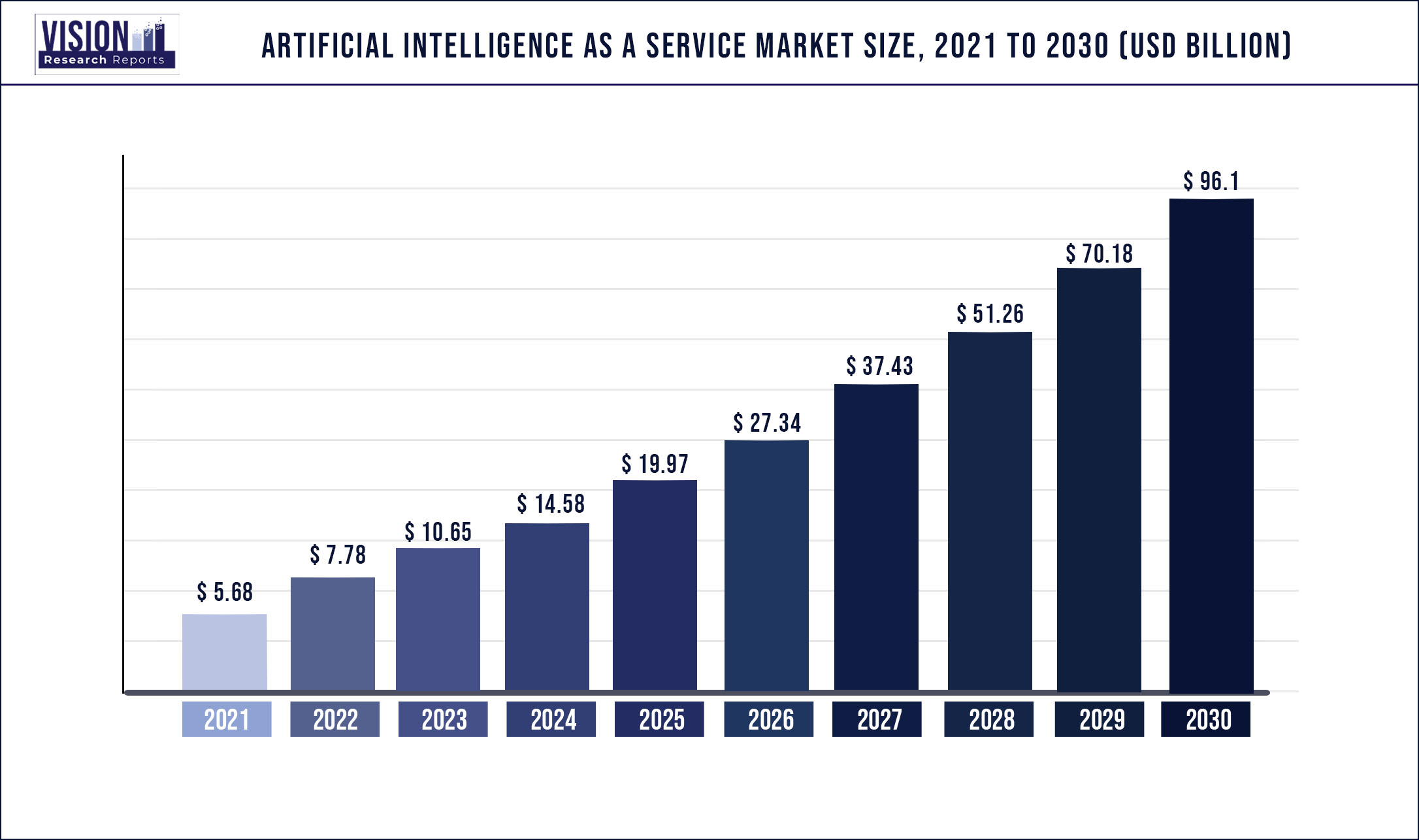

The global artificial intelligence as a service market was surpassed at USD 5.68 billion in 2021 and is expected to hit around USD 96.1 billion by 2030, growing at a CAGR of 36.93% from 2022 to 2030.

Report Highlights

Artificial intelligence as a service (AIaaS) is a third-party artificial intelligence outsourcing service that allows large enterprises and SMEs to explore development opportunities without requiring a significant initial investment. It enables businesses or end-users to experiment with AI for various applications while limiting initial investment and risk.

