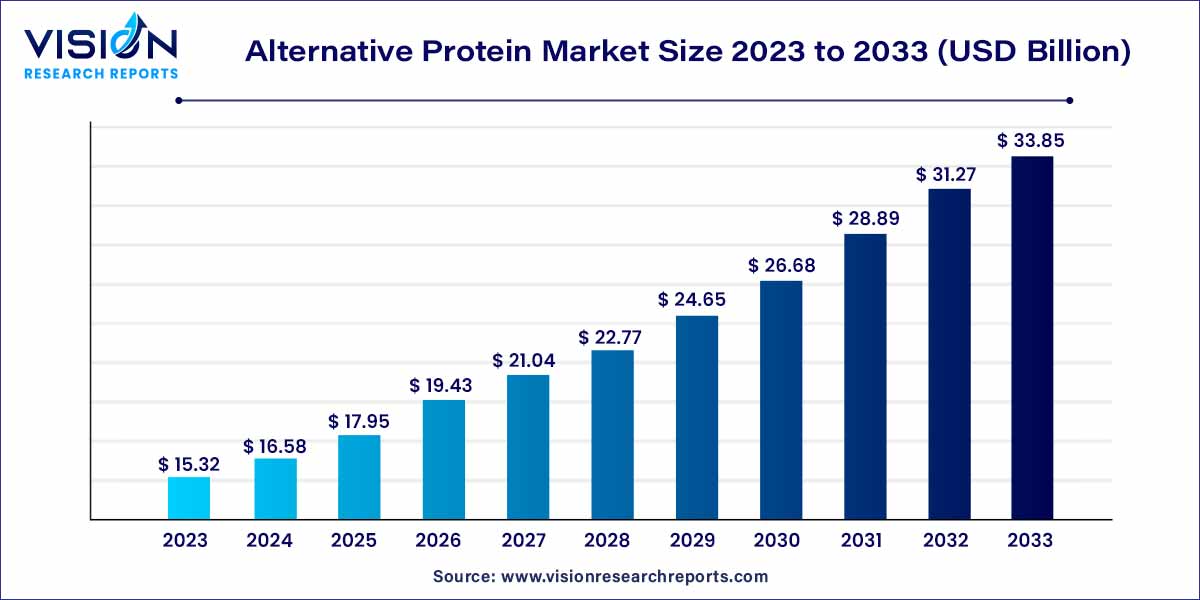

The global alternative protein market size was estimated at USD 15.32 billion in 2023 and it is expected to surpass around USD 33.85 billion by 2033, poised to grow at a CAGR of 8.25% from 2024 to 2033.

The growth of the alternative protein market is propelled by several key factors that contribute to its expansion and increasing consumer adoption. Firstly, growing awareness and concerns about the environmental impact of conventional animal agriculture have led consumers to seek more sustainable protein sources. Additionally, rising concerns about animal welfare and ethical considerations associated with meat consumption drive the demand for alternative protein products. Moreover, advancements in food technology and manufacturing processes have enabled the production of alternative proteins that closely mimic the taste, texture, and nutritional profile of traditional animal-derived products, enhancing their appeal to a broader consumer base. Furthermore, shifting dietary preferences towards plant-based diets, driven by health and wellness trends, contribute to the market's growth as consumers seek healthier and more environmentally friendly protein options. Lastly, supportive regulatory initiatives and investments in research and development further fuel innovation and market expansion within the alternative protein sector.

Plant-based protein accounted for a share of 90% of the global revenue in 2023. Plant-based proteins are being investigated for their role in managing chronic conditions, supporting immune health, and addressing specific nutritional deficiencies. The pharmaceutical industry's interest in plant-based proteins not only broadens the application scope of these proteins but also elevates their perceived value as functional and therapeutic ingredients. The surge in demand for plant-based protein products is evident in the wide range of available plant-based protein supplements, shakes, and snacks. Fitness enthusiasts, including athletes and bodybuilders, incorporate these products into their dietary routines to meet their protein requirements while aligning with their ethical and environmental values.

