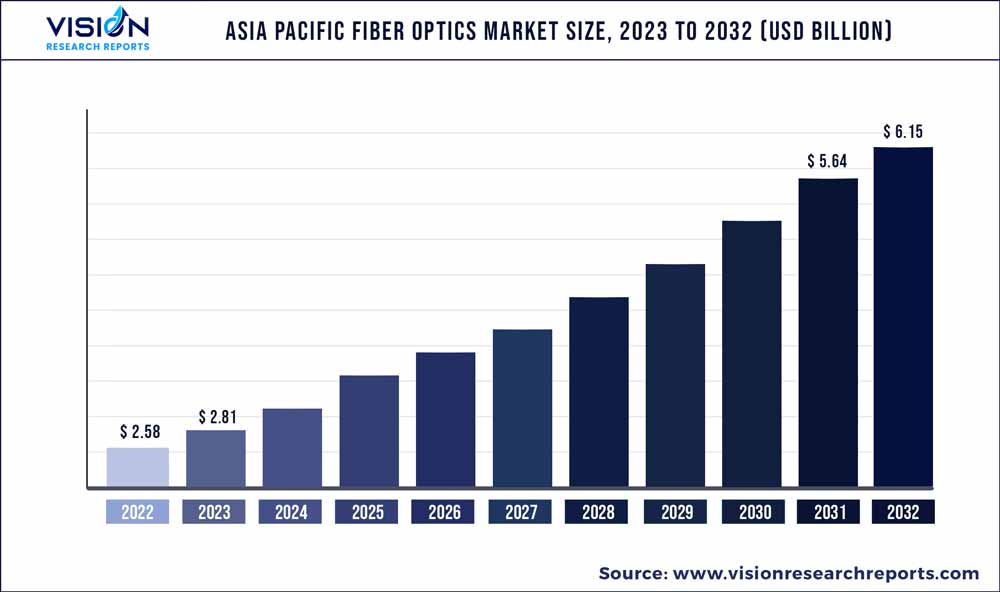

The Asia Pacific fiber optics market was estimated at USD 2.58 billion in 2022 and it is expected to surpass around USD 6.15 billion by 2032, poised to grow at a CAGR of 9.08% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Pacific Fiber Optics Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.58 billion |

| Revenue Forecast by 2032 | USD 6.15 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.08% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AFL; Birla Furukawa Asia-Pacific Fiber Optics Ltd.; Corning Inc.; Finolex Cables Ltd.; OFS Fitel, LLC; Optical Cable Corp. (OCC); Prysmian Group; Sterlite Technologies Ltd.; Yangtze Optical Fibre and Cable Joint Stock Ltd. Company (YOFC); Opcom Holdings Berhad; Telekom Malaysia Berhad |

Numerous countries in the Asia Pacific region are experiencing a shift toward a technologically advanced landscape, with a particular emphasis on projects, such as smart cities, Internet of Things (IoT) integration, and the development of healthcare systems. Fiber optics support these digital initiatives by providing high-speed and minimal latency communication for real-time data transmission and communication. Moreover, the growing use of fiber optic connectors in the Asia Pacific region, as it is vital in facilitating reliable and high-speed communication, is responsible for market growth.

The market is witnessing the adoption of advanced technologies, such as Wavelength Division Multiplexing (WDM) and Dense Wavelength Division Multiplexing (DWDM). Multiple light wavelengths can be transmitted over a single fiber via WDM and DWDM technologies, significantly improving the network's data capacity. For instance, in February 2023, Bharti Airtel, an Indian telecommunications company, collaborated with Ribbon Communications Inc., a U.S.-based telecommunications company, to expand its long-haul DWDM network. The collaboration enables Bharti Airtel to support various applications and services, including data-intensive applications, cloud computing, video streaming, and emerging technologies like 5G.

