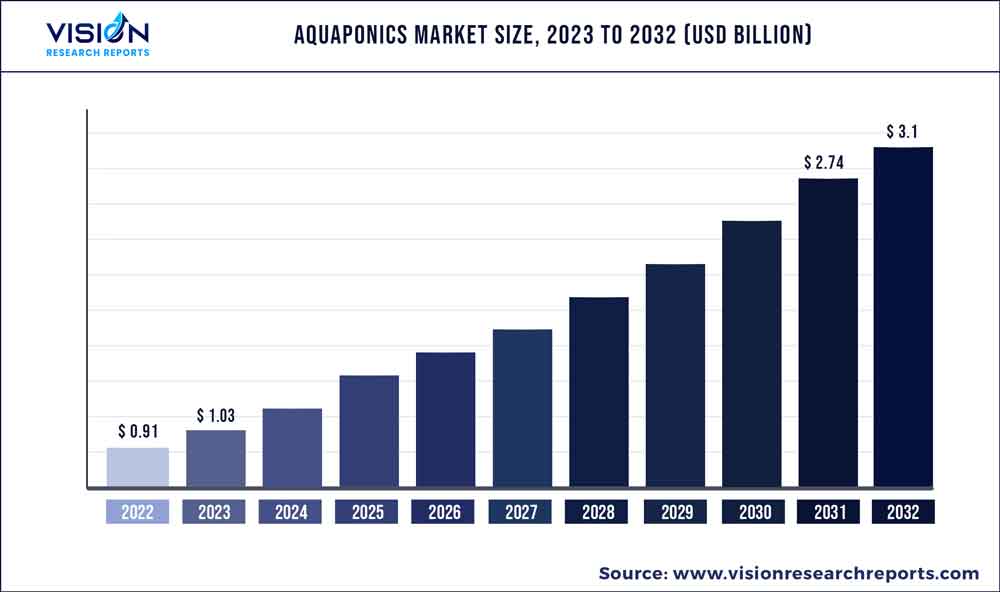

The global aquaponics market size was estimated at around USD 0.91 billion in 2022 and it is projected to hit around USD 3.1 billion by 2032, growing at a CAGR of 13.03% from 2023 to 2032. The aquaponics market in the United States was accounted for USD 181.9 million in 2022.

Key Pointers

Report Scope of the Aquaponics Market

| Report Coverage | Details |

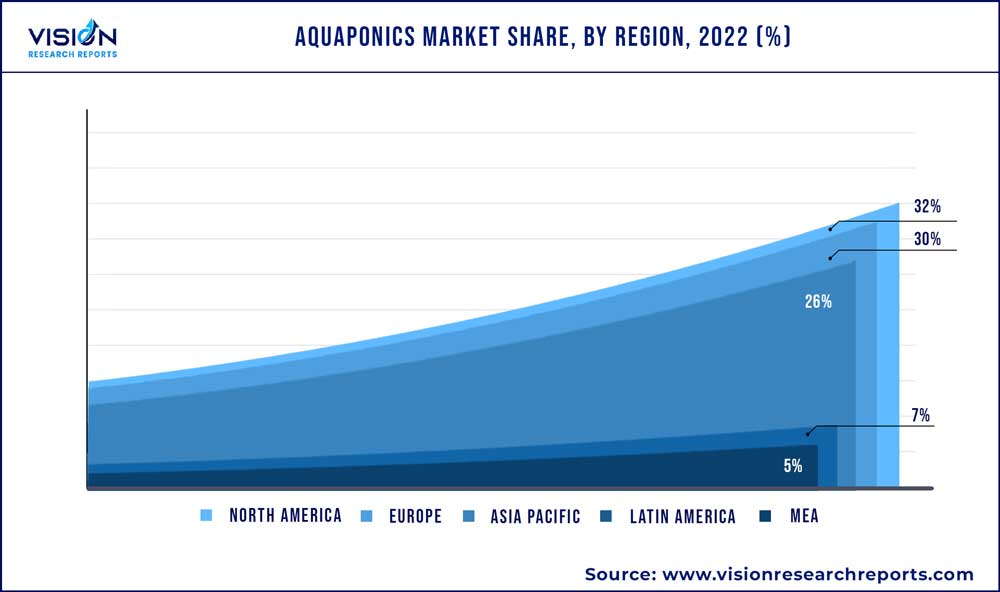

| Revenue Share of North America in 2022 | 32% |

| CAGR of Asia Pacific from 2023 to 2032 | 14.55% |

| Revenue Forecast by 2032 | USD 3.1 billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.03% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nelson and Pade Aquaponics; Pentair Aquatic Eco-System, Inc. (PAES); The Aquaponic Source; Hydrofarm Holdings Group, Inc.; Practical Aquaponics (Pty) Ltd; Greenlife Aquaponics; Backyard Aquaponics Pty Ltd; My Aquaponics; Aquaponic Lynx LLC; Portable Farms Aquaponics Systems; aquaponik manufactory GmbH; Aponic Ltd |

