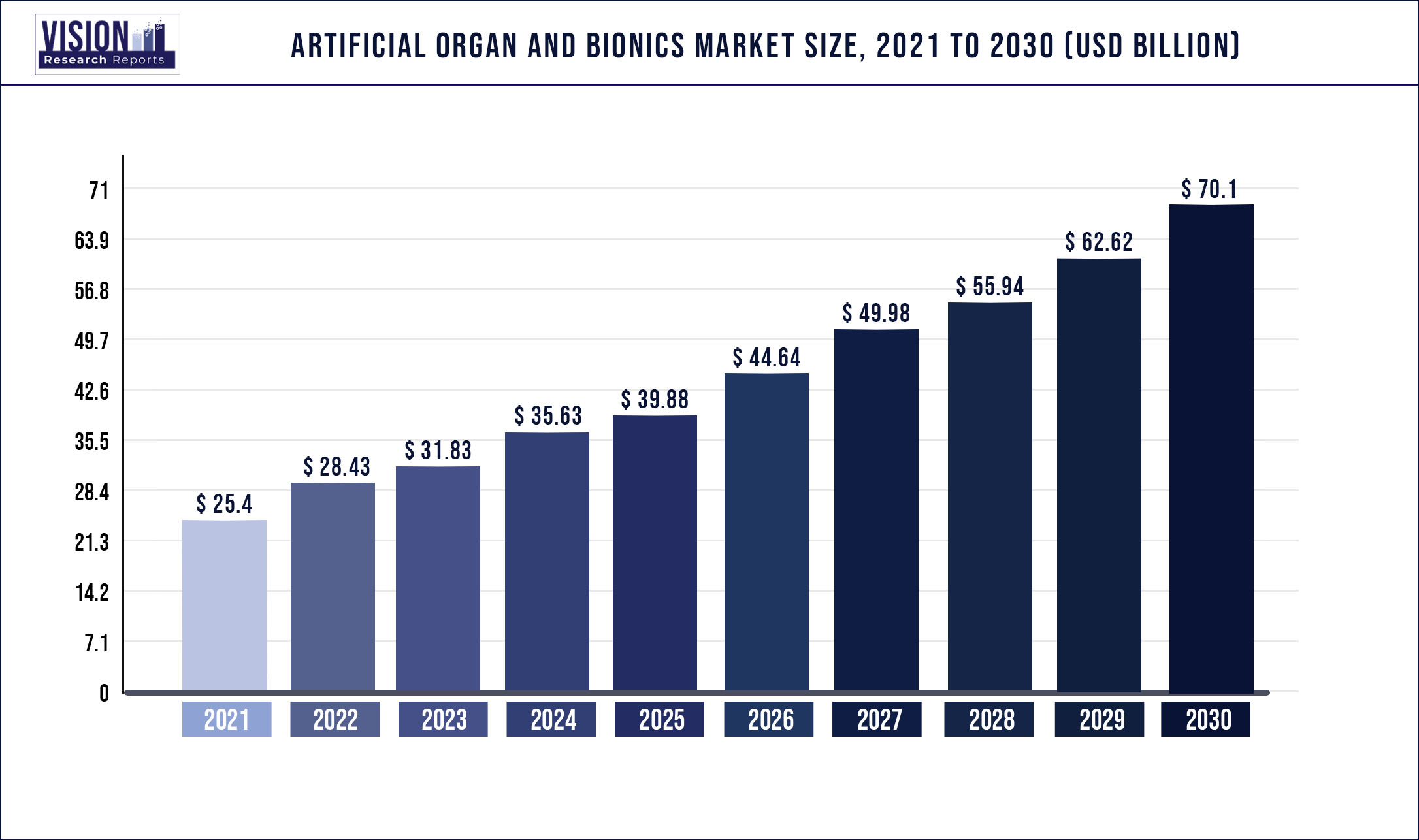

The global artificial organ and bionics market was estimated at USD 25.4 billion in 2021 and it is expected to surpass around USD 70.1 billion by 2030, poised to grow at a CAGR of 11.94% from 2022 to 2030.

