53% over the forecast period. With the expansion of commercial aviation and the rise in global travel, the volume of air traffic is steadily increasing. Surveillance equipment helps air traffic controllers manage the growing number of aircraft more effectively and safely.

The commercial aircrafts segment dominated the market with a revenue share of 40% in 2023. As global economies develop and disposable incomes rise, more people opt for air travel. It has led to a higher demand for commercial flights, which puts pressure on air traffic control systems to manage increased air traffic efficiently.

The private aircrafts segment is expected to grow at the fastest CAGR of 8.45% over the forecast period. Private aircraft offer flexibility and convenience that commercial flights often can't match. Business executives, celebrities, and high-net-worth individuals value the ability to travel on schedule and to destinations that might not be easily accessible by commercial airlines.

Asia Pacific accounted for the largest market share of 35% in 2023. The Asia-Pacific region has been one of the fastest-growing economic regions in the world. This economic growth has increased business and leisure travel, increasing demand for air travel services. Expanding the middle class in countries across the region has increased disposable income and a greater ability to afford air travel. This has translated into higher passenger numbers for both domestic and international flights.

Europe and North America accounted for a considerable revenue share of the air traffic control equipment industry in 2023 due to the increased government efforts to secure air traffic and aircraft. For instance, in June 2023 Federal Aviation Administration (FAA) announced the “Stand Up for Safety” campaign, which would be held on a monthly basis to provide mandatory training for its controller workforce.

In April 2023, Boeing, a player in aerospace, took a significant step in advancing sustainable aviation technology by expanding its ecoDemonstrator program. The company has introduced a series of specially modified aircraft, called 'Explorer' airplanes, to further its flight testing initiatives. This move underscores Boeing's commitment to developing innovative solutions that address environmental challenges in the aviation industry.

In February 2023, Skye Air, a player in the aviation industry, achieved a significant milestone by introducing India's inaugural Traffic Management System designed specifically for drones. This innovation marks a remarkable advancement in unmanned aerial vehicles (UAVs) and aerial mobility. The system addresses a crucial need as the utilization of drones continues to expand across various sectors, including logistics, agriculture, surveillance, and more.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Air Traffic Control Equipment Market

5.1. COVID-19 Landscape: Air Traffic Control Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Air Traffic Control Equipment Market, By Product

8.1. Air Traffic Control Equipment Market, by Product, 2024-2033

8.1.1. Communications Equipment

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Navigation Equipment

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Surveillance Equipment

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Air Traffic Control Equipment Market, By Application

9.1. Air Traffic Control Equipment Market, by Application, 2024-2033

9.1.1. Commercial Aircraft

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Private Aircraft

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Military Aircraft

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Air Traffic Control Equipment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Cobham Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Advanced Navigation and Positioning Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BAE Systems

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Endeavor Business Media, LLC.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. L3Harris Technologies, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Intelcan Technosystems Inc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Lockheed Martin Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Indra

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Northrop Grumman

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Verdict Media Limited.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others