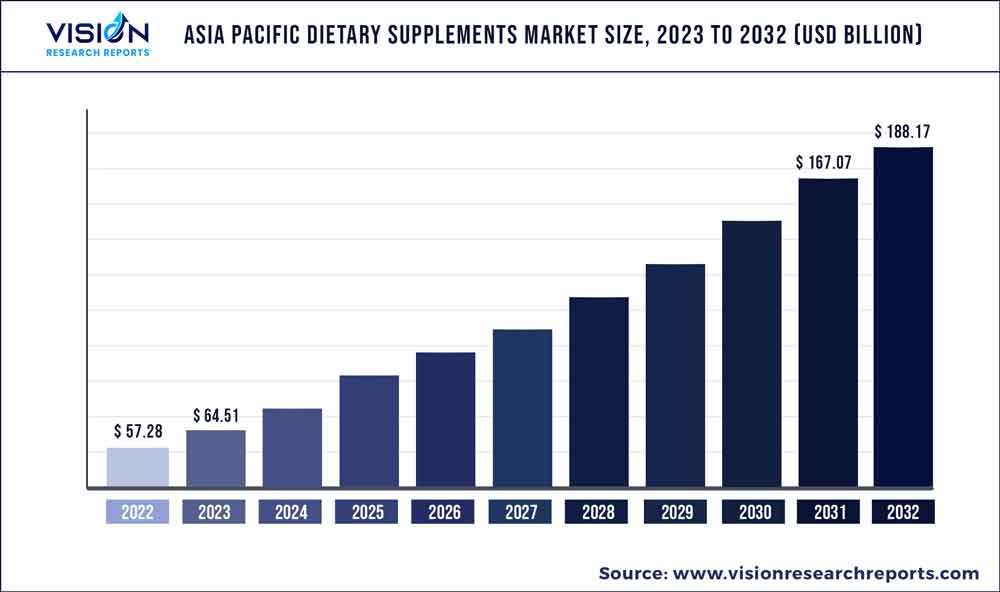

The Asia Pacific dietary supplements market size was estimated at around USD 57.28 billion in 2022 and it is projected to hit around USD 188.17 billion by 2032, growing at a CAGR of 12.63% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Pacific Dietary Supplements Market

| Report Coverage | Details |

| Market Size in 2022 | USD 57.28 billion |

| Revenue Forecast by 2032 | USD 188.17 billion |

| Growth rate from 2023 to 2032 | CAGR of 12.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nestle; Abbott; Amway; Bayer AG; Glanbia plc; Pfizer Inc.; Archer Daniels Midland; GlaxoSmithKline plc.; NU SKIN; Herbalife Nutrition; Otsuka Pharmaceutical Co., Ltd.; Bionova; Blackmores Limited |

The primary factors driving the market growth are increased awareness about healthcare, an increasing emphasis on preventive healthcare and personalized nutrition, and a trend towards self-directed care due to an increasing focus on personal health and well-being. Furthermore, many countries in the Asia Pacific region have aging populations, which has led to an increased demand for dietary supplements that can help manage age-related health issues such as joint pain, cognitive decline, and cardiovascular disease.

The Asia Pacific region is home to a large and diverse population that is becoming increasingly health conscious. As a result, there has been a growing awareness about the importance of maintaining a healthy lifestyle, including good nutrition and physical activity. This trend has led to an increase in the demand for dietary supplements that can support overall health and well-being. The young population in the Asia Pacific region is especially focused on fitness and physical activity, and this has led to an increased demand for energy and weight management supplements. These supplements are designed to help individuals increase their energy levels and manage their weight, which can be particularly important for those who are engaged in rigorous physical activity or looking to lose weight. With the rise of e-commerce and online marketplaces, these products are becoming more accessible to consumers across the region.

Traditional medicine has a long history in many parts of the Asia Pacific region, with practices such as traditional chinese medicine (TCM), Ayurveda, and Unani being widely used for centuries. These traditional medicine systems rely on natural remedies such as herbs, plants, and minerals to treat a wide range of health problems. As a result of this tradition, there is a high demand for dietary supplements made from traditional ingredients such as ginseng, turmeric, and ginger in the Asia Pacific region. These ingredients have been used for centuries in traditional medicine to promote health and treat various ailments. The popularity of these traditional ingredients has led to an increased demand for dietary supplements containing them in the Asia Pacific region. Many manufacturers of dietary supplements in the region now offer products containing traditional ingredients, often in combination with other vitamins, minerals, and natural extracts.