The increased R&D efforts of AI as service vendors and governments across countries are driving the artificial intelligence-as-a-service market. Furthermore, greater AIaaS integration with blockchain and increased investment in AIaaS by governments and end-users are likely to drive the artificial intelligence-as-a-service market. For instance, in July 2022, the United Nations Development Programme (UNDP), a United Nations agency, and the Telangana government established data in climate resilient agriculture (DiCRA), an AI-powered platform service focused on providing farmers with climate change information. The AI platform can identify farms that are robust to climate change and others that are vulnerable using pattern detection algorithms and remote sensing.

Furthermore, progressive enterprises are adopting artificial intelligence and other digital technologies to improve the overall work experience. Employees need fast support to stay productive with the change to work from anywhere, whether they have an HR request, an IT problem, or a query about the spending policy. Traditional service desks lack the speed and scale necessary to provide a hybrid workforce with 24/7 assistance in real-time. To completely solve this issue, AI as service providers offer employees the assistance they require in a matter of seconds. For instance, in July 2022, Moveworks, Inc., an artificial intelligence startup based in the United States, announced a collaboration with Tata Consultancy Services Limited. This partnership enables customers to revamp their service desks with AI, and they can rely on the partnership's expertise and technology to automatically support their personnel.

More firms are investing in AI technologies and exploiting AI skills to keep ahead of global competition. The increased usage of social media and the Internet of Things (IoT) is driving demand for AI technology. Furthermore, many AI technology vendors find that providing AI tools and software is insufficient since many enterprises are searching for outsourcing services. As a result, the market has witnessed an increasing demand for AI services. Businesses can improve their productivity by implementing AI-powered IoT solutions in industries such as manufacturing, retail analytics, self-driving cars, and others. This is projected to fuel the market for AI as a service. For instance, in May 2021, Bosch Global Software Technologies Private Limited introduced the Phantom Edge, an AIoT platform that provides a real-time picture of electrical energy usage and addresses energy efficiency challenges in various industries. The platform collects energy signatures and ML algorithms on edge using non-intrusive sensors. It processes these signatures to provide a real-time picture of electrical parameters, energy consumption, operating utilization, and appliance-level information, producing its digital twin.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 5.68 billion |

| Revenue Forecast by 2030 | USD 96.1 billion |

| Growth rate from 2022 to 2030 | CAGR of 36.93% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, service type, organizations size, deployment, vertical, region |

| Companies Covered |

Amazon Web Services, Inc.; Salesforce, Inc.; International Business Machines Corporation; Intel Corporation; Microsoft; BigML, Inc.; Google; SAP SE; Fair Isaac Corporation; SAS Institute Inc. |

Technology Insights

The machine learning segment led the market in 2021, accounting for over 35.2% share of the global revenue. Machine learning platforms, such as reinforcement machine learning algorithms, supervised machine learning algorithms and unsupervised machine learning algorithms, are primarily concerned with developing computer systems that can access data and use it for self-learning. Machine learning algorithms, methodologies, and frameworks enable businesses to tackle complex problems fast. Furthermore, the most successful firms and industries plan and create new concepts and strategies to reduce workload. For instance, in June 2022, Amazon Web Services, Inc. unveiled Amazon CodeWhisperer. This new AI service employs machine learning to produce code suggestions for software engineers, bolstering its efforts in the emerging field of AI-powered programming. The Amazon CodeWhisperer provides code recommendations based on contextual information.

The natural language processing segment is anticipated to register significant growth over the forecast period. The segment's growth can be attributed to the capability of the technology to analyze user actions, which aids in providing an improved customer experience. For instance, in August 2021, OpenAI, L.L.C., an AI research and deployment company, upgraded the OpenAI codex, an artificial intelligence model that interprets natural language and generates code in response. Codex interprets simple natural language instructions and runs them on the user's behalf, creating a natural language interface for existing applications.

Service Type Insights

The software segment dominated the market and accounted for more than 70.3% share of the global revenue in 2021. Software tools play a vital role in predicting outcomes from vast amounts of data by uncovering hidden patterns in data and data sets. Retail, healthcare & life sciences, and banking, financial services, & insurance (BFSI) are among the industries combining these tools with their existing business systems to analyze enormous volumes of data and develop data patterns. Furthermore, software tools aid in the development of various company strategies and the making of business-critical decisions. For instance, in July 2022, FutureAI.guru, Inc., a consulting firm specializing in bridging the knowledge gap in artificial intelligence for businesses, launched Sallie, its newly designed software and an artificial entity. The software learns in real-time with speaking, hearing, vision, and mobility, allowing it to reach conclusions, a critical aspect of authentic thinking. Without prior information, Sallie can distinguish objects with eyesight, construct an internal model, ask questions, and take instructions.

