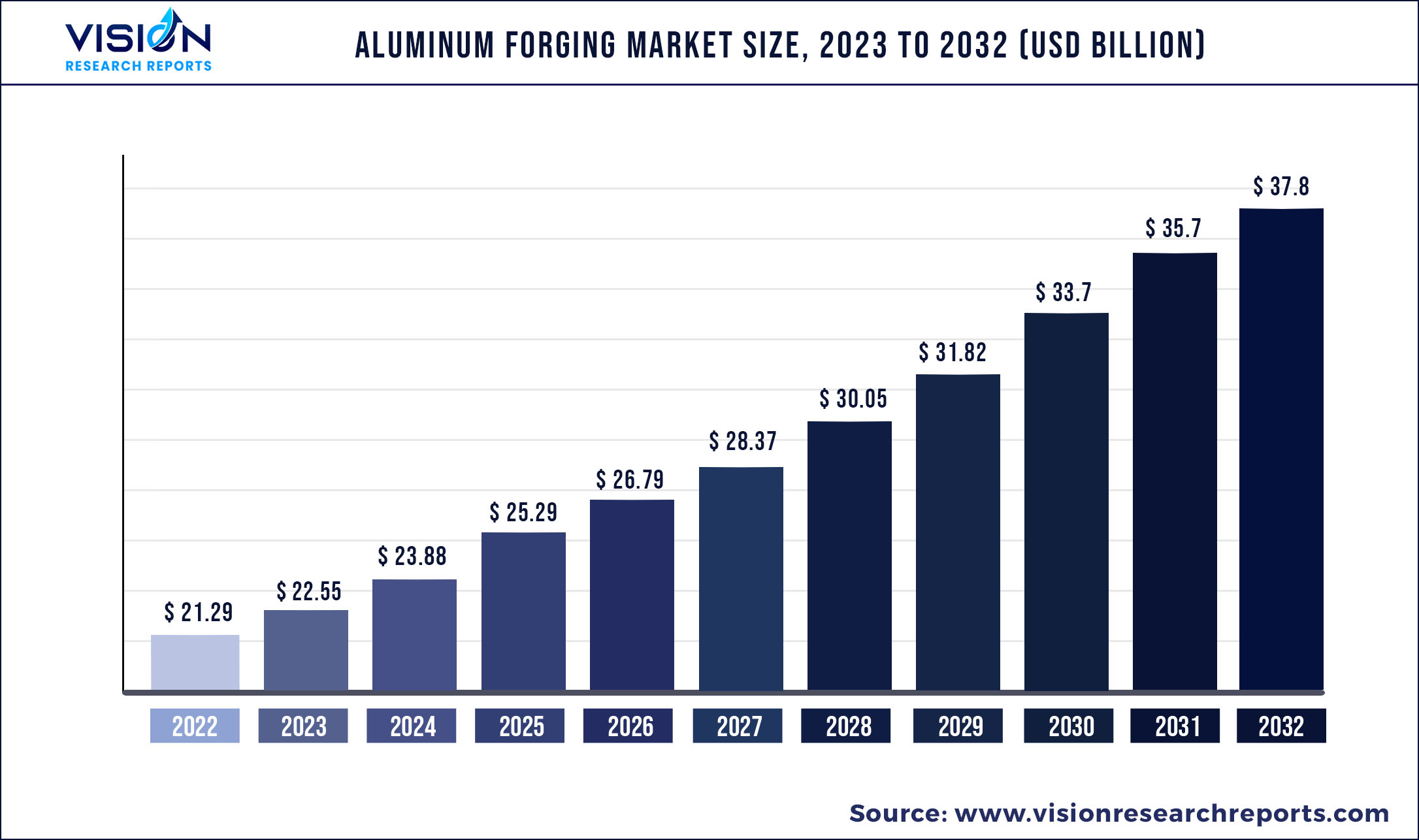

The global aluminum forging market size was estimated at around USD 21.29 billion in 2022 and it is projected to hit around USD 37.8 billion by 2032, growing at a CAGR of 5.91% from 2023 to 2032.

