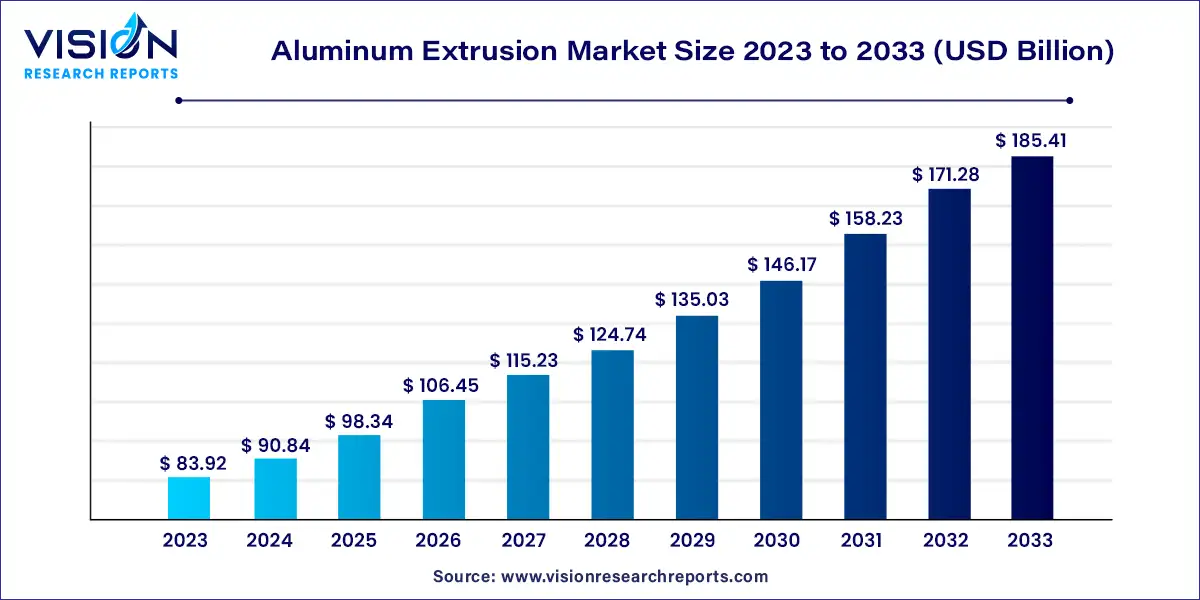

The global aluminum extrusion market size was estimated at around USD 83.92 billion in 2023 and it is projected to hit around USD 185.41 billion by 2033, growing at a CAGR of 8.25% from 2024 to 2033.

The aluminum extrusion market stands as a pivotal sector within the broader landscape of manufacturing and construction industries. Characterized by its versatility, durability, and lightweight nature, aluminum extrusions have garnered widespread adoption across various applications.

The growth of the aluminum extrusion market is driven by an increasing emphasis on sustainability across industries has propelled the demand for aluminum extrusions due to their recyclability and energy-efficient manufacturing process. Secondly, the design flexibility offered by aluminum extrusions enables the creation of intricate shapes and structures, catering to diverse applications and aesthetic preferences. Moreover, the lightweight properties of aluminum extrusions make them highly desirable in sectors such as automotive and aerospace, where weight reduction is paramount for enhancing fuel efficiency and performance. Additionally, the excellent corrosion resistance of aluminum extrusions further enhances their suitability for outdoor and marine applications, contributing to their widespread adoption. Lastly, the cost-effectiveness of aluminum extrusions, despite initial investments in tooling, equipment, and development, makes them a compelling choice for industries seeking long-term value and sustainability.

Shapes accounted for a dominant revenue share of more than 80% in 2023 in the aluminum extrusion market. Aluminum’s remarkable malleability facilitates seamless production of various shapes through the extrusion process. In this method, aluminum billets undergo heating and are subjected to high pressure using a ram or hydraulic press against steel dies. Subsequently, aluminum shapes are created, precisely mirroring contours of the dies.

Within the automotive and transportation industry, aluminum shapes find applications in various components such as transmission housings, chassis, panels, engine blocks, and roof rails for a wide range of vehicles, including cars, trucks, railways, and boats. Rising demand for structural elements in vehicles is driven by the objective of achieving lighter weight. A notable instance is the construction of the Ford F-150 truck model, which incorporates substantial aluminum components and this vehicle's weight is significantly influenced by utilization of aluminum in body panels and extruded shapes.

In extrusion process, aluminum billets undergo heating and are subsequently passed through a sequence of rolls. The material is then coiled and drawn into rods, bars, and tubes through finely crafted dies. Rods and bars find extensive application in construction, particularly in the creation of scaffolding systems. These lightweight scaffolding systems present several advantages over conventional alternatives, including enhanced stability, reduced weight, and increased flexibility.

In terms of application, building & construction accounted for the largest revenue share of over 61% in 2023. Use of extruded products in construction activities has been greatly influenced by growing investments in the housing sector. China currently holds a leading position in the construction sector, boasting the highest nominal value. Ongoing efforts of various countries to invest in new housing development are poised to contribute to this segment’s growth over the coming years.

Automotive & transportation is anticipated to advance at a lucrative CAGR throughout the forecast period. Aluminum extrusions play a crucial role in vehicles, with wide-ranging applications including engine mounts, anti-intrusion beams, radiator beams, fuel distribution pipes, longitudinal beams, seat tracks, cross rails, roof rails, tailgate frames, and underbody space frame rockers, among other components.

Surge in consumer goods manufacturing is poised to drive the need for aluminum extrusions, particularly in the production of furniture, sporting equipment, toys, refrigerators, freezers, and other significant appliances through 2033. Extruded components, including sheets, tailored shapes, and bars, are extensively employed in the consumer goods industry. Customized extruded shapes find broad applications in computer devices, audio-video systems, and various appliances. Escalating production of these devices and appliances is expected to contribute to a heightened demand for these products in coming years.

Asia Pacific dominated the global market in 2023 with a revenue share of more than 71%. This region is expected to retain its dominant position throughout the forecast years due to the presence of well-established manufacturing sectors in countries such as China, India, Vietnam, Japan, and South Korea. China is anticipated to be a pivotal driver of industry expansion among these countries, chiefly propelled by its expansive construction sector. The Chinese government's strategic investments in transportation and energy infrastructure are expected to have a positive impact on market growth in the foreseeable future.

In terms of revenue, North America is forecasted to experience substantial growth between 2024 and 2033. Resumption of commercial operations post the COVID-19 pandemic and recessionary pressures are anticipated to boost market growth. Government efforts aimed at economic development are anticipated to contribute to the recovery of regional markets. For instance, in November 2021, the U.S. government approved a Bipartisan plan allocating USD 1 trillion to enhance the country's infrastructure, encompassing upgrades to water systems, airports, railways, power infrastructure, roadways, and bridges. The expected completion of this initiative by 2025 is poised to drive demand for aluminum extrusion.

By Product

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others