The services segment is anticipated to register a noticeable growth rate over the forecast period. The increasing adoption of smart solutions is likely to fuel the demand for AI services. These services use the capabilities of solutions that speed up corporate operations. For instance, in June 2021, Google launched Vertex AI, a managed AI service with new features designed to assist businesses in accelerating the deployment of AI models. The new Vertex AI features will continue to speed up the deployment of machine learning models across enterprises. It also democratizes AI so that more users can deploy models in production, continually monitor, and create business impact with AI.

Organizations Size Insights

The large enterprises segment dominated the market and accounted for more than 71.01% share of the global revenue in 2021. The high share can be attributed to the increased demand for AI in various end-user industries and the financial capability of these large enterprises to implement AIaaS into their workflows. For instance, in July 2022, Shenzhen Super Eagle Technology Co., Ltd., a company specializing in power supply, car chargers, mobile phone chargers, and desktop chargers, announced the release of IPAW Model L, its AI robot server, a tremendously exciting development for the hospitality business. The IPAW Model L is capable of meal delivery, voice interaction, precise navigation, customer attraction, smart obstacle avoidance, and multi-machine collaboration. The startup is currently collaborating with Heineken, McDonald's, and Hilton to bring this fascinating technology to the people.

The small and medium-sized enterprises segment is anticipated to register a healthy CAGR over the forecast period. Businesses are becoming more digital than ever, and small and medium-sized enterprises are experimenting with artificial intelligence (AI) solutions to optimize their operations and processes, driving up demand for AI services. Small and medium-sized enterprises can use predictive analytics to reduce risk, automate business forecasts with real-time data, and improve asset management efficiency. Enhanced prediction capabilities also enable broader market segmentation and open new avenues to innovation. SMEs can source external AI solutions and expertise through knowledge markets, often compensating for the lack of internal capacity.

Deployment Insights

The public cloud segment dominated the market and accounted for 50.65% of the global revenue share in 2021. Public cloud infrastructure can support massive data storage and the scalable processing capabilities required to crunch vast volumes of data and AI algorithms. The public cloud provides a variety of data storage alternatives, such as data warehouses, serverless databases, data lakes, and NoSQL data stores. By operating specific workloads on the public cloud while preserving highly sensitive data in their data center to suit client needs or regulatory requirements, organizations receive the freedom and innovation that the public cloud brings. For instance, in May 2021, Nokia, Finnish multinational telecommunication, information technology, and consumer electronics business, launched AI use case library for telecom service providers in collaboration with Microsoft. The AVA AI use case library is now available as a public cloud on Microsoft Azure, integrating telco-grade safety with rapid web-scale architectural scalability.

The hybrid cloud segment is anticipated to register a notable CAGR over the forecast period. Hybrid cloud technology gives precise, cost-effective computing and a route for leveraging large amounts of data. It enables businesses to successfully manage their data, providing strategic insights and suggestions, revealing patterns and trends in data, improving customer experience, and automating workflows. For instance, in June 2022, Microsoft released new Azure capabilities that will make it easier for businesses to operate AI software in hybrid cloud environments. Microsoft's new hybrid cloud artificial intelligence capabilities are based on Azure Kubernetes Service, a service for managing software container deployments, and Azure Machine Learning, a set of tools for developing neural networks.

Vertical Insights

The BFSI segment led the market in 2021, accounting for over 15.33% of global revenue. The BFSI sector benefits from AI as a service to develop various growth prospects. Artificial intelligence is primarily employed in the BFSI sector for fraud detection, client suggestion, algorithmic trading, and chatbots. Banks are experimenting with chatbots, which are expected to drive other financial institutions to invest in comparable technologies. AI in finance can be valuable in assessing real-time activity in any setting. It gives reliable predictions and forecasts based on various variables, which are critical for business planning. For instance, in June 2022, Kiya.ai, an innovative digital solutions provider servicing financial institutions and governments worldwide, announced the arrival of Kiyaverse, a banking metaverse. India's first metaverse is allowing clients to access numerous banking services remotely. Kiya.ai will initially enable banks to launch their metaverse for partners, clients, and employees.

Other verticals, such as telecommunications, retail, government and defense, energy, manufacturing, and others, are expected to significantly contribute to the growth of the AI as a service market. AI assists in increasing the need for real-time data, accelerating time to market, lowering infrastructure costs, and improving business process time. For instance, in July 2022, Vodafone Idea Limited, one of the world's major telecommunications firms, is launching an MLOps service across the organization with the assistance of Google Cloud. The AI Booster project intends to automate and standardize the creation and distribution of machine-learning models inside the carrier.

