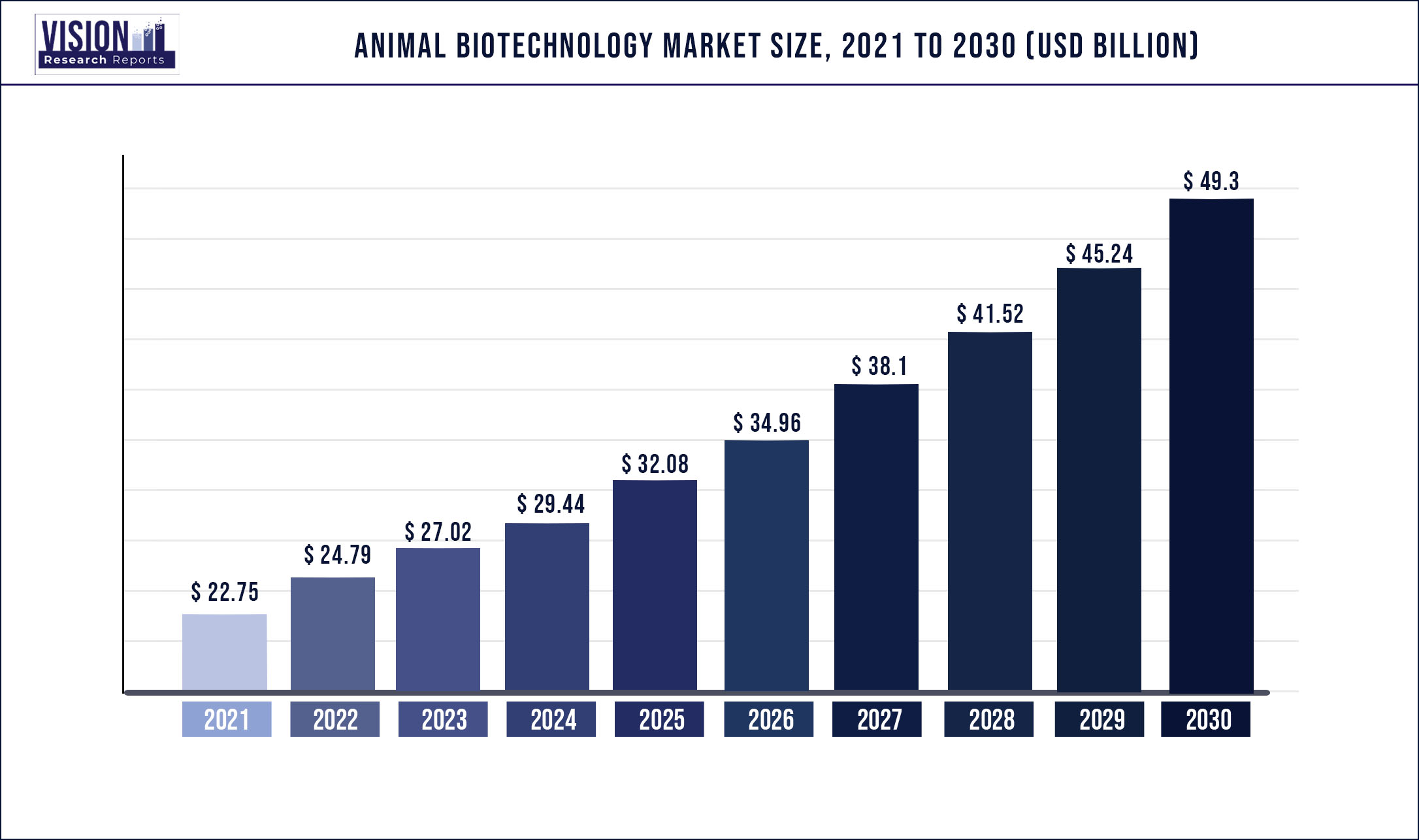

The global animal biotechnology market was surpassed at USD 22.75 billion in 2021 and is expected to hit around USD 49.3 billion by 2030, growing at a CAGR of 8.97% from 2022 to 2030

Report Highlights

The major growth factors are government initiatives and campaigns, innovations and recent advances in animal health biotechnology, growing initiatives to educate regarding animal genetic testing and rising incidence of zoonotic diseases. For instance, in January 2021, the governments of Canada and Ontario are providing up to $4 million through the Canadian Agricultural Partnership to offer farmers improved access to veterinary services when and where they require it.

