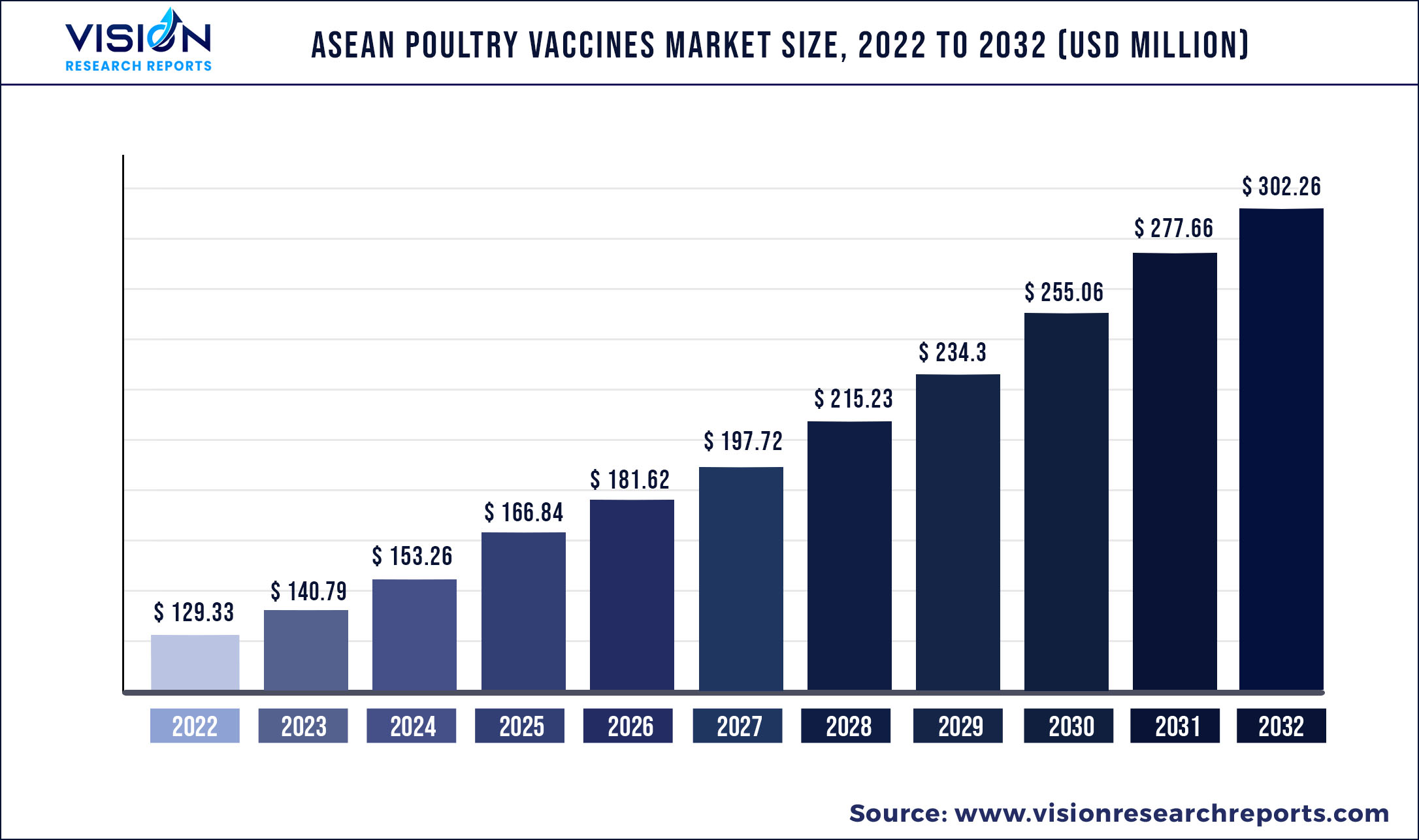

The ASEAN poultry vaccines market was surpassed at USD 129.33 million in 2022 and is expected to hit around USD 302.26 million by 2032, growing at a CAGR of 8.86% from 2023 to 2032.

