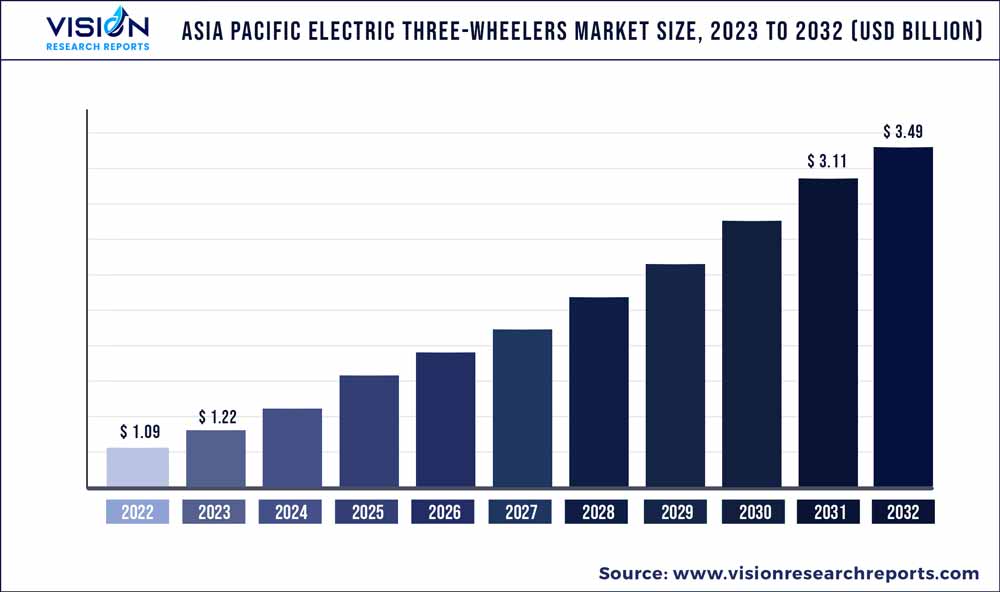

The Asia Pacific electric three-wheelers market was estimated at USD 1.09 billion in 2022 and it is expected to surpass around USD 3.49 billion by 2032, poised to grow at a CAGR of 12.35% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Pacific Electric Three-wheelers Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.09 billion |

| Revenue Forecast by 2032 | USD 3.49 billion |

| Growth rate from 2023 to 2032 | CAGR of 12.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Atul Auto Ltd.; Hero Electric; Jiangsu Kingbon Vehicle Co., Ltd.; Kinetic Engineering Ltd.; Lohia Auto Industries (Zuperia Auto Pvt. Ltd.); Mahindra & Mahindra Ltd.; Piaggio & C. SpA; Saera Electric Auto Pvt. Ltd.; Terra Motors Corp.; Xianghe Qiansheng Electric Tricycle Factory |

Factors, such as the growing adoption of electric 3-wheelers in rural areas and tier 2 & 3 cities, quick & affordable transportation service for last-mile connectivity, and low operational costs, are driving the growth of the market. Moreover, the extensive use of electric three-wheeler fleets by e-commerce, food delivery, and last-mile delivery companies has been propelling market growth. In addition, the development in battery technology, rising uptake of battery–as–a–service business model, and growing integration of connected vehicle technology is expected to create several growth opportunities for marketers in the market over the forecast period.

Several governments in the region have launched incentive programs that specifically promote the adoption of electric three-wheelers. These programs include incentives for purchasing and manufacturing electric vehicles (EVs), development in pilot projects, and public-private partnerships to accelerate the deployment of electric 3-wheeler deployment. For instance, the Indian government launched the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme; within the ambit of the FAME scheme II, the end users meeting the scheme criteria are eligible for an upfront reduction in the vehicle price.

Similarly, in June 2023, the Chinese government announced a tax incentive scheme worth USD 7,230 million (520 billion yuan) over four years. This tax incentive package provides tax incentives for EVs, including electric three-wheelers. The growing smartphone usage and adoption of 5G internet connectivity across the region are encouraging electric three-wheeler manufacturers to integrate telematics and vehicle management system in their products. Several manufacturers, such as Altigreen and Mahindra & Mahindra Ltd., have developed vehicle management and telematics system based on GPRS, CAN, GPS protocols, and cloud connectivity.

For instance, in August 2022, Mahindra Electric Mobility Ltd., a Mahindra & Mahindra Ltd. subsidiary, announced the launch of Zor Grand, a cargo electric three-wheeler. The vehicle is integrated with a NEMO-connected vehicle platform for fleet management & better operational efficiency, as well as an all-digital instrument cluster that shows the range, state of charge, battery health indicator speedometer, and tell-tale lights. The implementation of telematics enables fleet managers and last-mile delivery operators to receive real-time updates about the vehicle location, battery charge level, and idle time, ensuring efficient delivery operations.

Furthermore, the electric three-wheelers are equipped with Advanced Driver Assistance Systems (ADAS), enhancing the vehicle's safety. Considering the aforementioned technological advancements, the market is anticipated to grow considerably over the forecast period. Moreover, the growing need for charging infrastructure has been one of the key factors enabling manufacturers to make serious decisions and undertake necessary actions to mitigate the need. The unavailability of charging infrastructure is the main cause of inducing range anxiety in end-users, which may hinder market growth. The absence of charging stations, especially in rural areas and less developed regions, can restrict vehicle usability preventing their uptake in potential markets.

Thus, countries in the region are making significant progress in enhancing their charging infrastructure network. Both public and private players are planning on setting up fast charging stations at strategic locations that could cater to all sorts of electric vehicles, including electric three-wheelers. Moreover, government policies, such as FAME 2 in India, are expected to significantly facilitate the development of charging infrastructure, thereby enhancing the growth in product sale. The growing product usage for transportation and logistics in tier 2 cities may create new opportunities for battery-as-a-service solutions enabling regional market growth.

