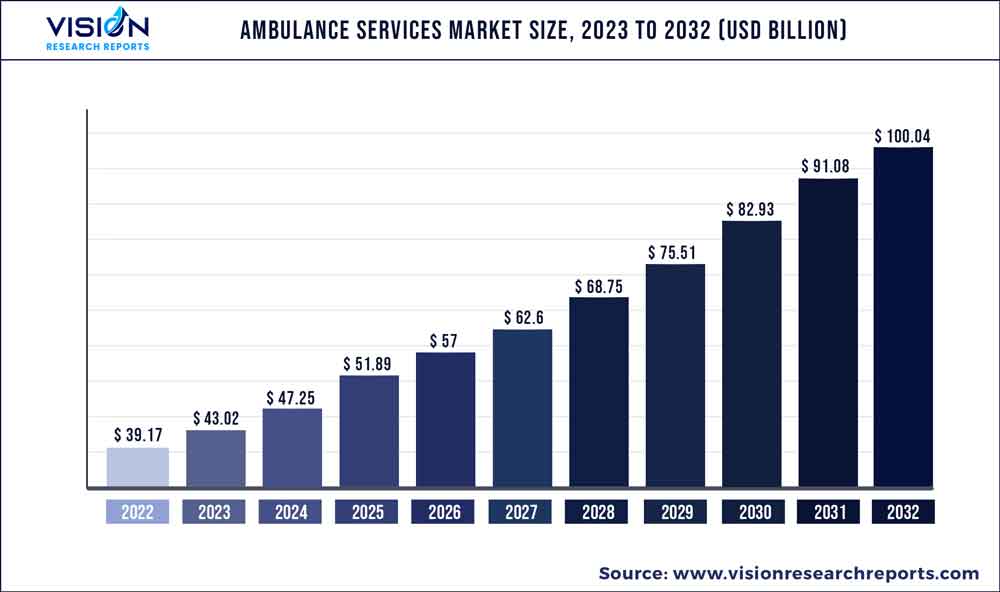

The global ambulance services market was estimated at USD 39.17 billion in 2022 and it is expected to surpass around USD 100.04 billion by 2032, poised to grow at a CAGR of 9.83% from 2023 to 2032.

Key Pointers

Report Scope of the Ambulance Services Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 48.11% |

| Revenue Forecast by 2032 | USD 100.04 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Babcock International Group PLC; London Ambulance Service NHS Trust; Acadian Ambulance Service; BVG India Limited; America Ambulance Services, Inc.; Falck Global Medical Response; Air Methods Corporation; Ziqitza Healthcare Limited; Medivic Ambulance |

Rising cases of chronic disorders such as cardiovascular disorders, increase in global geriatric population and rising cases of traumatic accidents are expected to be the key driving factors for the ambulance services market.

The growth of the market is due to favorable reimbursement policies in developed nations. In the U.S., Medicare covers both emergency and non-emergency ambulance services for medically necessary cases, given that the supplier fulfills stipulated requirements. In some cases, Medicare also covers irregular and unscheduled nonemergency trips. Medicare covers around 80.0% of the amount for emergency services while the remaining 20.0% is covered by the insurance policy of the patient.

Moreover, there have been constant increase in number of traumatic accidents globally. For instance, as per Association for Safe International Road Travel, around 1.35 million people die due to road accidents, whereas 20-25 million people suffer injuries leading to permanent disability. Thus, with rise in number of road accidents, the demand for air ambulance is expected to increase, thereby impelling the ambulance services market.

Furthermore, the ambulance services market witnessed a tremendous spike during the COVID-19 pandemic. For instance, as per Maharashtra Emergency Medical Service (MEMS), during the second wave of COVID-19, there was 33% spike from 2020, and 18% increase from the pre-pandemic period. Additionally, with decline in COVID-19 cases, the demand for ambulance services might affect negatively during the year 2022-2023. However, the ambulance services market is expected to grow at a significant pace post 2023. This can be attributed to increase in number of ambulances globally. For instance, as per The Hindu, in May 2021, the greater Chennai Corporation launched 250 COVID-19 special ambulances for 15 zones of the city.