The insect protein market is projected to grow at a CAGR of 16.92% from 2024 to 2033. Increasing concerns about sustainability and the environmental impact of traditional livestock farming have fueled interest in alternative protein sources such as insects, which require significantly fewer resources to produce. For instance, companies such as Entomo Farms have capitalized on this trend by pioneering large-scale insect farming operations, providing a sustainable source of protein. Insects are highly nutritious and rich in protein, healthy fats, and essential vitamins and minerals, making them an attractive option for health-conscious consumers. This nutritional profile has led to the development of innovative insect-based products, such as cricket flour from companies such as Bitty Foods, which can be used as a sustainable protein source in various food applications.

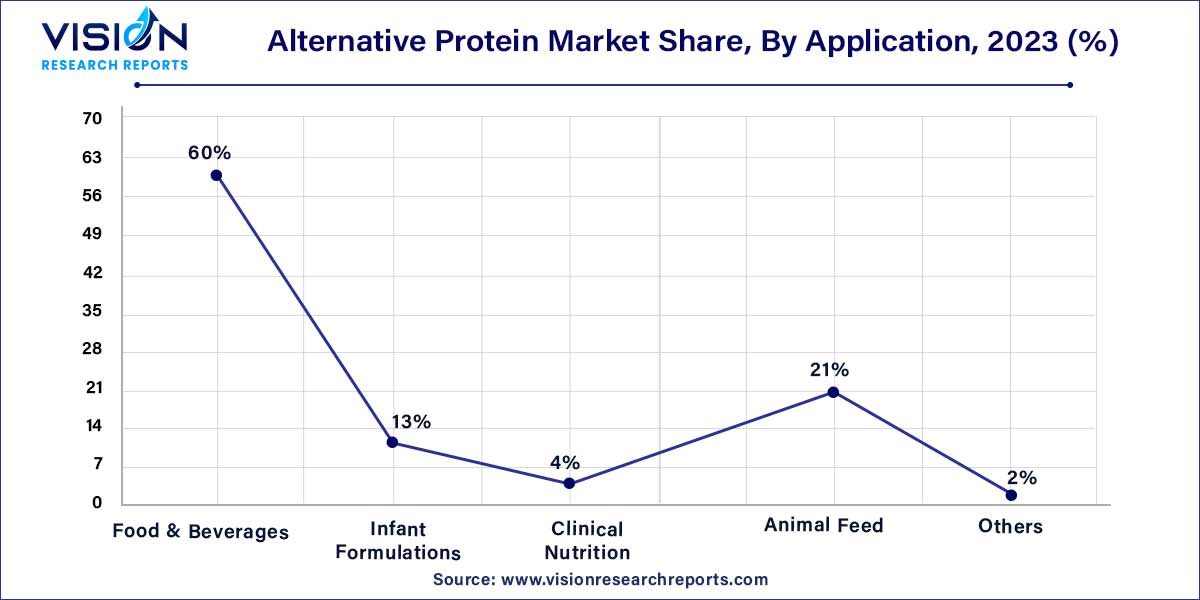

The food & beverages industry accounted for a share of 60% in terms of global revenue in 2023. This can be mainly attributed to several factors including the rising adoption of vegan diets and the prevalence of lactose intolerant conditions. An increasing awareness among consumers about the adverse health effects of meat consumption is driving a shift toward veganism, resulting in a decline in meat consumption. For instance, in the UK, Office for National Statistics data revealed that consumer spending on meat decreased from approximately 20.78 billion British pounds in 2020 to 20.54 billion British pounds in 2021.

The demand for alternative protein in the animal feed industry is projected to grow at a CAGR of 8.05% from 2024 to 2033. The driving force behind the growing demand for alternative proteins in the animal feed industry is a convergence of various factors that align with evolving consumer preferences, sustainability concerns, and advancements in nutritional research. One key factor is the increasing awareness among pet owners and livestock producers about the environmental impact of traditional animal-based protein sources, such as meat and fishmeal.

