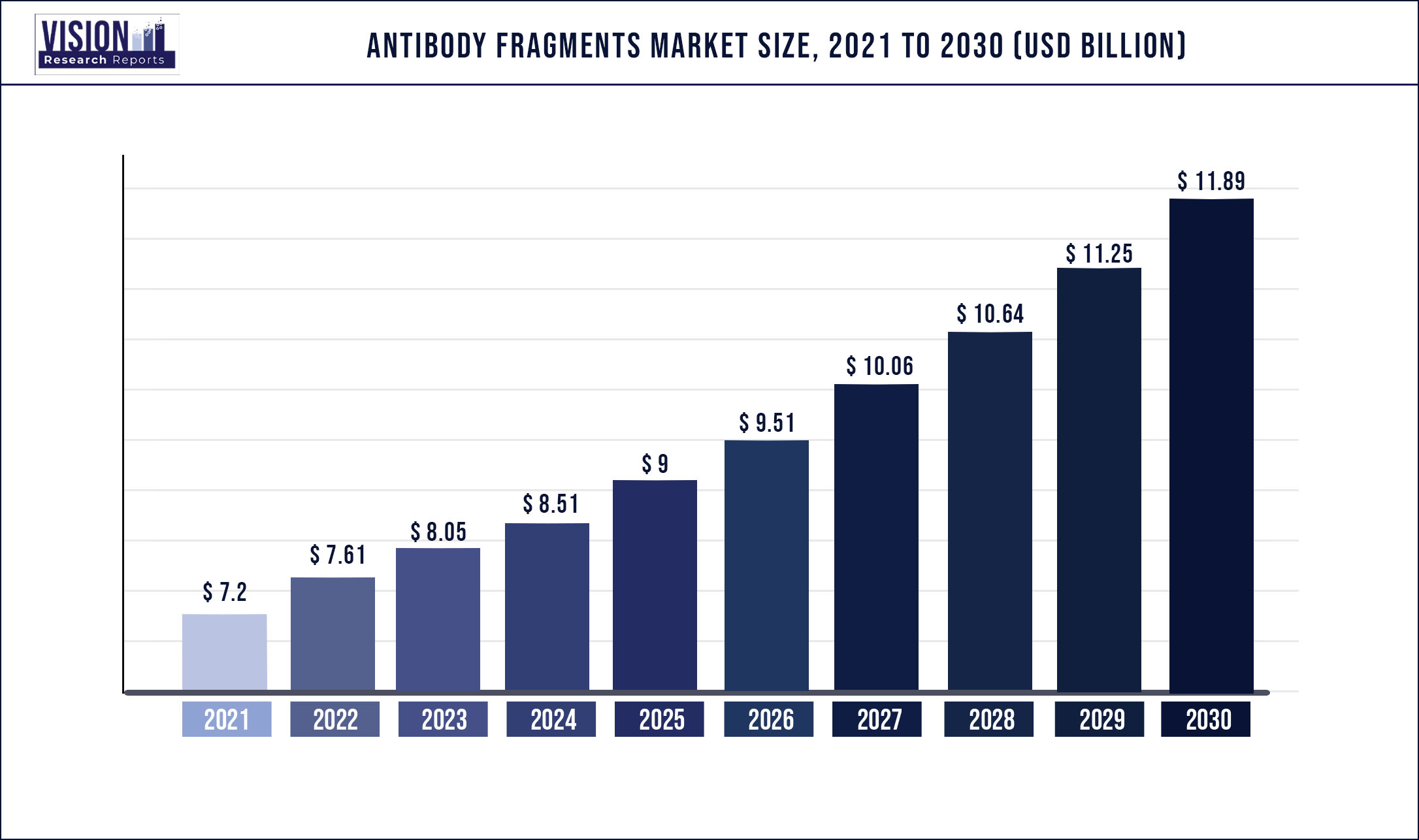

The global antibody fragments market was estimated at USD 7.2 billion in 2021 and it is expected to surpass around USD 11.89 billion by 2030, poised to grow at a CAGR of 5.73% from 2022 to 2030.

Report Highlights

There has been a steady increase in chronic conditions across the globe owing to the increasing geriatric population and societal behavior changes. The expediting urbanization is leading to the growth of the middle class resulting in people adopting a more sedentary and unhealthier lifestyle, in turn, causing an increase in diseases such as diabetes. The emerging markets are predicted to hold the largest patient burden owing to the significant population growth.

