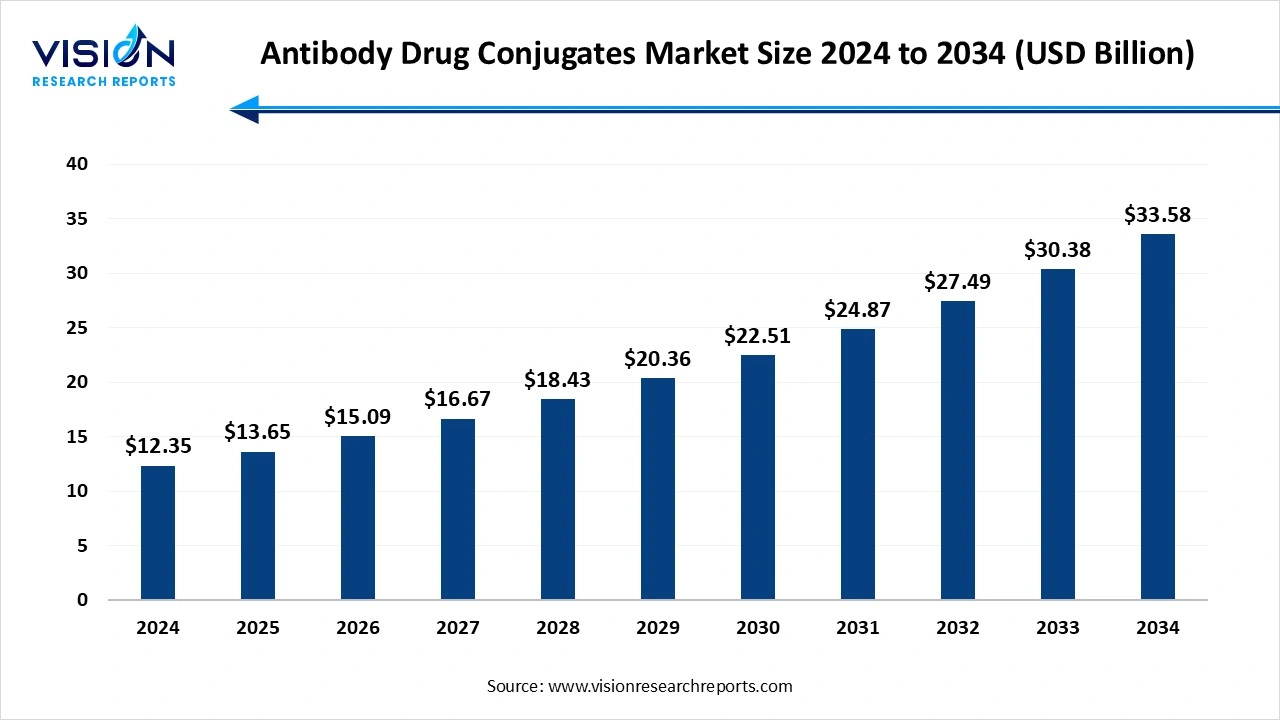

The global antibody drug conjugates market size stood at USD 12.35 billion in 2024 and is estimated to reach USD 13.65 billion in 2025. It is projected to hit USD 33.58 billion by 2034, registering a robust CAGR of 10.52% from 2025 to 2034.

The global Antibody Drug Conjugates (ADCs) market is witnessing robust growth driven by advancements in targeted cancer therapies and the rising prevalence of various malignancies. ADCs are an innovative class of biopharmaceutical drugs that combine the specificity of monoclonal antibodies with the potency of cytotoxic agents, enabling precise delivery of drugs to cancer cells while minimizing damage to healthy tissues. Increasing research and development activities, along with growing approvals of new ADC products, are fueling market expansion.