The increasing prevalence of organ failure has resulted in a massive increase in using human-made organs and bionics devices. The rising demand for donors to transplant kidneys, hearts, lungs, livers, and pancreas is a major factor boosting the market growth. Moreover, many biotechnology and medical device companies have concentrated on developing 3D printed bionic. These devices use myoelectric technology and sensory electric technology that enable the mobility of synthetic human body parts.

The COVID-19 pandemic had a detrimental effect on the artificial organ and bionics market. Patients with impairments and organ failures faced additional challenges due to the pandemic. Due to social distancing, many medical facilities were limited to non-elective procedures and surgeries and instead offered patients with impairments video conferencing to conquer market growth limitations. Moreover, there are treatment limitations that have hampered the growth of the market.

An increasing number of product launches and speedy FDA approval of these devices are bridging the shortage of donors. Rising R&D in synthetic human body parts is also boosting artificial organ and bionics market growth. For instance, on March 31, 2022, Edwards Lifesciences confirmed that the FDA certified the MITRIS RESILIA valve (a tissue valve replacement) that is specifically designed for the mitral position of the heart. Thus, with increasing healthcare expenditure and speedy FDA approval of synthetic human body parts, the market is expected to see robust growth during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 25.4 billion |

| Revenue Forecast by 2030 | USD 70.1 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.94% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, technology, region |

| Companies Covered |

Zimmer Biomet; Medtronic; Abbott; ABIOMED Inc.; Berlin Heart Gmbh; Biomet, Inc.; Boston Scientific Corporation; Edward Lifesciences Corporation; Ekso Bionics; Heartware International, Inc.; Iwalk, Inc.; Jarvik Heart, Inc.; SynCardia Systems LLC. |

Product Insights

Artificial organs dominated the market, with a share of over 70.9% in 2021. Demand for kidney, heart, lungs, and liver transplants is contributing to the growth of the segment. The average median waiting time to transplant a kidney in the U.S. is 5 years. Many factors are considered while on the waiting list, such as body size, blood type, distance from a donor, and severity of illness. Thus, the challenge of fulfilling unmet demand has compelled the manufacturers to develop bio-lungs, artificial pancreas, and wearable artificial kidneys.

The artificial bionics segment is projected to witness the fastest CAGR during the forecast period. Primary factors contributing to the segment's growth are the increasing demand for cochlear implants, vision, exoskeleton, limbs, and brain bionics. Furthermore, favorable reimbursement policies and fast-track FDA approval for implants are strengthening the growth of the market for artificial organs and bionics. For instance, in January 2022, the Cochlear Nucleus Implants of Cochlear Limited received clearance from the U.S. Food and Drug Administration to treat unilateral hearing loss and single-sided deafness.

Technology Insights

Mechanical bionics dominated the market with a share of 67.1% in 2021. This is primarily attributed to the rising incidence of organ failure and the low cost of mechanical bionics. A mechanical artificial heart valve lasts much longer as compared to the other options, creating a robust demand. Other factors contributing to the growth are speedy FDA approvals and reimbursement policies. For instance, in September 2021, the FDA approved Abbott's Portico with FlexNav TAVR system to treat individuals with symptomatic and aortic stenosis who may be at high or very high risk for open-heart surgery.

The electronic bionics segment is expected to register the highest growth rate in the artificial organs and bionics market during the forecast period. According to Bionics Queensland, approximately 1.0 billion people are living with a physical disability, and 190.0 million adults have primary functional difficulty. In most developing countries, the logistical and financial barriers remain high. The only option for many who are disabled is to obtain prosthetics such as artificial hands, arms, and legs.

These prosthetics are battery and electronic systems that are myoelectric-controlled and can create nerve movement through sensors. These sensory electric technologies enable mobility in artificial organs. Machine learning, smart wearables, and element modeling are used to achieve mobility. In addition, an increasing number of road accidents, the rising prevalence of amputees, and individuals born without limbs are expected to create a demand for electronic bionics.

