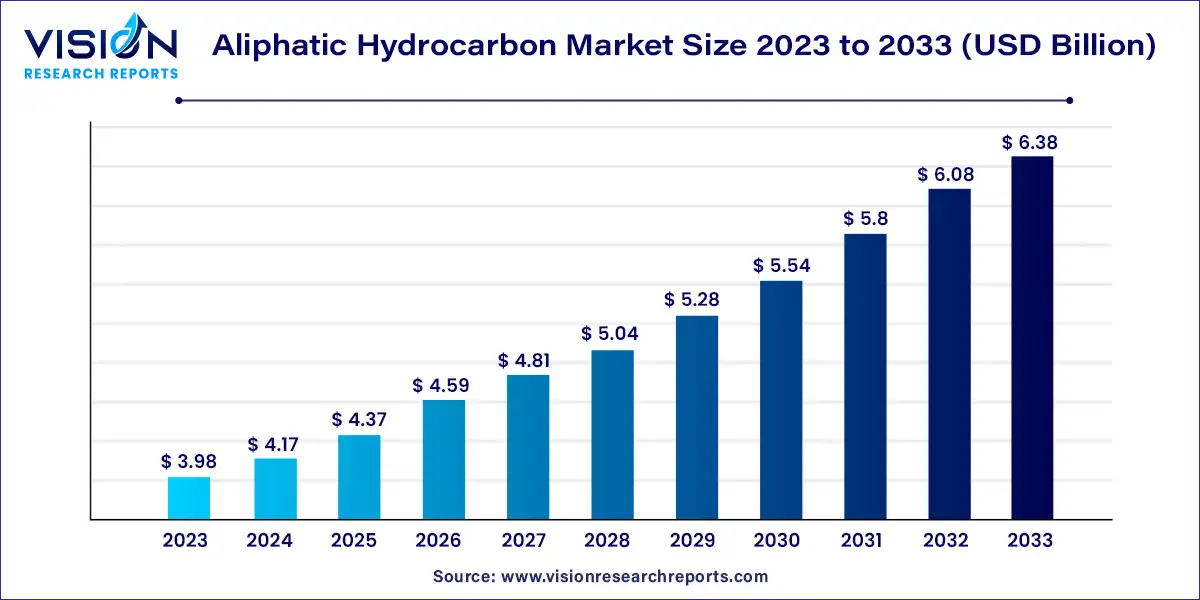

The global aliphatic hydrocarbon market size was estimated at around USD 3.98 billion in 2023 and it is projected to hit around USD 6.38 billion by 2033, growing at a CAGR of 4.83% from 2024 to 2033. The aliphatic hydrocarbon market encompasses a wide range of chemicals primarily used in industrial and commercial applications. Aliphatic hydrocarbons are organic compounds consisting entirely of hydrogen and carbon atoms arranged in straight chains, branched chains, or non-aromatic rings.

The aliphatic hydrocarbon market is experiencing substantial growth driven by an increasing demand in the paints and coatings industry, driven by the construction and automotive sectors, significantly boosts market expansion. Secondly, the pharmaceutical industry’s reliance on aliphatic hydrocarbons as intermediates for drug synthesis propels market growth, supported by rising healthcare investments and R&D activities. Additionally, the widespread use of these hydrocarbons in cleaning agents enhances market demand, particularly in industrial and domestic cleaning applications.

The aliphatic hydrocarbon market faces several significant challenges that could impact its growth trajectory. One of the foremost challenges is the stringent environmental regulations imposed by governments worldwide, aimed at reducing air pollution and controlling volatile organic compound (VOC) emissions. These regulations necessitate costly compliance measures and can limit the use of certain hydrocarbons. Additionally, the market is grappling with increasing health concerns associated with prolonged exposure to aliphatic hydrocarbons, which can lead to respiratory issues and skin irritation. This has led to a demand for safer alternatives and stricter workplace safety standards.

Moreover, the fluctuating prices of crude oil, a primary raw material for aliphatic hydrocarbons, create uncertainty in supply chains and affect production costs. Lastly, the growing competition from bio-based and synthetic alternatives, which are often perceived as more environmentally friendly, presents a significant market challenge, compelling traditional hydrocarbon producers to innovate and adapt to changing consumer preferences.