Regional Insights

North America dominated the market and accounted for over 40.3% share of the global revenue in 2021. This growth can be attributed to technical improvements and the increasing acceptance of digital technology. Furthermore, AI solution providers are emphasizing innovation and creating artificial intelligence technologies that may be delivered as a service in the market. Moreover, government initiatives that encourage the use of AI in various businesses, and the presence of emerging economies such as Canada and the U.S. The region is one of the most important cognitive computing markets; numerous large industries and IT infrastructure, government regulations regarding data security, and cloud application and security information services contribute to market growth. For instance, in June 2022, Guardforce AI Co., Limited, a provider of comprehensive security solutions, announced opening new offices in San Francisco, California, and Tokyo, Japan, to develop its Robotics-as-a-Service business lines in these two regions. The T-series robot for food delivery robots, reception services, and disinfection robots for shopping malls, hotels, and restaurants will be among the robotics solutions offered by the company.

Asia Pacific is anticipated to witness significant growth in AI as a service industry. Global investment in artificial intelligence is quickly expanding with Asia-Pacific leading the way. Furthermore, the use of AI as a service is quickly expanding in nations such as India and China. As a result, the industry's scope and demand for artificial intelligence are rising. For instance, in November 2021, Baidu, Inc., a Chinese multinational technology corporation, unveiled its AI-powered commercial self-driving cab service in the Beijing area. The technology is backed up by data gathered from vehicle operations on public roadways. The AI driver does not break traffic laws or become tired when operating in a complex traffic environment and can cut traffic accidents by more than 90%.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence As A Service Market

5.1. COVID-19 Landscape: Artificial Intelligence As A Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence As A Service Market, By Technology

8.1. Artificial Intelligence As A Service Market, by Technology, 2022-2030

8.1.1. Machine Learning (ML)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Computer Vision

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Natural Language Processing (NLP)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Artificial Intelligence As A Service Market, By Service Type

9.1. Artificial Intelligence As A Service Market, by Service Type, 2022-2030

9.1.1. Software

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Artificial Intelligence As A Service Market, By Organizations Size

10.1. Artificial Intelligence As A Service Market, by Organizations Size, 2022-2030

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Small and Medium-sized Enterprises (SMEs)

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Artificial Intelligence As A Service Market, By Deployment

11.1. Artificial Intelligence As A Service Market, by Deployment, 2022-2030

11.1.1. Public

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Private

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Hybrid

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Artificial Intelligence As A Service Market, By Vertical

12.1. Artificial Intelligence As A Service Market, by Vertical, 2022-2030

12.1.1. Banking, Financial, and Insurance (BFSI)

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Healthcare and Life Sciences

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Retail

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. IT & Telecommunication

12.1.4.1. Market Revenue and Forecast (2017-2030)

12.1.5. Government and defense

12.1.5.1. Market Revenue and Forecast (2017-2030)

12.1.6. Manufacturing

12.1.6.1. Market Revenue and Forecast (2017-2030)

12.1.7. Energy & Utility

12.1.7.1. Market Revenue and Forecast (2017-2030)

12.1.8. Others (Automotive, Education, Agriculture, Others)

12.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Artificial Intelligence As A Service Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Technology (2017-2030)

13.1.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.1.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Technology (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.7. Market Revenue and Forecast, by Vertical (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Technology (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Technology (2017-2030)

13.2.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.2.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.2.7. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.8. Market Revenue and Forecast, by Vertical (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Technology (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.2.10. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.11. Market Revenue and Forecast, by Vertical (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Technology (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.13. Market Revenue and Forecast, by Vertical (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Technology (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.15. Market Revenue and Forecast, by Vertical (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Technology (2017-2030)

13.3.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.3.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.7. Market Revenue and Forecast, by Vertical (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Technology (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.9. Market Revenue and Forecast, by Vertical (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Technology (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Technology (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Technology (2017-2030)

13.4.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.4.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.7. Market Revenue and Forecast, by Vertical (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Technology (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.9. Market Revenue and Forecast, by Vertical (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Technology (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Technology (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Technology (2017-2030)

13.5.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.5.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.5. Market Revenue and Forecast, by Vertical (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Technology (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.7. Market Revenue and Forecast, by Vertical (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Technology (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Organizations Size (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Vertical (2017-2030)

Chapter 14. Company Profiles

14.1. Amazon Web Services, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Salesforce, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. International Business Machines Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Intel Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Microsoft

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. BigML, Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Google

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. SAP SE

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Siemens

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Fair Isaac Corporation

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others