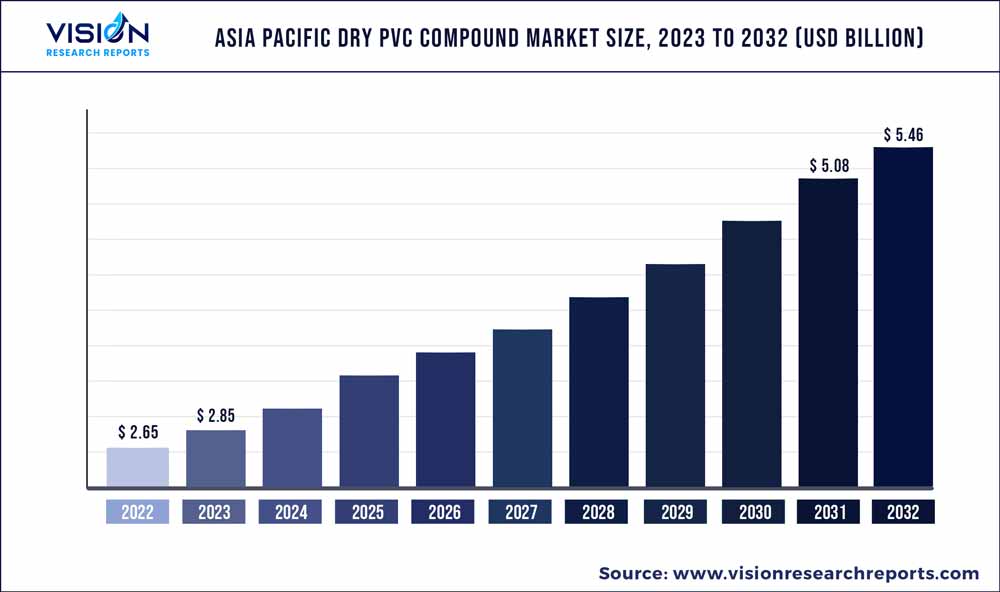

The Asia Pacific dry PVC compound market size was estimated at around USD 2.65 billion in 2022 and it is projected to hit around USD 5.46 billion by 2032, growing at a CAGR of 7.94% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Pacific Dry PVC Compound Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.65 billion |

| Revenue Forecast by 2032 | USD 5.46 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | TP Polymer Private Limited; NHAT HUY GROUP; AGC Vinythai; Shin-Etsu Chemical Co., Ltd.; Prism Masterbatches; Sinochem Holdings Corporation Ltd.; Hanwha Solutions; Xinjiang Zhongtai Chemical Co. Ltd.; SCG Chemicals Public Company Limited; NAN YA PLASTICS CORPORATION; East Hope Group; Vinacompound Co. Ltd.; Teknor Apex, RIKEN TECHNOS CORP |

The market is primarily driven by the expansion of numerous significant application areas, such as personal and home care, medicines, food and beverage, and the increasing penetration of e-retail in the region.

Dry Polyvinyl Chloride (PVC) compounds offer stiffness, flexibility, lightweight, and transparency make it suitable for use in several packaging applications such as pharmaceuticals, food & beverage, poultry, and seafood, among others. Moreover, they can be sealed very tightly, establishing a barrier against unwanted external variables such as dust or water. The growing population and urbanization in the region are expected to boost automotive production over the forecast period, thus creating demand for dry PVC compounds in the automotive industry.

To meet the growing need for rust prevention and UV resistance in the automobile industry, Asia Pacific Dry PVC Compounds plastics are being utilized. Asia Pacific Dry PVC dry compounds are increasingly being utilized to replace metal fasteners in automobiles in order to reduce overall car weight by roughly 15%, resulting in lower carbon emissions. The trends outlined above are projected to boost the use of dry PVC compounds in the automotive and construction industries.

Increased demand for coating solutions with characteristics such as corrosion resistance, extended service life, and thermal stability is likely to drive market expansion, owing to the growing emphasis on condition-based monitoring over breakdown maintenance in manufacturing industries.

Major players are continuously working on developing dry PVC compounds in the region owing to the rising investments in building & construction activities in the country. Moreover, the expanding economic development as well as the increasing number of people migrating to metropolitan cities, the need for infrastructural improvement, and the augmenting manufacturing industry.

End-use Insights

The building and construction segment dominated the end-use segment in the Asia Pacific dry PVC compounds market and accounted for more than 34% of the total market share, in terms of revenue, in 2022. Dry PVC compounds play a crucial role in the building and construction industry and find applications in pipes and fittings, window profiles and frames, flooring and wall coverings, roofing materials, insulation and electrical and electronics product.

