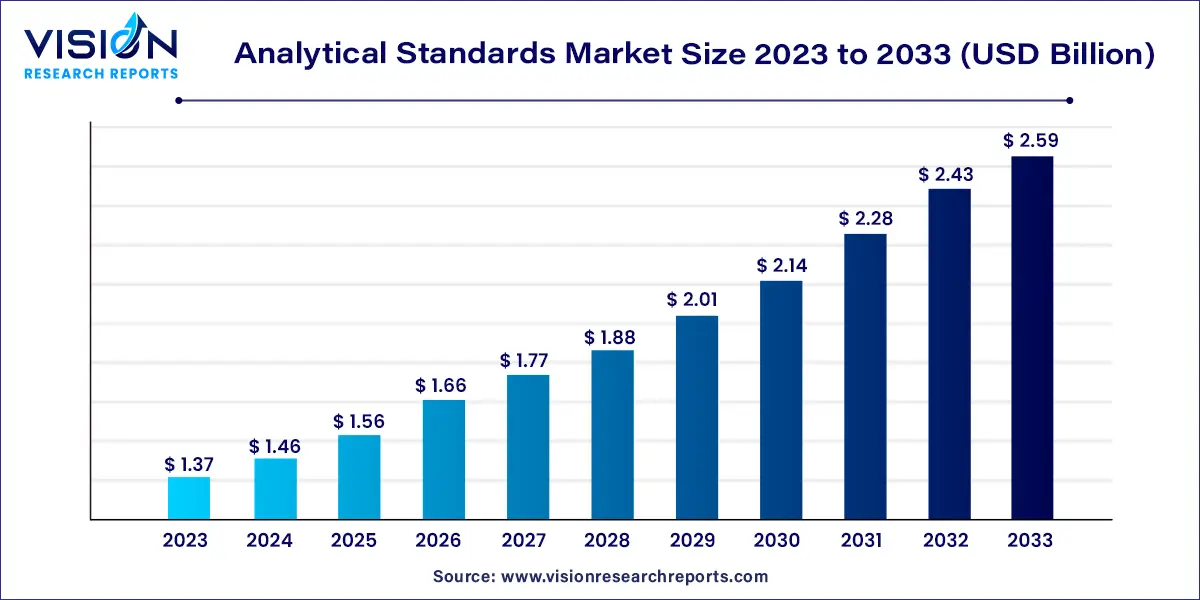

The global analytical standards market size was estimated at around USD 1.37 billion in 2023 and it is projected to hit around USD 2.59 billion by 2033, growing at a CAGR of 6.58% from 2024 to 2033. The growth of the market is linked to the growing demand for testing within the pharmaceuticals, environmental monitoring, and food and beverage industries.

The analytical standards market plays a pivotal role in ensuring the accuracy and reliability of analytical measurements across various industries. These standards serve as reference materials, allowing laboratories and researchers to calibrate and validate their instruments, ensuring the consistency and traceability of analytical results. This overview delves into the key aspects of the analytical standards market, highlighting its significance, major players, and emerging trends.

The growth of the analytical standards market is propelled by several key factors. Firstly, the escalating demand for precise and reliable analytical measurements across diverse industries, including pharmaceuticals, environmental monitoring, and clinical diagnostics, contributes significantly to market expansion. Stringent regulatory standards further drive the need for high-quality analytical standards, as compliance with these regulations is paramount for ensuring product safety and efficacy. The continuous advancement of analytical techniques, such as chromatography and spectroscopy, fuels market growth by necessitating the development of new and specialized analytical standards. Established market players like Merck KGaA, Agilent Technologies, Inc., Sigma-Aldrich (now part of MilliporeSigma), and Restek Corporation continue to innovate and collaborate, maintaining their dominance in the market. The emergence of trends like customized solutions to address specific industry challenges and the integration of digital technologies for enhanced data management and traceability further contribute to the dynamic growth of the analytical standards market.

