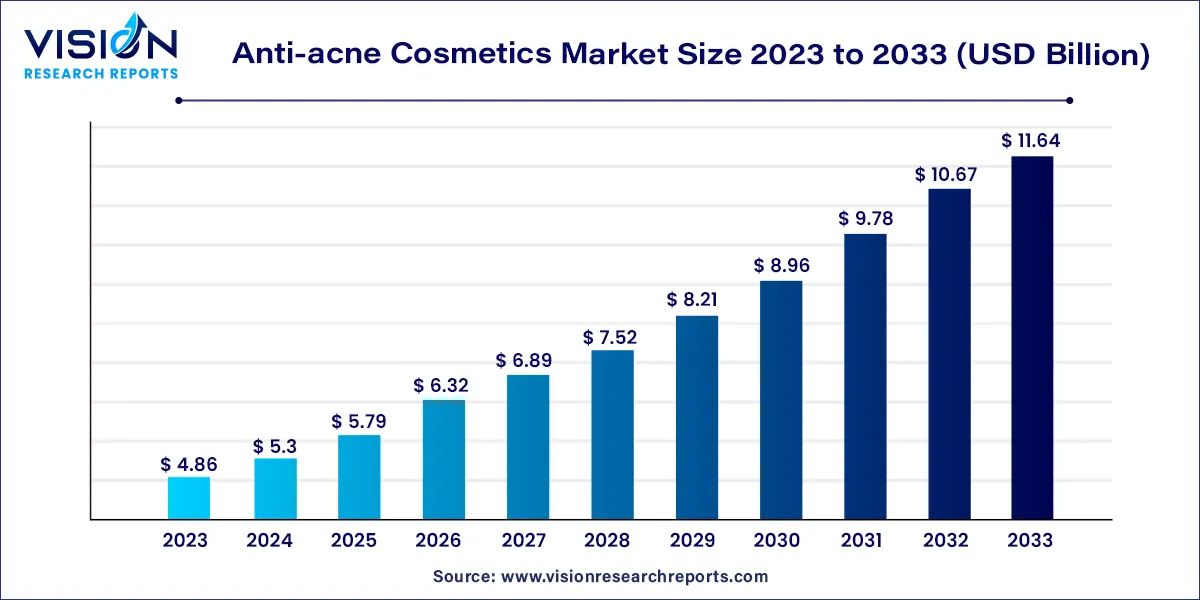

The global anti-acne cosmetics market was estimated at USD 4.86 billion in 2023 and it is expected to surpass around USD 11.64 billion by 2033, poised to grow at a CAGR of 9.13% from 2024 to 2033.

The anti-acne cosmetics market has emerged as a dynamic segment within the beauty and skincare industry, propelled by rising consumer awareness about skincare concerns and a growing demand for effective solutions. This overview explores the key factors driving the growth of the anti-acne cosmetics market, including market trends, product innovations, consumer preferences, and industry challenges.

The growth of the anti-acne cosmetics market is fueled by several key factors. Firstly, increasing awareness about skincare and the desire for clear, blemish-free skin drive demand for effective acne management solutions. Consumers are actively seeking products that not only treat existing acne but also prevent future breakouts, leading to a surge in the adoption of anti-acne cosmetics. Additionally, advancements in formulation technologies and ingredient science have resulted in the development of innovative products with enhanced efficacy and safety profiles. The growing preference for natural and organic skincare solutions further propels market growth, as consumers seek gentle yet effective alternatives to traditional acne treatments. Moreover, the rise of social media influencers and online beauty communities amplifies product visibility and consumer education, driving further market expansion. Overall, these factors converge to create a conducive environment for the continued growth and evolution of the anti-acne cosmetics market.

Rise in Demand for Natural and Organic Products:

Innovation in Ingredients:

Advent of Technologically Advanced Solutions:

Customization and Personalization:

Influence of Social Media and Influencers:

Focus on Holistic Approach to Skincare:

The creams & lotions segment accounted for the maximum share of 42% of the overall revenue in 2023 and is expected to expand at the fastest CAGR of 9.73% over the forecast period, owing to the high demand by both men and women, as moisturizing creams and body lotions protect the skin from bacteria and skin infections, such as psoriasis and eczema. Many times, these creams and lotions are produced in medicated form. They may contain Active Pharmaceutical Ingredients (API), vitamins like vitamin A, medications like antibiotics for acne caused due to bacterial infection, etc.

On the basis of product type, the global market is sub-segmented into masks, creams & lotions, cleansers & toners, and others. The other segment includes products such as face wash, gels, serums, and essential oils. These products help unclog the pores and reduce inflammation, as acne is characterized by clogging and inflammation. These products are available in various types based on ingredients and their usage. For instance, in March 2023, Galderma launched TWYNEO cream in the U.S. which contains 3% benzoyl peroxide (BPO) & 0.1% tretinoin 2-in-1 combination to treat all types of acne.