The antibody drug conjugates (ADCs) market is experiencing robust growth, propelled by an increasing incidence of cancer worldwide underscores the urgent need for innovative treatment options, driving the demand for ADC therapies. Secondly, continuous advancements in biotechnology, including antibody engineering and payload design, have resulted in the development of next-generation ADCs with enhanced efficacy and safety profiles. Additionally, strategic collaborations between pharmaceutical companies and research institutions facilitate the accelerated development and commercialization of novel ADC candidates. Moreover, regulatory approvals for new ADC therapies by authorities such as the FDA and EMA have expanded market opportunities and improved patient access to these innovative treatments. Lastly, the growing acceptance of ADCs in clinical practice, coupled with reimbursement support, further fuels market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.35 Billion |

| Revenue Forecast by 2034 | USD 33.58 Billion |

| Growth rate from 2025 to 2034 | CAGR of 10.52% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

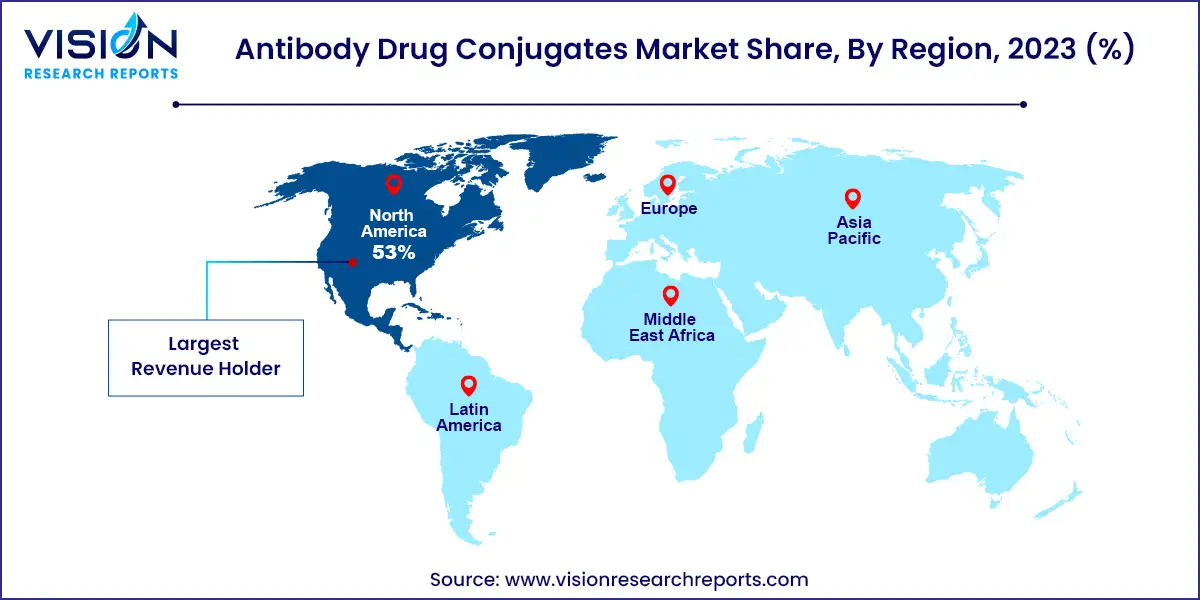

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Seagen, Inc., Takeda Pharmaceutical Company Ltd., AstraZeneca, F. Hoffmann-La Roche Ltd., Pfizer, Inc., Gilead Sciences, Inc., Daiichi Sankyo Company Ltd., GlaxoSmithKline Plc, Astellas Pharma, Inc., and ADC Therapeutics SA. |

In 2024, the North America antibody drug conjugate market held the largest revenue share at 41%. The market's growth is fueled by heightened awareness about ADCs among healthcare professionals and favorable reimbursement policies. Over the forecast period, North America is poised to experience significant growth, driven by increased awareness of current treatment therapies, favorable reimbursement policies, substantial R&D investment, and improved patient affordability. Key players operating in this region include Seagen, Inc.; F. Hoffmann La-Roche Ltd.; Gilead Sciences Inc.; and Pfizer Inc.

