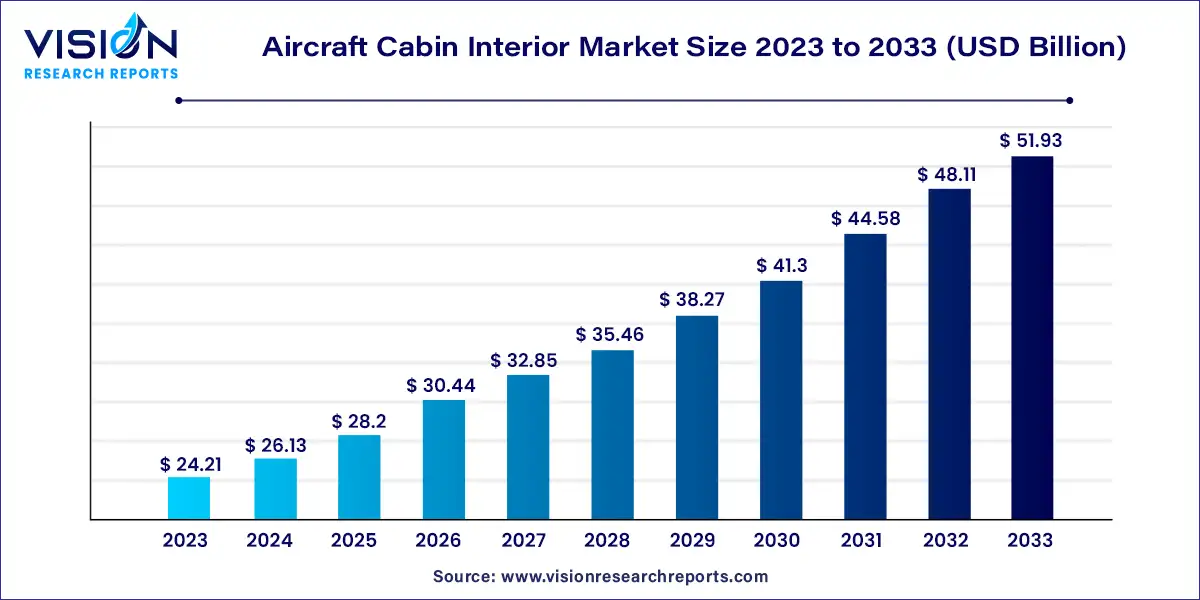

The global aircraft cabin interior market size was estimated at around USD 24.21 billion in 2023 and it is projected to hit around USD 51.93 billion by 2033, growing at a CAGR of 7.93% from 2024 to 2033.

The aircraft cabin interior market is a crucial sector within the aviation industry, serving as a reflection of both passenger preferences and industry innovation. It encapsulates a diverse array of components and features designed to enhance the in-flight experience for travelers worldwide.

The growth of the aircraft cabin interior market is driven by an increasing air travel demand, particularly in emerging markets, drives the need for upgraded cabin amenities and enhanced passenger experiences. Additionally, advancements in technology, such as wireless connectivity and interactive entertainment systems, contribute to the market's expansion by offering innovative solutions to meet evolving passenger expectations. Moreover, the focus on fuel efficiency and sustainability prompts the adoption of lightweight materials and eco-friendly cabin interior designs, further fueling market growth. Lastly, the rising trend of airline fleet modernization and retrofit projects provides lucrative opportunities for cabin interior suppliers and refurbishment specialists, driving sustained growth in the market.

| Report Coverage | Details |

| Revenue Share of Asia-Pacific in 2023 | 35% |

| CAGR of Middle East & Africa from 2024 to 2033 | 8.06% |

| Revenue Forecast by 2033 | USD 51.93 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The entertainment & connectivity segment accounted for the largest market share of around 23% in 2023 and is expected to lead the market over the forecast period. The shift in lifestyles has notably elevated the integration of entertainment and connectivity, and it is considered a fundamental necessity across various consumer behaviors. Furthermore, as the embrace of entertainment and connectivity continues to broaden to meet the growing demand for enhanced leisure experiences, the market is expected to grow over the forecast period.

The galley segment is expected to witness the highest CAGR of nearby 12.05% from 2024 to 2033. This is attributed to the growing necessity to cater to passengers' food and beverage needs. Additionally, the introduction of an array of in-flight food and beverage services is propelling the growth of the galley segment over the forecast period.

The alloy segment accounted for the largest revenue share of over 58% in 2023 and is likely to dominate the market over the forecast period. This is attributed to alloys' ability to meet the aviation industry's demand for lightweight yet robust materials, aligning with the industry's focus on fuel efficiency and sustainability. As airlines prioritize passenger comfort and safety, alloys find application in seats, panels, and frames, reflecting the market's pursuit of advanced and well-balanced cabin interior solutions.

