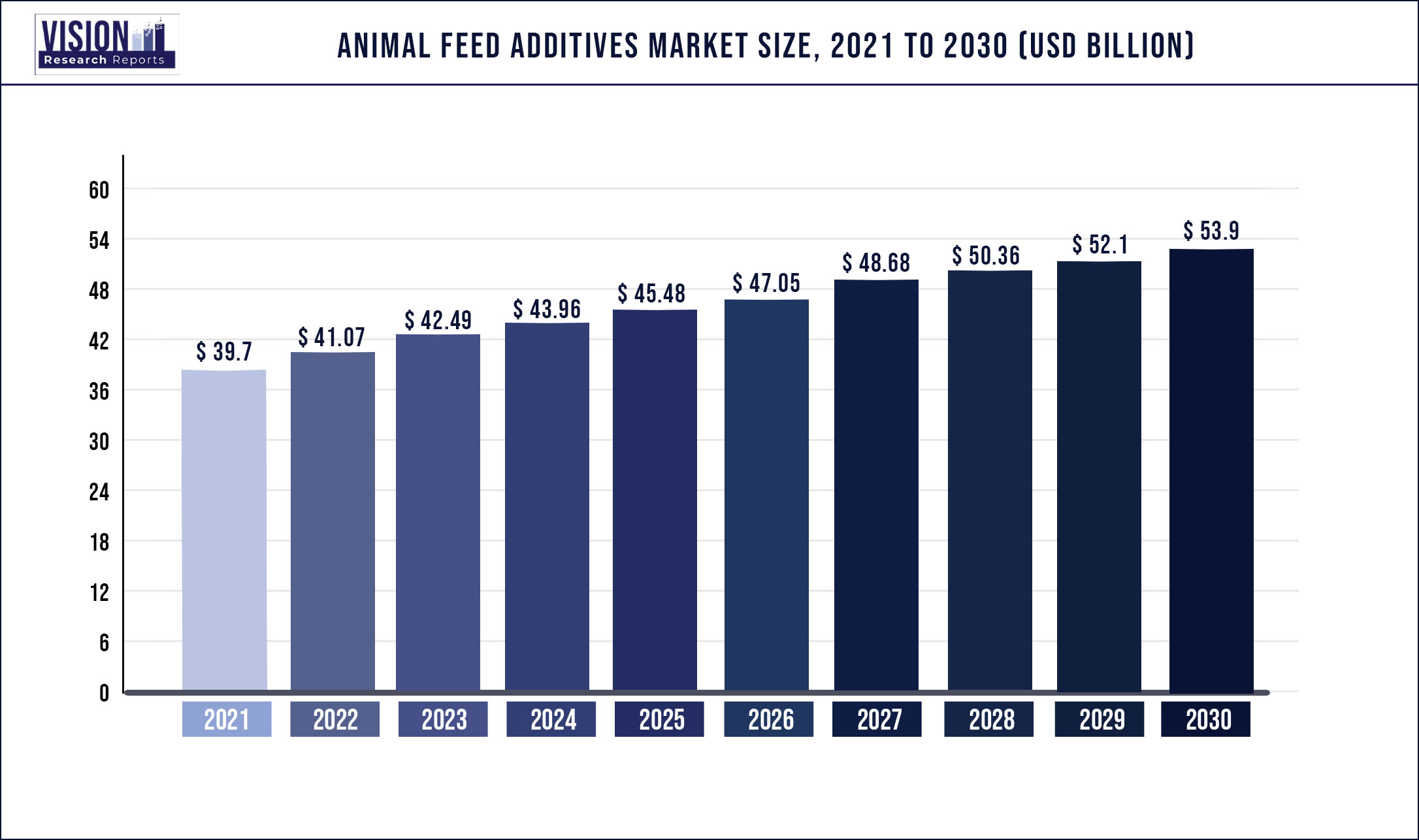

The global animal feed additives market size was estimated at around USD 39.7 billion in 2021 and it is projected to hit around USD 53.9 billion by 2030, growing at a CAGR of 3.46% from 2022 to 2030.

The growth is majorly driven by the increased consumption of meat and the rise in the livestock population worldwide.

Animal feed additives are types of supplements added to the feed which enhance the overall health, appearance, and body structure of the livestock. These additives make the livestock more desirable to the consumers and profitable for the cultivators. Generally utilized additives include vitamins, amino acids, enzymes, and antibiotics, among others. These additives are utilized extensively in the feed industry, especially for commercial purposes.

The demand for meat and other animal-based products directly affects the demand for additives. These additives are essential for supporting the global animal-based industries, which include the meat, poultry, milk, and milk products industries, among others. The use of these products in livestock diet is promoted for non-commercial uses, as they improve the overall health of the animals and enhance their growth and development.

Regions such as Europe and North America, where the consumption of meat is very high, serve as potentially major markets. The meat industry is highly dependent on the animal feed additives industry for optimum quality of meat. The growing population around the globe is also projected to surge the demand for meat and animal-based products, which will subsequently boost the market growth.

