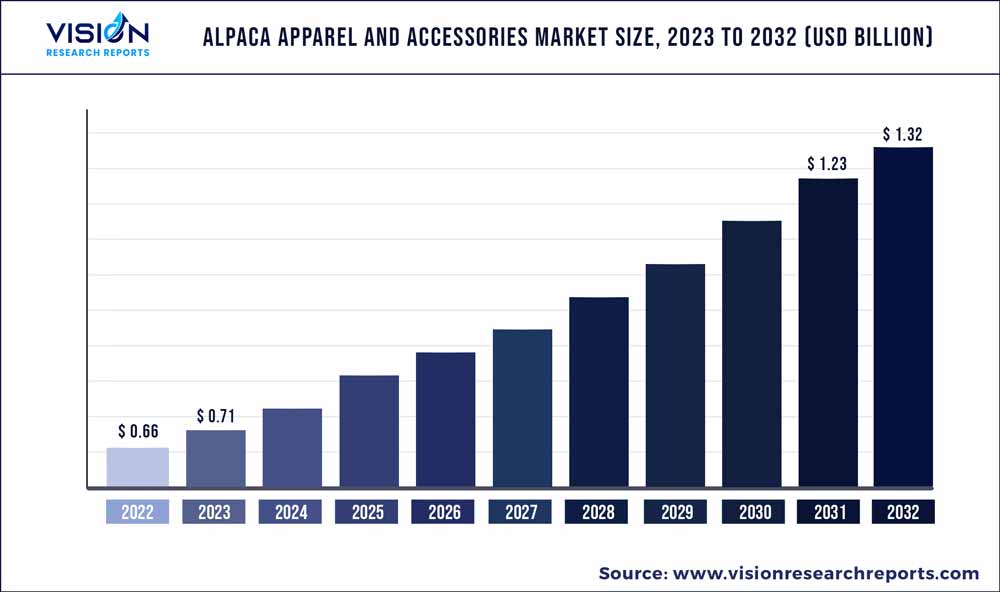

The global alpaca apparel and accessories market was valued at USD 0.66 billion in 2022 and it is predicted to surpass around USD 1.32 billion by 2032 with a CAGR of 7.15% from 2023 to 2032. The alpaca apparel and accessories market in the United States was accounted for USD 203.1 million in 2022.

Key Pointers

Report Scope of the Alpaca Apparel And Accessories Market

| Report Coverage | Details |

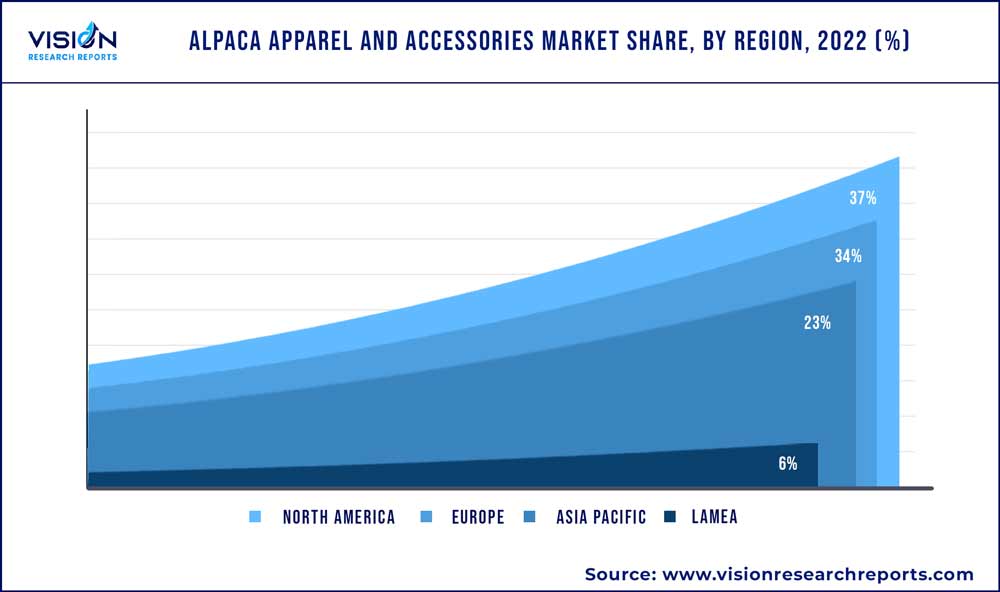

| Revenue Share of North America in 2022 | 37% |

| Revenue Forecast by 2032 | USD 1.32 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Natural Fibre Company; Alpaca Direct, LLC; Plymouth Yarn Company, Inc.; Mary Maxim Inc; Alpaca Owners Association, Inc; Lion Brand Yarn; Berroco, Inc.; Cascade Yarns; Malabrigo Yarn; Fil Katia |

The increasing demand for natural fashion accessories and clothing is driving the growth of the market in the coming years. Also, nowadays consumers are environmentally conscious and are seeking out products that are sustainable, ethical, and eco-friendly, which will likely drive the growth of the alpaca clothing market. Moreover, alpaca wool is considered to be soft, durable, and warm and provides efficient insulation to withstand cold climatic conditions. Alpaca wool is gaining huge traction among the cold climatic countries globally and the end products including sweaters, scarves, shawls, and jackets have undergone widespread sales in the cold climatic regions over the recent years.

