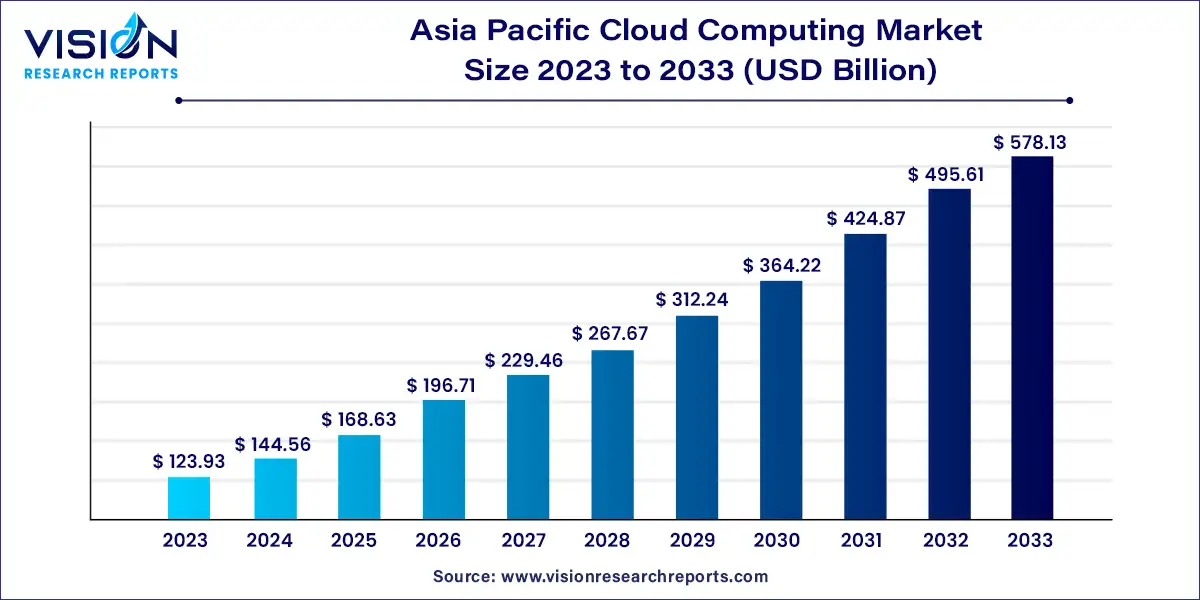

The Asia Pacific cloud computing market size was estimated at USD 123.93 billion in 2023 and it is expected to surpass around USD 578.13 billion by 2033, poised to grow at a CAGR of 16.65% from 2024 to 2033. The Asia Pacific cloud computing market has experienced remarkable growth over the past decade, driven by increasing digital transformation, rapid advancements in technology, and a growing demand for scalable and cost-effective IT infrastructure. The region is home to some of the fastest-growing economies and tech-savvy populations, which has accelerated cloud adoption in industries like healthcare, finance, manufacturing, and education.

The growth of the Asia Pacific cloud computing market is fueled by several key factors. Firstly, the increasing demand for digital transformation among businesses is pushing organizations to migrate to cloud-based solutions to enhance efficiency and innovation. The proliferation of small and medium enterprises (SMEs) in the region is another significant driver, as these companies seek cost-effective, scalable solutions to compete in the digital economy. Additionally, advancements in technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) are integrating seamlessly with cloud services, enabling businesses to harness data-driven insights for improved decision-making. Furthermore, the rising adoption of hybrid and multi-cloud strategies allows organizations to optimize their IT environments, fostering greater flexibility and resilience. Lastly, government initiatives promoting digital infrastructure development and cybersecurity measures are also contributing to the market's expansion, creating a conducive environment for cloud adoption across various sectors.

The Software as a Service (SaaS) segment accounted for the largest market share of over 57% in 2023. SaaS eliminates the need for companies to set up and manage software on their own computers or data centers. Therefore, software license, installation, and support, as well as purchase, provisioning, and maintenance of hardware are no longer required. As business requirements evolve continuously, SaaS strives to maintain cost and functionality. Moreover, the emergence of strong local players, the proliferation of various SaaS applications, and the increase in SaaS customers across various industries are also fueling the segment’s growth. In addition, Asia Pacific countries are still developing. The primary concern is always cost-effectiveness. Vendors of SaaS solutions offer solutions with lower operational costs, driving the market growth of the segment.

The IaaS segment is anticipated to register the fastest CAGR over the forecast period. IaaS reduces the upfront investment costs as the requirement for physical data centers with continuous service and maintenance expenses no longer remains. Moreover, the emerging digitalization trends, such as Artificial Intelligence, Machine Learning, Internet of Things, Kubernetes, and Multi and Hybrid cloud solutions, in the cloud infrastructure, are expected to drive the market in this segment. Furthermore, the rising demand for low-cost IT infrastructure and high-speed data connectivity across end-use industries such as IT & telecom, healthcare, retail & consumer goods, and BFSI, among others is anticipated to drive the demand for the IaaS segment.

For instance, in February 2023, Capgemini reported that telecom companies across the APAC region are expected to invest approximately USD 200 million a year on average in cloud transformation in the next five years. According to the report, technology infrastructure is expected to constitute one-third of cloud investments in the telecom industry which will include making networks more automated through machine learning (ML) and artificial intelligence (AI).