Meanwhile, the Asia Pacific antibody drug conjugate market is anticipated to witness significant growth over the forecast period, fueled by the presence of emerging economies, increasing investments in the biotechnology sector, improving government initiatives, and the rapidly growing clinical research and outsourcing markets. Additionally, enhancements in healthcare facilities and R&D in drug development are expected to further propel market growth in the region

In 2024, the breast cancer segment took the lead in the market, holding a significant revenue share of 41%. This was primarily driven by various factors including the increasing incidence of breast cancer, the promising pipeline of products, and the widespread adoption of Kadcyla. Noteworthy products approved for breast cancer treatment include Trodelvy, Enhertu, and Kadcyla. The recent label expansion of Kadcyla to encompass early breast cancer patients, along with the recent approvals of Enhertu and Trodelvy, are anticipated to further propel the growth of this segment. Conversely, the blood cancer segment is poised to exhibit a high Compound Annual Growth Rate (CAGR) from 2024 to 2030.

Blood cancer ranks as the fifth most common cancer globally and stands as the second leading cause of cancer-related deaths. According to data from the National Foundation of Cancer Research, approximately 186,400 new cases of leukemia, lymphoma, and myeloma were diagnosed in the United States alone in 2022. Furthermore, market growth in this segment is expected to be fueled by the approval of multiple products throughout the forecast period. For instance, the introduction of Polivy in October 2019 for treating diffuse large B-cell lymphoma (DLBCL) is indicative of the advancements driving market expansion in the blood cancer arena.

In 2024, the Kadcyla segment emerged as the frontrunner in the ADC space, boasting the highest revenue. The surge in breast cancer cases, coupled with increased approvals for ADCs tailored specifically for breast cancer treatment, has been instrumental in driving the market's upward trajectory. A significant milestone was achieved when F. Hoffmann-La Roche Ltd. secured approval for Kadcyla in China's rapidly expanding industry in January 2022, marking a pivotal development.

A strategic maneuver was observed with Kadcyla in 2023, as Roche implemented a strategic price reduction of over 50% for the drug in China. This bold move aimed to capture a larger market share through competitive pricing. Notably, China, once Roche's 10th largest market, has now ascended to the second position. Roche's decision to adjust prices strategically underscores the dynamic shift in its market approach, aligning with the evolving landscape in China.

Enhertu stands out as one of the fastest-growing segments over the forecast period. Developed by DAIICHI SANKYO COMPANY, LIMITED. and AstraZeneca, Enhertu has experienced a surge in sales projections following recent approvals. Particularly noteworthy is its groundbreaking approval for HER2-low breast cancer in August 2022, marking an industry-first achievement. During a recent earnings call, Daiichi emphasized Enhertu's swift adoption in this new indication, catering to patients with tumors previously classified as HER2-negative. Additionally, since its launch for second-line HER2-positive breast cancer in May 2022, Enhertu has outperformed competitors, securing the largest share of new patients.

In 2024, the HER2 (human epidermal growth factor receptor 2) target type segment emerged as the leader in market share. HER2 holds pivotal significance, particularly in breast cancer treatment, where its overexpression is common. ADCs engineered to target HER2 function by delivering potent drugs directly to cancer cells, thereby minimizing damage to healthy cells and enhancing therapeutic efficacy. With high adoption rates attributed to such factors, the HER2 segment asserted its dominance in the industry.

The CD22 target segment stands out as one of the fastest-growing segments over the forecast period. This segment is notable for its widespread adoption in cancer therapy, particularly in leukemia indications, making it the fastest-growing niche within the space. The increasing demand for CD22-targeted therapies in leukemia is driven by their demonstrated efficacy and limited side effects, rendering them a preferred choice among healthcare professionals and patients alike.

In 2024, the cleavable linker segment dominated the market, accounting for the largest revenue share at 68%. Cleavable linkers are favored for their ability to maintain stability in the bloodstream for extended periods and facilitate the controlled release of cytotoxins from ADCs, thereby enhancing the effectiveness of ADCs in cancer treatment. For example, Seagen’s and Takeda’s Adcetris, approved by the NMPA in 2020 for treating relapsed Hodgkin's lymphoma and relapsed systemic anaplastic large cell lymphoma sALCL in China, exemplifies the efficacy of cleavable linkers. Such factors are expected to drive further growth in the cleavable linker segment.

