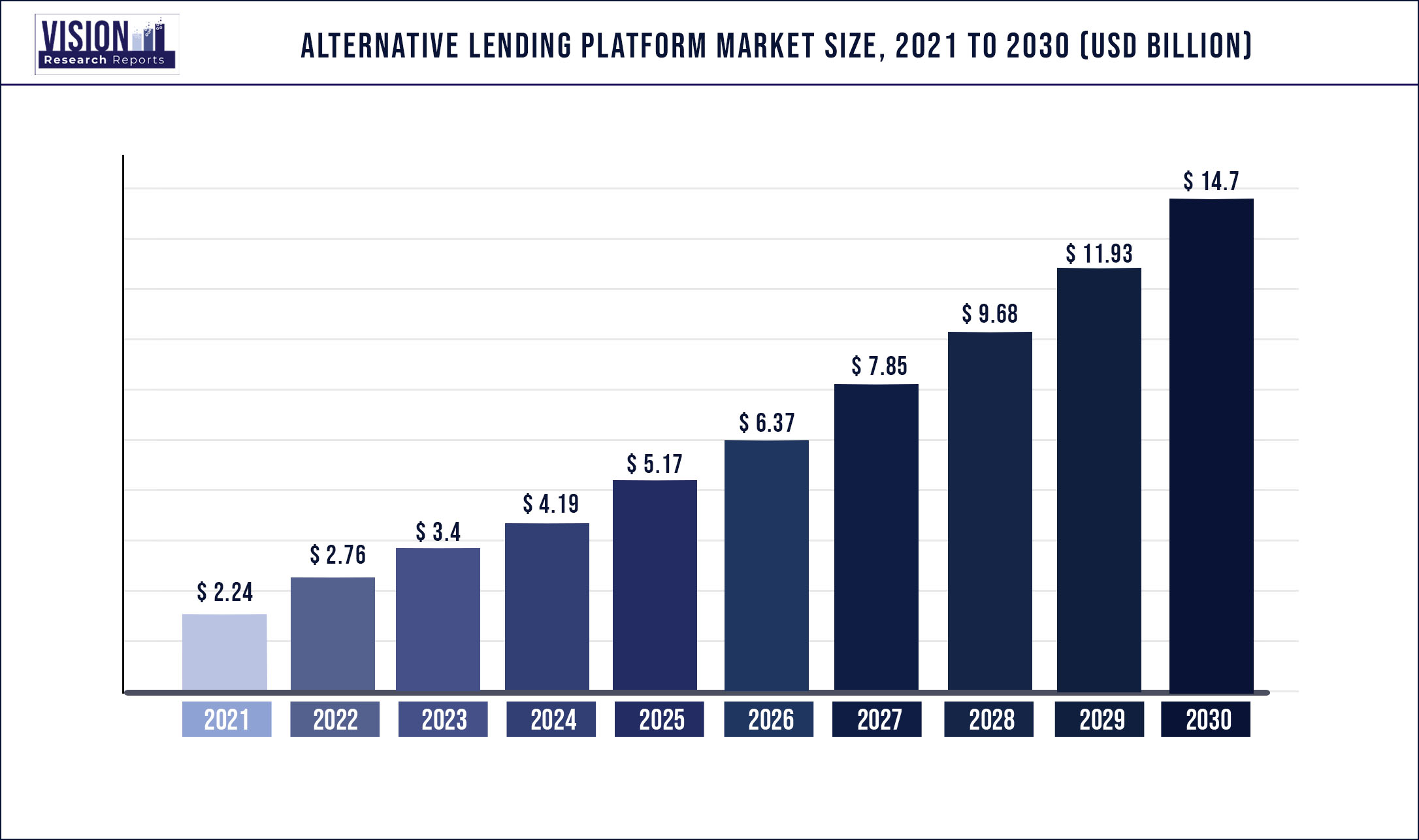

The global alternative lending platform market was estimated at USD 2.24 billion in 2021 and it is expected to surpass around USD 14.7 billion by 2030, poised to grow at a CAGR of 23.25% from 2022 to 2030.

Report Highlights

The growing integration of technology in the financial sector worldwide is anticipated to drive the growth. The strong emphasis by market players on offering enhanced lending solutions to revolutionize the financing ecosystem also bodes well for the development of the industry.

In June 2022, HES FinTech, a loan management platform provider, based in Lithuania, collaborated with Nordigen, a transaction analytics platform based in Latvia. This partnership was aimed to revitalize the lending ecosystem in the European markets by delivering integrated and seamless solutions for end-to-end digital lending. They are focused on a technologically advanced approach to making the lending sector more accessible by eliminating the hassle of traveling to offices and signing documents.

Industry incumbents across the globe are focused on customer acquisition by providing attractive products. For instance, in December 2021, Kabbage from American Express launched Kabbage FundingTM, providing flexible lines of credit between USD 1,000 and USD 150,000 to qualified small businesses. Small businesses may apply for loans in minutes with Kabbage Funding to get working capital available around the clock to help them manage their cash flow.

The outbreak of COVID-19 is expected to play a vital role in driving the growth of the market during the forecast period. Although the outbreak took a toll on the lending market, the need for credit, on the other hand, increased as many individuals suffered financial losses. This created unique opportunities for alternative lenders to cater to the vast credit requirement globally.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.24 billion |

| Revenue Forecast by 2030 | USD 14.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 23.25% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Solution, services, deployment, end-use, region |

| Companies Covered |

Funding Circle; On Deck Capital, Inc.; Kabbage; Social Finance, Inc.; Prosper Funding LLC; Avant, LLC.; Zopa Bank Limited; LendingClub Bank., Upstart Network, Inc.; CommonBond, Inc. |

Solution Insights

The loan origination segment accounted for the largest revenue share of more than 34.11% in 2021. The dominance is attributable to the growing popularity of alternative lending platforms as many individuals, especially students, are applying for personal and education loans. Several non-bank institutions such as insurance companies and fund managers previously invested in securitized products are exploring the growth potential. They offer credit to startups and SMEs in their developing phase.