Due to a rise in the prevalence of COVID-19 across the world, many nations stipulated that only emergency or urgent procedures are certainly necessary for veterinary healthcare. Delays in routine care such as vaccination have led to certain serious health and welfare problems. Moreover, an excess of work after the lifting of COVID-19 restrictions has created further delays in the delivery of such services. Veterinary visits and diagnostic testing were significantly reduced in March, April, and May 2020 but started improving from the third quarter of 2020 with a high growth rate.

Major players observed growth during the pandemic despite the restriction and supply chain disruption. Consolidated revenues of Neogen Corporation were USD 418.2 million in fiscal 2020, an upsurge of 1.0% compared to 2019. Moreover, in June 2022, India's first COVID-19 vaccine Anocovax for animals launched. Besides Anocovac, the Agriculture Minister of India unveiled the 'CAN-CoV-2 ELISA kit' -- specific nucleocapsid protein-based indirect ELISA kit -- for antibody detection against SARS-CoV-2 in canines. Thus, such developments promote overall market growth.

Other attributes contributing to the industry growth comprise improved demand for the usage of animals in agriculture, growing awareness of animal health and welfare, meat, and animal-based products, expanding role of animals in the development of pharmaceuticals for humans, growing pet adoption, and increasing R&D investments from market players. In August 2021, INDICAL BIOSCIENCE GmbH acquired the Check-Points, Dutch R&D-focused corporation.

The industry is highly competitive as major players are focusing on product innovation, new product developments, distribution agreements, and expansion strategies to improve their market penetration. In October 2021, Embark Veterinary, Inc. released its DNA test for purebred dogs. The kit offers purebred owners exclusive, actionable health information to assist in pinpoint diagnostic, treatment plans, and monitoring that can easily be shared with a veterinarian.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 22.75 billion |

| Revenue Forecast by 2030 | USD 49.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.97% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, application, animal type, end-use, region |

| Companies Covered | Zoetis; Boehringer Ingelheim International GmbH; Biogénesis Bagó; Merck & Co., Inc.; Virbac; Elanco; Idexx Laboratories; Heska Corporation; Indian Immunologicals Ltd.; HESTER BIOSCIENCES LIMITED |

Product Type Insights

The vaccines segment held the largest revenue share of over 25.08% in 2021. The growth of the vaccine segment is primarily attributed to the increasing burden of animal infections. These infections are naturally transmitted from animals to humans owing to contaminated food and water consumption or direct communication with infected humans or animals. Vaccination is an effective way to lower the disease burden in animals, and it plays an important role in preventive healthcare and disease control. Additionally, the increase in vaccine introductions for animals by the key market players is projected to drive the segment. In December 2021, Indian Immunologicals Ltd. introduced Goat Pox Vaccine (Raksha Goat Pox). Likewise, in May 2021, Boehringer Ingelheim India released its poultry vaccine VAXXITEK HVT+IBD. Such launches will lead to the increased adoption of vaccines, fueling segment growth.

The diagnostics tests segment is anticipated to witness exponential growth throughout the forecast period. The growth in this segment is attributed to factors, such as growing animal health expenditure, rising incidence of zoonotic diseases, increase in the number of veterinary practitioners, and increasing disposable income levels in developing territories. Besides, the overall market is determined by deeply understanding the demand for these products from veterinary hospitals, clinics, labs, etc., and increasing R&D investments from industry players. In August 2021, INDICAL BIOSCIENCE GmbH acquired the Check-Points, Dutch R&D-focused corporation. INDICAL is a global leader in the advancement of complete solutions for molecular and immunological veterinary testing.

Application Insights

The preventive care of animals segment held the largest revenue share of over 25.04% in 2021 due to the growing adoption of companion animals. The advent of pet parents as part of the pet humanization trend is a key revenue-generating trend in the market. Besides, an international survey by HABRI and Zoetis indicates a direct relationship between the human-animal bond and consistent veterinary care. The study including participants from the U.S., France, the U.K., Spain, Germany, Japan, Brazil, and China showed a clear global phenomenon of the improved bond between humans and pets, with 95% of respondents stating that they consider their pets to be a part of the family. Thus, such a human-animal bond advances better preventive care.

