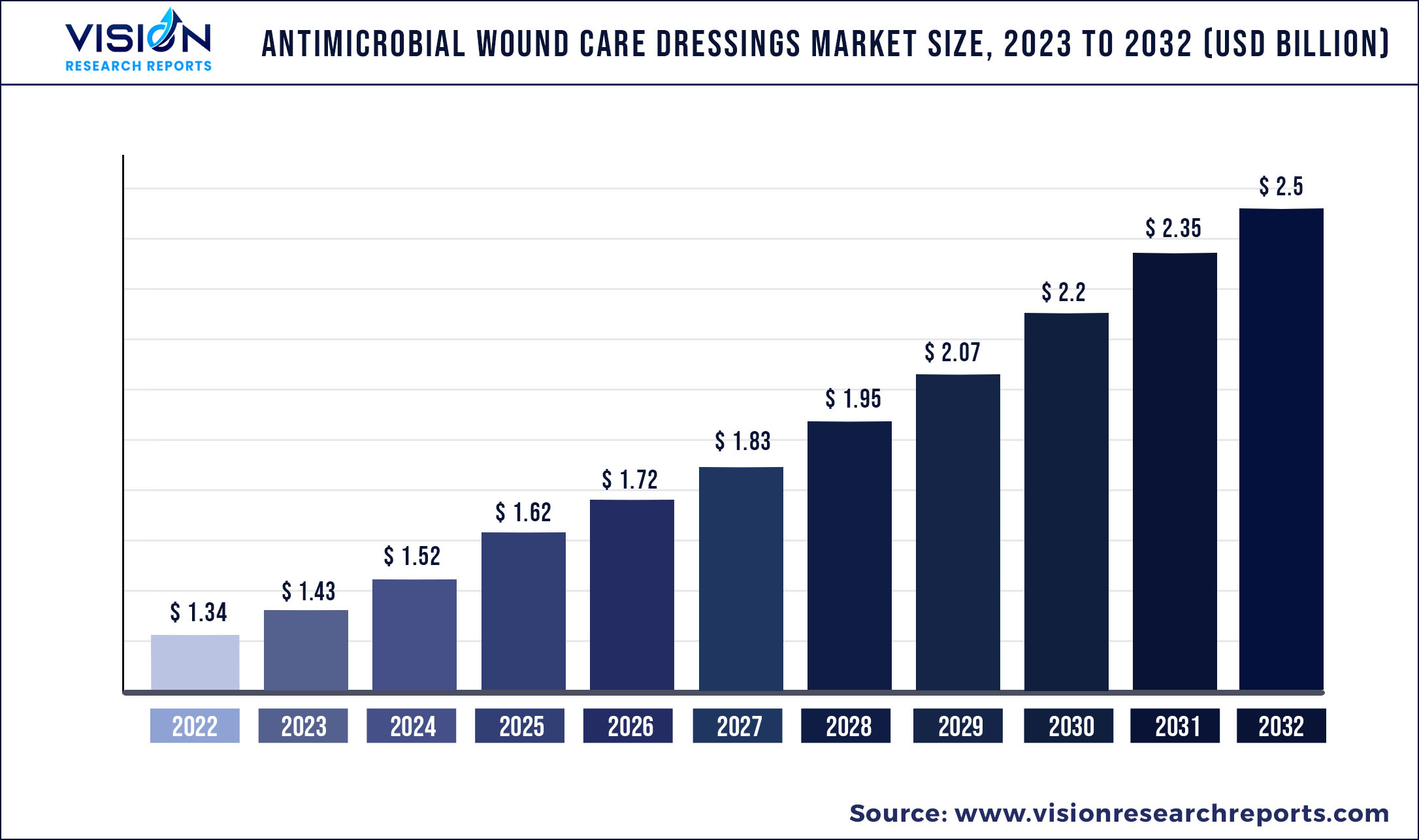

The global antimicrobial wound care dressings market size was estimated at around USD 1.34 billion in 2022 and it is projected to hit around USD 2.5 billion by 2032, growing at a CAGR of 6.42% from 2023 to 2032.