The key factors driving the market growth include the increasing prevalence of poultry diseases, growing population, rapid urbanization, rising government initiatives, and reducing antibiotic usage.

For instance, The U.S. Bureau of Census data suggests that the ASEAN region’s (inclusive of 10 countries) total population grew by 11.6% in 2017 from 2008 and is expected to reach 720.0 million by 2027. In addition, according to Bloomberg, the urban population in the ASEAN region will grow by 100.0 million people by 2030. The region’s per capita GDP has grown annually by 3.4% in the last decade and is expected to grow by 3.5% in the next decade.

Furthermore, owing to the increasing poultry production in developing economies, concerns regarding food safety are growing. To prevent the spread of deadly diseases such as avian influenza in poultry farms, the governments of ASEAN countries are individually taking several measures. For instance, based on the Ministry of Agriculture Decree No. 4026, pathogenic Avian Influenza (AI) has been considered a notifiable disease in Indonesia, and the government has implemented actions to maintain AI control via vaccination, improved biosecurity measures, education & awareness, and routine surveillance. As part of its strategy, the country implemented intense vaccination among layer and breeder types.

Recently, Vietnam reported its first human H5 bird flu case as a result of infected chicken consumption in October 2022, which alerted the country to take strict measures with avian influenza vaccination drives. Similarly, governments of other ASEAN countries are taking a wide range of measures to control such severe infectious diseases to prevent economic loss. For instance, the Vietnamese government has collaborated with international organizations such as World Organization for Animal Health (WOAH), Food and Agriculture Organization (FAO) of the UN, and United States Agency for International Development (USAID) to implement the national animal disease control program 2019-2025. These measures improve the country’s poultry disease management and help develop safe meat supply chains.

Asian countries such as Malaysia, India, Nepal, South Korea, Vietnam, and the Philippines have reported Newcastle disease outbreaks in chickens. Due to these sudden outbreaks, governments are taking severe actions to implement vaccination drives and biosecurity measures. Moreover, according to an article published in the International Journal of Poultry Science, a study was conducted to determine how Malaysian government policies have affected broiler output in Peninsular Malaysia. Three different production sizes of chickens were produced and sold by contract and noncontract farmers in the study.

The effect of government protection on broiler production in Peninsular Malaysia was assessed using a policy analysis matrix including policy protection indicators. A field survey was used to gather information from 310 farms in Peninsular Malaysia. According to the findings, contract farming is more profitable than noncontract farming when producing broilers. The notional protection coefficient calculation results show that current regulations do not adequately safeguard producers. It came to the conclusion that the broiler industry needs government support to increase its competitiveness.

| Report Coverage | Details |

| Report Market Size in 2022 | USD 129.33 billion |

| Revenue Forecast by 2032 | USD 302.26 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.86% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segmentation | Product, application, disease type |

| Companies Covered | Boehringer Ingelheim International GmbH;Ceva; HIPRA; Zoetis; Phibro Animal Health Corporation; Elanco; Merck & Co., Inc.; Medion Farma; Malaysian Vaccines & Pharmaceuticals Sdn Bhd.; Kemin Industries, Inc. |

Product Insights

The attenuated live vaccines segment dominated the market and accounted for the largest revenue share in 2022. Attenuated live vaccines are either formulated from cell cultures of wild-type viruses or made by utilizing live organisms from non-target hosts. They are prepared by reducing the virulent strain’s toxicity via chemical, physical, and genetic modifications. This way, the strain loses its pathogenicity but retains its immunogenicity. These vaccines help stimulate active and passive immunities in chickens. The vaccination is administered intramuscularly in animals, resulting in a reduced risk of death due to diseases. Attenuated vaccines should be administered only to animals that have been tested for the vaccine or their usage has been approved in the animals.

The DNA vaccine segment is estimated to witness the fastest growth rate during the forecast period. DNA vaccines are a type of subunit vaccine with no risk of infection or reversion to virulence, they have been suggested as potential treatments for poultry diseases. DNA vaccines are inexpensive to produce & store, easy to design, and can be used for simultaneous immunizations against several infections. In many animal studies, the administration of DNA vaccines has been proven to elicit immune responses and offer a defense against threats.