The drug development application is anticipated to witness exponential growth throughout the forecast period. Leveraging the monoclonal antibodies in animal health generated great potential to address unmet needs. For instance, in September 2021, Boehringer Ingelheim and Invetx announced that they have entered a collaboration agreement to develop innovative, species-specific monoclonal antibody biotherapeutics targeting a broad range of infections in the veterinary species, primarily focused on dogs and cats. This partnership will address Boehringer Ingelheim’s commitment to delivering unmet needs in the rapidly growing animal health biotechnology market.

Animal Type Insights

The livestock segment held the largest share of over 60.2% in 2021. Livestock is becoming increasingly vital in the growth of agriculture in developing nations. The contributions made by livestock to both agriculture and gross domestic product have risen in various nations. The demand for livestock products is a function of income in different parts of the world. The growing urban population and changes in diet and lifestyle are promoting growth in livestock production, thus contributing to the segment growth. Furthermore, government initiatives undertaken for livestock vaccinations promote market growth.

For instance, in June 2022, Indonesia launched a countrywide livestock vaccination program as the number of cattle affected with foot and mouth disease surged to more than 151,000. In the livestock segment, cattle held the largest revenue share in 2021. The U.S. is home to about 93.8 million cattle and calves as of 2020. The companion animal type segment is likely to grow lucratively during the forecast period owing to an increase in the demand for efficient animal care and the pet-human bond owing to the associated health benefits. Banfield Pet Hospital, in January 2021, confirmed a huge boom in U.S. pet ownership, thus supporting the segment growth.

End-use Insights

The veterinary hospitals and clinics segment held the largest revenue share of over 70.16% in 2021 and is anticipated to continue leading the market over the forecast period. The availability of a wide range of treatment and diagnostic options in veterinary hospitals and clinics is a high-impact rendering growth driver for this segment. An increase in the incidence of zoonotic diseases caused by globalization and climate changes is expected to drive the demand for diagnostic procedures, which is expected to drive the point-of-care testing/in-house testing segment in the coming years.

The others segment is expected to witness the fastest growth over the forecast period. Veterinary research institutes and universities are expected to grow at a lucrative rate over the forecast period. This can be attributed to the growing R&D funding to develop advanced diagnostic tools and therapeutically advanced vaccines and medicines. Research institutes are primarily responsible for the development of these diagnostics.

Regional Insights

North America accounted for the largest revenue share of over 30.3% in 2021 owing to the high animal awareness levels and improved healthcare infrastructure. The presence of healthcare programs and a rise in the number of initiatives to promote animal health are factors anticipated to increase the growth potential in this region. Moreover, high R&D spending in the region is anticipated to boost market growth in North America. In October 2021, Zoetis Inc. expanded its manufacturing and development facility in Tullamore, Ireland, which substantially expanded its capacity for producing veterinary monoclonal antibodies.

The Asia Pacific market is expected to witness the fastest growth over the forecast period. The rise in middle-class households, increased disposable income, acceptance of pet animals, new product launches, and high demand for animal proteins are some of the key factors expected to boost the growth of the market in the region. In June 2022, India's first COVID-19 vaccine Anocovax for animals unveiled. Besides Anocovac, the Agriculture Minister of India launched the 'CAN-CoV-2 ELISA kit' -- specific nucleocapsid protein-based indirect ELISA kit -- for antibody detection against SARS-CoV-2 in canines.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Animal Biotechnology Market

5.1. COVID-19 Landscape: Animal Biotechnology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Animal Biotechnology Market, By Product Type

8.1. Animal Biotechnology Market, by Product Type, 2022-2030

8.1.1. Diagnostics Tests

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Vaccines

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Drugs

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Reproductive and Genetic

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Feed Additives

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Animal Biotechnology Market, By Application

9.1. Animal Biotechnology Market, by Application e, 2022-2030

9.1.1. Diagnosis of Animal Diseases

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Treatment of Animal Diseases

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Preventive Care of Animals

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Drug Development

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Animal Biotechnology Market, By Animal Type

10.1. Animal Biotechnology Market, by Animal Type, 2022-2030

10.1.1. Companion

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Livestock

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Animal Biotechnology Market, By End-use

11.1. Animal Biotechnology Market, by End-use, 2022-2030

11.1.1. Laboratories

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Point-of-Care Testing/In-house Testing

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Veterinary Hospitals & Clinics

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Animal Biotechnology Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Zoetis

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Boehringer Ingelheim International GmbH

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Biogénesis Bagó

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Merck & Co., Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Virbac

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Elanco

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Idexx Laboratories

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Heska Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Indian Immunologicals Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. HESTER BIOSCIENCES LIMITED

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others