Transport Vehicle Insights

The ground ambulance segment dominated the market and held the largest revenue share of 64.63% in 2022. Ground ambulance includes van or pickup trucks, car/SUV, motorcycle, bicycle, all-terrain vehicles, golf cart, and bus. Rising cases of cardiovascular disorders in this region is anticipated to impel the segment growth. For instance, as per CDC, every 30 seconds, one person dies in the U.S. due to cardiovascular disorder. Moreover, as per similar source, around 18.2 million people aged 20 and above have coronary artery disease in the U.S.

Similarly, rising geriatric population in this region is expected to drive the segment growth further. For instance, according to Statistics Canada, the number of people aged 85+ increased by around 12% during the year 2016-2021. Thus, due to aforementioned factors, the ground ambulance segment is expected to dominate the ambulance services market.

The air ambulance segment is anticipated to witness the fastest growth rate of CAGR 11.44% over the forecast period. Increasing cases of various accidents is expected to increase the use of air ambulance, thereby propelling the segment growth. For instance, as per Association for Safe International Road Travel, more than 46,000 people in the U.S. die every year due to road accidents, whereas, more than 4.4 million people are seriously injured.

Air ambulance services are faster than ground ambulance and water ambulance services and can quickly reach remote areas where ground and water ambulance services are unable to reach. Thus, the aforementioned factors are anticipated to help the segment grow.

Emergency Services Insights

The emergency services segment dominated the market and held the largest revenue share of 60.65% in 2022. The segment is anticipated to witness a considerable growth rate over the forecast period. The growth of the emergency services segment can be attributed to the prevalence of cardiovascular diseases such as cardiac arrest, stroke, and congestive heart failure and rising cases of COVID-19 across the globe.

Emergency ambulance services are provided to patients with acute injury or illness and to those who are in urgent need of medical attention. For instance, according to Heart and Strokes Organization, Canada, every year, approximately 35,000 people in Canada suffer from cardiac arrest, whereas, this number increases to around 62,000 people suffering from stroke every year. Additionally, according to statistics by CDC, around 3.4 million people in the U.S. suffer from epilepsy. Similarly, as per Government of Canada, the number of injuries tallied up to about 101,572 in 2020. Moreover, as per UC Davis Health about 39,707 deaths occur in the U.S. due to firearm related accidents. Thus, people suffering from emergency healthcare situations and various traumatic accidents are expected to boost the segment growth over the forecast duration.

Nonemergency ambulance services are primarily for the transportation of pediatric and bariatric patients, transportation of patients from one healthcare facility to another, for patients requiring daycare treatments, and transportation of discharged patients from hospital to home. The segment is expected to witness significant CAGR of 9.19% during the forecast period.

Increasing number of geriatric populations in this region is expected to drive the segment growth. For instance, according to Administration of Community Living, in 2019, the geriatric population aged 65+ in the U.S. was 541 million which accounted for 30 million women and 24.1 million men. This population accounted for approximately 16% of the total population in the U.S. Moreover, as per the similar source, the geriatric population in the U.S. is projected to touch the mark of 80.8 million till 2040, and further impel to reach a total population of 94.7 million in 2060. Thus, due to tremendous growth in the geriatric population, coupled with rising number of discharged patients, the segment is anticipated to witness a considerable growth over the forecast period.

Equipment Insights

The Advance Life Support (ALS) ambulance services segment dominated the market and held the largest revenue share of 64.22% in 2022. Increase in number of people suffering from cardiac arrest is expected to boost the ALS segment over the forecast period. For instance, as per St. John Ambulance, Canada, approximately, 40,000 people in Canada suffer from cardiac arrest. Moreover, according to Sudden Cardiac Arrest Foundation, approximately 356,000 out-of-hospital cardiac arrests occur in the U.S. every year, which are around 1,000 people every day.

