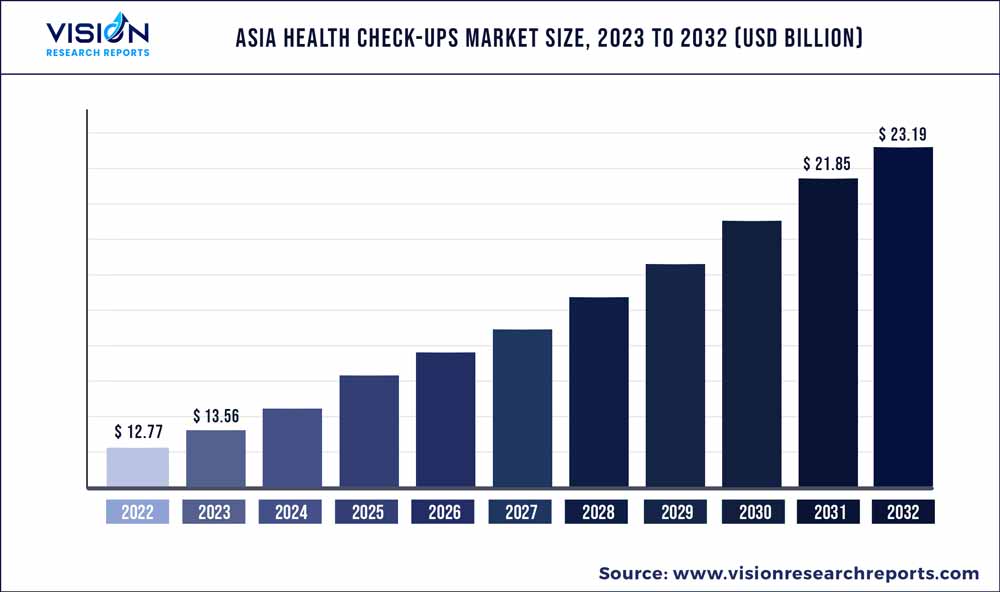

The Asia health check-ups market size was estimated at around USD 12.77 billion in 2022 and it is projected to hit around USD 23.19 billion by 2032, growing at a CAGR of 6.15% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Health Check-Ups Market

| Report Coverage | Details |

| Market Size in 2022 | USD 12.77 billion |

| Revenue Forecast by 2032 | USD 23.19 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Eurofins Scientific; SYNLAB International GmbH; UNILABS; OPKO Health, Inc. (BioReference Health; LLC.); Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions; Laboratory Corporation of America Holdings; LalPathLabs.com.; Quest Diagnostics Incorporated |

The market growth is attributable to the increasing prevalence of chronic diseases, growing investments from government and private organizations to detect diseases at early stages, and the adoption of digital technologies across various healthcare platforms. For instance, in March 2021, DoctorOnCall, a leading Malaysia digital healthcare platform, partnered with two key insurance companies to increase access to digital healthcare. Moreover, restrictions due to the COVID-19 pandemic have increased the adoption of telemedicine, which fueled the demand for home-based testing and sample collection services across the region.

The increasing prevalence of life-threatening diseases is one of the key drivers for the Asia health check-up market in Asia. Most countries in Asia are facing a growing burden of non-communicable diseases such as diabetes, hypertension, and cardiovascular diseases, which are often asymptomatic in their early stages. For instance, in September 2022, WHO stated that nearly two-thirds of deaths in the South-East Asian region are attributed to cardiovascular diseases, cancer, diabetes, and other diseases. Hence, healthcare professionals recommend people to periodically use various health check-up tests to mitigate premature deaths and chronic conditions.

Government and private organizations in many countries are investing in population screening programs to detect diseases at an early stage and provide appropriate treatment. As a result, people are becoming aware of the importance of regular health check-ups, increasing market growth. For instance, in May 2023, Vietnam Social Security (VSS) stated that nearly 91.1 million people residing in Vietnam were covered by health insurance in 2022, which was 2.2 million higher than in 2021 participation. In addition, the government is continuing to take steps towards achieving universal healthcare coverage and encouraging participation in medical insurance programs.