Moreover, the companies are introducing various alternative protein products for animal feed that further propel the market growth. For instance, in June 2023, BENEO introduced a new range of high-quality and non-GMO vegetable proteins for pet food manufacturers. The demand for plant-based pet food is growing, and BENEO's toolbox of plant-based proteins, which feature rice protein, vital wheat gluten, and faba bean protein concentrate, provide nutritional and technical benefits.

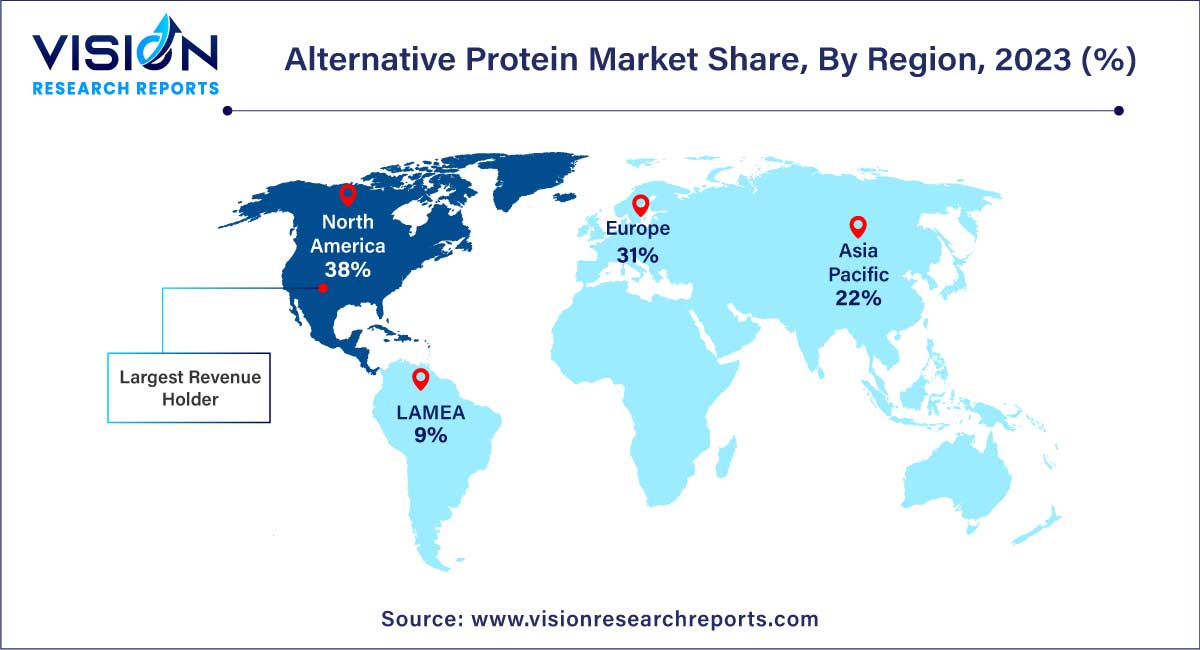

The North America alternative protein market accounted for 38% of the global revenue share in 2023. Increasing consumer awareness of environmental sustainability and animal welfare has led to a shift towards plant-based and alternative protein sources. For example, the rising demand for plant-based meat products, such as Beyond Meat and Impossible Foods, showcases consumers' willingness to embrace alternative protein options for ethical and environmental reasons.

The growing demand for protein-rich foods due to health and wellness trends, combined with the rise of flexitarian, vegetarian, and vegan diets, has created a substantial market opportunity for alternative protein products. Products like oat milk from companies like Oatly and Almond milk from Califia Farms are excellent examples of how non-animal-based proteins fulfill the demands of consumers pursuing plant-based dietary choices.

By Product

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others