Following closely, the non-cleavable linker segment emerged as the second-largest revenue generator in 2023, primarily due to the increased usage of Kadcyla, which incorporates a non-cleavable linker. Non-cleavable linkers are utilized in the production of ADCs that rely on lysosomal degradation, preventing nonspecific drug release and reducing overall cytotoxicity to surrounding healthy cells. This characteristic is anticipated to fuel growth in the segment. Currently, FDA-approved ADCs such as Kadcyla and Blenrep utilize non-cleavable linkers for binding the antibody and cytotoxic molecule.

Regarding payloads, these cytotoxic agents play a vital role in killing target cancer cells. Various payloads are available in the market, including microtubule inhibitors (such as Vinorelbine, Paclitaxel, Epothilone B, Tubulysins), DNA cleavers (like Bleomycin A2), Akt inhibitors (such as GDC-0068), DNA intercalators (including Doxorubicin hydrochloride, Epirubicin hydrochloride, Duocarmycins, PBD dimers), and MMAF & MMAE. For instance, Blenrep (belantamab mafodotin-blmf) developed by GlaxoSmithKline Plc., employs MMAF, protease linker, and anti-CD38 monoclonal antibody to target cells in adult patients with relapsed multiple myeloma.

By Application

By Product

By Target

By Technology

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antibody Drug Conjugates Market

5.1. COVID-19 Landscape: Antibody Drug Conjugates Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antibody Drug Conjugates Market, By Application

8.1. Antibody Drug Conjugates Market, by Application,

8.1.1. Blood Cancer

8.1.1.1. Market Revenue and Forecast

8.1.2. Breast Cancer

8.1.2.1. Market Revenue and Forecast

8.1.3. Urothelial Cancer & Bladder Cancer

8.1.3.1. Market Revenue and Forecast

8.1.4. Other Cancer

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Antibody Drug Conjugates Market, By Product

9.1. Antibody Drug Conjugates Market, by Product,

9.1.1. Kadcyla

9.1.1.1. Market Revenue and Forecast

9.1.2. Enhertu

9.1.2.1. Market Revenue and Forecast

9.1.3. Adcetris

9.1.3.1. Market Revenue and Forecast

9.1.4. Padcev

9.1.4.1. Market Revenue and Forecast

9.1.5. Trodelvy

9.1.5.1. Market Revenue and Forecast

9.1.6. Polivy

9.1.6.1. Market Revenue and Forecast

9.1.7. Others

9.1.7.1. Market Revenue and Forecast

Chapter 10. Global Antibody Drug Conjugates Market, By Target

10.1. Antibody Drug Conjugates Market, by Target,

10.1.1. HER2

10.1.1.1. Market Revenue and Forecast

10.1.2. CD22

10.1.2.1. Market Revenue and Forecast

10.1.3. CD30

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Antibody Drug Conjugates Market, By Technology

11.1. Antibody Drug Conjugates Market, by Technology,

11.1.1. Type

11.1.1.1. Market Revenue and Forecast

11.1.2. Linker Technology Type

11.1.2.1. Market Revenue and Forecast

11.1.3. Payload Technology

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Antibody Drug Conjugates Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Application

