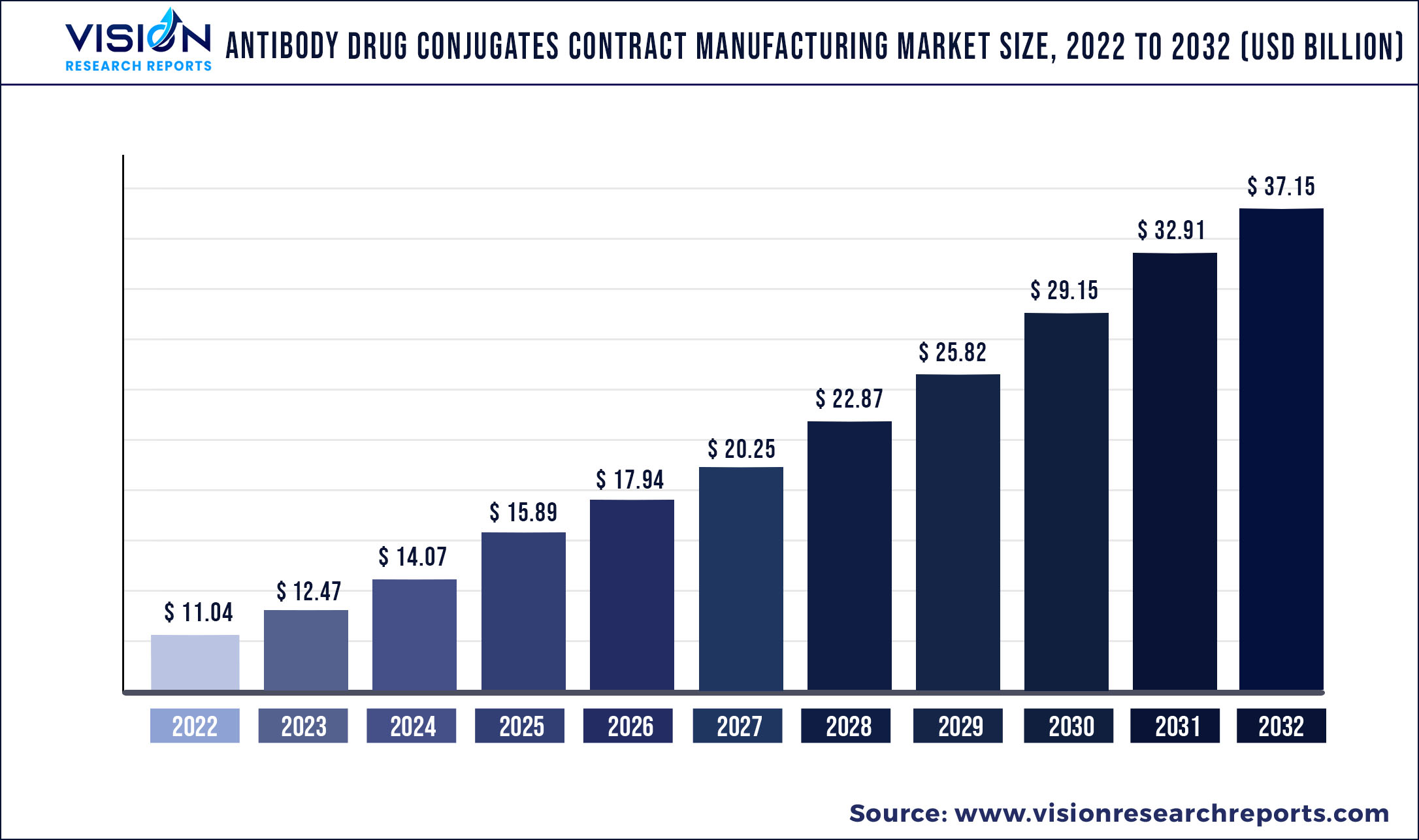

The global antibody drug conjugates contract manufacturing market was valued at USD 11.04 billion in 2022 and it is predicted to surpass around USD 37.15 billion by 2032 with a CAGR of 12.9% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 11.04 billion |

| Revenue Forecast by 2032 | USD 37.15 billion |

| Growth rate from 2023 to 2032 | CAGR of 12.9% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Sterling; Recipharm AB; Lonza; Catalent, Inc.; Sartorius AG; Wuxi Biologics; Samsung BioLogics; Piramal Group (Piramal Pharma Solutions); Abbvie, Inc. (Abbvie Contract Manufacturing); Merck KGaA |

The industry is anticipated to witness significant growth over the forecast period on account of the increasing prevalence of cancer, rising demand for biologic therapy, and the challenges associated with antibody drug conjugate (ADC) manufacturing, which contribute to the demand for contract manufacturing. During Q1 and Q2 of 2020, due to the global COVID-19 pandemic, the supply chain was disrupted due to stay-at-home orders by governments across the globe to control the spread of the virus.