The Asia health check up market is experiencing innovation driven by the adoption of digital technology, favorable government initiatives. For instance, in August 2022, the Health Ministry of Indonesia launched the SatuSehat platform in Jakarta, representing a significant step toward the country's medical technology transformation efforts. The platform aims to facilitate the implementation of various healthcare systems' transformation pillars, including the transformation of primary & referral services, medical financing systems, and human resources in the medical sector.

Type Insights

The general health check-up segment held the largest market share of 37% in 2022. A general check-up is a preventive medical service that helps people identify critical medical issues before they become serious. It comprises of various tests covering different aspects, such as general, metabolic, and cardiovascular health. In addition, the rising geriatric population and growing need for elderly screening are further supporting segment expansion. For instance, according to the International Trade Organization, by 2032, one in four individuals in Singapore will be over the age of 65 years.

The specialized health check-ups segment is expected to show the fastest growth rate during the forecast period. A specialized health check-up is a medical examination that mainly emphasizes a particular aspect of an individual's wellness. Supportive government legislation and public and private organizations' promotional activities are supporting segment growth. For instance, the Government of Malaysia provides free medical screening for Malaysians aged 40 years and above. In addition, Apollo Hospitals Enterprise Ltd offers tailored, personalized medical checkup packages in accordance with factors such as fitness, body type, and lifestyle in India.

Test Type Insights

The blood glucose test segment held the largest market share of 23% in the Asia health check-up market in 2022, which can be attributed to the increasing patient base of diabetes in the region. These tests are commonly used to diagnose and monitor diabetes & hyperglycemia. Moreover, these tests are used to screen for prediabetes, a condition in which the blood sugar is higher than normal but not yet high enough to be classified as diabetes. For instance, according to the article published in Elsevier B.V. in March 2022, an estimated 160 million Asians will have prediabetes by 2045. Due to the exponential growth in the diabetic population, the segment is anticipated to offer lucrative opportunities to the Asia health check-up industry players.

The tumor biomarkers segment of the market is expected to show the fastest growth rate during the forecast period. Tumor markers can be detected in urine, blood, and other bodily fluids to detect malignancies. In addition, these tests are used to assess the prognosis of cancer, track the effectiveness of cancer treatment, and spot cancer recurrence. For instance, as per Elsevier B.V. article published in February 2022, from 2015 to 2032, newer cancer cases are projected to increase by 46% from 2.2 million to 3.2 million in the Chinese adult population.

Application Insights

The cardiovascular disease segment held the largest market share of 29% in 2022, which can be attributed to increasing disease prevalence, high mortality rates, and advancements in testing products. Smoking, alcohol abuse, decreased physical activity, unhealthy diet, and high blood pressure are anticipated to increase the burden of cardiovascular diseases in Asia. In addition, the presence of co-morbidities such as diabetes and neurological disorders worsens cardiac disorders. According to the Singapore Heart Foundation, 21 people die due to cardiovascular diseases (CVDs) in Singapore every day, and CVDs accounted for 32% of all deaths in 2021. Hence, the growing number of deaths due to CVDs is expected to increase the segment share.

Cancer segment is expected to grow at the fastest growth rate during the forecast period. The increasing prevalence rate of cancer in Asia and the inclusion of cancer biomarkers tests in health check-up tests are major factors driving the segment growth. Many government and non-government organizations have launched cancer screening programs and regular medical check-ups to detect cancer in its early stages and understand its associated risk factors. For instance, the Health Promotion Board (HPB) and MOH of Singapore encourage people in Singapore to undergo regular medical screening and follow-up.