The private cloud deployment segment accounted for the highest market share of over 44% in 2023. Bring Your Own IP is one of the current trends found in the APAC region. For instance, in May 2023, Amazon Web Services made available Virtual Private Cloud, which supports Bring Your Own IP (Internet Protocol) in the India Region. BYOIP allows users to advertise IPv4 and IPv6 addresses on the internet using their own IPv4 and IPv6 addresses. Additionally, through AWS Direct Connect, users can access their on-premises networks via BYOIPv6. BYOIP is also available in various APAC regions such as Hong Kong, Sydney, Tokyo, and Singapore.

Hybrid cloud deployment is anticipated to register the highest CAGR over the forecast period. A hybrid implementation paradigm is gaining popularity across the public sector, BFSI, and IT & Telecom industries. Moreover, banks are using cloud-based mobile applications for customers which enable them to receive and repay loans, make budgetary and utility payments, deposit, and access international bank cards for real-time online transactions. As of January 2023, Uzbekistan had over 20 million users of remote banking services, including over 900,000 businesses. For instance, in February 2021, Malaysia Investment Development Authority (MIDA) reported that 97 percent of its organizations considered hybrid cloud as the ideal cloud service. Thus, developing countries across APAC are increasingly opting for hybrid cloud, which is expected to drive the demand for the segment.

The large enterprises segment accounted for the largest market share of over 52% in 2023. Cloud computing services are in high demand due to remote working adopted by businesses in the Asia Pacific. Moreover, the need for cloud computing services will grow as market players expand their business by offering new products in the Asia Pacific region, thereby it is anticipated to drive the segment's growth. For instance, in October 2021, Alibaba DAMO Academy, Alibaba Group's global research project, revealed a cloud-based AI-powered nowcasting platform that anticipated short-term weather patterns.

In China, the clients of Alibaba Cloud accessed the short-term AI weather forecasting platform, which provided high-resolution imagery with 1-km grid spacing and updates every ten minutes. The platform also monitored wind speed, rainfall, and extreme weather occurrences such as thunder and hailstorms. It provides significant value to weather-dependent industries such as agriculture, transportation, logistics, and renewable energy.

Small and medium-sized enterprises (SMEs) are expected to register the fastest CAGR during the forecast period. This can be attributed to the increasing number of SMEs in developing nations such as China and India. For instance, according to a report published by Asia Pacific Economic Corporation in April 2023, SMEs constitute over 97% of businesses in APEC economies. To optimize workflows and save operational costs, SMEs are adopting cloud services.

The BFSI segment accounted for the highest market share of over 22% in 2023. Increasing online banking activity has led money lenders to embrace the digital revolution, and cloud computing has played an important role in this development. Life insurance companies are adopting digital transformation to streamline their processes, automate operations, and offer digital services to their customers.

In May 2023, Grab Financial Group (GFG) launched GrabFin, a new platform for wealth management, lending, and digital payments. GrabFin provides simple, open, and flexible financial services to users of the Grab Financial group platform. Moreover, personalization in life insurance policies is a major trend in APAC life insurance. For instance, in August 2021, AIA Group Limited, a Hong Kong-based insurance and finance corporation, introduced the AIA Connect application to assist consumers in identifying the protection gap in their current life insurance policies through cloud computing.

The manufacturing sector is anticipated to register the highest CAGR over the forecast period. This growth can be attributed to factors such as real-time visibility and seamless data management. Manufacturers are adopting artificial intelligence, machine learning, big data analytics, and the Internet of Things (IoT) to enhance their operations and minimize downtime.

This is anticipated to drive the demand for cloud computing over the forecast period. For instance, in November 2021, Oracle Corporation introduced a smart manufacturing solution that connected shop floor data with manufacturing, maintenance, and planning systems. The solution also provided actionable insights, which allowed manufacturers to anticipate machine failures, adjust production schedules, and avoid unnecessary downtime.

By Service

By Deployment

By Enterprise Size

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Cloud Computing Market

5.1. COVID-19 Landscape: Asia Pacific Cloud Computing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Cloud Computing Market, By Service

8.1. Asia Pacific Cloud Computing Market, by Service, 2024-2033

8.1.1. Infrastructure as a Service (IaaS)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Platform as a Service (PaaS)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software as a Service (SaaS)

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Cloud Computing Market, By Deployment

9.1. Asia Pacific Cloud Computing Market, by Deployment, 2024-2033

9.1.1. Public

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Private

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hybrid

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Cloud Computing Market, By Enterprise Size

10.1. Asia Pacific Cloud Computing Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Cloud Computing Market, By End-use

11.1. Asia Pacific Cloud Computing Market, by End-use, 2024-2033

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. IT & Telecom

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Retail & Consumer Goods

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Manufacturing

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Energy & Utilities

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Media & Entertainment

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Government & Public Sector

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Others

11.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Asia Pacific Cloud Computing Market, Regional Estimates and Trend Forecast

12.1. Asia Pacific

12.1.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Alibaba Group Holding Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Microsoft Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Amazon.com Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Google LLC (Alphabet Inc.)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Cisco Systems, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Dell Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Dell Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. International Business Machines Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Oracle Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Salesforce.com Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others