Furthermore, growing investments by the key market players have contributed to the industry growth. For instance, in June 2020, Vanderbilt University Medical Center collaborated with AstraZeneca to advance the company’s coronavirus-neutralizing antibodies into clinical development as a possible combination therapy for the treatment and prevention of COVID-19. These factors would drive the market in the coming years.

Antibodies are an important tool for molecular and protein detection. Even though whole antibodies are preferable for most immunoassay applications, the performance for some experiments is only enhanced by antibody fragments, such as F(ab')2 and Fab. Monoclonal antibodies are a significant class of therapeutic drugs that have received approval to treat various cancers. With more than 80 antibodies already approved for use in various disease indications, these antibodies represent the largest class of biopharmaceuticals. The introduction of smaller, antigen-binding antibody fragments has been growing at a fast pace, which is impacting the industry positively.

Antibody fragments are also anticipated to be preferred over full-chain antibodies due to their lower manufacturing and purification costs. The use of antibody fragments for the treatment of a specific disease may be constrained by strict ICD-10 rules. However, the new advancements in the clinical development of antibody fragments for serious diseases may offer significant market growth opportunities.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.2 billion |

| Revenue Forecast by 2030 | USD 11.89 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.73% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Specificity, type, therapy, application, region |

| Companies Covered |

Pfizer Inc.; Ablynx; Novartis AG; Genentech, Inc.; AbbVie Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Private Limited; Lilly |

Specificity Insights

The monoclonal antibodies segment captured the largest revenue share of over 95.05% in 2021. Monoclonal antibodies (mAbs) are considered a significant class of therapeutic agents recommended in the therapy of several forms of malignancies. However, the applications of conventional mAbs may also encounter various limitations in anticancer immunotherapies such as adverse effects and insufficient efficacy. The application of antibody fragments for cancer therapy has gained wider recognition than any other therapeutic application.

However, its application to develop pharmacological tools for the treatment of autoimmune diseases and infectious diseases has been increasing expeditiously. For instance, in March 2019, researchers from the University of Utah Health started their research on disabling the specific immune cell sets that cause stress in inflammatory diseases, while maintaining the integrity of healthy immune cells to allow them to carry out their tasks.

Polyclonal antibodies (pAbs) have high specificity and flexibility and are much better than monoclonal antibodies for clinical applications. pAbs are secreted by different B-cell clones, therefore its heterogenous nature allows them to bind with several epitopes of an antigen. As the antibodies are mostly used as reagents, most of the manufacturers produce pAbs. However, since pAbs antibody reagents are inconsistent in nature, researchers have had difficulty using them since it interferes with their research studies. These are some of the factors that might limit the use of polyclonal antibodies, hence hindering the expansion of the market as a whole.

Type Insights

The FAB segment captured the largest revenue share of over 85.16% in 2021 as it is the first generation of antibody fragments. The increasing prevalence of cancer, infectious diseases, and autoimmune diseases has created a high demand for F(ab) fragments, thus fueling segment growth. Also, the approval and launch of novel therapies to facilitate the treatment of life-threatening diseases are expected to support segment growth. However, the market share is anticipated to decline over time with the introduction of the second and third-generation molecules of antibody fragments since the quality of molecules is increasing.

Single chain variable fragments (scFvs) are anticipated to register the fastest growth rate over the forecast period. They provide several advantages such as heterologous production, multivalency, low molecular weight, and multimeric form over the mAb. It is used for various medical applications, including bioimaging and targeted therapy. The scFv phage display antibody technology has become one of the most popular methods for developing recombinant antibodies. These factors are contributing to segment growth.

Therapy Insights

The monoclonal antibodies segment led the market and held a revenue share of over 95.22% in 2021. The Ranibizumab (Lucentis) segment captured the largest revenue share in 2021. Ranibizumab is a monoclonal antibody fragment that is produced in E.coli cells by recombinant DNA technology. In the pharmaceutical sector, it is present in the form of injection wherein it is used for the treatment of visual impairment due to diabetic macular edema, neovascular (wet) age-related macular degeneration (AMD), proliferative diabetic retinopathy (PDR), and others. Several academies and companies are working to understand the challenges and seek opportunities that could influence Ranibizumab R&D.