Key Pointers

Report Scope of the Aluminum Forging Market

| Report Coverage | Details |

| Market Size in 2022 | USD 21.29 billion |

| Revenue Forecast by 2032 | USD 37.8 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.91% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Arconic; Alcoa; Aluminum Precision Products;American Handforge; ATI; BE | Alutech Kft; Farinia Group; FORGINAL industrie; GV STAMPERIE SpA; Norsk Hydro |

The rising demand for lightweight materials in the automotive industry is driving growth. Automobile manufacturers have been trying to reduce the weight of vehicles for many years to increase fuel efficiency and improve vehicle performance, as well as to reduce carbon emissions. According to the U.S. Department of Energy, a decrease in the weight of vehicles by 10% can increase fuel efficiency by 6% to 8%. Thus, global automotive manufacturers are shifting towards the production of lightweight cars.

The U.S. is one of the key markets, owing to the presence of large-scale vehicle and aircraft production facilities in the country. Also, the strict government regulations and policies to reduce carbon emissions are increasing the demand for lightweight aluminum forgings in the country.

For instance, in March 2022, the U.S. Environmental Protection Agency published a new stringent standard to reduce carbon emissions from heavy-duty vehicles and engines from the beginning of 2027. The new stricter regulations are expected to force automotive manufacturers to use more lightweight materials, which may open new opportunities for the product across the forecast period.

Increasing demand for new defense aircraft is expected to further augment market growth. For instance, Airbus’ profit surged by 200% due to the rise in passenger aircraft sales and increasing demand for military aircraft. As a result of this, in May 2022, Airbus announced an increase of 50% in its A320 aircraft production and aims at manufacturing at least 75 aircraft per month by 2025.

The industry’s growth is anticipated to be restrained by the fluctuations in global aluminum prices. Volatility in prices can be attributed to a sudden increase in demand for aluminum after the economic recovery of countries from the COVID-19 pandemic in 2021 and supply constraints of raw materials owing to the cut down of aluminum production by China, along with the ongoing Russia-Ukraine war.

Regional Insights

North America is expected to register a CAGR of 5.56%, in terms of revenue, during the forecast period. The increase in orders to the U.S. for new defense aircraft from other countries is expected to propel market growth in the coming years. For instance, in 2022, Jordan ordered 70 new F-16 fighter jets. Similarly, Bahrain is set to receive 70 F-16 fighter jets by 2024.

Europe is expected to register a CAGR of 5.12%, in terms of revenue, over the forecast period. In 2022, Germany accounted for a revenue share of 35.0% of the European market and is one of the leading producers of aluminum forged components in Europe. The increasing demand for lightweight components from the automotive industry is driving product demand in the country.

For instance, in December 2022, Germany-based Mercedes received low-carbon aluminum from Norsk Hydro that complies with European standards related to emissions. The aluminum forged components have been ordered by the former to be used in a range of its car models in 2023 to achieve net zero carbon emissions by 2032. Over the forecast period, Asia Pacific is anticipated to register a CAGR of 6.66%, in terms of revenue.

Aluminum Forging Market Segmentations:

| By Product | By Application |

|

Open Die Forging Close Die Forging Ring-Rolled Forging |

Automotive Aerospace Oil & Gas Construction Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aluminum Forging Market

5.1. COVID-19 Landscape: Aluminum Forging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aluminum Forging Market, By Product

8.1. Aluminum Forging Market, by Product, 2023-2032

8.1.1. Open Die Forging

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Close Die Forging

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Ring-Rolled Forging

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Aluminum Forging Market, By Application

9.1. Aluminum Forging Market, by Application, 2023-2032

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Aerospace

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Oil & Gas

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Construction

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Aluminum Forging Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Arconic

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Alcoa

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Aluminum Precision Products

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. American Handforge

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ATI

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BE | Alutech Kft

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Farinia Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. FORGINAL industrie

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. GV STAMPERIE SpA

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Norsk Hydro

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others