The lending analytics segment is anticipated to witness significant growth during the forecast period. The growth is driven by the growing adoption of tools such as data analytics and predictive analytics in financing activities to reduce operational costs and maximize profitability. Improved customer acquisition and enhanced consumer experience contribute to the growth. Moreover, the efficient lifecycle management of the loans is one of the principal elements responsible for the growth of the segment.

Service Insights

The integration & deployment segment held the largest revenue share of more than 42.05% in 2021. The growing prevalence of alternative lending and the rising awareness of digital means of financing are propelling the segment’s growth. Continuous improvement in customer acquisition and the growing demand for matching the right lender with the borrowers are responsible for increasing the need for these services. Moreover, the flexibility to pick the deployment model as per various attributes such as security, budget, organizational needs, and infrastructure capability is also an important factor in boosting the growth of the segment.

The managed services segment is expected to witness the fastest growth during the forecast period. Managed services can help the institutions to cope with the rapidly changing industry trends and technological advancements. Businesses cannot maintain their line of operations while keeping up with the most recent IT trends. With the help of managed services, businesses are empowered to focus on what they do best. Additionally, the technology partners support these efforts with strong IT support; hence the segment is growing significantly.

Deployment Insights

The on-premise segment dominated the market in 2021 and contributed to a share of more than 68.2% of the global revenue. Although the lending industry is steadily adopting the cloud, many lenders still view this as a barrier since they are apprehensive about data security. They choose on-premise deployment over the cloud because they are unfamiliar with the technology and concerned about losing control over their data. The data kept with lending institutions are sensitive and can be stolen or misused. As a result, businesses are still preferring on-premise deployment.

The cloud segment is anticipated to grow at the fastest CAGR during the forecast period. In addition to offering a comprehensive view of client relationships to provide a better customer experience, cloud technology also reduces overall costs and improves operational efficiency. Furthermore, adopting cloud-based deployment enables remote access, which increases business flexibility. Several players are deploying cloud-based models to gain a competitive edge over their peers.

End-use Insights

The crowdfunding segment dominated the market in 2021 and accounted for a share of over 69.21% of the global revenue. The growing prevalence of social media platforms contributes to the segment's dominance as it acts as a low-cost promotional tool for crowdfunding platforms. The global reach of social media provides the necessary push to the crowdfunding campaigns to onboard a pool of investors from around the globe. Several crowdfunding platforms are also utilized to raise funds for various initiatives or fight a cause, thus creating a positive outlook for the segment.

The peer-to-peer lending segment is anticipated to grow at a promising CAGR during the forecast period. The proliferation of smartphones and internet penetration is driving the segments’ growth as P2P lending platforms are run primarily via the internet using laptops or smartphones. In addition, the advantages associated with it, such as relatively low operational cost compared to legacy platforms, fuel the segments' growth. Moreover, the convenience of getting a loan and easy accessibility also bodes well for growth.

Regional Insights

North America dominated the alternative lending platform market in 2021 and accounted for a share of over 29.08% of the global revenue. The dominance is attributable to the presence of several key players in the region. In addition, technological advancements and adoptions are also contributing to regional market growth. For instance, in June 2022, StellarFi, the U.S.-based public benefit corporation, launched its fintech platform, which is expected to help its users build their credit scores by paying their liabilities timely.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth of the regional market can be attributed to the growing awareness in countries such as China, India, and Japan, about the benefits offered by alternative lending platforms. The aggressive efforts being pursued by various organizations across the Asia Pacific to promote the utilization of alternative lending platforms are also expected to contribute to the growth of the regional market. For instance, in June 2022, a Singapore-based startup named Helicap raised USD 6.94 million in funding, and it has developed a technology for crunching data points of loans which can help in evaluating the creditworthiness of over 500 lenders across South East Asia and Oceania.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Alternative Lending Platform Market

5.1. COVID-19 Landscape: Alternative Lending Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Alternative Lending Platform Market, By Solution

8.1. Alternative Lending Platform Market, by Solution, 2022-2030

8.1.1. Loan Origination

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Loan Servicing

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Lending Analytics

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Alternative Lending Platform Market, By Service

9.1. Alternative Lending Platform Market, by Service, 2022-2030

9.1.1. Integration & Deployment

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Support & Maintenance

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Training & Consulting

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Managed Services

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Alternative Lending Platform Market, By Deployment

10.1. Alternative Lending Platform Market, by Deployment, 2022-2030

10.1.1. On-Premise

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Cloud

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Alternative Lending Platform Market, By End-use

11.1. Alternative Lending Platform Market, by End-use, 2022-2030

11.1.1. Crowdfunding

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Peer-to-Peer Lending

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Alternative Lending Platform Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2017-2030)

12.1.2. Market Revenue and Forecast, by Service (2017-2030)

12.1.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Service (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2017-2030)

12.2.2. Market Revenue and Forecast, by Service (2017-2030)

12.2.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Service (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Service (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Service (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2017-2030)

12.3.2. Market Revenue and Forecast, by Service (2017-2030)

12.3.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Service (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Service (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Service (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2017-2030)

12.4.2. Market Revenue and Forecast, by Service (2017-2030)

12.4.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Service (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Service (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Service (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Service (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Service (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Deployment (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Funding Circle

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. On Deck Capital

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Kabbage

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Social Finance, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Prosper Funding LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Avant, LLC

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Zopa Bank Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. LendingClub Bank

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Upstart Network, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. CommonBond, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others