12.1.2. Market Revenue and Forecast, by Product

12.1.3. Market Revenue and Forecast, by Target

12.1.4. Market Revenue and Forecast, by Technology

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Application

12.1.5.2. Market Revenue and Forecast, by Product

12.1.5.3. Market Revenue and Forecast, by Target

12.1.5.4. Market Revenue and Forecast, by Technology

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Application

12.1.6.2. Market Revenue and Forecast, by Product

12.1.6.3. Market Revenue and Forecast, by Target

12.1.6.4. Market Revenue and Forecast, by Technology

12.2. Europe

12.2.1. Market Revenue and Forecast, by Application

12.2.2. Market Revenue and Forecast, by Product

12.2.3. Market Revenue and Forecast, by Target

12.2.4. Market Revenue and Forecast, by Technology

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Application

12.2.5.2. Market Revenue and Forecast, by Product

12.2.5.3. Market Revenue and Forecast, by Target

12.2.5.4. Market Revenue and Forecast, by Technology

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Application

12.2.6.2. Market Revenue and Forecast, by Product

12.2.6.3. Market Revenue and Forecast, by Target

12.2.6.4. Market Revenue and Forecast, by Technology

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Application

12.2.7.2. Market Revenue and Forecast, by Product

12.2.7.3. Market Revenue and Forecast, by Target

12.2.7.4. Market Revenue and Forecast, by Technology

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Application

12.2.8.2. Market Revenue and Forecast, by Product

12.2.8.3. Market Revenue and Forecast, by Target

12.2.8.4. Market Revenue and Forecast, by Technology

12.3. APAC

12.3.1. Market Revenue and Forecast, by Application

12.3.2. Market Revenue and Forecast, by Product

12.3.3. Market Revenue and Forecast, by Target

12.3.4. Market Revenue and Forecast, by Technology

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Application

12.3.5.2. Market Revenue and Forecast, by Product

12.3.5.3. Market Revenue and Forecast, by Target

12.3.5.4. Market Revenue and Forecast, by Technology

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Application

12.3.6.2. Market Revenue and Forecast, by Product

12.3.6.3. Market Revenue and Forecast, by Target

12.3.6.4. Market Revenue and Forecast, by Technology

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Application

12.3.7.2. Market Revenue and Forecast, by Product

12.3.7.3. Market Revenue and Forecast, by Target

12.3.7.4. Market Revenue and Forecast, by Technology

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Application

12.3.8.2. Market Revenue and Forecast, by Product

12.3.8.3. Market Revenue and Forecast, by Target

12.3.8.4. Market Revenue and Forecast, by Technology

12.4. MEA

12.4.1. Market Revenue and Forecast, by Application

12.4.2. Market Revenue and Forecast, by Product

12.4.3. Market Revenue and Forecast, by Target

12.4.4. Market Revenue and Forecast, by Technology

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Application

12.4.5.2. Market Revenue and Forecast, by Product

12.4.5.3. Market Revenue and Forecast, by Target

12.4.5.4. Market Revenue and Forecast, by Technology

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Application

12.4.6.2. Market Revenue and Forecast, by Product

12.4.6.3. Market Revenue and Forecast, by Target

12.4.6.4. Market Revenue and Forecast, by Technology

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Application

12.4.7.2. Market Revenue and Forecast, by Product

12.4.7.3. Market Revenue and Forecast, by Target

12.4.7.4. Market Revenue and Forecast, by Technology

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Application

12.4.8.2. Market Revenue and Forecast, by Product

12.4.8.3. Market Revenue and Forecast, by Target

12.4.8.4. Market Revenue and Forecast, by Technology

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Application

12.5.2. Market Revenue and Forecast, by Product

12.5.3. Market Revenue and Forecast, by Target

12.5.4. Market Revenue and Forecast, by Technology

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Application

12.5.5.2. Market Revenue and Forecast, by Product

12.5.5.3. Market Revenue and Forecast, by Target

12.5.5.4. Market Revenue and Forecast, by Technology

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Application

12.5.6.2. Market Revenue and Forecast, by Product

12.5.6.3. Market Revenue and Forecast, by Target

12.5.6.4. Market Revenue and Forecast, by Technology

Chapter 13. Company Profiles

13.1. Seagen, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Takeda Pharmaceutical Company Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. AstraZeneca

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Pfizer, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Gilead Sciences, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Daiichi Sankyo Company Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. GlaxoSmithKline Plc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Astellas Pharma, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. ADC Therapeutics SA

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others