The women anti-acne cosmetics segment dominated the global market in 2023 with a 53% share in terms of revenue and is expected to expand at the fastest CAGR of 9.32% over the forecast period. On the basis of gender, the global market has been bifurcated into women and men. The growth of the women segment can be attributed to the high prevalence of acne among the female population globally. Acne is more prevalent in women than men after adolescence, since it is linked to hormone changes, such as the menstrual cycle.

According to a survey by Annals of International Medical and Dental Research, around 9.4% of the global population is believed to experience acne, with adolescents being the most affected group. The burden of acne vulgaris-related conditions is spread worldwide and has shown an increasing prevalence among adolescents. Furthermore, an expanding body of epidemiological evidence indicates that acne also impacts a significant number of adults, with adult women being more commonly affected by acne than men.

The medspa segment held the highest market share of around 64% in 2023. The segment is also anticipated to showcase the highest growth over the forecast period. This is due to the fact that Medspa provides aesthetic treatments under the supervision of a licensed medical practitioner. Medspas currently use innovative, cutting-edge technology and products to provide clinical treatments that are in line with modern medicine. Currently, the millennial population is the largest target demographic for medical-grade skincare brands.

According to the American Med Spa Association, the U.S. Medspa industry revenue has had a double-digit growth since 2010, and a majority of the Medspa patients are between the ages of 35-54 years. In 2018, the Association also stated that the emergence of large medical spa chains, including Orange Twist, Beverly Hills Rejuvenation Centre, and Kalologie 360 is expected to further boost the market growth in the country.

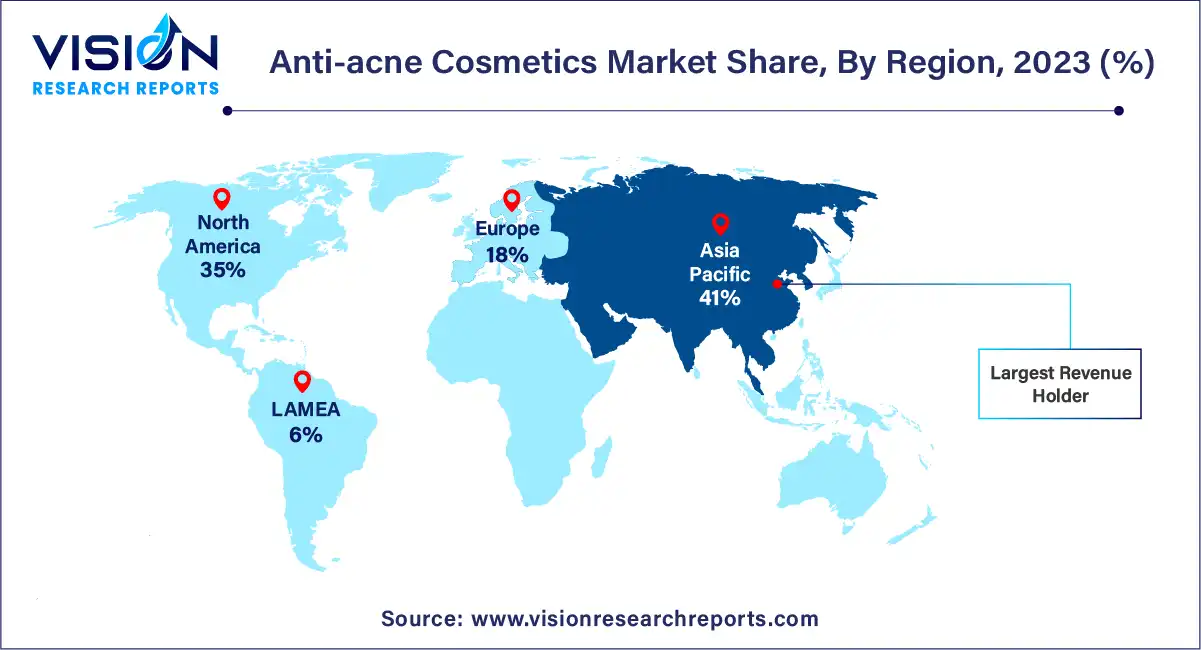

Asia Pacific dominated the market in 2023 with a revenue share of more than 41% and is assessed to witness strong growth over the projection period. Asia Pacific is the largest potential export market for U.S.-based products owing to over 3 billion potential consumers of anti-acne cosmetic products. A study conducted by JAMA Dermatology stated that in Westernized societies, such as the U.S., acne is a universal skin disease afflicting 79 to 95% of the adolescent population.

Economies, such as Australia, Japan, and South Korea are some of the largest consumers of well-established U.S.-based products. For instance, in 2021, Galderma Korea launched a new acne treatment Aklief to treat torso and facial acne, after successful clinical trials. Aklief showed positive results by reducing inflammatory lesions in an effective time period.

By Product Type

By Gender

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others