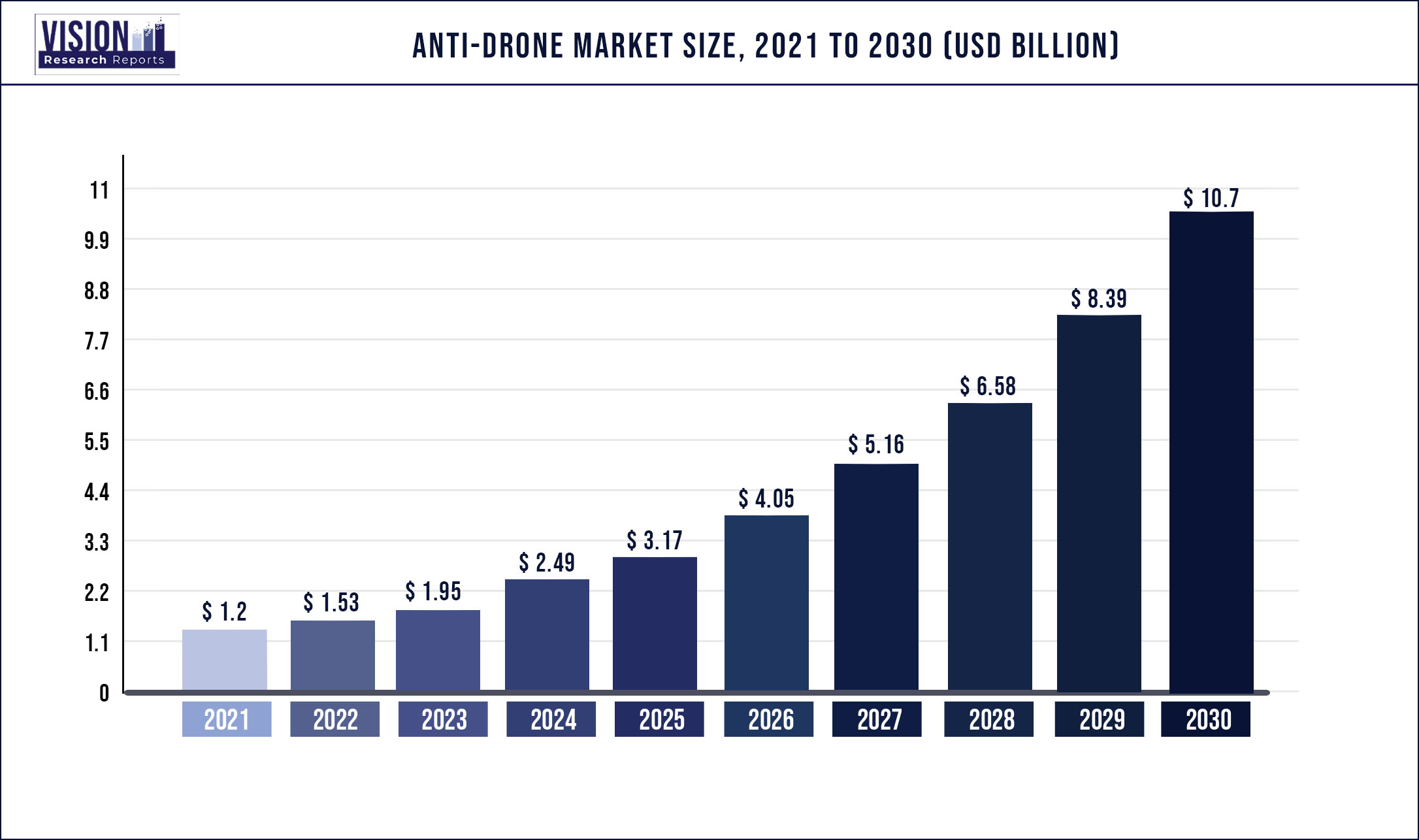

The global Anti-drone market was surpassed at USD 1.2 billion in 2021 and is expected to hit around USD 10.7 billion by 2030, growing at a CAGR of 26.39% from 2022 to 2030.

The use of drones is getting more normal which increases the risk of security and privacy. These threats are faced by both civilians and military personnel as drones can be remotely operated and even unauthorized unmanned vehicles.