The growing adoption of fiber optic cables under the sea in Asia has played a crucial role in driving market growth. It has improved connectivity between countries and provided increased network capacity and spectral efficiency. Undersea fiber optic cables will likely be used increasingly as the demand for fast data transmission and reliable connectivity increases, which will further fuel the market expansion in the region. For example, the Asia-Africa-Europe 1 submarine (AAE-1) cable system spans over 25,000 kilometers, connecting multiple countries across Asia, the Middle East, Africa, and Europe. The AAE-1 submarine cable system deployment has significantly increased the utilization of deployed fiber in the region.

Type Insights

The multimode fiber optic segment dominates the market with a revenue share of 53% in 2022. Multi-mode fiber optic cables provide a cost-effective solution for short-range applications within buildings, campuses, and data centers where high data rates are required. Multi-mode fiber optic cables play a vital role in enabling reliable and high-bandwidth connectivity, making them a preferred choice for short-range applications in Asia Pacific. Telecommunication providers, internet service providers, and enterprises in the region increasingly deploy multi-mode fiber optic cables to support their network infrastructure and meet the growing demand for high-speed data transmission. This pattern is anticipated to persist as more businesses and organizations embrace digital transformation and necessitate robust and efficient connectivity solutions.

Revenue from the plastic optical fiber segment in the market is expected to grow during the forecast period. Asia Pacific is increasingly adopting Plastic Optical Fiber (POF) as a viable substitute for conventional glass fiber optic cables. POF, composed of polymer material like Polymethyl Methacrylate (PMMA), provides several advantages in specific applications. Cost-effectiveness is a significant factor driving the uptake of POF in the region. POF is typically more affordable to manufacture and install than glass fiber optic cables. This affordability makes it particularly appealing for applications with shorter transmission distances, including home networks, automotive systems, and industrial control systems.

Application Insights

The telecom segment dominated the market with a revenue share of 40% in 2022. The telecom sector of the region provides a range of benefits. It offers a significantly higher bandwidth capacity, enabling telecommunication providers to meet the demands of connected devices and data-intensive applications. This ensures a seamless user experience, even during peak usage periods. Fiber optic cables also facilitate long-distance communication without signal degradation, which is crucial in the vast APAC region, where networks must span large geographical areas and connect remote locations. Furthermore, fiber optics provide a future-proof solution, supporting higher data rates and emerging technologies, such as 5G, the Internet of Things (IoT), and smart cities, ensuring continued adaptability and growth.

In the military and aerospace segment in the region, fiber optics play a crucial role in providing secure and reliable communication channels. They resist electromagnetic interference, making them ideal for transmitting sensitive information. In addition, fiber optic cables offer high bandwidth capacity, enabling fast and efficient data transfer. This capability is essential for real-time situational awareness, remote sensing, and military and aerospace operations surveillance. Fiber optics in the military and aerospace segment ensure secure communication, high-speed data transfer, resilience in harsh environments, enhanced sensor networks, long-distance transmission, and significant potential for future applications.

Asia Pacific Fiber Optics Market Segmentations:

By Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Fiber Optics Market

5.1. COVID-19 Landscape: Asia Pacific Fiber Optics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Fiber Optics Market, By Type

8.1. Asia Pacific Fiber Optics Market, by Type, 2023-2032

8.1.1. Single-mode

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Multi-mode

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Plastic Optical Fiber (POF)

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Asia Pacific Fiber Optics Market, By Application

9.1. Asia Pacific Fiber Optics Market, by Application, 2023-2032

9.1.1. Telecom

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Oil & Gas

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Military & Aerospace

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Military & Aerospace

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Medical

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Railway

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Asia Pacific Fiber Optics Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. AFL

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Birla Furukawa Asia-Pacific Fiber Optics Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Corning Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Finolex Cables Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. OFS Fitel, LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Optical Cable Corp. (OCC)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Prysmian Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sterlite Technologies Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Yangtze Optical Fibre and Cable Joint Stock Ltd. Company (YOFC)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Opcom Holdings Berhad

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others