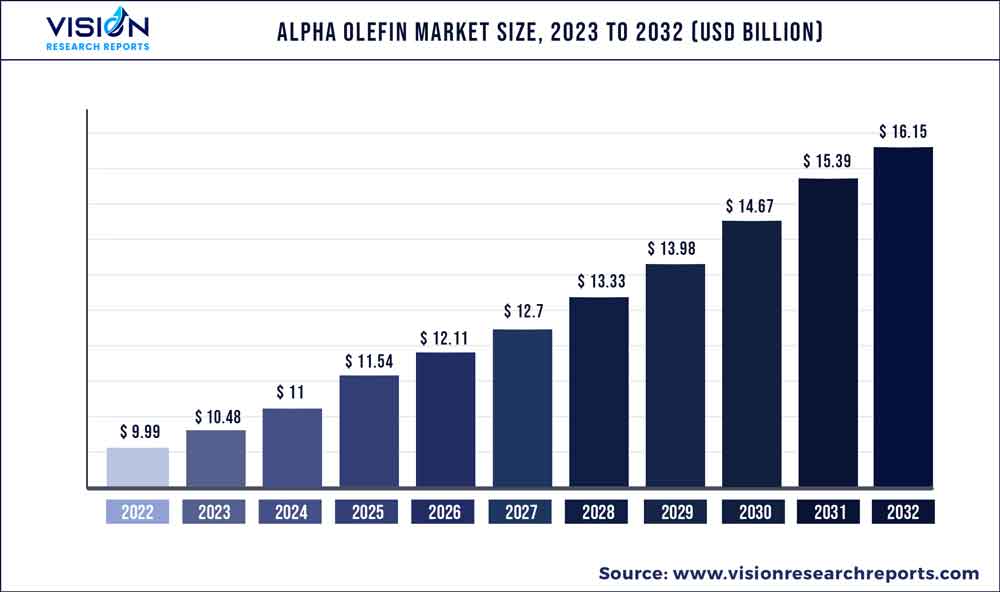

The global alpha olefin market size was estimated at around USD 9.99 billion in 2022 and it is projected to hit around USD 16.15 billion by 2032, growing at a CAGR of 4.92% from 2023 to 2032. By Product segment, the alpha olefin market in the United States was accounted for USD 2.3 billion in 2022.

Key Pointers

Report Scope of the Alpha Olefin Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 39.04% |

| Revenue Forecast by 2032 | USD 9.99 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Chevron Phillips Chemical Company LLC; Exxon Mobil Corporation; Petrochemicals (Malaysia) Sdn. Bhd; INEOS Oligomers; Mitsubishi Chemical Corp.; Qatar Chemical Company Ltd (Q-chem) |

Increasing polyethylene demand from various end-use industries is expected to remain a key driving factor for the global market. Surge in demand can be attributed to its easy processability, versatility, recyclability, and low cost of production. Growing population and increasing consumer spending, coupled with increasing industrial output in emerging markets of China, India, Brazil, and Mexico, have fueled polyethylene consumption.

Growing demand for polyalphaolefin in synthetic lubricants, because of its ability to protect engines from wear and tear damages, is also expected to fuel market growth over the forecast period. Synthetic lubricants exhibit high demand owing to increasing usage in industrial, automotive, marine, and aerospace industries. These lubricants are gaining wide acceptance due to its benefits such as reduction in oil consumption and increased thermal stability.

Increasing oilfield activities and petrochemical production in Middle East have propelled ethylene production, thereby assisting the growth of the alpha olefin market in the region. Major manufacturers are also aiming to shift their production base in MEA, owing to the abundant availability of raw material.

Product Insights

1-hexene emerged as the largest product segment accounting for over 32.03% of global market share in 2022 and are expected to grow at a fastest pace during the forecast period. Increasing utilization of 1-hexene as a common monomer for manufacturing High-Density Polyethylene (HDPE) and Linear Low-Density Polyethylene (LLDPE) polymers is expected to augment the segment growth. Rising demand for polyethylene on account of growing automotive and consumer goods markets, in the emerging economies of China, India, and Brazil is expected to drive the 1-hexene segment further.

It is also used as an additive in synthetic lubricants, which is expected to further augment market development. Demand for 1-dodecane from industrial and household cleaners and increasing application in the personal care industry will boost this product segment as 1-dodecane is used in the production of detergent alcohols. However, increasing consumption of bio-based detergent alcohols and alkyl aromatics is anticipated to replace 1-dodecane.

Application Insights

Polyethylene is the major application segment and accounted for around 55.11% of the market share, in terms of revenue, in 2022. Construction is the leading application market for polyethylene compounds. Polyethylene is also used in the packaging sector and for prototype development on Computer Numerical Control (CNC) machines and 3D printers. High-density polyethylene offers easy processing at a lower cost, a good moisture barrier, and holds the ability to produce an opaque packaging product.

Low-density polyethylene is often preferred based on the field of application due to low production costs, heat seal-ability, high clarity and elongation, and softness. Demand for synthetic lubricants is expected to be driven by the implementation of stringent regulations regarding pollution control. Rising expenditure on R&D is also expected to play a major role in driving the demand for synthetic lubricants. Moreover, the wide scope of application of these lubricants is expected to further boost the market.

Regional Insights

North America dominated the global market with a revenue share of over 39.04% in 2022. Shale gas boom in the U.S. has driven ethylene production in the region which has in turn propelled alpha olefin production. Increasing oil exploration along the Gulf of Mexico is expected to further drive the alpha olefin market. Increasing crude oil production in Canada is expected to further drive alpha olefin production.

The three largest producers of Linear Alpha Olefins (LAO) via ethylene oligomerization are Chevron Phillips, INEOS, and Shell. These companies have a significant presence in North America, Western Europe, and the Middle East. However, Western Europe is likely to experience a limited supply of ethylene and will continue to produce LAO through extractive distillation or full range process with minor capacity additions. Investments in the Middle East and North America are being focused on heavier LAOs. These regions are expected to target specialty grades of polyethylene, with a focus on the production of C6 and C8 LLDPE.

Rapid urbanization and industrialization in emerging economies of China and India are expected to drive product demand in polyethylene. Various government incentives and favorable regulatory scenario in China, India, Malaysia, and Indonesia have driven the growth of the manufacturing sector in the Asia Pacific. The product is widely utilized in polyethylene, detergent alcohols, synthetic lubricants, and plasticizers. Increasing the production of these products in the Asia Pacific is further expected to drive the regional market over the forecast period.

Alpha Olefin Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Alpha Olefin Market

5.1. COVID-19 Landscape: Alpha Olefin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Alpha Olefin Market, By Product

8.1. Alpha Olefin Market, by Product, 2023-2032

8.1.1. 1-butene

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 1-hexene

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. 1-octene

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. 1-decene

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. 1-dodecene

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Alpha Olefin Market, By Application

9.1. Alpha Olefin Market, by Application, 2023-2032

9.1.1. Polyethylene

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Detergent Alcohol

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Synthetic Lubricants

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Alpha Olefin Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Chevron Phillips Chemical Company LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Exxon Mobil Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Petrochemicals (Malaysia) Sdn. Bhd

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. INEOS Oligomers

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mitsubishi Chemical Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Qatar Chemical Company Ltd (Q-chem)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others