The Asia-Pacific region has seen several new product launches from nutrition companies, including Junlebao's lactoferrin infant formula, DSM's "faster-acting" vitamin D from Singapore, and various new launches from other key players. In August 2022, Junlebao, a Chinese dairy company, launched a lactoferrin infant formula. Lactoferrin is a protein found in breast milk that supports the immune system and promotes healthy gut bacteria. The new formula is designed to provide infants with similar benefits to those of breast milk.

Similarly, in March 2021, DSM launched a "faster-acting" vitamin D supplement called ampli-D in Australia. The supplement is designed to enhance calcium absorption and support bone health. These launches indicate the growing demand for specialized nutrition products in the region, as consumers become increasingly interested in products that target specific health concerns and provide unique benefits.

Ingredient Insights

Vitamins held a dominant position in the Asia Pacific market in 2022 accounting for a share of 31%. This is primarily attributed to various factors such as the introduction of new multivitamin supplements, increasing consumer interest in overall wellness, and growing awareness of lifestyle disorders. In March 2021, DSM introduced a new type of vitamin D called ampli-D in the Asia Pacific region, which is designed to work quickly and efficiently in dietary supplements.

Proteins & amino acids are expected to record the fastest growth during the forecast period, at a CAGR of 17.22%. This is primarily attributed to the rising demand for protein supplements such as whey powders, and amino acid products like creatine, citrulline, tyrosine, and proline, as consumers are becoming more health conscious.

Form Insights

Tablets dominated the market with a revenue share of 34% in 2022. This can be attributed to the higher prevalence of multivitamin products in tablet form, which are easy to dose, have a low cost, longer shelf life, and provide greater convenience to consumers.

Gummies are projected to grow at a CAGR of 15.24% during the forecast period. Over the recent past, manufacturers have focused on launching gummy supplements owing to their increasing preference among consumers. In June 2022, First Day, a U.S.-based brand that offers gummy vitamins for all age groups, entered the Chinese market through its launch on significant Chinese eCommerce platforms.

The liquid form is expected to grow at a CAGR of 16.7% over the forecast period. The growth is attributed to the fact that liquid supplements can evenly disperse in water, making them easier to consume. Additionally, the liquid form of supplements facilitates easy blending, leading to higher usage in yogurt, smoothies, and other energy drinks. These factors are expected to drive the growth of the liquid form of dietary supplements in the Asia Pacific market.

Application Insights

The energy and weight management segment emerged as the dominant application segment in the market in 2022, accounting for a revenue share of 31%. This is attributed to the increasing focus on physical wellness and fitness among consumers in the region. Rising obesity concerns in Asia Pacific are expected to fuel the demand for weight management dietary supplements. Consumers are shifting from traditional diet products, which offer short-term benefits, to weight management products that provide long-term satiety and appetite control. This trend is expected to widen the growth opportunities for the market, with the growing penetration of supplements in households for weight monitoring and management.

The Asia Pacific dietary supplements industry is expected to witness significant growth in the fibers and specialty carbohydrates segment due to increasing awareness regarding gut health. The rising prevalence of irritable bowel syndrome, constipation, acid reflux, and indigestion is expected to drive the demand for dietary supplements that promote gut health.

Furthermore, the revenue from immunity applications is expected to grow at a CAGR of 12.53% over the forecast period. The outbreak of the COVID-19 pandemic in 2020 has led to a surge in demand for immunity-boosting products throughout the Asia Pacific. This has resulted in increased demand for vitamins, minerals, and botanical supplements that can boost immunity, a trend that is expected to continue driving market growth until 2032.