Sensitive military areas require anti-drone systems to protect them from any terrorism or illegal activities. The ease of access of small-sized drones has caused a significant increase in the market investment for the anti-drone equipments.

The sale of remote-controlled drones is legal based on location; however there are many strict no-fly zones which the common public is unaware of. However, the threat for spy-attacks and other type of attacks is higher for the regular public, military and government.

The anti-drone market helps governments identify, locate, and destroy illegal drones either via software or direct launches. Government institutions, private enterprises, and military forces are the major clients of the anti-drone market. This market is also responsible for assisting the government in various public safety operations.

The anti-drone market uses a combination of modern technology and hardware in their product offerings. For instance, in October 2021, U.S. Homeland Security struck a deal with Drone Shield Ltd., and purchased drones with on the move attack technology from them. It has also been observed that the military also invest a large amount of money in the research and development of anti-drone systems making them a significant part of the anti-drone market.

The North American region generated the largest market share for the anti-drone market in 2021 as a direct result of the heavy investment in military and defense. It has been observed that multiple start-ups are providing custom and out of the box solutions in the anti-drone market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.2 billion |

| Revenue Forecast by 2030 | USD 10.7billion |

| Growth rate from 2022 to 2030 | CAGR of 26.39% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Mitigation type, defense type, end use, region |

| Companies Covered |

Advanced Radar Technologies S.A.; Airbus Group SE; Blighter Surveillance Systems; Dedrone; DeTech Inc.; Drone shield LLC; Enterprise Control Systems; Israel Aerospace Industries Ltd. (IAI); Lit eye Systems, Inc.; Lockheed Martin Corporation; Orelia; Prime Consulting and technologies; Raytheon Company; Saab Ab; Selex Es Inc.; Thales Group; The Boeing Company |

Mitigation Type Insights

The destructive system segment accounted for the largest share of 91.4% 2021 and is expected to grow the market during the forecast period. The growth is due to a large budget allotment to the laser system, a sub-segment in the destructive system, during the forecast period. The destructive segment is further divided into electronic countermeasure, missile effectors, and laser system.

These systems destroy essential parts of the drone airframe through force, causing it to crash to the ground. In addition, some low-power lasers are intended to destroy electro-optical (EO) sensors located in the target area, thus disrupting UAV operation.

The electronic countermeasure segment is predicted to grow at a CAGR of 31.2% from 2022 to 2030. Drones are emerging and small in size due to advances in technology and drone technology. Therefore, there has been a steady increase in the use of small drones over the years. Therefore, several companies work in production. Compact counter-drones will improve the market size of anti-drone throughout the forecast period.

Counter-UAV systems that use electronic resistance measures often include a powerful microwave and electromagnetic weapons designed to transmit strong magnetic signals. When aimed towards unauthorized UAVs, these robust signals block data transfer between the operator and the gadget, shuttering drone operations overall.

Defense Type Insights

The detection and disruption segment captured the largest revenue share of 68.0% in 2021. This segment is likely to dominate the anti-drone market throughout the forecast period. The detection and disruption defence measure is used primarily to identify, classify and detect UAV’s. After the identification, classification and detection, the UAV’s can undergo neutralization to counter the unauthorized drones.

The step for countering a potential attack is by equipping monitoring apparatuses which not only distinguishes drones from other aerial objects like airplanes and birds but also can identify the type and model for drone to alert security and deploy countermeasures.

The detection system segment is predicted to grow at a CAGR of 29.3% from 2022 to 2030. The detection systems include various techniques for detecting and identifying drones, including radar reflectance, the emergence of a particular photon, and resulting magnetic field, as well as the acoustic and electromagnetic emissions. These programs reflect growing demand due to the increasing number of security breaches worldwide.

Leading counter-drone technology providers and system manufacturers offer a wide range of tracking, diagnostic equipment and professional detection, to meet this growing need. These tools include acoustic sensors, perimeter detection and monitoring radars, video and infrared systems, and RF spectrum analysers.

End-User Insights

The military and defence segment captured the largest revenue share of 58.5% in 2021, and this segment is likely to dominate the Anti-drone market throughout the forecast period. The sharp rise in illegal and terrorist activities worldwide, such as unlawful smuggling and border crossings, is expected to further adoption of anti-UAV programs between the international security forces. Increased costs in R&D by leading defence contractors, coupled with augmented use of anti-drone programs by various military forces to protect the invaders, are the factors expected to play a significant role in the growth of the military and defence segment.

