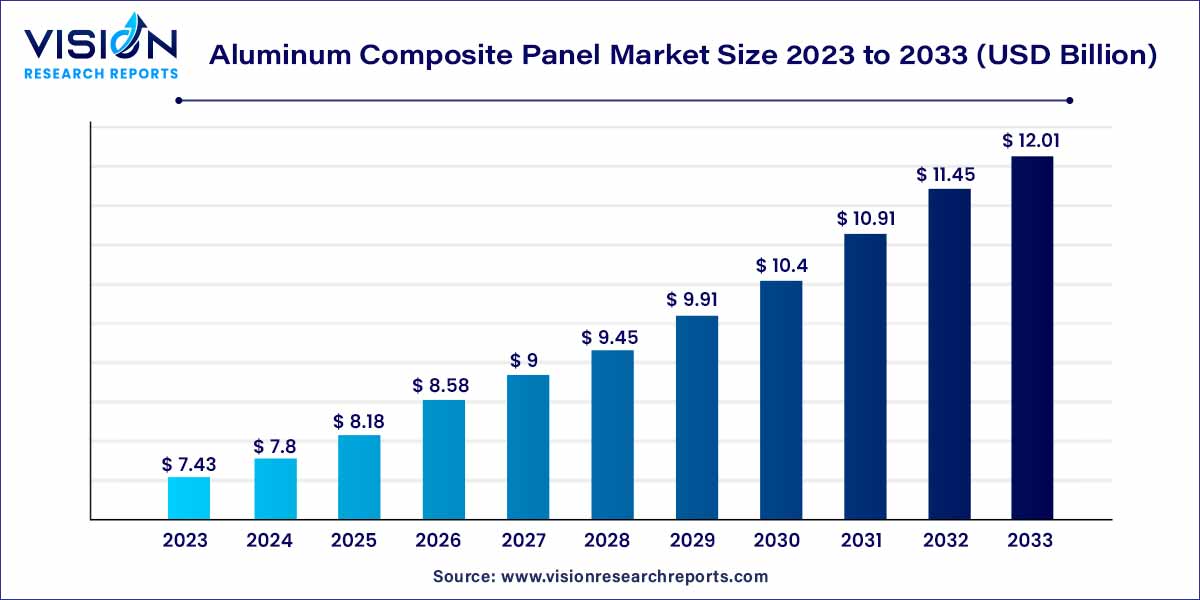

The global aluminum composite panel market size was estimated at around USD 7.43 billion in 2023 and it is projected to hit around USD 12.01 billion by 2033, growing at a CAGR of 4.92% from 2024 to 2033.

The aluminum composite panel (ACP) market has experienced substantial growth, becoming a prominent player in the construction materials sector. ACPs consist of a core material sandwiched between two aluminum sheets, offering a blend of functionality, durability, and aesthetic appeal. This overview delves into key market dynamics, trends, and factors influencing the growth of the aluminum composite panel market.

The growth of the aluminum composite panel (ACP) market is propelled by several key factors. Firstly, the increasing architectural significance of ACPs, driven by their versatility and aesthetic appeal, has led to a rising demand among architects and designers for contemporary building facades. Additionally, the growing emphasis on sustainability in construction practices has positioned ACPs favorably, as they are recyclable and contribute to energy efficiency. The ongoing global trends of urbanization and infrastructure development further boost the demand for lightweight and durable construction materials, with ACPs meeting these criteria. Furthermore, technological advancements in manufacturing, such as innovations in core materials and coatings, enhance the performance and durability of ACPs. The market's ability to offer customization options, providing architects and builders with design flexibility, also contributes to its sustained growth. Despite challenges related to regulatory compliance and raw material price volatility, the aluminum composite panel market is poised for continued expansion, making it a key player in the evolving landscape of modern construction materials.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 12.01 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.92% |

| Revenue Share of Asia Pacific in 2023 | 41% |

| CAGR of North America from 2024 to 2033 | 4.96% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Architectural Versatility:

The versatility of ACPs in architectural applications is a significant driver, with architects and designers increasingly favoring these panels for their ability to achieve modern and aesthetically appealing building designs.