Key Pointers

Report Scope of the Antimicrobial Wound Care Dressings Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.34 billion |

| Revenue Forecast by 2032 | USD 2.5 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.42% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Convatec, Inc., B. Braun SE, 3M, Smith & Nephew; Cardinal Health; Coloplast Corp.; Paul Hartmann AG, Medline Industries; McKesson Corporation; Mölnlycke Health Care AB |

Antimicrobial wound care dressings are specialized wound dressings that contain agents or substances that help to prevent or treat infections in wounds. These dressings are designed to provide a barrier against bacteria, viruses, fungi, and other microorganisms that may enter the wound and cause infection. Increasing incidence of chronic and acute wounds, growing geriatric population, rise in number of surgical cases and traumatic wounds is expected to drive the market.

The increasing incidence of chronic wounds is one of the key drivers for the antimicrobial wound care dressings market. Antimicrobial wound care dressings contain agents or substances that have antimicrobial properties, such as silver, iodine, and PHMB. By providing a barrier against microorganisms, antimicrobial wound care dressings can reduce the risk of infection and promote healing. As the incidence of chronic wounds continues to rise globally, the demand for antimicrobial wound care dressings is expected to grow. For instance, as per ResearchGate, more than 13 million people globally experience chronic wounds every year. These dressings are particularly useful in the treatment of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, which are at high risk of infection. Therefore, increasing number of chronic wounds is anticipated to drive the antimicrobial wound care market.

The growing geriatric population is another important factors which drives the antimicrobial wound care dressings market. For instance, according to WHO, as of 2019, the number of people aged above 60 was more than 1 billion. Moreover, as per similar source, by 2030, one every six people globally will be aged more than 60. The incidence of chronic wounds, such as pressure ulcers and venous leg ulcers, increases with increasing elder population. Older adults are more susceptible to chronic wounds due to a variety of factors, including reduced mobility, impaired circulation, and comorbidities such as diabetes and cardiovascular disease. Therefore, increasing the use of antimicrobial wound care dressings.

Rising surgical procedures is further is expected to increase the demand for antimicrobial wound care dressings during the forecast period. Surgical wounds are at risk of infection, and antimicrobial wound care dressings can help to prevent or treat these infections, promoting faster healing and reducing the risk of complications. Further surgical cite infections (SII) are infections that patients acquire while receiving treatment in a healthcare setting during or after a surgery. These infections can be caused by a variety of microorganisms, including bacteria, viruses, and fungi. The occurrence of SII is a major concern for healthcare providers and patients alike. Antimicrobial wound care dressings can be used in various surgical procedures, such as orthopedic, cardiovascular, and plastic surgeries, to reduce the risk of infection and promote faster healing. Thus, driving the market growth.

Antimicrobial Wound Care Dressings Market Segmentations:

By Product

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antimicrobial Wound Care Dressings Market

5.1. COVID-19 Landscape: Antimicrobial Wound Care Dressings Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antimicrobial Wound Care Dressings Market, By Product

8.1. Antimicrobial Wound Care Dressings Market, by Product, 2023-2032

8.1.1 Silver Dressings

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Povidone-iodine Dressings

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. PHMB Dressings

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Antimicrobial Wound Care Dressings Market, By Application

9.1. Antimicrobial Wound Care Dressings Market, by Application, 2023-2032

9.1.1. Chronic Wounds

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Acute Wounds

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Antimicrobial Wound Care Dressings Market, By End-use

10.1. Antimicrobial Wound Care Dressings Market, by End-use, 2023-2032

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Outpatient Facilities

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Home Care

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Research & Manufacturing

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Antimicrobial Wound Care Dressings Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Convatec, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. B. Braun SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. 3M

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Smith & Nephew

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cardinal Health

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Coloplast Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Paul Hartmann AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medline Industries

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. McKesson Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Mölnlycke Health Care AB

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others