Additionally, the rise in COVID-19 patients has helped the ALS segment propel over the past few years. For instance, according to Worldometer, the total COVID-19 cases in the U.S. have tallied up to 83,437,158 as of May 06, 2022. Patients suffering from COVID-19 are in continuous need of ventilator. Moreover, if a person suffers from additional comorbidities, continuous cardiac monitoring is required. The ALS provides patients with continuous cardiac monitoring and ventilator support along with emergency medical technician. Hence, as a result of aforementioned factors, the segment is expected to dominate the ambulance services market.

The Basic Life Support (BLS) is anticipated to have CAGR of 8.66% during the forecast period. Rising incidence rate of acute illness such as asthma attack, bronchitis, burns, heart attacks, pneumonia is expected to drive the segment growth. For instance, as per American Thoracic Society, approximately 1.0 million adults in the U.S. are admitted in the hospital to treat pneumonia, whereas, 50,000 people from pneumonia.

Moreover, as per data by the WHO, around 3.24% people died due to influenza, pneumonia in Canada. Similarly, rising number of burn incidence is further increasing the use of BLS ambulance. For instance, according to U.S. Fire Administration, in the U.S. around 1.29 million burn injuries took place in the year 2019. Similarly, according to the Joye Law Firm, on an average, about 450,000 burn injuries are registered in the U.S. alone.

Regional Insights

North America dominated the ambulance services market and accounted for the largest revenue share of 48.11% in 2022. The growth can be attributed to factors such as presence of several key market players in this region, growing demand for high-quality healthcare services, well-established healthcare infrastructure, and favorable reimbursement policies and regulatory reforms in the healthcare sector. For instance, in February 2019, the U.S. Department of Health and Human Services (HHS), Center for Medicare and Medicaid Innovation (Innovation Center), announced a new payment model for emergency ambulance services that aims to allow Medicare Fee-For-Service (FFS) beneficiaries to obtain the most appropriate level of care at the right time and place with the potential for lower out-of-pocket costs. All of these reimbursement regulations make ambulance services accessible for the patient population, hence propelling the ambulance services market’s growth.

However, the Asia Pacific region is projected to witness the fastest CAGR of 12.46% during the forecast duration. The growth rate can be attributed to rising geriatric population in countries such as China, India, and Japan. For instance, as per Statistics Bureau of Japan, in 2020, the number of population aged 65+ was tallied up to 36.19 million which contributed around 28.8% of the total population. Similarly, according to the WHO, the geriatric population in China in expected to reach 28% of the total population by 2040, as geriatric population is more susceptible to various ailments, the Asia Pacific region is anticipated to have the fastest growth rate.

Ambulance Services Market Segmentations:

By Transport Vehicle

By Emergency Services

By Equipment

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Transport Vehicle Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ambulance Services Market

5.1. COVID-19 Landscape: Ambulance Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ambulance Services Market, By Transport Vehicle

8.1. Ambulance Services Market, by Transport Vehicle, 2023-2032

8.1.1 Ground Ambulance

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Air Ambulance

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Water Ambulance

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Ambulance Services Market, By Emergency Services

9.1. Ambulance Services Market, by Emergency Services, 2023-2032

9.1.1. Emergency Services

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-emergency Services

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Ambulance Services Market, By Equipment

10.1. Ambulance Services Market, by Equipment, 2023-2032

10.1.1. Advance Life Support (ALS) Ambulance Services

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Basic Life Support (BLS) Ambulance Services

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Ambulance Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.1.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.1.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.2.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.2.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.3.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.3.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Transport Vehicle (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Emergency Services (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Equipment (2020-2032)

Chapter 12. Company Profiles

12.1. Babcock International Group PLC

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. London Ambulance Service NHS Trust

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Acadian Ambulance Service

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BVG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. America Ambulance Service, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Falck A/S

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Global Medical Response

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Air Methods Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ZIQITZA HEALTHCARE LIMITED

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Medivic Ambulance

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others