Regional Insights

North America dominated the market in 2021 with a share of 45.4% and is expected to continue its dominance throughout the forecast period. The reason for this growth is the increase in transplant surgeries and the need for artificial organs due to the high incidence of organ failure. Furthermore, the presence of well-developed healthcare facilities and local presence of many large biotechnology and medical devices companies, such as Zimmer Biomet, Arthrex, Inc., Medtronic, Novartis AG, and Stryker, contribute to its dominance.

For instance, on 10 March 2022, Zimmer Biomet Holdings, Inc. released WalkAI, an evolving AI design that recognizes patients1 who are expected to have a lesser gait speed outcome ninety days after hip or knee surgical intervention. WalkAI augments ZBEdge, a suite of integrated smart, robotic technologies digitally designed to offer transformative data-powered clinical insights to boost patient outcomes, with strong predictive analytic capabilities.

The number of donors in the U.S. has increased significantly in the last 5 years. According to the U.S. Department of Health and Human Services, there was a 27.7% increase in the number of organ donors from 2015 to 2019. The growing demand for kidney transplantation is one of the major drivers of the market for artificial organs and bionics. Kidney transplantation witnessed an exponential growth from 16,186 transplants in 2011 to 23,401 transplants in 2019 and 24,670 in 2021.

In the Asia Pacific, the market is expected to grow at the fastest rate during the forecast period, owing to emerging economies like Japan, China, and India. These countries have a large population base with a high incidence of chronic diseases. An increase in the number of chronic diseases that lead to organ failure is expected to boost artificial organ and bionics device growth.

For instance, in February 2022, Warburg Pincus invested USD 210 in Micro Life Sciences Pvt Ltd (parent organization of Meril group of companies). This investment will promote domestic medical devices at a high level of legitimacy in the global context, allowing them to expand their overseas footprint, attract international talent, and scale-up clinical research programs.

The countries are technologically advanced and offer various advanced surgical procedures with booming medical tourism. The low cost of surgical procedures in the region allows many patients to visit for medical reasons. Thus, an increase in the number of chronic diseases leading to organ failure and a rise in medical tourism has contributed significantly to the growth of the market in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Organ And Bionics Market

5.1. COVID-19 Landscape: Artificial Organ And Bionics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Organ And Bionics Market, By Product

8.1. Artificial Organ And Bionics Market, by Product, 2022-2030

8.1.1. Artificial Organs

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Kidney

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Heart

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Lungs

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Liver

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Pancreas

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Artificial Bionics

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Cochlear implant

8.1.8.1. Market Revenue and Forecast (2017-2030)

8.1.9. Exoskeleton

8.1.9.1. Market Revenue and Forecast (2017-2030)

8.1.10. Bionic limbs

8.1.10.1. Market Revenue and Forecast (2017-2030)

8.1.11. Vision bionics

8.1.11.1. Market Revenue and Forecast (2017-2030)

8.1.12. Brain bionics

8.1.12.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Artificial Organ And Bionics Market, By Technology

9.1. Artificial Organ And Bionics Market, by Technology, 2022-2030

9.1.1. Mechanical bionics

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Electronic bionics

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Artificial Organ And Bionics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Technology (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Technology (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Technology (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Technology (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Technology (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Technology (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Technology (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Technology (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Technology (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Technology (2017-2030)

Chapter 11. Company Profiles

11.1. Zimmer Biomet

11.1.1. Company Overview

11.1.2. Medtronic

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Abbott

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ABIOMED, INC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Berlin Heart Gmbh

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Biomet, Inc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Boston Scientific Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Edward Lifesciences Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ekso Bionics

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Heartware International, Inc

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Iwalk, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. Jarvik Heart, Inc

11.11.1. Company Overview

11.11.2. Product Offerings

11.11.3. Financial Performance

11.11.4. Recent Initiatives

11.12. SynCardia Systems, LLC.

11.12.1. Company Overview

11.12.2. Product Offerings

11.12.3. Financial Performance

11.12.4. Recent Initiatives

11.13. Medtronic

11.13.1. Company Overview

11.13.2. Product Offerings

11.13.3. Financial Performance

11.13.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others