Durability and Weather Resistance:

ACPs offer high durability and weather resistance, making them suitable for a wide range of climates. This characteristic ensures the longevity of structures, reduces maintenance costs, and contributes to the panels' popularity in various construction projects.

Regulatory Compliance:

Adhering to evolving building codes, standards, and regulations presents a significant restraint for ACP manufacturers. The need to stay updated with ever-changing compliance requirements adds complexity and requires continuous efforts to ensure that products meet the necessary regulatory standards.

Raw Material Price Volatility:

The ACP market is susceptible to fluctuations in the price of aluminum, a primary raw material. The volatility in raw material costs poses a challenge for manufacturers in maintaining competitive pricing while ensuring the quality and consistency of their products.

Customization and Design Flexibility:

The demand for unique and visually appealing building designs creates opportunities for ACP manufacturers to provide customization options. Offering a diverse range of colors, finishes, and textures allows architects and builders to achieve distinctive aesthetics, catering to a broad spectrum of design preferences.

Global Infrastructure Development:

As infrastructure development projects continue to expand globally, there is a growing demand for reliable and efficient construction materials. ACPs, with their durability and lightweight characteristics, stand to benefit from this trend, creating opportunities for increased market penetration in diverse construction applications.

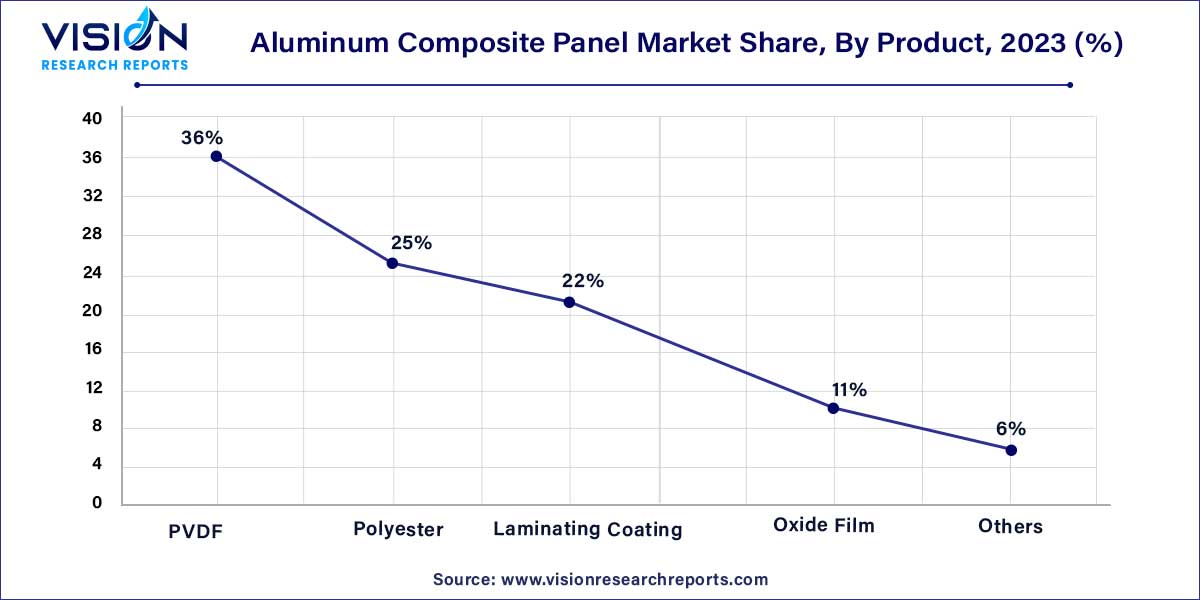

The polyvinylidene fluoride (PVDF) segment accounted for the largest revenue share of 36% in 2023 owing to a wide range of applications including lightweight construction, high-speed trains, and advertisement boards. Also, their features, such as corrosion and wear resistance and durability, are expected to benefit the segment growth. PE panels are also among the majorly used products owing to properties, such as extreme rigidity, surface flatness, smoothness, and thermal as well as acoustical insulation. It is expected to register notable growth in the future due to benefits, such as easy fabrication and processing.

