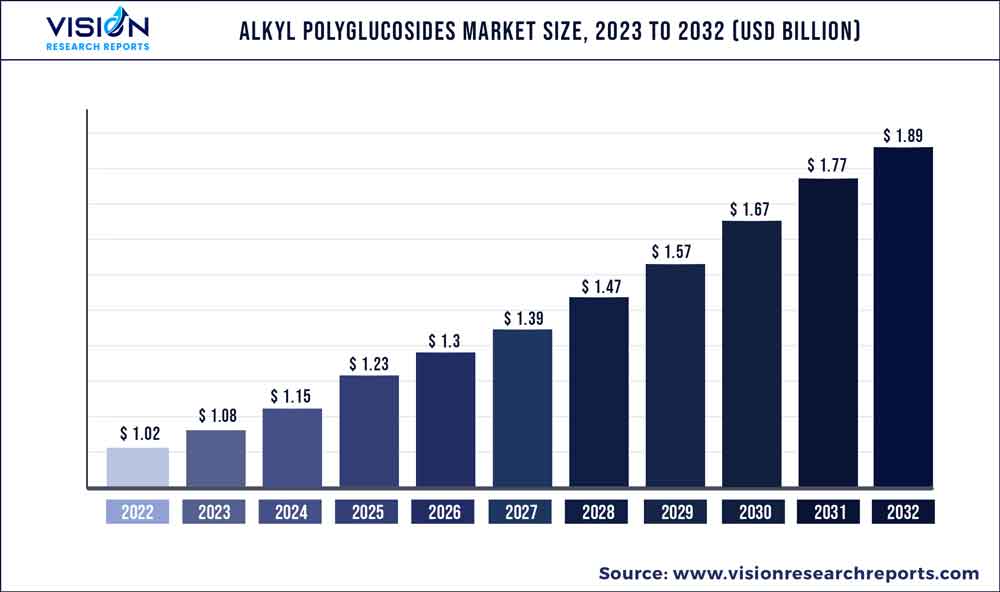

The global alkyl polyglucosides market was valued at USD 1.02 billion in 2022 and it is predicted to surpass around USD 1.89 billion by 2032 with a CAGR of 6.34% from 2023 to 2032. The alkyl polyglucosides market in the United States was accounted for USD 213.6 million in 2022.

Key Pointers

Report Scope of the Alkyl Polyglucosides Market

| Report Coverage | Details |

| Revenue Share of Asia-Pacific in 2022 | 30.85% |

| Revenue Forecast by 2032 | USD 1.89 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.34% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Actylis; Airedale Chemical Company Limited; APL; Clariant; Croda International Plc; Kao Corporation; Dow; Shanghai Fine Chemical Co., Ltd.; BASF SE; SEPPIC |

The cleaning, wetting, and emulsification properties of alkyl polyglucosides are driving their adoption across key end-use industries such as home care, pharmaceutical, and refining.

The application of APG in homecare products has been on the rise in recent years due to increasing consumer awareness of the environmental and health impacts of traditional cleaning products. Consumers are seeking products that are safer for their families and the environment, and APGs are meeting that demand.

One example of the growing adoption of APG in homecare products is laundry detergents. They are used as a primary surfactant in many eco-friendly laundry detergents due to their excellent cleaning performance and low toxicity. For instance, ECOS Laundry Detergent by Earth Friendly Products is a popular laundry detergent that uses APGs as its primary surfactant.

As consumers become more conscious of the environmental and health impacts of traditional cleaning products, alkyl polyglucosides are becoming a popular choice for homecare manufacturers. APGs offer an effective and sustainable solution for cleaning products, and their popularity is only expected to increase in the coming years. For instance, Croda International PLC announced in 2021 that it will be expanding its production capacity for APGs in Europe. The company is investing in a new production facility in France, which will increase its production capacity and support its growth strategy in the European market.

