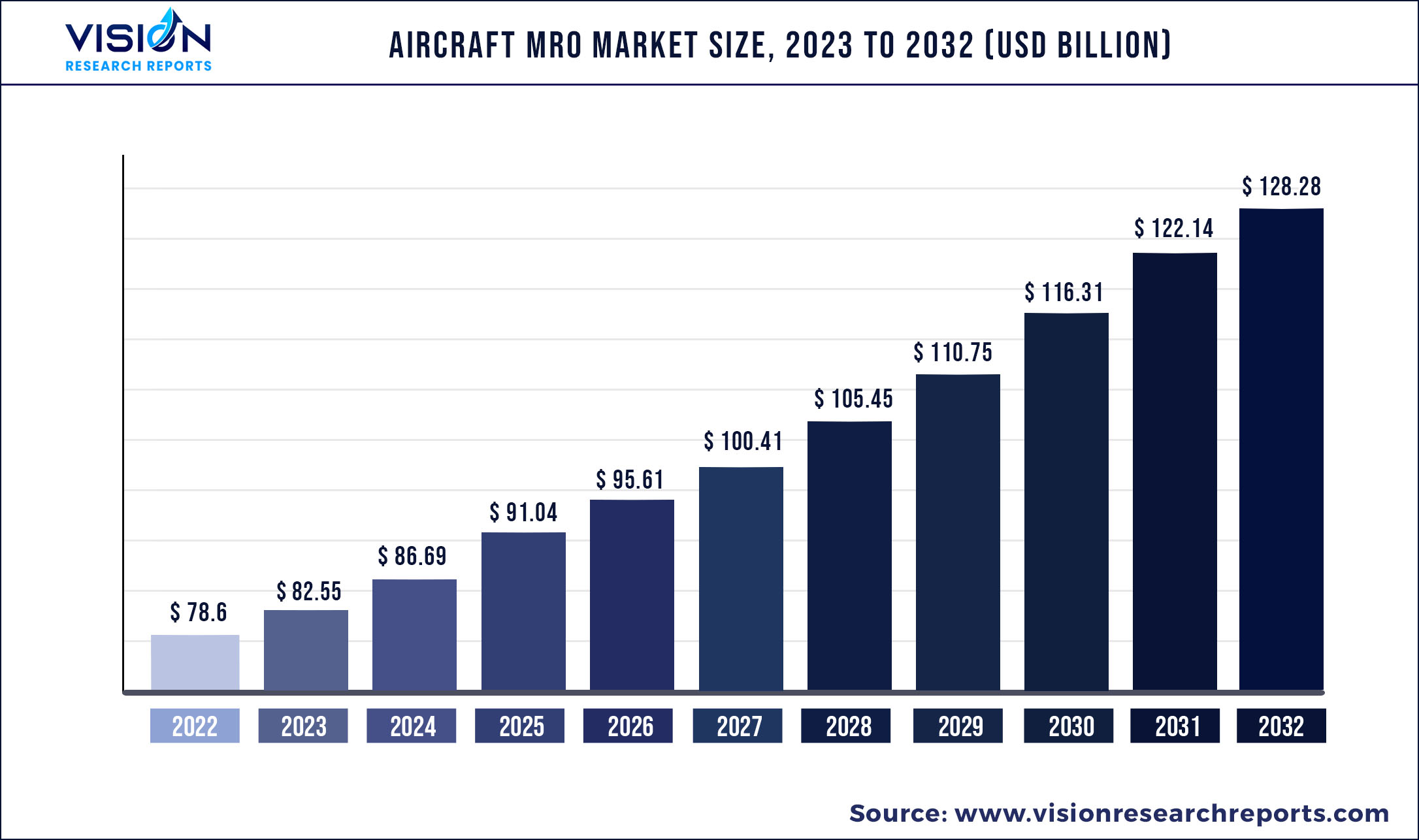

The global aircraft MRO market was valued at USD 78.6 billion in 2022 and it is predicted to surpass around USD 128.28 billion by 2032 with a CAGR of 5.02% from 2023 to 2032.

Key Pointers

Report Scope of the Aircraft MRO Market

| Report Coverage | Details |

| Market Size in 2022 | USD 78.6 billion |

| Revenue Forecast by 2032 | USD 128.28 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.02% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM U.K. Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal) |

Rapid urbanization and the rising economic growth in emerging countries with increased business and tourism travels are expected to increase the market growth. Various external factors, such as air traffic volumes, global fleet size, and aircraft utilization, are the factors expected to significantly impact the market. Also, the increased air travel by individuals for business and personal purposes is expected to create more aircraft production, thereby substantially impacting the market.