The application of DNA vaccines in the chicken industry is hampered by drawbacks such as the difficulty to elicit robust immunity and the fact that they are not currently appropriate for mass immunization. The existing delivery restrictions of DNA vaccines for veterinary applications have been addressed, and the introduction of either biological or physical carriers has been suggested as a potential remedy.

Application Insights

The breeder segment dominated the market and accounted for the largest revenue share in 2022.Breeders are those who produce both layers (eggs) and broilers (meat). Many different people breed poultry for a variety of reasons and objectives. Commercial breeding, village/backyard breeding, and fancy/exhibition breeding are the three primary subcategories of poultry breeding. Hatcheries supply both the broiler and layer industries, and breeding for the commercial poultry business is done on a massive industrial scale.

According to the Thai Broiler Processing Exporters Association, the Thai poultry market features more than 40 players. Only 20% of these market participants are integrated commercial farms or large to medium commercial farms. With 29.0% of global production, Charoen Pokphand Foods Thailand is the largest company by production volume. Laemthong, Bet agro, Thai Foods Group, Saha Farm, and GFPT are the companies that come after it.

The layer segment is estimated to witness the fastest growth rate during r the forecast period. Raising egg-laying chickens for commercial egg production is known as layer poultry farming. A special breed of a hen, named the layer, needs to be cared for from day one. They start producing eggs for the marketplace when they are 18 to 19 weeks old. They continue to lay eggs until they are about 72 and 78 weeks old. They might consume about 2.25 kg of feed during their egg-laying cycle and lay about 1.0 kg of eggs. The outbreak of COVID-19 in Myanmar and the subsequent response severely impacted both broiler and layer farms. Prices for eggs have increased for the consumers as a result of layer farms' poor response to the rise in egg demand after the initial COVID-19 waves.

Disease Type Insights

The salmonella segment dominated the market and accounted for the largest revenue share in 2022. The prevalence of Salmonella spp. in developed economies as compared to developing ones is lower in chicken and poultry products. Overall Salmonella spp. infection incidence is on the rise. Additionally, the review noted the existence of multidrug-resistant salmonella strains in several Asian countries. Treating, preventing, and engaging in campaigns to control the infections typically bear a significant cost, and therefore, the rising number of infectious diseases linked to Salmonella has become a burden for most developing economies. Additionally, researchers and the general public are more aware of the wide range of Salmonella serovars and the high frequency of shifting trends in salmonellosis as a result of the emergence of novel serotypes and antibiotic resistance.

Avian Influenza (AI) affects farmed poultry, as well as pet, and wild birds. A few AI viruses are highly pathogenic, producing severe systemic disease with multiple organ failure and significant mortality, while most AI viruses in domestic poultry are of moderate pathogenicity causing subclinical infections, respiratory sickness, or decreases in egg production. In agar gel immunodiffusion assays, serology can identify avian influenza viruses of type A orthomyxo viruses, often known as Influenza virus A or Alpha influenza virus. They are distinguished by antigenically similar nucleoprotein and matrix internal proteins. There are 16 hemagglutinin (H1-16) and 9 neuraminidase (N1-9) subtypes of AI viruses.

Country Insights

Indonesia accounted for the maximum revenue share of more than 19.0% in 2022, owing to the increasing chicken meat consumption and poultry production rates in the country, which further boosts demand for the import of technology for poultry keeping, feeding, & storage. Between 2010 and 2019, Indonesian chicken consumption increased from 3.5 to 6 Kg per person per year, and this trend is expected to continue. Approximately 90.0% of the country's population is Muslim and religiously forbidden from consuming pork, owing to which, poultry is a primary source of animal protein. Furthermore, cattle, goats, and mutton, as well as dairy goods, have been imported in large amounts, making them too expensive for many residents.