Furthermore, worldwide fashion and textile conferences hosted by important market participants in the alpaca space influenced the audience's preference for alpaca garments and accessories. This aspect will play a key role in driving the demand for alpaca apparel and accessories. For example, the International Alpaca Association (IAA) and Peruvian Government Agency (PROMPER) hosted Alpaca Fiesta 2021, which was a major feature of the 2021 textile conferences and event calendar. The event featured alpaca testimonials and movies, breeders, fashion presentations, debates, and seminars on a variety of themes linked to the sustainability and circularity of the alpaca value chain.

Companies are investing in research and development to improve the nutrition of alpacas, which is essential for enhancing the quality of their fiber. In addition, scientists are using various genetic tools to improve alpaca production and develop better fiber quality. These efforts are expected to drive the growth of the alpaca industry in the coming years. In November 2022, Wild Saint London introduced its latest scarf collection which is available in seven decadent colors including moss green, hot pink, sunflower yellow, and navy as well as undyed options. The latest scarf collection is made from 100% alpaca fibres from the baby alpaca.

Product Insights

Alpaca apparels dominated the market with a share of 75% in 2022 and is projected to maintain a dominant position throughout the forecast period. The demand for alpaca apparel is anticipated to be driven by high consumer spending power in North America and Europe as well as the region's favorable weather conditions that facilitates the consumption of sweaters and scarves made from alpaca wool. The sweaters, shawls, and scarves are not only soft, warm, and durable but are elegant and stylish, making them a perfect choice for the high-income demographic.

The insulating property of the alpaca wool will make it ideal for cold climates, which has allowed manufacturers to develop winter clothing products all around the globe. For instance in April 2022, Paka, a sustainable alpaca fibre apparel manufacturer, has developed the traceable alpaca sweater for the first time as part of its Origin program, which aims to demonstrate that regenerative and small scale farming practices are a viable road to a more connected and sustainable future.

End-user Insights

The women segment dominated the end-user category with a share of 74% in 2022. Women are indeed the primary consumers of clothing and accessories, and as such, they are a key demographic for manufacturers and designers of alpaca clothing. Many women are willing to spend more on high-quality, sustainable, and fashionable clothing, and alpaca fiber products are increasingly meeting these needs among the female population. The soft and luxurious feel of alpaca fiber makes it a desirable material for women's clothing, and the eco-friendly properties of the fiber further enhance its appeal. As a result, women continue to be a significant and growing segment of the alpaca fiber market.

Men category is expected to grow at a significant rate of 6.4% over the forecasted period as the clothing and accessories designed for men including men’s jackets, men’s sweaters, hoodies, and other clothing products are a popular choice among the men population who prioritize spending on high-end fashionable apparel and accessories.

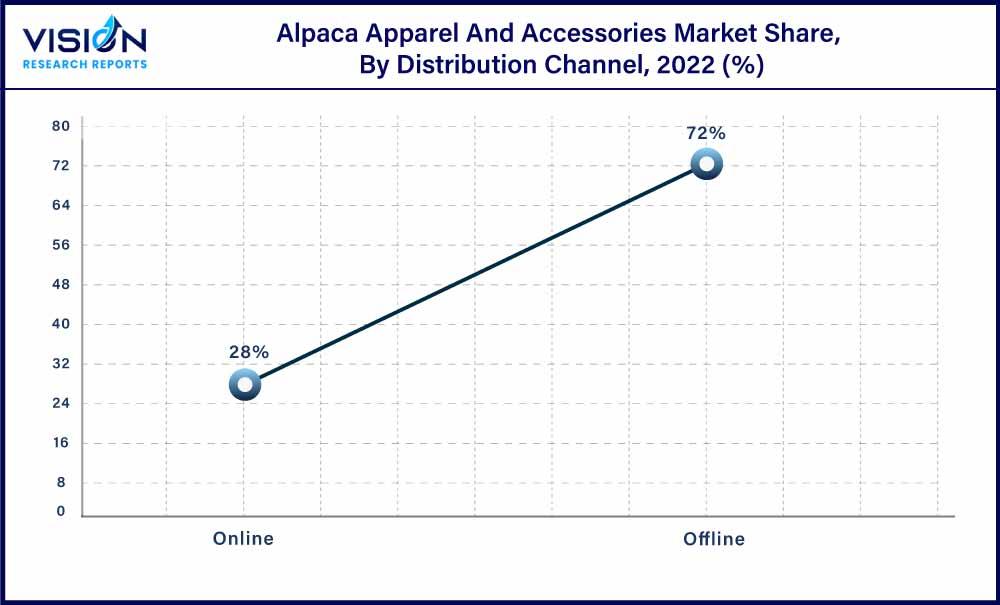

Distribution Channel Insights

The offline channel segment exhibited the leading growth of 72% in 2022. One of the key benefits of shopping at these stores is the professional guidance that is provided to customers. This can include advice on fit, style, and trends, as well as information on the ethical and environmental aspects of the products. Consumers may also appreciate the opportunity to learn more about the brands and designers represented in the store, which is a key indicator in driving the offline channel growth. Moreover, prominent brands in the global market have expanded their retail stores globally and have made the alpaca clothing and accessories readily available for purchase, which drives the users to spend from such branded stores.