The commercial segment is predicted to grow at a CAGR of 31.9% from 2022 to 2030. The growing demand for counter-UAV technology in various commercial areas, including airports, prisons, live events, and critical infrastructure, is expected to allow the adoption of such programs in all of these areas. Many busy airports worldwide are increasingly using a variety of air defence systems to protect their commercial trade aircraft from dangerous collisions with unauthorised flying objects like drones.

The cost of upgrading anti-drone systems is very high. Parts used in these systems, such as laser, radar, and advanced electrical appliances, are expensive, and hence it is difficult for the producers to reduce the overall cost of the system. Due to the high cost, these systems are not able to be used for the commercial applications such as public and home spaces, which affect the demand for it.

Regional Insights

The North America segment accounted for the largest revenue share of 45.3% in 2021. This segment is likely to dominate the Anti-drone market during the forecast period. The aviation and defence sector, particularly in the U.S., is observing an increase in the adoption of drone technology. The Federal Aviation Administration (FAA) of the U.S. has been testing different UAS technologies at various airports during the past few years; hence demand for the product is growing.

In addition, the U.S. Army, along with other members of the North Atlantic Treaty Organization (NATO), was using these programs in war-torn areas of Syria and Afghanistan, leading to an increase in product sales across the region.

Asia Pacific is expected to grow at a CAGR of 32.1% from 2022 to 2030. This growth can be attributed to an increase in funding from the government for the development of aviation and defence infrastructure in different countries, majorly China and India. Numerous institutions and companies across the region, including China National Nuclear Corporation, the Beijing Institute of Technology, and Nova Sky, are forming partnerships to focus on R&D to counter UAS technology, which enhances regional market size.

In addition, Asia pacific is a region with major political conflicts; hence countries in the region constantly try to keep their security systems and forces up to date. For instance, China has a political dispute with India plus its many bordering nations, and hence the nation has started to strengthen its forces and defence infrastructure.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Anti-drone Market

5.1. COVID-19 Landscape: Anti-drone Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Anti-drone Market, By Mitigation Type

8.1. Anti-drone Market, by Mitigation Type, 2022-2030

8.1.1 Destructive System

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Non-destructive System

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Anti-drone Market, By Defence Type

9.1. Anti-drone Market, by Defence Type, 2022-2030

9.1.1. Drone Detection & Disruption Systems

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Drone Detection Systems

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Anti-drone Market, By End-Use

10.1. Anti-drone Market, by End-Use, 2022-2030

10.1.1. Military & Defence

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Government

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Anti-drone Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.2.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.3.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Mitigation Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Defence Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

Chapter 12. Company Profiles

12.1. Advanced Radar Technologies S.A.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Airbus Group SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Blighter Surveillance Systems

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dedrone

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. DeTect, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Drone shield LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Enterprise Control Systems

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Israel Aerospace Industries Ltd. (IAI)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Lit eye Systems, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lockheed Martin Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Orelia

12. 11.1. Company Overview

12. 11.2. Product Offerings

12. 11.3. Financial Performance

12. 11.4. Recent Initiatives

12.12. Prime Consulting and technologies

12.12.1. Company Overview

12. 12.2. Product Offerings

12. 12.3. Financial Performance

12. 12.4. Recent Initiatives

12.13. Raytheon Company

12. 13.1. Company Overview

12. 13.2. Product Offerings

12. 13.3. Financial Performance

12. 13.4. Recent Initiatives

12.14. Saab Ab

12. 14.1. Company Overview

12. 14.2. Product Offerings

12.10.3. Financial Performance

12. 14.4. Recent Initiatives

12.15. Selex Es Inc.

12.15.1. Company Overview

12. 15.2. Product Offerings

12. 15.3. Financial Performance

12. 15.4. Recent Initiatives

12.16. Thales Group

12. 16.1. Company Overview

12. 16.2. Product Offerings

12. 16.3. Financial Performance

12. 16.4. Recent Initiatives

12.17. The Boeing Company

12. 17.1. Company Overview

12. 17.2. Product Offerings

12. 17.3. Financial Performance

12. 17.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others