The recent COVID-19 pandemic adversely affected the market, due to labor shortages and disruptions in the supply chain. Although the market has shown an overall prompt recovery after the pandemic and has exhibited prolific growth in this period, and is anticipated to expand quickly during the forecast years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 39.7 billion |

| Revenue Forecast by 2030 | USD 53.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 3.46% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, livestock, region |

| Companies Covered | AFB International; Alltech; Kemin Industries, Inc.; Vitablend Asia Pacific Pte. Ltd.; Kalsec, Inc.; DSM; Ameri-Pac, Inc.; BASF SE; Evonik Industries AG; FoodSafe Technologies; Lallemand, Inc.; DuPont; Nutreco N.V.; Elanco; Biomin Holding GmbH; Adisseo France S.A.S.; Archer Daniels Midland; Penny Newman |

Product Insights

The amino acids segment dominated the animal feed additives market with a revenue share of over 34% in 2021. Its high share is attributable to the increasing demand for meat and the growing population of livestock globally. It supports the growth of livestock and thus is an essential component of animal feed.

Amino acids consist of properties that supplement the growth in animals and prevent them from diseases. They consist of lysine, methionine, and cysteine, among others. They are essential in protein synthesis and also prevent diseases like herpes in livestock. Such factors make amino acids very necessary to be used as an additive. A predominant lack of amino acids in livestock combined with mounting concerns about animal tissue breakdown is likely to drive the demand for amino acids during the forecast period.

The vitamin product segment accounts for the second-largest revenue share after amino acids. Vitamins are as essential for animal growth as they are for humans. The deficiency of vitamins may hinder the growth of animals and stop them from reaching their full potential.

The vitamins product segment includes different types of vitamins such as Vitamin A, B, C, D E, and others. They are added to animal feed to ensure the proper growth of the livestock, making them fit for end-use industries such as milk and milk-based products, meat, and others. The mounting demand from the meat and milk industry is likely to drive the market globally.

Livestock Insights

The poultry segment dominated the market with a revenue share of more than 37% in 2021. Its significant share is attributable to the increasing demand for poultry-based products such as meat and eggs across the globe. Poultry refers to ducks, chickens, geese, and other domestic birds which are bred for commercial as well as domestic purposes.

Animal feed additives increase the nutritional value of the feed given to poultry animals. Poultry animals are usually bred in captivity; therefore, they are likely to develop deficiencies. These additives ensure that the livestock does not develop any deficiencies and grow to their full potential. Maintaining the health of the livestock in the poultry industry is very critical, as diseased livestock may incur huge losses. Thus, poultry breeders use extra precautions for maintaining the health of the livestock by using appropriate feed additives such as enzymes, antioxidants, vitamins, and acidifiers, among others.

Another livestock segment that is highly demanded and holds a considerable share of the global revenue is pork or swine. Pork meat is extensively consumed, especially in the western hemisphere. It is used to make varied delicacies around the globe, more particularly in cold regions.

Majorly used pork feed additives include antimicrobials, antioxidants, binders, emulsifiers, enzymes, and pH control agents. These additives help in driving high efficiency, productivity, and profitability in the meat industry. The pigs which are bred for meat are fed the pork feed with additives to attain the desired results and increase the profit of the breeders.

Regional Insights

The Asia Pacific region dominated the market with a revenue share of more than 33% in 2021. This high share is attributed to the growing consumption of meat in the region, the constantly rising population, increased purchasing power of the people, and a large presence of livestock breeders in the region.

There is a presence of a large number of animal breeders in the region, who require high-quality additives for feed formulation. The rise in purchasing power of the people and upliftment in the living standards in the region has resulted in the increased consumption of meat, which directly impacts the regional demand for animal feed additives.

Furthermore, Europe is the largest consumer of meat globally, which consequently impacts the demand for animal feed additives in the region. The high demand for meat in the region is a fundamental reason that is anticipated to drive the market for animal feed additives in this region during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Animal Feed Additives Market

5.1. COVID-19 Landscape: Animal Feed Additives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Animal Feed Additives Market, By Product

8.1. Animal Feed Additives Market, by Product, 2022-2030

8.1.1. Antibiotics

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Vitamins

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Antioxidants

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Amino Acids

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Feed Enzymes

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Feed Acidifiers

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Animal Feed Additives Market, By Livestock

9.1. Animal Feed Additives Market, by Livestock, 2022-2030

9.1.1. Pork/Swine

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Poultry

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Cattle

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Aquaculture

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Animal Feed Additives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Livestock (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Livestock (2017-2030)

Chapter 11. Company Profiles

11.1. AFB International

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Alltech

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kemin Industries, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Vitablend Asia Pacific Pte. Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Kalsec, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DSM

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Ameri-Pac, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. BASF SE

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Evonik Industries AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. FoodSafe Technologies

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others