The rising prevalence of poultry disorders, increasing poultry production, and growing poultry product exports are the major factors expected to drive the market in Thailand. For instance, according to the USDA Foreign Agriculture Services’ published article, Thai broiler meat production was expected to reach 3.23 Million Metric Tons (MMT) in 2020, a 6.0% increase over 2019 due to increased export and domestic demand. Meanwhile, domestic chicken meat consumption (chicken meat and other broiler meat) was estimated to increase by 3.0% in 2020. Exports of chicken meat were estimated to rise another 7.0% to 1.02 MMT in 2020, in anticipation of continued growth in exports to Japan and other non-EU markets such as South Korea, China, & the Association of Southeast Asian Nations.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on ASEAN Poultry Vaccines Market

5.1. COVID-19 Landscape: ASEAN Poultry Vaccines Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. ASEAN Poultry Vaccines Market, By Product

8.1. ASEAN Poultry Vaccines Market, by Product, 2023-2032

8.1.1 Attenuated Live Vaccines

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Inactivated Vaccines

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Subunit Vaccines

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. DNA Vaccines

8.1.4.1. Market Revenue and Forecast (2019-2032)

8.1.5. Recombinant Vaccines

8.1.5.1. Market Revenue and Forecast (2019-2032)

Chapter 9. ASEAN Poultry Vaccines Market, By Application

9.1. ASEAN Poultry Vaccines Market, by Application, 2023-2032

9.1.1. Broiler

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Layer

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Breeder

9.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 10. ASEAN Poultry Vaccines Market, By Disease Type

10.1. ASEAN Poultry Vaccines Market, by Disease Type, 2023-2032

10.1.1. Infectious Bronchitis

10.1.1.1. Market Revenue and Forecast (2019-2032)

10.1.2. Infectious Bursal Diseases

10.1.2.1. Market Revenue and Forecast (2019-2032)

10.1.3. Infectious Laryngotracheitis

10.1.3.1. Market Revenue and Forecast (2019-2032)

10.1.4. Egg Drop Syndrome

10.1.4.1. Market Revenue and Forecast (2019-2032)

10.1.5. Adenovirus

10.1.5.1. Market Revenue and Forecast (2019-2032)

10.1.6. Duck Viral Enteritis

10.1.6.1. Market Revenue and Forecast (2019-2032)

10.1.7. Inclusion Body Hepatitis

10.1.7.1. Market Revenue and Forecast (2019-2032)

10.1.8. Coccidiosis

10.1.8.1. Market Revenue and Forecast (2019-2032)

10.1.9. Avian Influenza

10.1.9.1. Market Revenue and Forecast (2019-2032)

10.1.10. Marek's Disease

10.1.10.1. Market Revenue and Forecast (2019-2032)

10.1.11. Newcastle Disease

10.1.11.1. Market Revenue and Forecast (2019-2032)

10.1.12. Salmonella

10.1.12.1. Market Revenue and Forecast (2019-2032)

10.1.13. Avian Encephalomyelitis

10.1.13.1. Market Revenue and Forecast (2019-2032)

10.1.14. Fowl Cholera

10.1.14.1. Market Revenue and Forecast (2019-2032)

10.1.15. Others

10.1.15.1. Market Revenue and Forecast (2019-2032)

Chapter 11. ASEAN Poultry Vaccines Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2019-2032)

11.1.2. Market Revenue and Forecast, by Application (2019-2032)

11.1.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.1.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.1.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2019-2032)

11.2.2. Market Revenue and Forecast, by Application (2019-2032)

11.2.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.2.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.2.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2019-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2032)

11.2.6.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2019-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2032)

11.2.7.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2019-2032)

11.3.2. Market Revenue and Forecast, by Application (2019-2032)

11.3.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.3.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.3.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2019-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2032)

11.3.6.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2019-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2032)

11.3.7.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.4.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.4.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2019-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2032)

11.4.6.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2019-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2032)

11.4.7.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2019-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2032)

11.5.4.3. Market Revenue and Forecast, by Disease Type (2019-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2019-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2032)

11.5.5.3. Market Revenue and Forecast, by Disease Type (2019-2032)

Chapter 12. Company Profiles

12.1. Boehringer Ingelheim International GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Ceva

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. HIPRA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Zoetis

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Phibro Animal Health Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Elanco

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Merck & Co., Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medion Farma

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Malaysian Vaccines & Pharmaceuticals Sdn Bhd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others