Due to these reasons, manufacturing organizations were working with reduced capacity. This hampered the industry's growth slightly. However, beginning in Q3, manufacturing operations were resumed, and many companies implemented strategies, such as expansions to improve their ADC manufacturing capacities. Such actions benefited the industry in 2020. The cases of cancer are rising steadily. This is likely to boost the demand for potential ADCs for cancer treatment in the coming years.

Many cancer medicines have toxicities that cause substantial side effects, thus, limiting the dosage and efficacy of these medications is placing a significant burden on patients. An ADC can help reduce some of these complications. ADCs enable the delivery of a particular medication dosage to a specific site of interest. They are most often used in oncology when a large medication dosage is required at the tumor site but not in nearby tissue. These factors are supporting the demand for ADC for cancer treatment and thus contribute to its demand for contract manufacturing. Manufacturing ADC is a complicated process, and owing to this, biopharmaceutical companies are partnering with Contract Manufacturing Organizations (CMOs).

CMOs have technical knowledge in conjugation and linker creation, as well as in solid platforms. Collaborating with CMOs decreases the time for ADCs to reach the market since they can handle all stages, such as conjugation, scale-up, commercial production, and ADC fill-finish operations, saving time in scheduling and testing. Moreover, ADC CMOs are constantly trying to improve their bioconjugation and manufacturing capabilities to provide their clients with high-quality ADCs. For instance, in October 2022, CMO Lonza partnered with the biotechnology company, Singzyme.

As per the partnership, Lonza could use Singzyme’s enzymatic conjugation platform for developing ADC more efficiently. Such collaborations are expected to improve the demand for ADC CMO activities and hence support industry growth. According to the European Pharmaceutical Review (EPR), as of 2021, over 14 ADCs were commercially approved globally. The EPR also states that over 140 ADCs are currently under development. This is expected to create opportunities for manufacturing ADCs post-pandemic and, thus, support market growth.

antibody drug conjugates contract manufacturing Market Segmentations:

| By Condition | By Linker |

|

Myeloma Lymphoma Breast Cancer Others (Urothelial Cancer) |

Cleavable Linker Non-cleavable Linker |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antibody Drug Conjugates Contract Manufacturing Market

5.1. COVID-19 Landscape: Antibody Drug Conjugates Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antibody Drug Conjugates Contract Manufacturing Market, By Condition

8.1. Antibody Drug Conjugates Contract Manufacturing Market, by Condition, 2023-2032

8.1.1. Myeloma

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Lymphoma

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Breast Cancer

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. Others (Urothelial Cancer)

8.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 9. Global Antibody Drug Conjugates Contract Manufacturing Market, By Linker

9.1. Antibody Drug Conjugates Contract Manufacturing Market, by Linker, 2023-2032

9.1.1. Cleavable Linker

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Non-cleavable Linker

9.1.2.1. Market Revenue and Forecast (2019-2032)

Chapter 10. Global Antibody Drug Conjugates Contract Manufacturing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Condition (2019-2032)

10.1.2. Market Revenue and Forecast, by Linker (2019-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.1.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.1.4.2. Market Revenue and Forecast, by Linker (2019-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Condition (2019-2032)

10.2.2. Market Revenue and Forecast, by Linker (2019-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.2.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.2.4.2. Market Revenue and Forecast, by Linker (2019-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Condition (2019-2032)

10.2.5.2. Market Revenue and Forecast, by Linker (2019-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Condition (2019-2032)

10.2.6.2. Market Revenue and Forecast, by Linker (2019-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.3.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.3.4.2. Market Revenue and Forecast, by Linker (2019-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Condition (2019-2032)

10.3.5.2. Market Revenue and Forecast, by Linker (2019-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Condition (2019-2032)

10.3.6.2. Market Revenue and Forecast, by Linker (2019-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.4.2. Market Revenue and Forecast, by Linker (2019-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.4.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.4.4.2. Market Revenue and Forecast, by Linker (2019-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Condition (2019-2032)

10.4.5.2. Market Revenue and Forecast, by Linker (2019-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Condition (2019-2032)

10.4.6.2. Market Revenue and Forecast, by Linker (2019-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Condition (2019-2032)

10.5.2. Market Revenue and Forecast, by Linker (2019-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Condition (2019-2032)

10.5.3.2. Market Revenue and Forecast, by Linker (2019-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Condition (2019-2032)

10.5.4.2. Market Revenue and Forecast, by Linker (2019-2032)

Chapter 11. Company Profiles

11.1. Sterling

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Recipharm AB

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Lonza

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Catalent, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sartorius AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Wuxi Biologics

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Samsung BioLogics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Piramal Group (Piramal Pharma Solutions)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Abbvie, Inc. (Abbvie Contract Manufacturing)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Merck KGaA

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others