In 2023, the spectroscopy segment emerged as the market leader, capturing the largest revenue share at 45%. This segment is poised to experience the swiftest Compound Annual Growth Rate (CAGR) throughout the forecast period. The surge in adoption of advanced spectroscopic techniques across pharmaceuticals, environmental testing, and food and beverage industries propels this growth. Particularly in pharmaceutical development, the demand for precise analysis is met through spectroscopy, playing a pivotal role in drug formulation and quality control. Notably, the pharmaceutical sector extensively employs high-performance liquid chromatography (HPLC) coupled with mass spectrometry for drug compound analysis, intensifying the need for certified reference materials (CRMs) to uphold analytical result accuracy and reliability.

Concurrently, the physical property testing segment anticipates substantial growth, driven by industries aspiring for higher product quality. Robust quality control and assurance measures, facilitated by physical property testing, are deemed essential to ensure materials and products adhere to specified standards, thus enabling companies to uphold consistency and reliability.

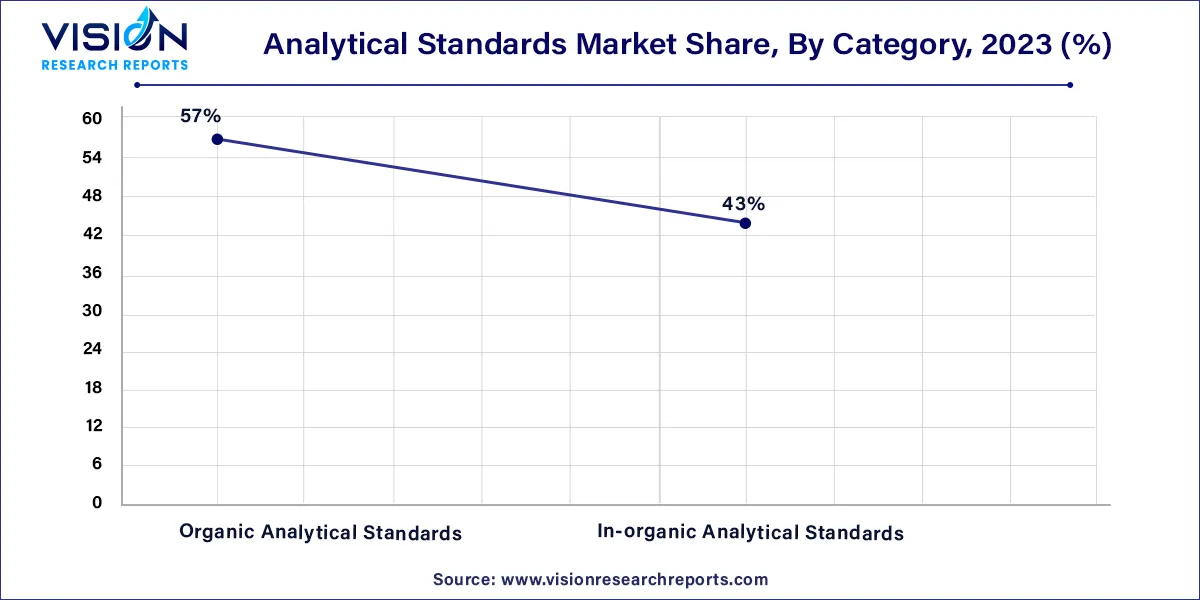

In 2023, the organic analytical standards segment emerged as the market leader, securing the largest revenue share at 57%. These standards are indispensable for ensuring the precision and dependability of analytical measurements across diverse industries, including pharmaceuticals, environmental testing, and the food and beverage sector. The growing complexity of organic compounds used in these industries serves as a significant driver for the heightened use of organic analytical standards. Notably, in the pharmaceutical sector, the development of new drug compounds necessitates meticulous analysis, thereby amplifying the demand for organic analytical standards to facilitate calibration and validation processes.

Furthermore, the escalating emphasis on environmental protection has spurred the requirement for organic analytical standards in analyzing pollutants and contaminants present in air, water, and soil. This trend is anticipated to persist, fostering sustained demand for organic analytical standards in the foreseeable future. Conversely, the inorganic analytical standards segment is poised to experience a stable Compound Annual Growth Rate (CAGR) throughout the forecast period.

In 2023, the pharmaceutical and life science segment took the lead in the market, securing the largest revenue share at 23%. Analytical standards play a pivotal role in the realm of pharmaceutical and life science research and development, ensuring the precision and reliability of measurements critical for drug development and testing. For instance, in the creation of a new drug, analytical standards are instrumental in gauging the purity and potency of the active pharmaceutical ingredient (API).