The target market includes equipment and components required to build an aquaponics system. It has tremendous growth opportunities in the coming years as the aquaponics system eliminates the use of inorganic fertilizers and pesticides. Fish provides nutrition. There is a high demand for organic fruits and vegetables, and the organic trend is expected to gain more traction in the coming years, thus supporting the growth of the target market.

The positive environmental impact of aquaponics is expected to further contribute to the growth of the target market. The water required to grow crops in these systems is 90% less than traditional farming techniques. Also, it requires 90% less area than traditional farming methods. The growing demand for food owing to the exponentially increasing global population and limitations of water and land resources is expected to significantly boost the demand for aquaponics setups. Additionally, the better quality of yield obtained with these systems will drive the demand for aquaponics agriculture produce over conventional produce.

The aquaponics sector faces several challenges, including a high cost of initial investment and maintenance. The operational costs of an aquaculture system are high as it requires regular maintenance. Moreover, the aquaponics system is unsuitable for all crops, and it’s expensive to upscale production with these systems. Moreover, the lack of a specialized skilled workforce for both managing the aquaculture systems and soilless farming techniques hampers the growth.

Equipment Insights

Based on equipment, the market is segmented into pumps & valves, grow lights, aeration systems, water heaters, and others. The pumps & valves segment held a revenue share of 29% in 2022 and is expected to grow at a CAGR of 13.13% through the forecast period. Pumps help in the transportation of water in the aquaponics systems. It also ensures oxygenation and nutrient supply in the system. Pump types used in the system include submersible pumps and inline pumps. Along with the pumps, valves are installed in the system to regulate and control the water flow in the system.

The grow light segment is anticipated to grow at the fastest CAGR of 14.22% through the forecast period. Different plants and fishes require different light conditions for healthy growth. Some thrive in dark conditions, while some require timely exposure to light for average growth. LED grow lights, induction, high-intensity discharge, and fluorescent grow lights can be used in aquaponics systems. Grow lights assist in the year-round production of plants and also ensure increased growth and yield of crops.

Component Insights

Based on component, the market is segmented into rearing tanks, bio-filters, settling basins, sump tanks, and others. The rearing tank segment dominated in 2022, with a revenue share of 25%. It is anticipated to grow at a CAGR of 12.54% through the forecast period. Different types of rearing tanks can be utilized in aquaponics systems. Even a small aquarium can be used for home-based units. Glass tanks, plastic tanks, Rubbermaid stock tanks, and intermediate bulk container totes are different types of rearing tanks or fish tanks.

The bio-filters segment is expected to grow at the fastest CAGR of 13.73% through the forecast period. Bio-filters in aquaponics system converts ammonia into nutrient for plants. It is made by filling a container with bio media which increases the surface area for nitrifying bacteria. Moving bed filters, static filters, and drop filters are different bio-filters used. Although bio-filters are not an absolute necessity for aquaponics, their usage improves the efficiency of these systems and are thus installed religiously.

Facility Type Insights

Based on facility type, the market is segmented into greenhouse, building-based indoor farms, and others. Among these, the greenhouse segment dominated the market in 2022, with a market share of 46%. It is anticipated to grow at a CAGR of 12.74% through the forecast period. Passive solar greenhouses are most suitable for aquaponics systems. All growing mechanisms, including deep water culture, nutrient film technique, media filled grow beds, and vertical aquaponics, can be accommodated in a greenhouse facility. The rearing and sump tank placements vary in a greenhouse, as sump tanks are partially buried in a greenhouse and placed below grow beds.

The building-based indoor farms segment is expected to grow at a considerable CAGR of 13.84% throughout the forecast period. Building-based indoor farms are being increasingly installed to produce crops throughout the year and in areas with unsuitable climates for plant growth, such as arid regions. Aquaponics systems are installed in urban warehouses, homes, and containers. Aquaponics systems can also be installed in an outdoor environment. However, indoor facilities are preferred over outdoor setups as the environment can be controlled and thus avoid crop damage.