Battery swapping enables the driver to exchange depleted batteries with a charged battery. Several strategic partnerships among battery manufacturers, electric three-wheeler OEMS, and government agencies have been witnessed in the Asian market enabling steady growth of innovation in the battery technology sector. For instance, in June 2022, SUN Mobility expanded the reach of its battery-swapping infrastructure to the Indian state of Maharashtra in collaboration with Amazon India. As part of the collaboration, the first batch of battery-swapping stations was installed in the state of Maharashtra in the cities of Mumbai and Pune. Sun Mobility aims to have 2000 charging stations for electric three- and two-wheelers.

Battery Type Insights

The lithium-ion (Li-ion) segment accounted for the largest share of over 61% of the overall market revenue in 2022. The rise in demand for li-ion batteries is attributed to the benefits li-ion offers, including longer battery life due to improved energy density, compact size, shorter charging time, and reduced maintenance requirements. Government initiatives, such as the reduction in the custom duty of import of types of machinery required to manufacture li-ion cells and subsidies in manufacturing li-ion batteries are augmenting the segment growth. Development in li-ion battery technology, such as cell chemistry and increasing battery cells, is further expected to open new growth opportunities for the segment.

The li-ion segment is expected to register the highest growth rate over the forecast period. The reliability of these batteries in providing high power has made them efficient for EVs. Furthermore, battery packaging and design advancements have resulted in improved storage capacity, and durability, which is expected to create new opportunities for segment growth. The increasing sales of electric three-wheelers in countries like India and China and the emergence of electric mobility startups in the region are driving market growth.

Power Insights

The 1000 W to 1500 W segment accounted for the largest share of over 60% of the overall revenue in 2022. The market's demand for electric three-wheelers with increased power range drives the segment's growth. The instant torque provided by the 1000W to 1500W motor improves vehicle efficiency, resulting in better acceleration right from the start, which makes them a preferred choice for original equipment manufacturers (OEMs). Furthermore, the ability of electric motors to attain high speeds quickly compared to internal combustion engines allows them to operate with a single gear while still achieving their maximum speed.

Vehicles with a power rating of 1000 W to 1500 W have a larger range of applications in various industries, including construction, mining, machine manufacturing, and logistics. This is anticipated to create new opportunities for segment growth. Moreover, the high demand for electric three-wheelers that can carry heavy loads and have extended driving ranges is propelling segment growth. The higher motor power allows for improved acceleration and torque, enabling the vehicles to cover longer distances while carrying heavy cargo loads.

End-use Insights

The passenger carrier segment held the largest market share of over 56% of the overall revenue in 2022. The expansion of this segment can be attributed to the rising demand for three-wheelers as a public transportation choice for daily commutes and last-mile journeys. Public transport is preferred over private transportation in developing nations with a significant middle-income population. Electric three-wheelers are emerging as a cost-effective and environmentally friendly alternative, driving the segment growth. In addition, both central and state governments have implemented incentive programs to promote the development of sustainable public transportation in rural and urban areas, further stimulating segment growth.

The goods carrier segment is expected to register the fastest growth rate over the forecast period. The rise in last-mile delivery solutions is primarily expected to drive segment growth over the forecast period. Electric three-wheelers are recognized as a cost-effective and environmentally friendly solution for commercial vehicles, well-suited for transporting various types of cargo, including utilities and furniture. The increasing consumer preference for e-commerce platforms, subsequently leading to the high use of three-wheelers for logistics, is poised to fuel the demand for electric 3-wheeler in coming years.

Electric three-wheeler manufacturers are partnering with logistic service providers to deploy their electric three-wheelers for last-mile delivery. For instance, in May 2022, Mahindra Electric Mobility Ltd. announced a partnership with Terrago Logistics, a start-up based in New Delhi, India. The partnership envisaged the company supplying additional EVs to Terrago Logistics to expand the latter’s zero-pollution, last-mile delivery fleet. Terrago Logistics operates a fleet of 65 Mahindra Treo Zor units, which are deployed with Big Basket, an e-commerce grocery company.

Asia Pacific Electric Three-wheelers Market Segmentations:

By Battery Type

By Power

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Battery Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Electric Three-wheelers Market

5.1. COVID-19 Landscape: Asia Pacific Electric Three-wheelers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Electric Three-wheelers Market, By Battery Type

8.1. Asia Pacific Electric Three-wheelers Market, by Battery Type, 2023-2032

8.1.1 Lithium-ion

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Lead Acid

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Asia Pacific Electric Three-wheelers Market, By Power

9.1. Asia Pacific Electric Three-wheelers Market, by Power, 2023-2032

9.1.1. Up to 1000 W

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 1000 W - 1500 W

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Above 1000 W

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Asia Pacific Electric Three-wheelers Market, By End-use

10.1. Asia Pacific Electric Three-wheelers Market, by End-use, 2023-2032

10.1.1. Passenger Carrier

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Goods Carrier

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Asia Pacific Electric Three-wheelers Market, Regional Estimates and Trend Forecast

11.1. Asia Pacific

11.1.1. Market Revenue and Forecast, by Battery Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Power (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Atul Auto Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Hero Electric.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Jiangsu Kingbon Vehicle Co., Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Kinetic Engineering Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Lohia Auto Industries (Zuperia Auto Pvt. Ltd.)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mahindra & Mahindra Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Piaggio & C. SpA.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Saera Electric Auto Pvt. Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Terra Motors Corp.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Xianghe Qiansheng Electric Tricycle Factory

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others