Beovu (brolucizumab-dbll) is anticipated to witness the fastest growth over the forecast period. It is a monoclonal single-chain Fv antibody fragment used for ophthalmic intravitreal injection. Moreover, in June 2022, the FDA approved Beovu (brolucizumab-dbl) to be used for the treatment of patients suffering from diabetic macular edema (DME). Advancements in this segment are anticipated to drive the market in the coming years.

Application Insights

The immunodeficiency segment held the largest revenue share of over 85.17% in 2021 owing to the increasing prevalence of the disease globally. According to the National Organization for Rare Disorders (NORD), this disease affects around 200,000 Americans. Furthermore, increasing partnerships and collaborations for the development of novel therapies for immunocompromised patients are anticipated to support segment growth. For instance, in January 2020, Adaptimmune Therapeutics plc, a clinical-stage biopharmaceutical company, entered into a partnership agreement with Astellas Pharma Inc., a Japanese pharmaceutical company, to develop and commercialize TCR T cell therapies and stem-cell-derived allogeneic chimeric antigen receptor (CAR)-T to treat a huge patient population suffering from immunodeficiency induced from several forms of cancers, including solid tumors.

The cancer segment is expected to witness the fastest growth during the forecast period. The high prevalence of cancer globally is one of the major factors contributing to the growth of the market over the forecast period. The American Cancer Society estimated that in 2022, around 1.9 million new cases of cancer are to be reported in the U.S., and around 609,360 deaths are to be witnessed due to cancer. According to a report published by the International Agency for Research on Cancer, around 1 in 6 women and 1 in 5 men can develop cancer during their lifetime. Thus, such a high incidence of cancer is anticipated to boost the adoption of novel and efficient cancer diagnostic and therapeutic methods.

The others segment including chronic diseases such as age-related macular degeneration (AMD) and infectious diseases such as HIV/AIDS and influenza is anticipated to witness significant growth in the coming years. Moreover, key market players are engaged in developing antibody fragments for eye disorders that are in preclinical and clinical development stages. For instance, Lampalizumab, a Fab developed by Roche for geographic atrophy, is an advanced form of age-related macular degeneration (AMD).

Regional Insights

North America dominated the market in 2021 with a revenue share of over 50.03% owing to the expansion of the regional pharmaceutical industries leading to the rising demand for antibody fragments. Moreover, the increasing prevalence of immunodeficiency diseases and cancer has led to the increasing demand for antibody fragments for research purposes.

Asia Pacific is anticipated to witness significant growth over the forecast period owing to the developing medical tourism market. India and China are anticipated to dominate the market owing to the growing focus on the biologics manufacturing sector. For instance, in May 2020, The Centre for Cellular and Molecular Biology and the University of Hyderabad entered into a collaboration with Vins Bioproducts Ltd. to develop immunotherapy based on antibody fragments that provide immediate treatment for COVID-19.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antibody Fragments Market

5.1. COVID-19 Landscape: Antibody Fragments Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antibody Fragments Market, By Specificity

8.1. Antibody Fragments Market, by Specificity, 2022-2030

8.1.1. Monoclonal Antibodies

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Polyclonal Antibodies

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Antibody Fragments Market, By Type

9.1. Antibody Fragments Market, by Type, 2022-2030

9.1.1. FAB

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. scFv

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. sdAb

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Antibody Fragments Market, By Therapy

10.1. Antibody Fragments Market, by Therapy, 2022-2030

10.1.1. Monoclonal Antibodies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. PAB

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Pipeline

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Antibody Fragments Market, By Application

11.1. Antibody Fragments Market, by Application, 2022-2030

11.1.1. Cancer

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Immunodeficiency

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Antibody Fragments Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.1.2. Market Revenue and Forecast, by Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.1.4. Market Revenue and Forecast, by Application (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.2.2. Market Revenue and Forecast, by Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.2.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.3.2. Market Revenue and Forecast, by Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.3.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.4.2. Market Revenue and Forecast, by Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.4.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Specificity (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Therapy (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

Chapter 13. Company Profiles

13.1. Pfizer Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Albynx

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Novartis AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Genentech, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. AbbVie Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Bristol-Myers Squibb Company

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Johnson & Johnson Private Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Lilly

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others