Growing Mechanism Insights

Based on the growing mechanism, the market is segmented into deep water culture, nutrient film technique, media filled grow beds, and vertical aquaponics. The media filled grow beds segment dominated in 2022, with a revenue share of 37.68%. It is anticipated to grow at a CAGR of 12.9% through the forecast period. The media filled grow beds is a simple and inexpensive type of aquaponics system. The media beds support several fruit and vegetable plants with large root masses. However, this method is not space efficient and also requires a high amount of labor.

The vertical aquaponics segment is expected to grow at a considerable CAGR of 13.7% through the forecast period. In vertical aquaponics, the grow beds are stacked above the rearing tank on one another. Plants that require less support, such as strawberries and leafy greens, are compatible with growing vertically. Vertical aquaponics is a space-efficient system and is being increasingly adopted in urban facilities. Nutrient Film Technique (NFT) is also expected to witness significant growth over the forecast period owing to its space-efficient design and low labor costs.

Produce Insights

Based on produce, the market is segmented into fish, fruits & vegetables, and others. Among these, the fish segment held the largest revenue share of 55% in 2022. It is anticipated to grow at a CAGR of 12.94% through the forecast period. Tilapia is one of the most commonly bred fishes in aquaponics owing to the highly adaptable nature of the fish. The fish type decides the size of the rearing tank, as some fishes require more space to thrive and grow. For example, catfish can grow up to 45lbs to 50lbs and hence require more than the 250-gallon size of the rearing tank.

The fruits & vegetables segment is expected to grow at the fastest CAGR of 13.44% through the forecast period. Tomatoes, herbs, lettuce, spinach, kale, marijuana, watercress, peppers, lettuce, squash, leafy greens, zucchini, peppers, cucumber, and eggplant are some of the commonly and successfully produced plants with aquaponics systems. Several herbs such as basil, chive, lemongrass, parsley, and fruits such as pineapple, blueberries, strawberries, and tangerine can be produced in these facilities.

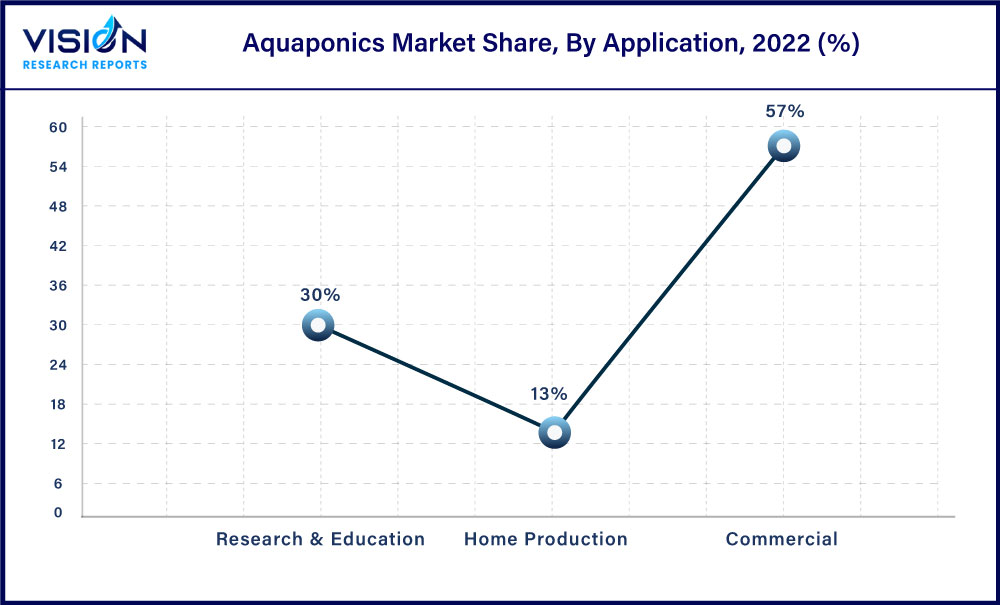

Application Insights

Based on application, the market is segmented into commercial, home production, and research & education. The commercial application segment dominated in 2022, with a revenue share of 57%. Commercial growers widely adopt aquaculture to produce vegetables and different breeds of fish. The dual production of fish and plants obtained in aquaculture is improving its adoption among commercial growers. Several types of fish, such as tilapia, bass, trout, carp, catfish, koi, fingerlings, and different ornamental fishes, can be reared in aquaculture.