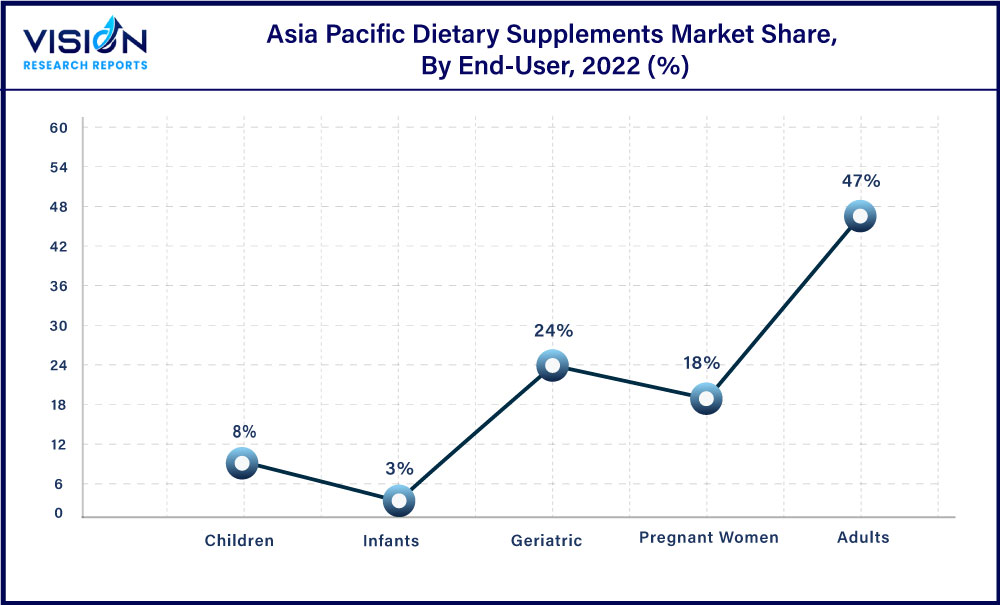

End-user Insights

Adults dominated the market with a revenue share of 47% in 2022 the increasing awareness of the significance of maintaining a balanced diet among working professionals and athletes. Modern lifestyles and busy work schedules make it difficult for adults to obtain all the necessary nutrients through their regular diet. Consequently, there is an increasing demand for dietary supplements to bridge the gap between the nutrients required and those obtained from regular meals. By providing the essential vitamins, minerals, and other nutrients that may be lacking in a regular diet, these supplements can help individuals to maintain their overall health and well-being.

Furthermore, in the Asia Pacific region, the high incidence of conditions such as obesity, cardiovascular diseases, and diabetes among adults is likely to be a significant driving factor for the growth of the dietary supplement industry. Additionally, the growing acceptance of sports as a professional career among adults is expected to contribute to the demand for dietary supplements such as protein, vitamins, and amino acids. As athletes and fitness enthusiasts seek to enhance their performance and recovery, they are likely to turn to dietary supplements for support.

The market for geriatric end-user is expected to grow at a CAGR of 14.74% during the forecast period. This growth is largely attributed to the rising number of geriatric population in Asia Pacific countries, which is expected to drive the demand for dietary supplements. As the geriatric population is particularly susceptible to infections, there has been a surge in demand for immunity boosters among these end-users, especially in the post-pandemic era. This trend is expected to continue driving market growth in the geriatric consumer segment.

Type Insights

OTC (Over-the-Counter) dietary supplements dominated the market with a revenue share of 77% in 2022. The consumer trend of self-directed health care is likely to drive the demand for OTC supplements. OTC supplements are often less expensive than prescription supplements, which can make them an affordable option for consumers. Furthermore, the growth of e-commerce and online retailers has made it easier for consumers to purchase dietary supplements online, contributing to the growth of the OTC segment. Online retailers often offer a wider selection of products and competitive prices, making it easier for consumers to find the dietary supplements they need.

The prescribed dietary supplements segment is expected to grow at a CAGR of 12.95% over the forecast period. These supplements are manufactured to meet high standards that are similar to pharmaceutical drugs. They come with minimal side effects and are properly labeled. Due to strict regulations imposed by governing bodies and a lack of awareness among individuals about health claims and labeling, sales of prescription-based dietary supplements are expected to rise in the Asia Pacific region. Moreover, individuals with nutritional deficiencies who require precise delivery of nutrients are increasingly using prescribed dietary supplements.

Distribution Channel Insights

The offline distribution channel is projected to dominate the market with a revenue share of 83% in 2022. Supermarkets and hypermarkets are the leading contributors to sales in the offline channel due to their widespread presence and popularity among consumers in the region. These traditional brick-and-mortar stores offer a wide variety of dietary supplements from different manufacturers and brands, making it easier for consumers to find and purchase the products they need. Moreover, these stores provide an opportunity for consumers to physically inspect and compare different products, which is important when buying health supplements.