Service Provider Insights

Hospital-based laboratories dominated the market with a share of 59% in 2022. It is attributed to a large number of patient tests performed, majorly for complex and severe disease conditions that are comparatively more cost intensive. The segment is expected to maintain its dominance owing to the increasing number of hospitals integrating laboratories into their premises. Additionally, strategic partnerships of hospitals with leading medical device manufacturers provide the opportunity for hospital-based laboratories to grow. For instance, in August 2020, Singapore General Hospitals (SGH) and Philips established a digital and computational pathology center of excellence. SGH developed a fully digitized histopathology laboratory by growing the utilization of Philips IntellSite Pathology Solution, allowing the hospital to save nearly 12,000 hours annually.

Standalone laboratories segment is expected to show the fastest growth rate during the forecast period. It is owing to rising efforts to improve patient outcomes by offering diagnostic facilities at a retail level. Moreover, the ability of standalone labs to handle large volumes of diagnostic tests, health check-up service expansion, and better test results at comparatively cheaper prices is projected to propel the segment growth over the forecast period.

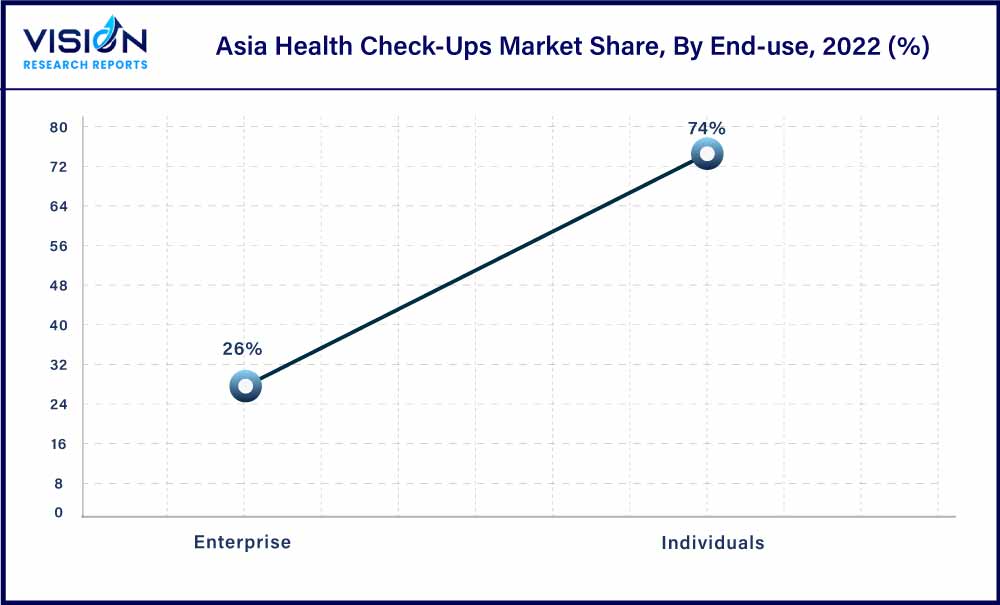

End-use Insights

The individuals segment held the largest market share of 74% in 2022, it can be attributed to increasing awareness about general health check-ups among people, increasing offers related to health check-ups from market players, and government initiatives to promote routine testing services. These services typically target people interested in proactively managing their fitness and wellness. A few of the medical check-ups may be customized to specific age groups, such as young adults, middle-aged adults, or seniors. For instance, Tata 1MG provides health check-up tests in India based on disease relevance, age, elderly care, and others.

Enterprise segment of the market is expected to grow at the fastest growth rate during the forecast period. Enterprise health check-ups involve a series of evaluations and assessments arranged by companies or employers to evaluate the well-being of their employees. Moreover, supportive government legislation to promote health screening is supporting segment expansion. For instance, in September 2022, Malaysia’s MOH proposed that employers give an extra day’s leave to their staff for regular health screening.

Asia Health Check-Ups Market Segmentations:

By Type

By Test Type

By Application

By Service Provider

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others