The research & education application segment is anticipated to register the fastest CAGR of 13.54% during the forecast period. Aquaponics are valuable tools for research and educational institutions in the fields of agriculture, horticulture, and plant biology. Research institutes require aquaponics systems to conduct experiments by manipulating growing conditions, temperature, humidity, light, and nutrient levels. In-house systems allow researchers to manipulate these factors and test hypotheses about the impact of different environmental conditions on plant growth, yield, and quality.

Regional Insights

North America led the overall market in 2022, with a revenue share of 32%. The region's growth can be attributed to the presence of several key players and the high adoption of controlled environment agriculture in North America. In addition, the rising awareness about alternative and sustainable farming techniques and increasing demand for organic food are improving the adoption of aquaponics systems. The U.S. government has implemented various indoor farming initiatives to promote sustainable agriculture, support local food systems, and reduce the environmental impact of farming.

The Asia Pacific is expected to grow at the fastest CAGR of 14.55% over the forecast period. Asia Pacific is expected to register the highest CAGR due to strong government support for sustainable farming in agricultural countries such as India, China, and Southeast Asian countries. The Indian government provides subsidies up to 50% under its various schemes, such as the National Horticulture Mission (NHM), which mainly focuses on constructing vertical farms across the country. Various state governments in the country are providing an additional 10-15% subsidies for the implementation of modern technologies in the agriculture sector.

Aquaponics Market Segmentations:

By Equipment

By Component

By Facility Type

By Growing Mechanism

By Produce

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Application Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aquaponics Market

5.1. COVID-19 Landscape: Aquaponics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aquaponics Market, By Equipment

8.1. Aquaponics Market, by Equipment, 2023-2032

8.1.1. Pumps & Valves

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Grow Light

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Aeration Systems

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Water Heaters

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Aquaponics Market, By Component

9.1. Aquaponics Market, by Component, 2023-2032

9.1.1. Rearing Tank

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Settling Basin

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Bio-Filters

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Sump Tank

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Aquaponics Market, By Facility Type

10.1. Aquaponics Market, by Facility Type, 2023-2032

10.1.1. Greenhouse

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Building Based Indoor Farms

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Aquaponics Market, By Growing Mechanism

11.1. Aquaponics Market, by Growing Mechanism, 2023-2032

11.1.1. Deep Water Culture (DWC)

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Nutrient Film Technique (NFT)

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Media Filled Grow Beds

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Application Aquaponics

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Aquaponics Market, By Produce

12.1. Aquaponics Market, by Produce, 2023-2032

12.1.1. Fish

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Fruits & Vegetables

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Others

12.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Aquaponics Market, By Application

13.1. Aquaponics Market, by Application, 2023-2032

13.1.1. Commercial

13.1.1.1. Market Revenue and Forecast (2020-2032)

13.1.2. Home Production

13.1.2.1. Market Revenue and Forecast (2020-2032)

13.1.3. Research & Education

13.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 14. Global Aquaponics Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.1.2. Market Revenue and Forecast, by Component (2020-2032)

14.1.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.1.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.1.5. Market Revenue and Forecast, by Produce (2020-2032)

14.1.6. Market Revenue and Forecast, by Application (2020-2032)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.1.7.2. Market Revenue and Forecast, by Component (2020-2032)

14.1.7.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.1.7.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.1.8. Market Revenue and Forecast, by Produce (2020-2032)

14.1.8.1. Market Revenue and Forecast, by Application (2020-2032)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.1.9.2. Market Revenue and Forecast, by Component (2020-2032)

14.1.9.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.1.9.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.1.10. Market Revenue and Forecast, by Produce (2020-2032)

14.1.11. Market Revenue and Forecast, by Application (2020-2032)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.2.2. Market Revenue and Forecast, by Component (2020-2032)

14.2.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.2.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.2.5. Market Revenue and Forecast, by Produce (2020-2032)

14.2.6. Market Revenue and Forecast, by Application (2020-2032)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.2.8.2. Market Revenue and Forecast, by Component (2020-2032)

14.2.8.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.2.9. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.2.10. Market Revenue and Forecast, by Produce (2020-2032)

14.2.10.1. Market Revenue and Forecast, by Application (2020-2032)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.2.11.2. Market Revenue and Forecast, by Component (2020-2032)

14.2.11.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.2.12. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.2.13. Market Revenue and Forecast, by Produce (2020-2032)

14.2.14. Market Revenue and Forecast, by Application (2020-2032)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.2.15.2. Market Revenue and Forecast, by Component (2020-2032)