The online distribution channel for dietary supplements in Asia Pacific is expected to grow at a CAGR of 13.62% during the forecast period. The increasing popularity of online shopping in the region, coupled with the convenience and accessibility it offers, is expected to drive the growth of the online distribution channel for the dietary supplements industry in the Asia Pacific region. The 24/7 availability of products and the ability to compare prices and products across different online retailers contributes to the growth of the online distribution channel for dietary supplements in Asia Pacific.

Asia Pacific Dietary Supplements Market Segmentations:

By Ingredient

By Form

By Application

By End-User

By Type

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Distribution Channel Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Dietary Supplements Market

5.1. COVID-19 Landscape: Asia Pacific Dietary Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Dietary Supplements Market, By Ingredient

8.1. Asia Pacific Dietary Supplements Market, by Ingredient, 2023-2032

8.1.1. Vitamins

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Botanicals

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Minerals

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Proteins & Amino acids

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Fibers & Specialty Carbohydrates

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Omega Fatty Acids

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Asia Pacific Dietary Supplements Market, By Form

9.1. Asia Pacific Dietary Supplements Market, by Form, 2023-2032

9.1.1. Tablets

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Capsules

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Soft Gels

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Powders

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Gummies

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Liquids

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Asia Pacific Dietary Supplements Market, By Application

10.1. Asia Pacific Dietary Supplements Market, by Application, 2023-2032

10.1.1. Energy & Weight Management

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. General Health

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Bone & Joint Health

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Gastrointestinal Health

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Immunity

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Cardiac Health

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Diabetes

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Anti-cancer

10.1.8.1. Market Revenue and Forecast (2020-2032)

10.1.9. Lungs Detox/Cleanse

10.1.9.1. Market Revenue and Forecast (2020-2032)

10.1.10. Skin/Hair/Nails

10.1.10.1. Market Revenue and Forecast (2020-2032)

10.1.11. Sexual health

10.1.11.1. Market Revenue and Forecast (2020-2032)

10.1.12. Brain/Mental Health

10.1.12.1. Market Revenue and Forecast (2020-2032)

10.1.13. Insomnia

10.1.13.1. Market Revenue and Forecast (2020-2032)

10.1.14. Menopause

10.1.14.1. Market Revenue and Forecast (2020-2032)

10.1.15. Anti-aging

10.1.15.1. Market Revenue and Forecast (2020-2032)

10.1.16. Prenatal Health

10.1.16.1. Market Revenue and Forecast (2020-2032)

10.1.17. Others

10.1.17.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Asia Pacific Dietary Supplements Market, By End-User

11.1. Asia Pacific Dietary Supplements Market, by End-User, 2023-2032

11.1.1. Adults

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Geriatric

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Pregnant Women

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Children

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Infants

11.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Asia Pacific Dietary Supplements Market, By Type

12.1. Asia Pacific Dietary Supplements Market, by Type, 2023-2032

12.1.1. OTC

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Prescribed

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Asia Pacific Dietary Supplements Market, By Distribution Channel

13.1. Asia Pacific Dietary Supplements Market, by Distribution Channel, 2023-2032

13.1.1. Offline

13.1.1.1. Market Revenue and Forecast (2020-2032)

13.1.2. Online

13.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 14. Asia Pacific Dietary Supplements Market, Regional Estimates and Trend Forecast

14.1. Asia Pacific

14.1.1. Market Revenue and Forecast, by Ingredient (2020-2032)

14.1.2. Market Revenue and Forecast, by Form (2020-2032)

14.1.3. Market Revenue and Forecast, by Application (2020-2032)

14.1.4. Market Revenue and Forecast, by End-User (2020-2032)

14.1.5. Market Revenue and Forecast, by Type (2020-2032)

14.1.6. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 15. Company Profiles

15.1. Nestle

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Abbott

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Amway

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Bayer AG

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Glanbia plc

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Pfizer Inc.

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Archer Daniels Midland

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. GlaxoSmithKline plc.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. NU SKIN

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Herbalife Nutrition

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others