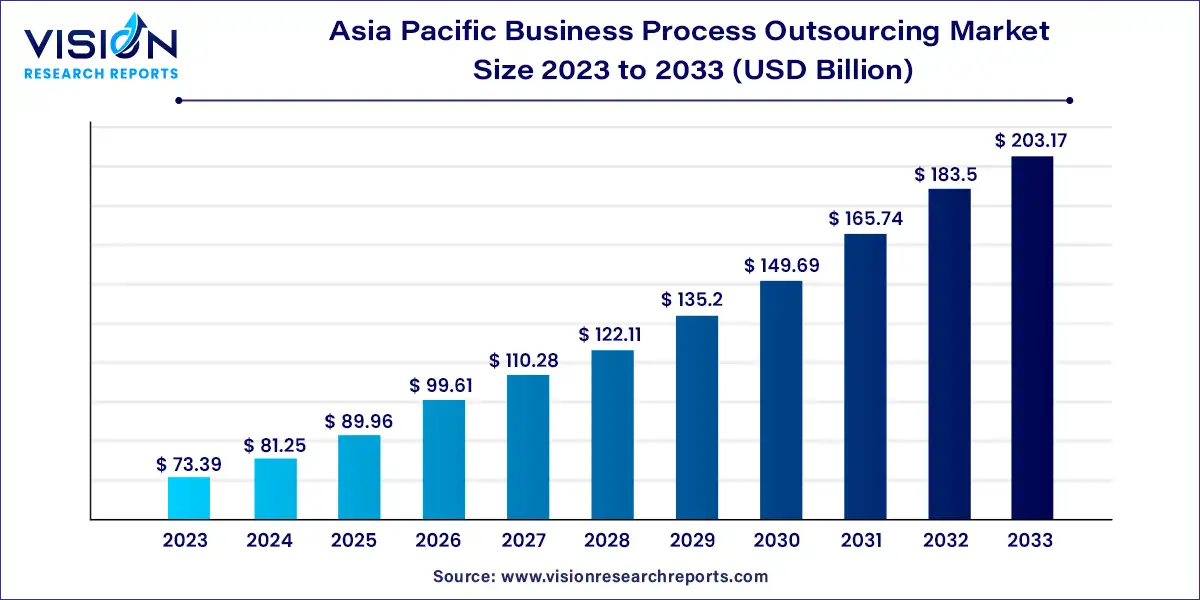

The Asia Pacific business process outsourcing market was estimated at USD 73.39 billion in 2023 and it is expected to surpass around USD 203.17 billion by 2033, poised to grow at a CAGR of 10.72% from 2024 to 2033.

The Asia Pacific region has emerged as a hub for business process outsourcing (BPO) services, offering a diverse range of outsourcing solutions to businesses worldwide. With its strategic location, skilled workforce, and favorable business environment, the Asia Pacific BPO market has experienced significant growth in recent years.

The growth of the Asia Pacific Business Process Outsourcing (BPO) market can be attributed to several key factors. Firstly, the region offers significant cost advantages compared to Western counterparts, making it an attractive destination for companies seeking to reduce operational expenses. Additionally, the availability of a skilled and diverse workforce in countries like India, the Philippines, and Malaysia enables efficient delivery of BPO services across various industries. Furthermore, advancements in technology, such as automation and artificial intelligence, have enhanced the capabilities of BPO providers, enabling them to offer more sophisticated solutions and drive further growth in the market. Moreover, the region's strategic location, cultural affinity, and language proficiency make it well-suited for serving global clients, further fueling the expansion of the Asia Pacific BPO market.

| Report Coverage | Details |

| Market Size in 2023 | USD 73.39 billion |

| Revenue Forecast by 2033 | USD 203.17 billion |

| Growth rate from 2024 to 2033 | CAGR of 10.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on service, the market has been segmented into finance & accounting, human resources, knowledge process outsourcing, procurement, customer services, and others. The customer service segment held the largest market share of 35% in 2023 and is anticipated to grow at the fastest CAGR of 12.64% during the forecast period. The rising establishment of service centers that necessitate online and offline technical support has been fueling the segment growth. Interaction with customers opens an opportunity for strengthening the brand and developing customer relationships.

The finance and accounting segment is anticipated to witness significant growth over the forecast period. This can be ascribed to the rising presence of banking facilities and stringent regulatory requirements in the banking sector, thereby resulting in a need for outsourcing services as outsourcing permits a significant reduction i.e. operating costs. Moreover, the human resource service segment is also anticipated to register a substantial CAGR of over 11.15% over the forecast period, ascribed to the rising need for resources across different sub-segments including payment processing, recruitment and relocation, administration, and other employee benefit services.

Knowledge process outsourcing (KPO) includes research and analytical outsourcing, such as competitive analysis, quantitative research and analytics, strategy and business development research, and risk management and analytics, among others. Rising demand for project management, market research, remote education, legal processes, data search, and data integration is anticipated to spur the segment growth. In addition, the availability of experienced and skilled professionals abroad, the adoption of global standards for qualification, and improved remote project management capabilities are some of the additional factors anticipated to fuel the segment's growth.

Based on end-use, the market has been segmented into BFSI, healthcare, manufacturing, IT and telecommunications, retail, and others. The IT & Telecommunications segment held the largest market share of 37% in 2023 owing to the growth of IT companies and rapid industrialization. In addition, the government's support to improve the economy by encouraging sectors such as banking and healthcare is projected to boost their investments in technology. This factor is anticipated to fuel the market in Asia Pacific. Telecom companies in the region are leveraging business process outsourcing and are adopting telecommunications outsourcing to reduce costs. They outsource various business functions from call center outsourcing to billing operations to finance and accounting outsourcing. Outsourcing solutions help telecom companies establish a flexible strategy to acquire and retain more customers, access specialized resources, optimize current investments, and manage cost pressures.

The BFSI segment is anticipated to grow at the fastest CAGR of 12.47% during the forecast period. BPO has long been seen by financial institutions as a tool for increasing cost-effectiveness. Asset management and investment management are just two examples of BFSI industry verticals that are choosing to outsource key activities and incorporate them into their business strategies. In addition to higher cost-effectiveness, increased flexibility, and improved service quality, BPO also provides innovative, specially designed solutions to address the difficulties the sector is currently facing. BFSI organizations have long viewed BPO as a tool to increase productivity and save operating costs. The BFSI sector is anticipated to experience the fastest growth throughout the forecast period despite the market's maturity. BFSI is anticipated to increase significantly in the upcoming years because of the availability of new, modified solutions meant to address the current digitization requirements as well as offering new value-added services.

By Service

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Business Process Outsourcing Market

5.1. COVID-19 Landscape: Asia Pacific Business Process Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Business Process Outsourcing Market, By Service

8.1. Asia Pacific Business Process Outsourcing Market, by Service, 2024-2033

8.1.1. Finance & Accounting

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Human Resource

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. KPO

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Procurement

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Customer services

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Business Process Outsourcing Market, By End-use

9.1. Asia Pacific Business Process Outsourcing Market, by End-use, 2024-2033

9.1.1. BFSI

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Healthcare

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Manufacturing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. IT & Telecommunications

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Retail

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Business Process Outsourcing Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Service (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Accenture

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Infosys Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. HCL Technologies Limited

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Capgemini

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Wipro Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. TTEC Holdings, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Sodexo

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amdocs

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tata Consulting Services Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. IBM Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others