Dry PVC compounds are extensively used in the manufacturing of window profiles and frames. These compounds offer exceptional thermal insulation properties, contributing to energy efficiency in buildings.The growing construction industry in the Asia Pacific region, particularly in emerging economies, has fueled the demand for high-quality window profiles and frames.

Moreover, the automotive segment is anticipated to fastest CAGR of 8.53% over the forecast period, owing to the increasing integration of electronic components in vehicles, the demand for high-quality wire and cable insulation materials. Dry PVC compounds also find extensive usage in various under-the-hood applications in the automotive industry. These include gaskets, seals, and hoses that are used in engine compartments, cooling systems, and other critical areas of a vehicle.

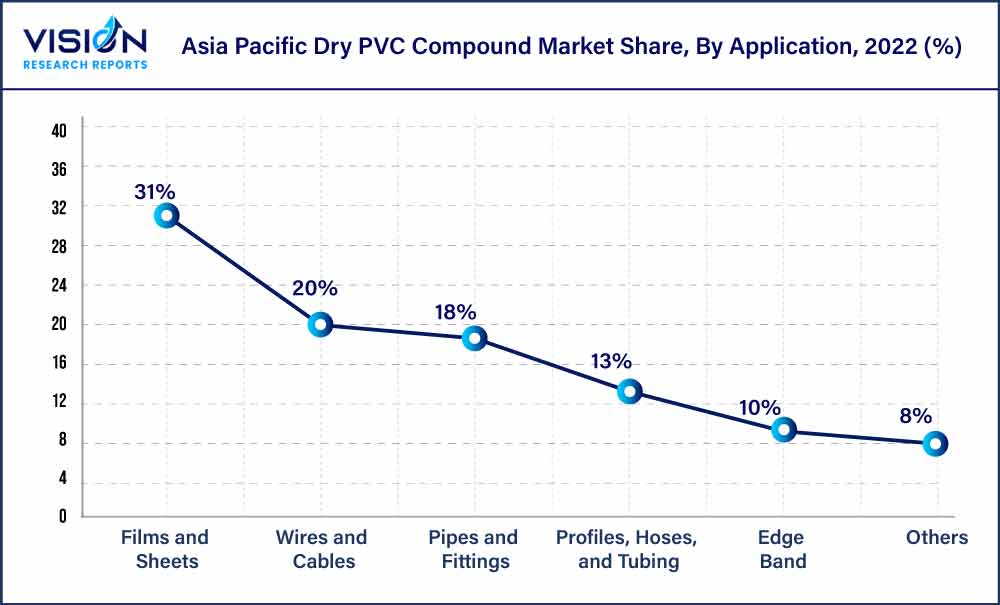

Application Insights

The films and sheets segment dominated the Asia Pacific dry PVC compounds market and accounted for more than 31% of the total market share, in terms of revenue, in 2022. Films and sheets made from dry PVC compounds find extensive use in the construction and architecture sector. They are used as roofing membranes, wall coverings, and cladding materials. PVC films and sheets offer durability, weather resistance, and UV protection in exterior applications. They also provide insulation properties and contribute to energy efficiency in buildings.

Dry PVC compounds are used to produce flexible packaging films and sheets with excellent barrier properties, protecting the packaged products from moisture, oxygen, and contaminants. PVC films and sheets are also known for their heat seal ability, ensuring secure packaging and extending the shelf life of food and consumer goods.

Another significant application of dry PVC compounds is Wires and Cables. The versatility, durability, and excellent electrical properties of dry PVC compounds make them ideal for use in the production of wires and cables. The construction and infrastructure sectors are major consumers of wires and cables made from dry PVC compounds. These materials are used for electrical wiring in residential, commercial, and industrial buildings.

Asia Pacific Dry PVC Compound Market Segmentations:

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Dry PVC Compound Market

5.1. COVID-19 Landscape: Asia Pacific Dry PVC Compound Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Dry PVC Compound Market, By Application

8.1. Asia Pacific Dry PVC Compound Market, by Application, 2023-2032

8.1.1. Films and Sheets

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Wires and Cables

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Pipes and Fittings

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Profiles, Hoses, and Tubing

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Edge Band

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Asia Pacific Dry PVC Compound Market, By End-use

9.1. Asia Pacific Dry PVC Compound Market, by End-use, 2023-2032

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Building & Construction

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Consumer Goods

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Packaging

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Medical

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Footwear

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Toys

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Asia Pacific Dry PVC Compound Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. TP Polymer Private Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. NHAT HUY GROUP

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. AGC Vinythai

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Shin-Etsu Chemical Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Prism Masterbatches

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Sinochem Holdings Corporation Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hanwha Solutions

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Xinjiang Zhongtai Chemical Co. Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. SCG Chemicals Public Company Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. NAN YA PLASTICS CORPORATION

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others