The North American aliphatic hydrocarbon market is expanding significantly due to strong market fundamentals for commercial real estate and a robust economy, coupled with increasing state and federal funding for institutional buildings and public works. In March 2023, the U.S. government announced a $2 trillion investment plan in response to the coronavirus pandemic, aimed at enhancing infrastructure such as hospitals, roads, and other critical facilities. This investment is expected to boost the demand for paints and coatings, subsequently increasing the demand for aliphatic hydrocarbons in the region.

| Attribute | North America |

| Market Value | USD 1.23 Billion |

| Growth Rate | 4.82% CAGR |

| Projected Value | USD 1.97 Billion |

In 2023, the Asia Pacific region dominated the market segment with a 37% revenue share. The paints and coatings market in Asia Pacific is projected to experience considerable growth due to rising construction activities and growing demand from the automotive sector in emerging countries like India, Japan, and South Korea. The aliphatic hydrocarbon market in China is experiencing significant growth, primarily driven by expanding industrial sectors such as automotive, construction, and manufacturing. The demand in China is fueled by applications in lubricants, solvents, and various chemical processes.

The Asia Pacific aliphatic hydrocarbon market size was estimated at USD 1.43 billion in 2023 and it is expected to surpass around USD 2.29 billion by 2033, poised to grow at a CAGR of 4.82% from 2024 to 2033.

The expanding construction sector in countries such as the UK, Netherlands, Germany, France, Italy, and Spain is expected to drive product demand over the forecast period. Increased funding from the EU, along with supportive measures like subsidies, tax incentives, and other governmental initiatives, is expected to boost construction sector growth across the region. This surge in construction activities is anticipated to increase the demand for paints and coatings, leading to higher consumption of aliphatic hydrocarbons.

In 2023, the saturated hydrocarbon segment led the market, capturing a 60% revenue share due to their extensive use in products like waxes, lubricants, and paints & coatings. Saturated hydrocarbons, also known as alkanes, are organic compounds made up solely of carbon and hydrogen atoms with single bonds between them. These compounds, often referred to as paraffins, are the main components of liquefied petroleum gas and natural gas. They play a crucial role in many industrial lubricants and greases, helping to reduce friction and wear between moving parts.

In 2023, paints and coatings applications dominated the market with a 27% revenue share, driven by the increasing demand from the construction and automotive industries. Aliphatic hydrocarbons are widely used as solvents and thinners in paints and coatings to adjust viscosity, making the paints easier to apply and ensuring a smooth finish. Commonly used aliphatic hydrocarbons in this sector include hexane, heptane, mineral spirits, and naphtha.

Furthermore, aliphatic hydrocarbons are essential in adhesives and sealants, providing tackiness, adhesion, and durability for secure bonding of various materials. Aliphatic hydrocarbon resins, in particular, enhance the tackiness of adhesives, which is crucial for pressure-sensitive adhesives like those on labels and tapes. These resins also offer resistance to UV light, moisture, and extreme temperatures, ensuring the longevity and effectiveness of adhesives.

In the polymer and rubber industries, aliphatic hydrocarbons like ethylene and propylene serve as vital building blocks for creating various polymers. Polyethylene, the most commonly used plastic globally, is utilized in packaging films, bottles, pipes, and textiles. Another versatile plastic, polypropylene, is used in food containers, carpet and clothing fibers, and automotive parts.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aliphatic Hydrocarbon Market

5.1. COVID-19 Landscape: Aliphatic Hydrocarbon Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aliphatic Hydrocarbon Market, By Product

8.1. Aliphatic Hydrocarbon Market, by Product, 2024-2033

8.1.1. Saturated

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Unsaturated

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Aliphatic Hydrocarbon Market, By Application

9.1. Aliphatic Hydrocarbon Market, by Application, 2024-2033

9.1.1. Paints & Coatings

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Adhesives & Sealant

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Polymer & Rubber

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Surfactant

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Dyes

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Aliphatic Hydrocarbon Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. ExxonMobil Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BASF SE

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Shell Global

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BP Plc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. LyondellBasell Industries N.V.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Total S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Reliance Industries Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Chevron Phillips Chemical

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Mitsubishi Chemical Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sasol

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others