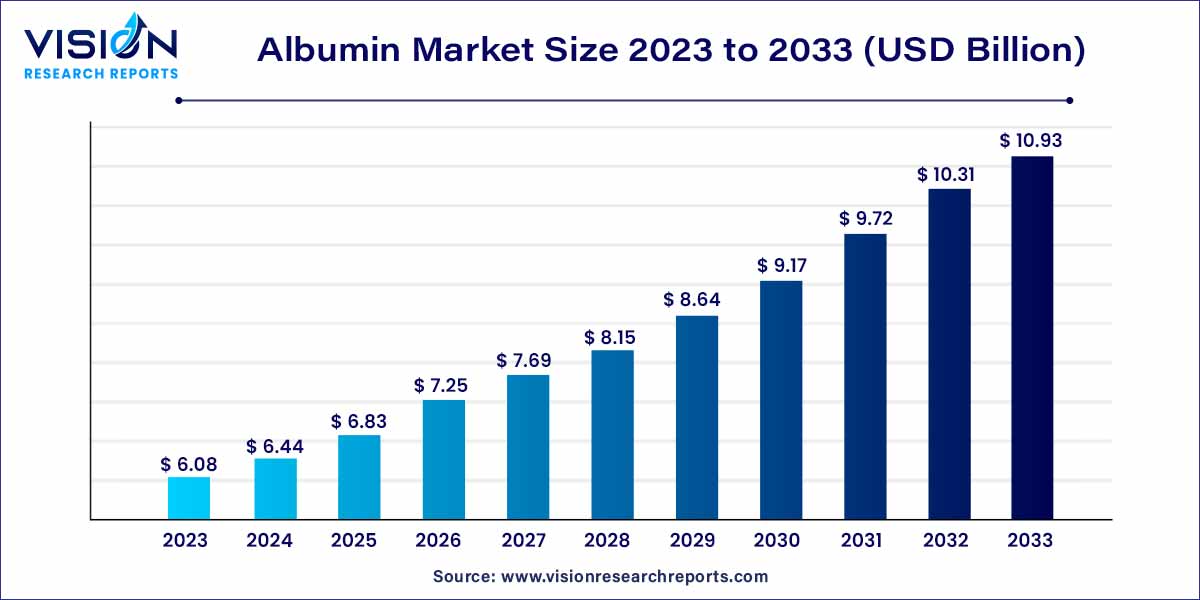

The global albumin market size was estimated at around USD 6.08 billion in 2023 and it is projected to hit around USD 10.93 billion by 2033, growing at a CAGR of 6.05% from 2024 to 2033.

The albumin market, a pivotal component in the pharmaceuticals and biotechnology, presents a landscape marked by innovation, demand dynamics, and therapeutic advancements. Albumin, a protein abundantly found in blood plasma, has transcended its conventional roles to become a linchpin in various medical applications.

The albumin market is experiencing robust growth driven by a confluence of factors propelling its widespread adoption across diverse sectors. A primary catalyst is the escalating prevalence of chronic diseases, necessitating advanced therapeutic interventions. Additionally, the expanding applications of albumin in drug delivery systems and diagnostics contribute significantly to market growth. The protein's innate ability to maintain colloidal osmotic pressure, coupled with its role as a versatile carrier for various substances, positions it as a pivotal player in the evolving landscape of medical treatments. Furthermore, the advent of recombinant albumin, a product of continuous advancements in biotechnology, has not only addressed supply chain challenges but has also ushered in a new era of scalable and sustainable alternatives. As key industry players actively engage in research and development, seeking to unlock the full potential of albumin, the market is poised for sustained expansion, promising transformative advancements in healthcare and offering a spectrum of opportunities for stakeholders.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.08 billion |

| Revenue Forecast by 2033 | USD 10.93 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Albumin Market Drivers

Increasing Prevalence of Chronic Diseases:

Expanding Applications in Drug Delivery:

Albumin Market Restraints

Risk of Contamination and Allergenicity:

Alternative Therapies and Substitutes:

Albumin Market Opportunities

Expansion of Therapeutic Applications:

Increasing Demand in Emerging Economies:

Based on the product, the market is divided into human, bovine and recombinant albumin. T Human serum segment held the largest market share in 2023. The increasing frequency of surgical interventions that rely on human serum albumin for fluid regulation drive the demand for human albumin. Progress in biotechnological techniques has simplified the production and purification of human serum albumin, making it more readily available and cost-efficient. Consequently, its use has expanded across various medical and non-medical domains, including drug development and vaccine preservation. Furthermore, the industry relies on regulatory backing from agencies such as the European Medicines Agency (EMA) in Europe and the Food & Drug Administration (FDA) in the U.S. to guarantee product quality and safety, thereby enhancing consumer confidence.

The market is segmented by application into drug formulation, therapeutics, and others, with therapeutics emerging as the largest segment in 2023. Its versatility in healthcare stems from unique properties that make it a valuable tool. Among its primary therapeutic applications is its role as a volume expander. In this capacity, it is employed to restore and maintain blood volume, particularly in situations involving the risk of hypovolemia (low blood volume). The colloid osmotic pressure generated by albumin proves instrumental in retaining water within the blood vessels, preventing its leakage into surrounding tissues and averting the onset of edema. This fluid management function contributes to enhancements in cardiac output, blood pressure, and tissue perfusion.

The market is segmented based on end use into hospitals & clinics, pharmaceutical companies, and research institutions. Among these, hospitals & clinics emerge as the largest end-users of albumin, primarily due to its versatile applications in patient care and medical treatments. In the healthcare, hospitals commonly employ albumin in intravenous (IV) fluid therapy, especially for critically ill patients. For instance, individuals admitted with severe sepsis may undergo albumin administration to restore blood volume and enhance blood pressure.

Moreover, hospitals and cancer clinics leverage albumin-based formulations in the field of oncology care. Notably, chemotherapy drugs like Abraxane are administered to cancer patients to optimize drug delivery, enhance efficacy, and mitigate side effects. The utilization of albumin extends to various other applications such as the management of liver diseases, trauma care, and support in surgical procedures. This broad spectrum of applications underscores the pivotal role of albumin in diverse medical settings.

North America dominated the market with the largest market share in 2023. This commanding position can be attributed to several key factors that collectively shape the region's robust healthcare landscape. With a well-established healthcare infrastructure, a substantial patient population, and a high level of research and development activities, North America stands out as a focal point for albumin utilization. The region boasts some of the world's leading medical institutions, hospitals, and research centers, creating an environment conducive to the diverse applications of albumin in various medical contexts.

Additionally, North America is undergoing a demographic shift, marked by an increasingly aging population. The elderly demographic is particularly prone to health issues necessitating the use of albumin, including surgical procedures, trauma care, and chronic disease management. This demographic shift contributes to a sustained and growing demand for albumin in the region, further solidifying North America's prominent position in the market.

By Product

By Application

By End-User

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Albumin Market

5.1. COVID-19 Landscape: Albumin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Albumin Market, By Product

8.1. Albumin Market, by Product, 2024-2033

8.1.1 Human Serum Albumin

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Bovine Serum Albumin

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Recombinant Albumin

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Albumin Market, By Application

9.1. Albumin Market, by Application, 2024-2033

9.1.1. Therapeutics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Drug Formulation & Vaccines

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Component of Media

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Other

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Albumin Market, By End-User

10.1. Albumin Market, by End-User, 2024-2033

10.1.1. Hospitals & Clinics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmaceutical Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Research Institutions

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Albumin Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-User (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-User (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-User (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-User (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-User (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-User (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-User (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-User (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-User (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-User (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-User (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-User (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-User (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-User (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-User (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-User (2021-2033)

Chapter 12. Company Profiles

12.1. Baxter International Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. China Biologic Products, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CSL Limited.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Grifols, S.A.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Merck KGaA.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Novozymes

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Octapharma AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Takeda Pharmaceuticals Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Thermo Fisher Scientific.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ventria Bioscience

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others