The laminating coating segment is expected to grow at a CAGR of 4.36% during the forecast period. Laminating coating ACPs are manufactured through multi-layer extrusion lamination and primarily used for lamination applications in the construction industry. The use of oxide film in the production of ACPs provides several advantages, such as fire protection and UV, corrosion, and acid resistance. These properties are crucial in the construction and automotive industries. Thus, this is also estimated to boost market development.

The construction segment held the largest revenue share of 56% in 2023. Eco-friendly characteristics offered by the product are expected to increase its demand for green buildings, thereby propelling market growth. Benefits, such as thermal & acoustic insulation and corrosion resistance offered by the product are also expected to fuel their demand in the modern construction industry. Also, rising product use in decorative and cladding applications to meet transition energy and building standards is likely to augment the segment growth product over the next few years.

The advertising boards segment is expected to grow a CAGR of 4.63% over the forecast period. Rapidly expanding advertising, marketing, and mass media industry worldwide has resulted in increased expenditure on advertising boards. ACPs are broadly used for these boards as they are subjected to extreme environmental conditions, such as humidity, moisture, temperature fluctuations, and pollution. The railway application segment is also projected to witness considerable growth. Moreover, these composites help reduce the overall weight of trains resulting in improved speed and reduced power consumption.

Asia Pacific dominated the market with the largest revenue share of 41% in 2023. The rapidly growing construction industry, especially in emerging economies like China, India, Indonesia, and Vietnam, is anticipated to have a positive impact on the regional market. The rising population coupled with government schemes promoting basic amenities and high demand for affordable housing are also among the major factors driving the region’s growth.

North America is anticipated to grow at a CAGR of 4.96% during the forecast period. The industry is expected to grow as a result of the region's growing number of green buildings. The expansion of North America is being aided by an increase in governmental programs and initiatives to foster better infrastructure. In addition, the increase is anticipated to be boosted by the increasing usage of panels in cladding and ornamental applications to meet evolving architectural and energy standards. Increased manufacturing of hybrid and electric cars in North America will also bode well for the market's expansion.

Alumaze, a manufacturer of aluminum composite panels (ACP), debuted a new range of products in June 2023. This featured ACP sheets that were created at their freshly opened plant in the district of Vizianagaram. This production facility was quickly built, taking only eight months to complete, thanks to a substantial USD 6 million investment. The increasing market demand for aluminum panels, notably for use in interior design and signage, served as the impetus for this calculated development.

The first government-approved non-combustible grade aluminum composite panel in the nation was introduced in January 2021 by Alucopanel, an aluminum composite panel manufacturer with headquarters in the United Arab Emirates. This panel is suggested for building projects requiring a high degree of fire safety. With its debut, Alucopanel becomes the world's first civil A1-grade aluminum composite panel certified for use in defense.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aluminum Composite Panels Market

5.1. COVID-19 Landscape: Aluminum Composite Panels Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aluminum Composite Panels Market, By Product

8.1. Aluminum Composite Panels Market, by Product, 2024-2033

8.1.1. PVDF

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polyester

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Laminating Coating

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Oxide Film

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Aluminum Composite Panels Market, By Application

9.1. Aluminum Composite Panels Market, by Application, 2024-2033

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Advertising Boards

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Railways

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Aluminum Composite Panels Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Arconic

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Mitsubishi Engineering-Plastics Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Alcoa Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Fairfield Metal

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Shanghai Yaret Industrial Group Co., Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others