Concurrently, the food and beverage analysis segment anticipates a lucrative Compound Annual Growth Rate (CAGR) throughout the forecast period. The complexity of global food supply chains and the imperative for rigorous quality control have fueled a notable upswing in the demand for analytical standards within the food and beverage industry. Precise measurement and verification of ingredients, contaminants, and nutritional content are crucial to ensuring compliance with regulatory standards and meeting consumer expectations for safety and transparency, factors expected to drive increased demand in the years to come

In 2023, the bioanalytical testing segment emerged as the market leader, capturing the largest revenue share at 34%. This segment holds immense importance in drug development and pharmacokinetic studies, heavily relying on analytical standards to achieve accurate and reliable results. A key driver for utilizing analytical standards in bioanalytical testing is the imperative for consistent and reproducible measurements, ensuring the safety and efficacy of drugs. For instance, in pharmacokinetic studies, analytical standards play a vital role in calibrating instruments and validating methods for quantifying drugs and their metabolites in biological samples.

Concurrently, the stability testing segment is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This growth is fueled by regulatory requirements and the necessity to uphold product quality. In stability testing, analytical standards are employed to monitor drug degradation over time, involving the exposure of samples to various stress conditions and subsequent analysis using chromatography or spectroscopy. The rapid expansion of drug development and increasing regulatory demands are expected to drive significant growth in the stability testing segment.

In 2023, North America emerged as the dominant force in the market, securing a substantial revenue share of 44%. This leadership is attributed to various factors, including stringent regulatory requirements, technological advancements, and the presence of key market players. Regulatory bodies such as the FDA and EPA mandate the use of analytical standards to ensure the quality and safety of pharmaceuticals, food, and environmental samples. The region is also witnessing a surge in demand for more sophisticated analytical standards, driven by continuous technological advancements, especially in the development of high-performance analytical instruments.

Meanwhile, the Asia Pacific region is poised to experience the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is propelled by factors such as increasing industrialization, the burgeoning pharmaceutical and biotechnology industries, and a heightened focus on food safety and environmental monitoring. Significant opportunities for market expansion are evident, particularly in economically dynamic countries like China, India, and Japan, which are witnessing rapid economic growth and technological advancements.

By Category

By Technique

By Application

By Methodology

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Analytical Standards Market

5.1. COVID-19 Landscape: Analytical Standards Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Analytical Standards Market, By Category

8.1. Analytical Standards Market, by Category, 2024-2033

8.1.1. Organic Analytical Standards

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. In-organic Analytical Standards

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Analytical Standards Market, By Technique

9.1. Analytical Standards Market, by Technique, 2024-2033

9.1.1. Spectroscopy

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Chromatography

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Titrimetry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Physical Property Testing

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Analytical Standards Market, By Application

10.1. Analytical Standards Market, by Application, 2024-2033

10.1.1. Pharmaceutical and Life Science Analysis

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Environmental Analysis

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Food and Beverage Analysis

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Forensic Standards

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Petrochemical Analysis

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Veterinary Drug Analysis

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Analytical Standards Market, By Methodology

11.1. Analytical Standards Market, by Methodology, 2024-2033

11.1.1. Bioanalytical Testing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Stability Testing

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Raw Material Testing

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Dissolution testing

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Analytical Standards Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Category (2021-2033)

12.1.2. Market Revenue and Forecast, by Technique (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Category (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technique (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Category (2021-2033)

12.2.2. Market Revenue and Forecast, by Technique (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Category (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technique (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Category (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technique (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Category (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technique (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Category (2021-2033)

12.3.2. Market Revenue and Forecast, by Technique (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Category (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technique (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Category (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technique (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Category (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technique (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Category (2021-2033)

12.4.2. Market Revenue and Forecast, by Technique (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Category (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technique (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Category (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technique (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Category (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technique (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Category (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technique (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Methodology (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Category (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technique (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Methodology (2021-2033)

Chapter 13. Company Profiles

13.1. Merck KGaA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Waters Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Agilent Technologies, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Shimadzu Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PerkinElmer Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. LGC Limited

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Restek Corporation.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AccuStandard

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Cayman Chemical

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. RICCA Chemical Company

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others