14.2.15.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.2.15.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.2.16. Market Revenue and Forecast, by Produce (2020-2032)

14.2.16.1. Market Revenue and Forecast, by Application (2020-2032)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.2.17.2. Market Revenue and Forecast, by Component (2020-2032)

14.2.17.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.2.17.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.2.18. Market Revenue and Forecast, by Produce (2020-2032)

14.2.18.1. Market Revenue and Forecast, by Application (2020-2032)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.3.2. Market Revenue and Forecast, by Component (2020-2032)

14.3.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.3.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.3.5. Market Revenue and Forecast, by Produce (2020-2032)

14.3.6. Market Revenue and Forecast, by Application (2020-2032)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.3.7.2. Market Revenue and Forecast, by Component (2020-2032)

14.3.7.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.3.7.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.3.8. Market Revenue and Forecast, by Produce (2020-2032)

14.3.9. Market Revenue and Forecast, by Application (2020-2032)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.3.10.2. Market Revenue and Forecast, by Component (2020-2032)

14.3.10.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.3.10.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.3.11. Market Revenue and Forecast, by Produce (2020-2032)

14.3.11.1. Market Revenue and Forecast, by Application (2020-2032)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.3.12.2. Market Revenue and Forecast, by Component (2020-2032)

14.3.12.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.3.12.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.3.12.5. Market Revenue and Forecast, by Produce (2020-2032)

14.3.12.6. Market Revenue and Forecast, by Application (2020-2032)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.3.13.2. Market Revenue and Forecast, by Component (2020-2032)

14.3.13.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.3.13.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.3.13.5. Market Revenue and Forecast, by Produce (2020-2032)

14.3.13.6. Market Revenue and Forecast, by Application (2020-2032)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.4.2. Market Revenue and Forecast, by Component (2020-2032)

14.4.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.4.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.4.5. Market Revenue and Forecast, by Produce (2020-2032)

14.4.6. Market Revenue and Forecast, by Application (2020-2032)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.4.7.2. Market Revenue and Forecast, by Component (2020-2032)

14.4.7.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.4.7.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.4.8. Market Revenue and Forecast, by Produce (2020-2032)

14.4.9. Market Revenue and Forecast, by Application (2020-2032)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.4.10.2. Market Revenue and Forecast, by Component (2020-2032)

14.4.10.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.4.10.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.4.11. Market Revenue and Forecast, by Produce (2020-2032)

14.4.12. Market Revenue and Forecast, by Application (2020-2032)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.4.13.2. Market Revenue and Forecast, by Component (2020-2032)

14.4.13.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.4.13.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.4.13.5. Market Revenue and Forecast, by Produce (2020-2032)

14.4.13.6. Market Revenue and Forecast, by Application (2020-2032)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.4.14.2. Market Revenue and Forecast, by Component (2020-2032)

14.4.14.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.4.14.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.4.14.5. Market Revenue and Forecast, by Produce (2020-2032)

14.4.14.6. Market Revenue and Forecast, by Application (2020-2032)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.5.2. Market Revenue and Forecast, by Component (2020-2032)

14.5.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.5.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.5.5. Market Revenue and Forecast, by Produce (2020-2032)

14.5.6. Market Revenue and Forecast, by Application (2020-2032)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.5.7.2. Market Revenue and Forecast, by Component (2020-2032)

14.5.7.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.5.7.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.5.8. Market Revenue and Forecast, by Produce (2020-2032)

14.5.8.1. Market Revenue and Forecast, by Application (2020-2032)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Equipment (2020-2032)

14.5.9.2. Market Revenue and Forecast, by Component (2020-2032)

14.5.9.3. Market Revenue and Forecast, by Facility Type (2020-2032)

14.5.9.4. Market Revenue and Forecast, by Growing Mechanism (2020-2032)

14.5.9.5. Market Revenue and Forecast, by Produce (2020-2032)

14.5.9.6. Market Revenue and Forecast, by Application (2020-2032)

Chapter 15. Company Profiles

15.1. Nelson and Pade Aquaponics

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Pentair Aquatic Eco-System, Inc. (PAES)

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. The Aquaponic Source

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Hydrofarm Holdings Group, Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Practical Aquaponics (Pty) Ltd

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Greenlife Aquaponics

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Backyard Aquaponics Pty Ltd

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. My Aquaponics

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Aquaponic Lynx LLC

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Portable Farms Aquaponics Systems

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others