The rise in investments in aircraft (maintenance, repair and overhaul) MRO software are also expected to create new business prospects. Aircraft MRO software consists of maintenance tracking, logbook tracking, flight time tracking, service bulletins management, maintenance scheduling, budget forecasting, electronic task card management, and work order management. For instance, in May 2021, India observed significant foreign direct investments in different sectors, including aircraft maintenance, repair, and overhaul industries. Therefore, investments and acquisitions are the factors expected to create lucrative opportunities for the market.

The market is also influenced by the regulatory compliance with organizations like the Federal Aviation Administration (FAA) and International Civil Aviation Organization (ICAO). Furthermore, the rise in demand for older planes and environmental concerns emphasize the continuous monitoring and maintenance of the older planes, thereby creating traction for the market. Furthermore, the global outburst of the COVID-19 and shutting down of travel and tourism due to strict lookdowns imposed by the governments to curb the spread hampered the revenue and profit margins of the airline industry.

The shutting down of the functioning of airlines resulted in more airlines turning to MRO to maintain fleet efficiency. Moreover, numerous government programs have been developed to encourage airports to embrace MRO as a strategic activity. Governments are currently pursuing a variety of holistic measures to ensure that enough space is available for the MRO at various airports around the country, which could boost aircraft MRO activities during the forecasted period.

The MRO industry has faced challenges such as shortage in workforce supply, rise in labor force costs, lack of an experienced workforce, and reduced interest in technical maintenance jobs from the recent graduate engineers. This is expected to affect the aircraft maintenance, repair, and overhaul (MRO) industry in the forecast period. For MRO operators, right-sourcing and outsourcing are the two options that are more relevant to MRO service providers.

Ever-increasing material prices are becoming a critical factor that affect the expansion. Due to this, MRO service providers are targeting to create strategic alliances with OEMs to get help in procuring aircraft parts and components. For instance, in November 2021, Singapore-headquartered SIA Engineering Company (SIAEC) announced that it has set up 23 joint ventures and subsidiaries across seven countries with OEMs, including Pratt & Whitney, Collins, Jamco, Rolls-Royce, GE, Safran, aiming to develop a range of MRO capabilities.

Aircraft MRO Market Segmentations:

| By Service Type | By Organization Type | By Aircraft Type | By Aircraft Generation |

|

Engine Overhaul Airframe Maintenance Line Maintenance Modification Components |

Airline/Operator MRO Independent MRO Original Equipment Manufacturer (OEM) MRO |

Narrow-body Wide-body Regional Jet Others |

Old Generation Mid Generation New Generation |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aircraft MRO Market

5.1. COVID-19 Landscape: Aircraft MRO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aircraft MRO Market, By Service Type

8.1. Aircraft MRO Market, by Service Type, 2023-2032

8.1.1. Engine Overhaul

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Airframe Maintenance

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Line Maintenance

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Modification

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Components

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Aircraft MRO Market, By Organization Type

9.1. Aircraft MRO Market, by Organization Type, 2023-2032

9.1.1. Airline/Operator MRO

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Independent MRO

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Original Equipment Manufacturer (OEM) MRO

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Aircraft MRO Market, By Aircraft Type

10.1. Aircraft MRO Market, by Aircraft Type, 2023-2032

10.1.1. Narrow-body

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Wide-body

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Regional Jet

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Aircraft MRO Market, By Aircraft Generation

11.1. Aircraft MRO Market, by Aircraft Generation, 2023-2032

11.1.1. Old Generation

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Mid Generation

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. New Generation

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Aircraft MRO Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.2.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.3.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.4.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Organization Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Aircraft Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Aircraft Generation (2020-2032)

Chapter 13. Company Profiles

13.1. AAR Corp.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Airbus SE

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Delta Airlines, Inc. (Delta TechOps)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Hong Kong Aircraft Engineering Company Limited

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. KLM U.K. Engineering Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lufthansa Technik

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. MTU Aero Engines AG

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Raytheon Technologies Corporation (Previously United Technologies Corporation)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Singapore Technologies Engineering Ltd

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. TAP Maintenance & Engineering (TAP Air Portugal)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others