The others segment is projected to grow at the highest CAGR of more than 11.04% from 2024 to 2033. The increased use of phenolic resins reinforced with glass or carbon are used for interior structures such as ceiling and sidewalls. Furthermore, the emphasis on reducing aircraft weight while maintaining structural integrity aligns with the overarching trend towards sustainable and performance-driven cabin interior solutions is propelling the market demand over the forecast period.

The aftermarket segment registered the largest share of over 59% in 2023. This segment encompasses flight interior upgrades and MRO services provided by third-party entities or OEM players. This trend is propelled by the global commercial airplane fleet, necessitating regular maintenance, repair, and overhaul activities. Moreover, the aftermarket services industry is strengthened by market players introducing unique and captivating cabin interior designs. For instance, Emirates' decision to upgrade the cabin interior of their complete fleet of approximately 120 A320 and B777 aircraft shows this the escalating demand for aftermarket services.

The OEM segment is expected to grow at the fastest CAGR of around 8.07% over the forecast period. The rise in demand for aircraft across the world is expected to drive the OEM market during the forecasted period. For instance, aircraft manufacturer and market leader Airbus has predicted a demand of approx. 39,000 new commercial passenger and freighter aircraft by 2040. The growth of economically emerging nations, rise in air traffic both domestically and internationally, and airlines focusing on customer satisfaction, all lead to increase to increased demand for aircraft. Therefore, the increase in growth rate of OEM segment is expected to drive the market demand.

The narrow body aircraft segment accounted for the largest market share of over 61% in 2023. The narrow-body aircraft category is foreseen to be one of the most sought-after aircraft types. The dominance of narrow-body aircraft is attributed to the surge in domestic air traffic worldwide. The combination of air travel's convenience and budget-friendly fares, arising from heightened competition among domestic airlines, is anticipated to fuel the escalating demand for narrow-body aircraft.

The wide body aircraft segment expected to witness significant growth over the forecast period from 2024 to 2033. The increase in international air travel traffic flow catalyzes the demand for wide body aircraft. The corporate sector's need for international travel, coupled with an expanding business workforce, has propelled market growth. Furthermore, the tourism industry's surge, driven by consumer preferences for international destinations, has further amplified the demand for international travel. Therefore, the boost in international air passengers due to corporate work, businesses, tourism among others has created demand for wide body aircrafts.

The Asia-Pacific region accounted for the largest market share of over 35% in 2023. Emerging economies like India and Southeast Asian countries hold substantial potential for expanding passenger aircraft presence, driven by the growing inclination towards flight travel. For instance, Boeing, an aircraft manufacturer, forecasts a rapid air traffic growth rate of 6.9% for India, followed by Southeast Asia with 5.5%.

The Middle East & Africa region is expected to grow at the highest CAGR of around 8.06% over the forecast period. The demand for commercial planes in the Middle East region is expected to drive market growth in the region. Recently, Boeing in their 2022 commercial outlook report has predicted that the region is expected to more than double their aircraft fleet by 2041. Furthermore, as per the 2022 Boeing CMO African region is expected to witness air passenger traffic growth by 5,4 % annually. Therefore, the demand for new airplanes in Africa is expected to boost the market growth.

By Material

By Type

By Aircraft Type

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aircraft Cabin Interior Market

5.1. COVID-19 Landscape: Aircraft Cabin Interior Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aircraft Cabin Interior Market, By Material

8.1. Aircraft Cabin Interior Market, by Material, 2024-2033

8.1.1. Alloys

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Composites

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Aircraft Cabin Interior Market, By Type

9.1. Aircraft Cabin Interior Market, by Type, 2024-2033

9.1.1. Aircraft Seating

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Entertainment & Connectivity

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cabin Lighting

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Galley

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Lavatory

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Windows & Windshields

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Stowage Bins

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Interior Panels

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Aircraft Cabin Interior Market, By Aircraft Type

10.1. Aircraft Cabin Interior Market, by Aircraft Type, 2024-2033

10.1.1. Narrow Body Aircraft

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Wide Body Aircraft

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Business Jets

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Regional Transport Aircraft

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Aircraft Cabin Interior Market, By End-user

11.1. Aircraft Cabin Interior Market, by End-user, 2024-2033

11.1.1. Original Equipment Manufacturer (OEM)

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. After Market

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Aircraft Cabin Interior Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. Astronics Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cobham PLC

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Collins Aerospace

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Gogo, Inc

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Honeywell International Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Hong Kong Aircraft Engineering Company Limited

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. JCB Aero

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Panasonic Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Thales Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. The Boeing Company

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others