End-use Insights

Home care products dominated the market with a revenue share of more than 38.35% in 2022. The growth is attributed to increasing adoption of products in laundry detergents, dishwashing liquids, and surface cleaners due to their excellent cleaning performance, low toxicity, and biodegradability. The growing use of APGs in homecare products is seen in laundry detergents. For instance, ECOS laundry detergent by Earth Friendly Products is a popular laundry detergent that uses APGs as its primary surfactant.

In addition, APGs are used as primary or co-surfactants in many eco-friendly surface cleaners due to their excellent cleaning performance and low toxicity. For instance, Method All-Purpose Cleaner uses APGs as primary surfactants, along with other natural ingredients, to clean surfaces effectively and safely. Also, it is used in dishwashing liquids. APGs are used as a co-surfactant in many eco-friendly dishwashing liquids due to their ability to boost foam and reduce surface tension. For instance, Ecover Dishwashing Liquid uses APGs in combination with other surfactants to provide effective cleaning power while being gentle on hands and the environment.

Additionally, it is used in a range of agricultural applications, including foliar sprays, seed treatments, and soil treatments. In foliar sprays, APG improves the coverage and efficacy of herbicides and insecticides, while reducing the amount of chemicals required. In seed treatments, it enhances the absorption of nutrients and protects the seeds from fungal and bacterial infections. In soil treatments, APG improves the wetting and dispersal of chemicals, ensuring that they reach the target area and are not washed away by rain or irrigation.

Overall, the use of APG in agricultural chemicals is an effective and sustainable way to improve the performance of chemicals, while reducing their environmental impact and ensuring the safety of workers and consumers.

Regional Insights

Asia Pacific region dominated the market with a highest revenue share of 30.85% in 2022. The growth is attributed to a surge in the demand for alkyl polyglucoside from textile, food & beverages, and oil & gas industries. According to Fashionating World Magazine, Asia Pacific dominated the global textile market with a market value of USD 234.2 billion in 2021. This dominance can be attributed to increasing production of textile products from countries like India, China, Bangladesh, and Pakistan.

These countries are some of the largest exporters of textiles in the world. According to Fiber2Fashion, 72.56% of the imported apparels in the U.K. came from Asia Pacific countries in 2022, registering an increase of nearly 50% compared to 2021. Therefore, the increasing production of textiles in the region coupled with the high consumption of textile and textile-related products in both international and domestic markets is set to have a positive impact on product demand.

In 2022, North America accounted for a considerable revenue share. On account of increasing product demand from the personal care & cosmetics industry. In addition, increasing utilization of alkyl polyglucoside in soaps and detergents and other cleaning products is expected to drive the market, particularly in the U.S. According to ATAMIN KIMYA, alkyl polyglucoside is largely used in soaps due to their superior lather and mildness. Procter & Gamble, Colgate-Palmolive, and Church & Dwight are some of the leading soap manufacturing companies in the U.S.

In addition, the market in North America is driven by the growth in the cosmetics market. According to Forbes, the U.S. accounted for approximately 20% share of the total cosmetics market in 2021. Furthermore, the skincare segment accounted for more than 23% of the total U.S. beauty and cosmetics market, according to Toptal, LLC. The increasing adoption of APG in various skincare products such as sunscreen, moisturizers, and anti-ageing creams & lotions, coupled with overall growth in the U.S. beauty and cosmetic market is anticipated to have a positive impact on the market in North America.

Alkyl Polyglucosides Market Segmentations:

By End-use

By Regional

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Alkyl Polyglucosides Market

5.1. COVID-19 Landscape: Alkyl Polyglucosides Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Alkyl Polyglucosides Market, By End-use

8.1.Alkyl Polyglucosides Market, by End-use Type, 2023-2032

8.1.1. Personal Care & Cosmetics

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Home Care Products

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Industrial Cleaners

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Agricultural Chemicals

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.4. Other Applications

8.1.4.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Alkyl Polyglucosides Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by End-use (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 10.Company Profiles

10.1. Actylis

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Airedale Chemical Company Limited

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. APL

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Clariant

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Croda International Plc

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Kao Corporation

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Dow

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Shanghai Fine Chemical Co., Ltd.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. BASF SE

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. SEPPIC

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others