The online channel segment is expected to be the fastest growing over the forecasted period with a CAGR of 8.33%. Online sales for alpaca clothing have witnessed immense growth in recent years. As consumers increasingly turn to e-commerce platforms for their shopping needs, manufacturers and retailers of alpaca clothing have also started to leverage the benefits of online sales channels. Online sales allow businesses to reach a wider audience, including customers in remote locations, and offer a convenient shopping experience. Additionally, online sales are more cost-effective than traditional brick-and-mortar stores, as they often require less overhead costs. As a result, many businesses in the alpaca clothing industry have expanded their online presence, and the growth of online sales is likely to continue in the coming years.

Regional Insights

North America dominated the alpaca apparel and accessories market with a share of over 37% in 2022. North America is expected to register the fastest growth in the alpaca fiber market during the forecast period and is likely to retain its dominance in the industry. This growth in alpaca fiber clothing production and retail is driven by increasing consumer awareness of the benefits of alpaca fiber, such as sustainability, durability, and softness. As consumers become more conscious about the environmental impact of their fashion choices, they are seeking out high-quality, sustainable clothing options like alpaca fiber. Additionally, the U.S. has a large population with a high spending capacity, making it an attractive market for manufacturers and designers of alpaca clothing and accessories. The combination of these factors is likely to drive the growth of the alpaca fiber market in North America in the coming years.

Europe is also expected to witness significant growth in the alpaca apparel and accessories market during the forecast period. The region has a high demand for soft and comfortable winter wear, making alpaca fiber a desirable material for manufacturers and designers. In addition, the favorable weather conditions in the region, particularly during the winter months, make alpaca clothing and winter wear a popular choice among consumers seeking warmth and comfort.

Alpaca Apparel And Accessories Market Segmentations:

By Product

By End-user

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution End-user Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Alpaca Apparel And Accessories Market

5.1. COVID-19 Landscape: Alpaca Apparel And Accessories Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Alpaca Apparel And Accessories Market, By End-user

8.1. Alpaca Apparel And Accessories Market, by End-user, 2023-2032

8.1.1 Apparel

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Accessories

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Alpaca Apparel And Accessories Market, By End-user

9.1. Alpaca Apparel And Accessories Market, by End-user, 2023-2032

9.1.1. Men

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Women

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Children

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Alpaca Apparel And Accessories Market, By Distribution Channel

10.1. Alpaca Apparel And Accessories Market, by Distribution Channel, 2023-2032

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Alpaca Apparel And Accessories Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by End-user (2020-2032)

11.1.2. Market Revenue and Forecast, by End-user (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.1.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.1.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by End-user (2020-2032)

11.2.2. Market Revenue and Forecast, by End-user (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.2.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.2.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by End-user (2020-2032)

11.2.6.2. Market Revenue and Forecast, by End-user (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by End-user (2020-2032)

11.2.7.2. Market Revenue and Forecast, by End-user (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by End-user (2020-2032)

11.3.2. Market Revenue and Forecast, by End-user (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.3.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.3.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by End-user (2020-2032)

11.3.6.2. Market Revenue and Forecast, by End-user (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by End-user (2020-2032)

11.3.7.2. Market Revenue and Forecast, by End-user (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.4.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.4.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by End-user (2020-2032)

11.4.6.2. Market Revenue and Forecast, by End-user (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by End-user (2020-2032)

11.4.7.2. Market Revenue and Forecast, by End-user (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by End-user (2020-2032)

11.5.4.2. Market Revenue and Forecast, by End-user (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by End-user (2020-2032)

11.5.5.2. Market Revenue and Forecast, by End-user (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. The Natural Fibre Company

12.1.1. Company Overview

12.1.2. End-user Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Alpaca Direct, LLC.

12.2.1. Company Overview

12.2.2. End-user Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Plymouth Yarn Company, Inc..

12.3.1. Company Overview

12.3.2. End-user Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mary Maxim Inc.

12.4.1. Company Overview

12.4.2. End-user Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Alpaca Owners Association, Inc

12.5.1. Company Overview

12.5.2. End-user Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Lion Brand Yarn

12.6.1. Company Overview

12.6.2. End-user Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Berroco, Inc..

12.7.1. Company Overview

12.7.2. End-user Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Cascade Yarns

12.8.1. Company Overview

12.8.2. End-user Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Malabrigo Yarn.

12.9.1. Company Overview

12.9.2. End-user Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Fil Katia

12.10.1. Company Overview

12.10.2. End-user Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others